The terms “alimony” and “property settlement” (read: equitable division of property) are terms of art that are not one and the same. Alimony is an allowance out of one party’s estate, made for the support of the other party, when living separately. O.C.G.A. § 19-6-1(a).

Is alimony treated as child support or property settlement?

The payment isn't treated as child support or a property settlement. Not all payments under a divorce or separation instrument are alimony or separate maintenance. Alimony or separate maintenance doesn’t include: Voluntary payments (that is, payments not required by a divorce or separation instrument).

Are all payments under a divorce or separation instrument alimony?

Not all payments under a divorce or separation instrument are alimony. Alimony doesn't include: Child support, Noncash property settlements, whether in a lump-sum or installments, Payments that are your spouse's part of community property income, Payments to keep up the payer's property, Use of the payer's property, or

What are the tax benefits of paying alimony?

This is one of the benefits of paying alimony, rather than a property settlement payment. Property transfers incident to divorce are not taxable income to the recipient and, therefore, are not tax deductible to the payor.

When does one party get alimony in a divorce settlement?

This usually occurs when one spouse earns significantly more than the other or one of the spouse’s stayed at home to take care of the children. For one party to get alimony in a divorce settlement, he or she must be able to show the court that he or she earned less money than his or her spouse.

What is not considered alimony?

Child support, for example, is not considered alimony, while payments that cover expenses for a home that you own in joint capacity with your ex-spouse could be considered alimony.

Why is it important to distinguish between a property settlement and alimony?

A distinction between the two is critical if for no other reason than tax consequences. Alimony payments are different from property distributions, which are generally without tax consequences to either spouse. Failure to properly label alimony can result in drastic tax consequences to the payor.

What is not an example of deductible alimony?

You must pay alimony by cash or check for the benefit of a spouse or former spouse. The value of in-kind alimony—for example, giving your spouse your car—isn't deductible. Follow the documents and designate payments as tax-deductible.

Is alimony considered an asset?

Your and your spouse's financial resources includes marital and non-marital/separate assets. To provide a complete financial picture, assets and alimony are considered together.

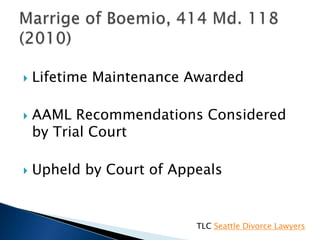

What is difference between alimony and maintenance?

The terms alimony and maintenance are synonymous with each other, and the usage of the names varies according to the different locales. It refers to the financial support offered to a spouse in the event of a divorce or judicial separation. The provision is only extended to the parties whose marriage were legal.

Which of these payments is classified as alimony?

Alimony or separation payments paid to a spouse or former spouse under a divorce or separation agreement, such as a divorce decree, a separate maintenance decree, or a written separation agreement, may be alimony for federal tax purposes.

Which of the following payments may be considered alimony?

Amounts paid to a spouse or a former spouse under a divorce or separation instrument (including a divorce decree, a separate maintenance decree, or a written separation agreement) may be alimony or separate maintenance payments for federal tax purposes.

Why is alimony no longer deductible?

Beginning with the 2019 tax return, alimony will no longer be tax-deductible for certain people. According to the Tax Cuts and Jobs Act P.L. 115-97, alimony is neither deductible for payers nor can it be included as income unless it was included in a divorce decree that was finalized before 2019.

Is furniture considered an asset in divorce?

Including Personal Belongings In Your Divorce Marital property and assets typically include items such as your home, cars, furniture, household belongings, artwork, and antiques, as well as money in bank accounts, investments, and retirement benefits.

What is considered an asset during divorce?

The legal definition of an asset in a divorce is anything that has a real value. Assets can include tangible items that can be bought and sold such as cars, properties, furniture, or jewelry.

What assets are taken into account in divorce?

Matrimonial assets typically include things like the family home, pensions, investments and savings. Matrimonial assets can also include any property acquired before the date of the marriage if this was purchased for use as the family home, or any furniture that was bought specifically for this residence.

What are examples of deductible alimony?

