Full Answer

How to settle a mortgage?

- The name of the creditor

- The amount owed

- That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

Is reverse mortgage better than mortgage?

The answer is that it depends on the situation. They have many similarities, but there are a few key differences that make reverse mortgages a better choice than a traditional mortgage. Or vice versa. This article breaks down the basics of these two types of home loans to give you a general idea of when to choose one over the other.

What was the National Mortgage Settlement?

he National Mortgage Settlement is an agreement reached in 2012 by the state and federal governments and five of the largest mortgage loan servicing companies in the United States.

Is a mortgage considered consumer debt?

Mortgages on your house are consumer debt. Mortgages on your business property are business debt. A mortgage on a property that you resided in when you mortgaged it, but is now a rental property, remains a consumer debt. A mortgage on property you purchased as an investment property to rent out is a business debt. Car loans.

What does mortgage settlement mean?

In some cases, the parties may be able to work out negotiations that involve compensation. They may decide to negotiate an agreement in terms of financial reimbursements on the mortgage. This is known as a mortgage settlement. It is similar to settlements in other areas of law, such as personal injury law.

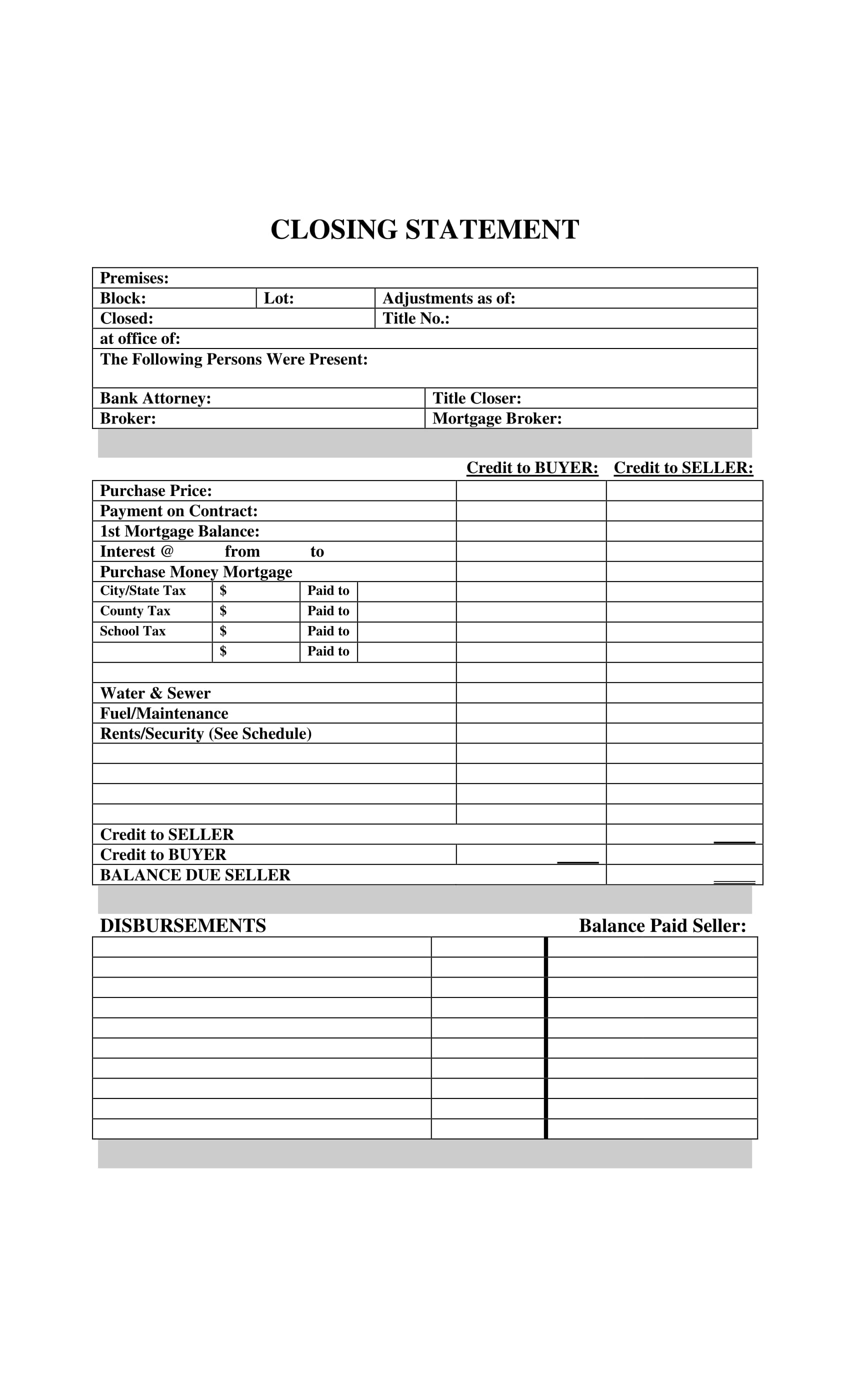

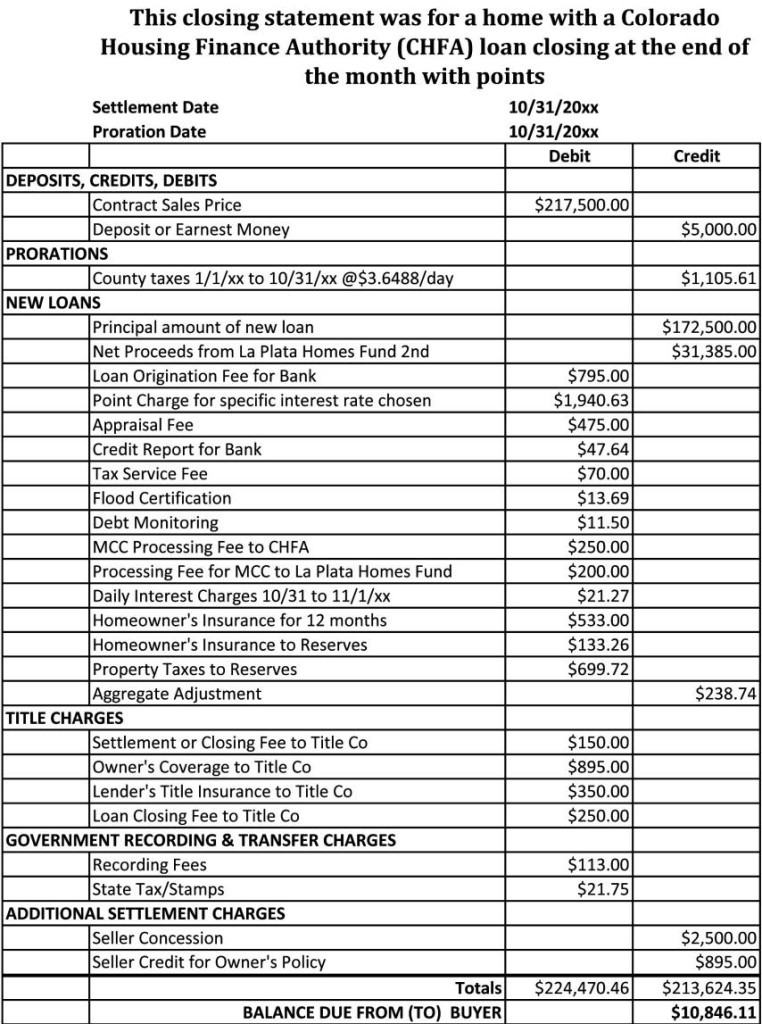

What is the difference between settlement and closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What is a settlement date for a mortgage loan?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How do I settle with a mortgage lender?

How to negotiate mortgage ratesShop around with multiple lenders.Ask your lender to match lower interest rate offers.Negotiate with discount points.Strengthen your mortgage application.

What happens after settlement of house?

