"A settlement is not considered a contribution," says IRA expert Ed Slott of Rockville Centre, N.Y. "It is replacing lost value and constitutes a valid rollover to your IRA."

What can I do with my IRA settlement fund?

The settlement fund should be considered as part of the IRA account (settlement funds are usually where cash is put after a fund is sold or after a dividend if not reinvested). Therefore you can use those funds to buy other positions all under the IRA umbrella.

Should I keep money in my settlement fund?

You should consider keeping some money in your settlement fund so you're ready to trade. You can use your settlement fund to buy mutual funds and ETFs (exchange-traded funds) from Vanguard and other companies, as well as stocks, CDs (certificates of deposit), and bonds. An investment that represents part ownership in a corporation.

What happens to my IRA when I roll over to Vanguard?

I rolled over an IRA from another institution and the money is sitting in the Settlement Fund, rather than in an IRA. I would assume Vanguard sold the shares in the original IRA (or the original brokerage did before they made the transfer to Vanguard). You can use that settlement cash to buy funds in your IRA.

What is a settlement fund?

A mutual fund that seeks income and liquidity by investing in very short-term investments. Money market funds are suitable for the cash reserves portion of a portfolio or for holding funds that are needed soon. Now that you understand how to use your settlement fund, let's break it down a little further:

What is a settlement fund Vanguard Roth IRA?

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

Can you withdraw from a Roth IRA settlement fund?

Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in other words, if you withdraw more than you've contributed in total—you could be subject to both taxes and penalties on the earnings portion of the withdrawal.

Can you withdraw from settlement fund Vanguard?

Funds available to withdraw The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account.

Can I withdraw money from settlement fund?

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash-out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