Sometimes, payments that are not intended to be treated as alimony may be considered alimony. For example, where a divorce court orders one spouse to make payments on a mortgage for which both spouses are jointly liable, the paying spouse may deduct one-half the payments on the mortgage as alimony.

Is alimony tax-deductible in 2022?

Alimony taxation Today, alimony or separate maintenance payments relating to any divorce or separation agreements dated January 1, 2019 or later are not tax-deductible by the person paying the alimony. The person receiving the alimony does not have to report the alimony payments as income.

Are spousal support payments deductible?

Spousal support is usually taxable and deductible And they must pay income tax on the payments. The spouse who pays the support (the payor) can claim it as a deduction. (It's like deducting contributions to registered retirement plans or child care expenses).

Is alimony tax-deductible 2020?

In California: If you receive alimony payments, you must report it as income on your California return. If you pay alimony to a former spouse/RDP, you're allowed to deduct it from your income on your California return.

What is the difference between alimony and property settlement?

A distinction between the two is critical if for no other reason than tax consequences. Alimony payments are different from property distributions , which are generally without tax consequences to either spouse.

What is alimony pendente lite?

Temporary alimony (alimony pendente lite) is given to one spouse (usually the woman) pending a divorce. Rehabilitative alimony is given to a lesser earning spouse until she (or he) becomes self-sufficient.

What does it mean when a former wife cohabits with a new husband?

A former wife cohabiting with a new love may drive her former husband to distraction , particularly when he is paying her alimony, but payments in support of a property settlement are a distribution of what they had when they were husband and wife.

Can alimony be enforced by the decedent's estate?

Alimony continues only during the lives of the spouses; property settlements are inheritable and can be enforced by the decedent's estate . Spousal support is one of many issues that is often difficult for spouses to agree upon.

Is alimony taxable?

Alimony payments are different from property distributions, which are generally without tax consequences to either spouse. Failure to properly label alimony can result in drastic tax consequences to the payor.

Is it hard to agree on spousal support?

Spousal support is one of many issues that is often difficult for spouses to agree upon. Before negotiating and even signing an agreement regarding spousal support it is very important that you understand your rights and the repercussions of any actions taken.

Is alimony a modification of remarriage?

While the terms and conditions of a property division are negotiated first and set in stone, alimony is often modifiable, and based on changing circumstances, such as changes in employment or retirement. Payments of property division are unaffected by remarriage, whereas alimony often terminates if the recipient makes another trip to the altar. A former wife cohabiting with a new love may drive her former husband to distraction, particularly when he is paying her alimony, but payments in support of a property settlement are a distribution of what they had when they were husband and wife. Alimony continues only during the lives of the spouses; property settlements are inheritable and can be enforced by the decedent's estate.

How to deduct alimony on taxes?

If you paid amounts that are considered taxable alimony or separate maintenance, you may deduct from income the amount of alimony or separate maintenance you paid whether or not you itemize your deductions. Deduct alimony or separate maintenance payments on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors (attach Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF ). You must enter the social security number (SSN) or individual taxpayer identification number (ITIN) of the spouse or former spouse receiving the payments or your deduction may be disallowed and you may have to pay a $50 penalty.

What is child support settlement?

Child support, Noncash property settlements, whether in a lump-sum or installments, Payments that are your spouse's part of community property income, Payments to keep up the payer's property, Use of the payer's property, or. Voluntary payments (that is, payments not required by a divorce or separation instrument).

What form do you file for alimony?

Report alimony received on Form 1040 or Form 1040-SR (attach Schedule 1 (Form 1040) PDF) or on Form 1040-NR, U.S. Nonresident Alien Income Tax Return (attach Schedule NEC (Form 1040-NR) PDF ). You must provide your SSN or ITIN to the spouse or former spouse making the payments, otherwise you may have to pay a $50 penalty.

What is separate maintenance?

A payment is alimony or separate maintenance only if all the following requirements are met: The spouses don't file a joint return with each other; The payment is in cash (including checks or money orders); The payment is to or for a spouse or a former spouse made under a divorce or separation instrument; The spouses aren't members of the same ...