After settlement, your lender will draw down on your loan. This means that they'll debit the amount they've paid at settlement from your loan account. You're then responsible for paying land transfer duty or stamp duty. It's usually paid on the settlement date.

What happens during settlement?

Settlement, or completion, is the final process in the sale of a property that takes place after the seller and buyer exchange contracts of sale. It all culminates on settlement day when the title is transferred to the buyer and they take physical and legal ownership of the property.

How long after settlement do you get money?

around 6 weeksSettlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What can go wrong at settlement?

Where can things go wrong? While hiccups rarely happen prior to settlement day, there are still factors which can delay the process. Some situations that you may encounter are missing documents, no-show conveyancers, delayed cheque issuances, and other unforeseen circumstances that may affect you financially.

What is a settlement period?

Property settlement is the final stage of a property sale wherein the buyer completes payment of the contract price to the vendor and takes legal possession of the property. The 'settlement period' is the amount of time between the exchange of contracts and the property settlement.

What is mortgage settlement letter?

In this case, you inform the lender of your situation and request them to give you some time off before you begin repayments. The lender may give you a one-time settlement option where you take some time off and then, settle the loan in one go. Since you are given some time, you may readily accept this offer.

How do you negotiate a mortgage balance?

How to Negotiate Mortgage RatesShop Around With at Least Three Lenders. ... Improve Your Credit. ... Negotiate Lender Fees. ... Increase Your Down Payment. ... Rate Lock Options. ... Discount Points. ... Negotiating Fees.

Will mortgage companies settle for less?

Thankfully, speaking to creditors can help—even if you haven't followed through on a previous payment plan. Lenders can be surprisingly forgiving, and many settle for much less than their customers owe.