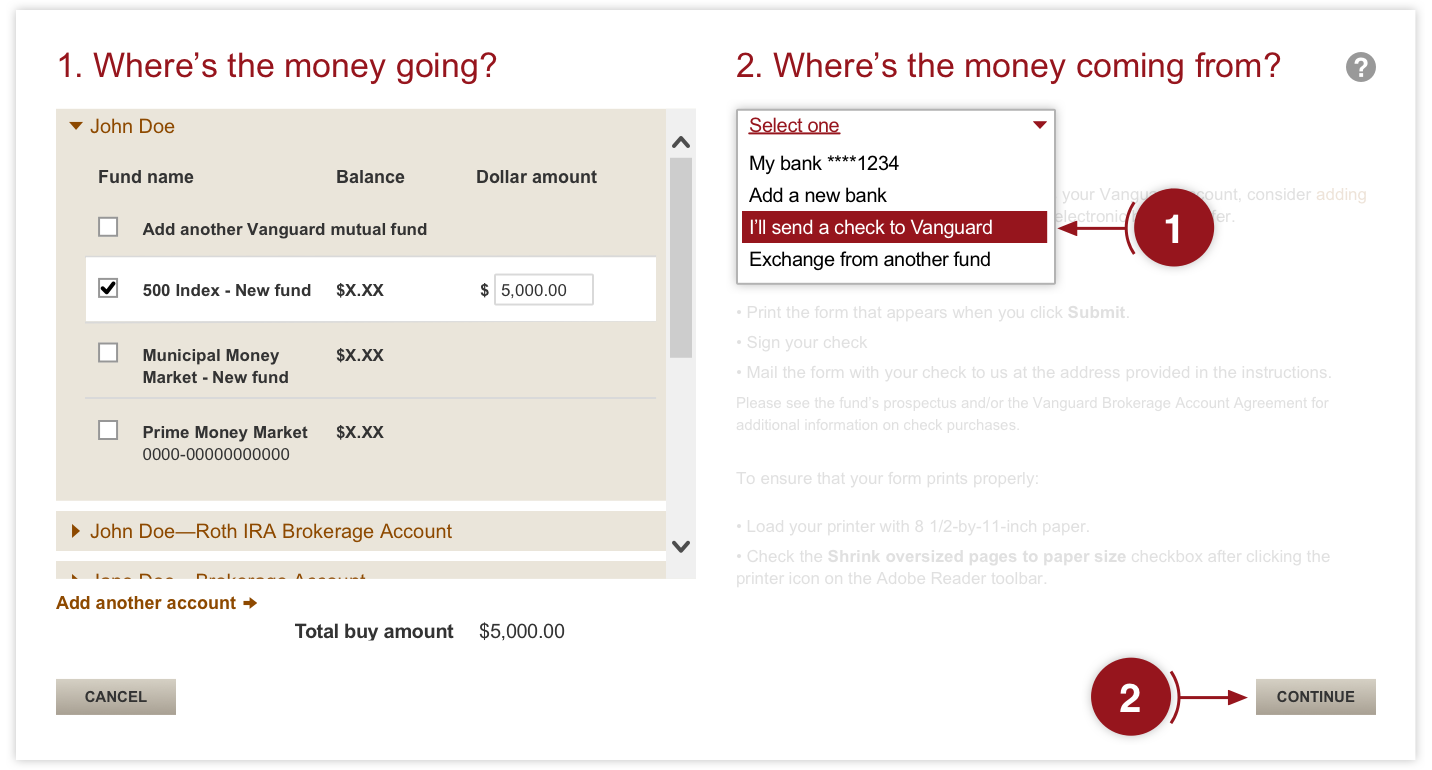

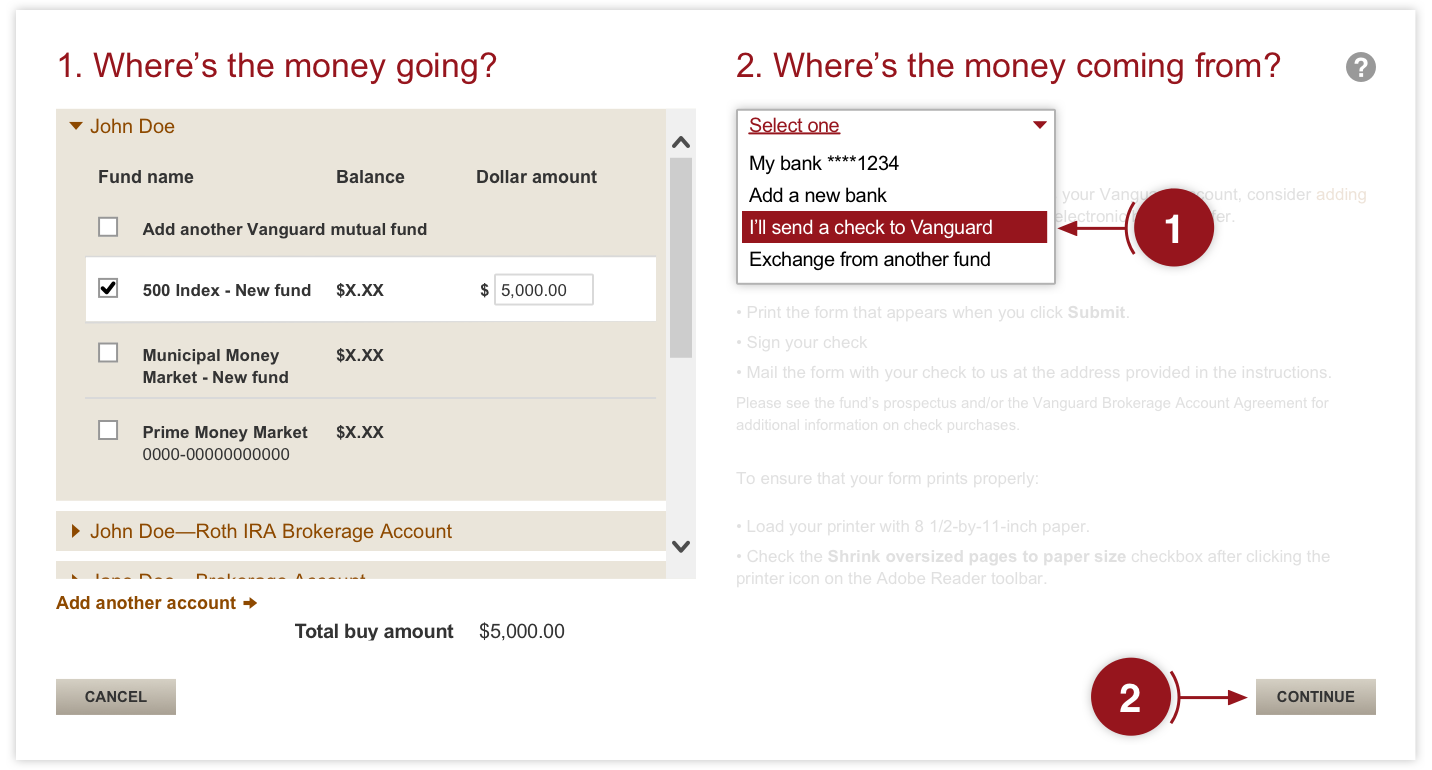

How do I transfer money from Vanguard settlement funds?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

How much tax do you pay when you withdraw from your IRA?