What is voluntary payment?

Voluntary payments (that is, payments not required by a divorce or separation instrument).

Is there a liability to make a divorce payment?

The payment is to or for a spouse or a former spouse made under a divorce or separation instrument; The spouses aren't members of the same household when the payment is made (This requirement applies only if the spouses are legally separated under a decree of divorce or of separate maintenance.); There's no liability to make ...

Is there a liability for a death payment?

There's no liability to make the payment (in cash or property) after the death of the recipient spouse; and

Is property transfer taxable income?

Property transfers incident to divorce are not taxable income to the recipient and, therefore, are not tax deductible to the payor. This means, for example, you could not deduct your monthly payments to pay off your ex’s share of the equity in the home you keep.

Can you deduct divorce payments in Michigan?

Michigan Divorce Lawyer. No matter what your settlement agreement / divorce decree calls it, you can deduct payments to your ex under four circumstances. You can deduct payments that: 1.) are made pursuant to a written agreement or judgment; 2.) when you are not members of the same household, provided that.

When is alimony paid?

In most cases, the alimony is paid until the receiving spouse is able to receive educational or skill training to improve his or her earning power. For instance, alimony might be paid while the receiving spouse attends a trade school or pursues a college degree.

What is alimony in divorce?

Alimony is something most of us have heard about at some point, but depending upon where you live or grew up, it may be something of which you are not completely familiar. When a divorce sett lement occurs, one of the parties may be required to pay a predetermined amount to the second party on a monthly basis. ...

Why do people get alimony?

Alimony is in place to ensure that both parties leave the marriage in an equal financial status. If this was not in place, the stay at home spouse would be left in financial ruin after dedicating his or her life to taking care of the home and children so the other spouse was able to pursue his or her career.

What are the factors that determine alimony?

Some of the factors that determine the alimony payment are financial need, income earned, and children. Once these factors are considered, the court will award a percentage of the income of the higher earning spouse.

Can a spouse work a lesser paying job?

There are also situations where one spouse will work a lesser paying job to support the other spouse while he or she continues his or her schooling so that eventually, that spouse will earn a higher salary. Situations such as this are always considered when a judge awards alimony settlements.

Can a spouse receive alimony if the receiving party is deceased?

In some cases, the receiving spouse is never able to create financial independence and receives alimony until one of the parties is deceased or the receiving party is remarried. Each case is decided on its own merits, as the court may or may not set a definitive time frame for the alimony to cease. However, in virtually all cases, the agreement is reviewed by the court periodically to see if it needs to be adjusted or ceased.

Do you have to stay home to pay alimony?

But, there are still spouses, both male and female, that stay at home to take care of the household because the other spouse earns enough to support the home. There are also situations where one spouse will work a lesser paying job to support the other spouse while he or she continues his or her schooling so that eventually, that spouse will earn a higher salary. Situations such as this are always considered when a judge awards alimony settlements.

Why is alimony not a recapture?

Because the IRS sees this as a property settlement , not alimony. Because of this rule replacing all monthly payments with a lump sum “alimony” payment that is paid all in one year will often cause a trigger of this recapture rule, since alimony will go down to $0 in year 2.

How much alimony can you deduct?

The IRS says that if alimony payments decrease by more than $15,000 per year between years 1 and 2, or years 2 and 3, then part of the payments will not qualify for a tax deduction to the payor (and hence will not be taxable to the payee.) In other words, if alimony payments total more than $15,000 per year then they must last more than one year and cannot be reduced too quickly. Why? Because the IRS sees this as a property settlement, not alimony. Because of this rule replacing all monthly payments with a lump sum “alimony” payment that is paid all in one year will often cause a trigger of this recapture rule, since alimony will go down to $0 in year 2.

Can you replace alimony with a payoff?

In general when you and your client are considering replacing alimony with a payoff, remember that, among other possible outcomes, they are losing a tax-deduction. This must be weighed in the decision process.

Can a spouse give up assets in lieu of a monthly obligation?

There may be a great deal of financial assets and the payor spouse is willing to forego the tax deduction by giving up some assets in lieu of a monthly obligation.