How soon after settlement can you move in?

You'll have to vacate prior to settlement day unless another arrangement has been negotiated. Buyers are generally keen to get in the day after settlement, so you'll want everything ready to go the day before.

Is settlement date the day you move in?

Settlement day is the day you assume legal ownership of your new home. Picture: iStock.

How long is settlement usually?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What not to do after closing on a house?

So to raise the odds that all goes smoothly, here are five things you should never, ever say at closing.'I quit my job this morning' ... 'I can't wait to get all the new furniture we bought' ... 'I can't believe the appraisal came in $20,000 above the sales price' ... 'I can't wait to gut the house'More items...•

What was the settlement of the Ally/GMAC foreclosure?

The agreement settled state and federal claims against Ally/GMAC, Bank of America, Citi, JP Morgan Chase and Wells Fargo that they routinely signed for eclosure related documents without knowing if they were correct, a practice referred to at the time as “Robo-signing.” The settlement provided over $50 billion in relief to distressed borrowers harmed by the wrongful foreclosures and direct payments to the states and the federal government. The settlement included relief to servicemembers who were wrongfully foreclosed upon or charged higher interest rates in violation of the Servicemembers Civil Relief Act, or forced to sell their home at loss due to Permanent Change of Station (PSC) orders. Similar settlements were later made with HSBC, Ocwen and Suntrust. The CFPB was a party to these later settlements.

How to contact the CFPB about a mortgage?

If you’re having trouble paying your mortgage, contact the CFPB at (855) 411-2372 to be connected to HUD-approved housing counselor. If you’re having an issue with your mortgage, you can submit a complaint with the CFPB.

When was the National Mortgage Settlement?

The National Mortgage Settlement (2012) On February 9, 2012, the Attorney General announced that the federal government and 49 states had reached a settlement agreement with the nation’s five largest mortgage servicers to address mortgage servicing, foreclosure, and bankruptcy abuses (the “National Mortgage Settlement”).

What was the largest consumer financial protection settlement in the United States history?

The National Mortgage Settlement was the largest consumer financial protection settlement in United States history. The National Mortgage Settlement settled certain state and federal investigations relating to mortgage servicing abuses including abuses in the bankruptcy process and provided for over $20 billion in direct consumer relief.

How much did Wells Fargo pay in remediation?

(Wells Fargo) requiring Wells Fargo to pay $81.6 million in remediation affecting nearly 68,000 accounts for its repeated failure to provide homeowners in bankruptcy with legally required notices, thereby denying homeowners the opportunity to challenge the accuracy of mortgage payment increases.

What is a mortgage settlement?

Mortgage settlement--sometimes called mortgage closing--can be confusing. A settlement may involve several people and many documents and fees. This information will help you understand all that is involved. Although the focus of this guide is on settlements for home purchases, much of it will also be useful if you are refinancing a mortgage.

When are mortgage payments due?

Your first regular mortgage payment is usually due about 6 to 8 weeks after you settle (for example, if you settle in August, your first regular payment will be due on October 1; the October payment covers the cost of borrowing the money for the month of September). Interest costs, however, start as soon as you settle.

What are the fees for FHA mortgage insurance?

As with Private MI, insurance premium payments will stop when you acquire 22% equity in your home. FHA fees are about 1.5% of the loan amount. VA guarantee fees range from 1.25% to 2% of the loan amount, depending on the size of your down payment (the higher your down payment, the lower the fee percentage). RHS fees are 1.75% of the loan amount.

How long does it take to get a good faith estimate of closing costs?

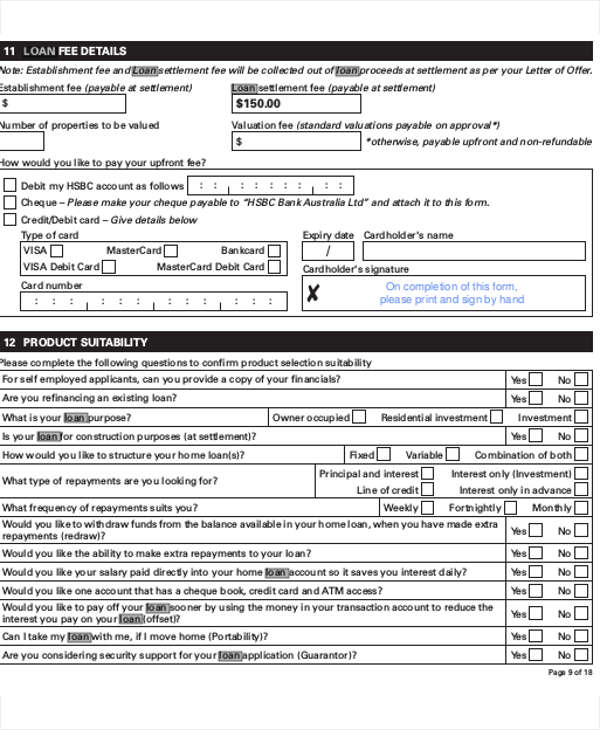

The Real Estate Settlement Procedures Act (RESPA) requires your mortgage lender to give you a good faith estimate of all your closing costs within 3 business days of submitting your application for a loan, whether you are purchasing or refinancing the home. This is a good faith estimate, but the actual expenses at closing may be somewhat different. If you are purchasing the home, you will also get an information booklet, Buying Your Home: Settlement Costs and Helpful Information.