Regardless of how many traditional IRAs you have, all withdrawals from any of them are 100% taxable, and you must include them on lines 4a and 4b of Form 1040. If you take any withdrawals before age 59½, they will be hit with a 10% penalty tax unless an exception applies.

Why can't I withdraw my money from Vanguard?

When you sell funds you'll need to wait for the trade to settle before you can withdraw the cash. This normally happens 2 business days after the trade completes.

What are settlement funds?

This holds the money you use to buy securities, as well as the proceeds whenever you sell.

What is the interest rate on Vanguard settlement fund?

The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%. The one-year return as of March 31 was 0.14%.

Where do settlement funds go?

Where the Money Goes. Attorneys general usually keep some settlement money to cover the costs of cases and to help finance future litigation. But distribution of damage recoveries or awards can be set by law, such as reimbursing Medicaid for fraud.

How do you handle settlement money?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

When can I withdraw settled cash Fidelity?

Generally, 7-10 business days after establishing Electronic Funds Transfer on your account, you can begin to withdraw money from, as well as deposit to, your Fidelity account using Fidelity.com.

What can you withdraw from Roth IRA?

With a Roth IRA, contributions are not tax-deductible Withdrawals must be taken after age 59½. Withdrawals must be taken after a five-year holding period. There are exceptions to the early withdrawal penalty, such as a first-time home purchase, college expenses, and birth or adoption expenses.

How can I withdraw money from my Roth IRA without penalty?

Roth IRA Five-Year Rule In general, you can withdraw your earnings without owing taxes or penalties if: You're at least 59½ years old3. It's been at least five years since you first contributed to any Roth IRA (the five-year rule). 4.

What are qualified distributions from a Roth IRA?

Any earnings you withdraw are considered qualified distributions if you're 59½ or older, and the account is at least five years old, making them tax- and penalty-free. Other kinds of withdrawals are considered non-qualified and can result in both taxes and penalties.

Can I withdraw contributions from Roth IRA before 5 years?

The Roth IRA five-year rule says you cannot withdraw earnings tax-free until it's been at least five years since you first contributed to a Roth IRA account. This five-year rule applies to everyone who contributes to a Roth IRA, whether they're 59 ½ or 105 years old.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

What line is income on 1040?

The income will be reported on Form 1040 line 21 with the description that you entered.

Is a check made out to an IRA account reported?

Ok ... if the check is made out to the IRA account and you must deposit it to that account then it is not reported at all.

What are non-taxable transactions in an IRA?

Transactions that are not taxable in an IRA account include purchases, exchanges between mutual funds, buying and selling stocks, dividend reinvestments and capital gain distributions. Mutual fund exchanges are not taxable as long as the money is being exchanged into an account registered as an IRA.

What age can you cash out an IRA?

Funds an investor cashes out from an IRA or Roth IRA before reaching age 59-1/2 are typically subject to a 10% early withdrawal fee, with some exceptions for medical emergencies and a few other issues. Funds that are withdrawn after age 59-1/2 from traditional, SEP, Simple or SARSEP IRAs are subject to ordinary income tax at ...

How much is the catch up contribution for 2019?

The so-called catch-up contribution, for those aged 50 and over, is an extra $1,000, the same as it was in 2019. 2 For other guidelines on contributions to IRAs and Roth IRAs, see the latest updates from the IRS.

Is IRA withdrawal taxable?

Transactions within an IRA account are not taxable, but withdrawals from an IRA are usually taxable, depending on the investor's specific circumstances. Contributions to a traditional IRA account may be tax-deductible, but any withdrawals made from the account are taxed as ordinary income.

Is sweep account taxable?

In the case of brokerage accounts, transactions may clear through a sweep account but are not taxable. Buy and sell orders, however, may still result in commissions and fees. These costs are deducted from the account balance but are not considered a taxable withdrawal from the account.

Is an IRA taxable in 2020?

Updated Jul 11, 2020. Transactions that are made within an individual retirement account (IRA) are not taxable. Stocks, funds and other securities can be purchased and sold within an IRA account without triggering any consequences.

Is a mutual fund taxable?

Mutual fund exchanges are not taxable as long as the money is being exchanged into an account registered as an IRA. Dividend and capital gains distributions made by funds and stocks result from the initial investment and are not considered contributions or taxable events.