What happens if you don't pay down on a mortgage?

If your down payment is less than 20% of the value of the house, the lender will usually require mortgage insurance. The insurance policy covers the lender's risk in the event that you do not make the loan payments. Typically, you will pay a monthly premium along with each month's mortgage payment. Your private MI can be canceled at your request, in writing, when your reach 20% equity in your home, based on your original purchase price, if your mortgage payments are current and you have a good payment history. By federal law your private MI payments will automatically stop when you acquire 22% equity in your home, based on the original appraised value of the house, as long as your mortgage payments are current.

What is origination fee?

The origination fee (also called underwriting fee, administrative fee, or processing fee) is charged for the lender's work in evaluating and preparing your mortgage loan. This fee can cover the lender's attorney's fees, document preparation costs, notary fees, and so forth.

How much is prepay for a mortgage?

Estimated cost: 0.5% to 1.5% of the loan amount to pre-pay for the first year

What are Mortgage Settlement Scams?

Mortgage settlement scams are scams which are designed to prey on consumers who either are or believe they are eligible for the National Mortgage Settlement. Scammers’ goal is to obtain personal information (like your social security number), bank account information, or charge you a fee to help determine whether you qualify for relief.

What are the Most Common Mortgage Settlement Scams?

Criminals who commit fraud will do just about anything to get their hands on money, and with the passage of the settlement back in 2012, mortgage scams surged. Below is a non-exhaustive list of common types of mortgage settlement scams.

Should I Hire a Lawyer?

If you believe that you have been a victim of a mortgage settlement scam, you may wish to contact a mortgage lawyer for advice or representation in court. You may also wish to contact a lawyer for advice regarding your eligibility for a settlement payout.

What is mortgage loan?

A written document evidencing the lien on a property taken by a lender as security for the repayment of a loan. The term 'mortgage' or 'mortgage loan' is used loosely to refer both to the ...

What is a foreclosed loan?

An agreement by the lender not to exercise the legal right to foreclose in exchange for an agreement by the borrower to a payment plan that will cure the borrowers delinquency. ...

Why don't wholesale lenders use fixed dollar fees?

While some retail lenders view fixed-dollar fees as an easy way to generate additional revenue from unwary borrowers, wholesale lenders don't because it would cause them problems with brokers.

What is mortgage insurance premium?

A mortgage insurance premium is a policy that insures the lender against loss if the homeowner defaults on a mortgage. ...

What is rate protection?

Protection for a borrower against the danger that rates will rise between the time the borrower applies for a loan and the time the loan closes. Rate protection can take the form of a ...

What is lease purchase mortgage?

Wondering what is the best lease purchase mortgage definition?A lease purchase mortgage is a financing option that allows potential homebuyers to lease a property with the option to ...

How to find the best mortgage deal?

It isn't easy to do right, as a summary of the major steps involved will demonstrate. Step 1: Decide if you are a potential shopper. Step 2: ...

What is a settlement in a mortgage?

With regards to your language of “loan transaction,” in context, this is a process, called a “settlement,” or a “closing,” or “escrow,” that has procedures for executing legally binding documents relating to a lien on a property that is subject to a federally related mortgage loan.

What is a RESPA settlement?

RESPA provides quite a broad definition of a settlement service, starting with the meaning of a “Settlement Service.”. That is, whoever provides a settlement service is obviously a settlement service provider. With regards to your language of “loan transaction,” in context, this is a process, called a “settlement,” or a “closing,” or “escrow,” ...

What is mortgage broker?

2. Rendering of services by a mortgage broker (including counseling, taking of applications, obtaining verifications and appraisals, and other loan processing and origination services, and communicating with the borrower and lender); 3.

Is a settlement service provider a provider?

Any provider of a settlement service is , mutatis mutandis, a settlement service provider. The following list is a guide, certainly not meant to be exclusive, that forms a basis for RESPA’s broad way of defining a settlement service. [24 CFR § 3500.2 (b)]

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

Why is there credit risk in forward foreign exchange?

Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement risk because the currencies are not paid and received simultaneously. Furthermore, time zone differences increase that risk.