How does Vanguard make money?

Vanguard does not make its money through hidden fees or through stock or ETF commissions. Instead, they operate essentially at cost, as the company is owned by its funds, making fund and ETF shareholders partial owners in Vanguard. In general, everything is low-cost or free with Vanguard. Although they have massive revenues and more than $7 ...

What is the interest rate on Vanguard money market?

Vanguard Treasury Money Market Fund: Short-term, U.S. Treasuries: $3,000: 0.09%: 0.09%: VMSXX Vanguard Municipal Money Market Fund: Short-term, tax-exempt securities: $3,000: 0.05%: 0.15%: VCTXX Vanguard California Municipal Money Market Fund: Short-term California municipal securities: $3,000: 0.01%: 0.16%: VYFXX Vanguard New York Municipal Money Market Fund

What happened to Vanguard Prime money market?

- Name change. Vanguard Prime Money Market Fund will change its name to Vanguard Cash Reserves Federal Money Market Fund.

- Even safer. It will now invest only in securities fully backed by the U.S. ...

- Even cheaper. Basically, everyone will get the lower expense ratio from Admiral shares which previously had a $5,000,000 minimum (!). ...

- No more checkwriting. ...

How to send money to Vanguard?

Invest by sending a check

- Don't send a check without a purchase form.

- Make your personal check payable to Vanguard. ...

- Be sure to sign your check. ...

- If you're submitting an employer's check, simply enclose it without endorsing it.

- Don't include additional forms or hand-written instructions with your check.

Is there a minimum balance for Vanguard money market?

Allow you to access your money without penalty. Focus on maintaining a stable share price. Have a $3,000 minimum investment requirement.

What is a Vanguard money market settlement fund?

Money market fund A mutual fund that seeks income and liquidity by investing in very short-term investments. Money market funds are suitable for the cash reserves portion of a portfolio or for holding funds that are needed soon.

Does Vanguard have a money market fund?

Vanguard Municipal Money Market Fund: The Fund is only available to retail investors (natural persons). You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

What is the minimum for a Vanguard index fund?

around $3,000How much does it cost to buy Vanguard index fund shares? Investors make an initial minimum investment — typically around $3,000 — and pay annual costs to maintain the fund, known as an expense ratio, based on a small percentage of your cash invested in the fund.

Can Vanguard settlement fund lose money?

An investment in the fund could lose money over short or even long periods. You should expect the fund's share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market.

Can you withdraw from settlement fund Vanguard?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

Are Vanguard money market funds safe?

So when interest rates rise, money market mutual funds like Vanguard's Cash Reserves Federal Money Market Fund become more attractive to investors. Like all mutual fund money market funds, VMRXX is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC).

Are money market funds Worth It?

Money market funds are generally considered one of the most stable investments—they experience low volatility and are less prone to market fluctuations. Money funds are also more liquid than other investments with similar returns, such as CDs, because they allow you to withdraw cash or buy other investments quickly.

How much interest does Vanguard money market pay?

Vanguard State-Specific Money Market Funds It has an average one-year return of 0.25%. Investors encounter the same minimum investment amount and expense ratio as the California fund with the Vanguard New York Municipal Money Market Fund (VYFXX).

Why does Vanguard have high minimums?

See the Vanguard Brokerage Services commission and fee schedules for limits. ***Some funds have higher minimums to protect the funds from short-term trading activity.

Which Vanguard fund has the highest return?

Fastest growing Vanguard funds worldwide in May 2022, by one year return. The fastest growing investment fund managed by U.S. asset management company Vanguard is the Vanguard Energy Index Fund. Over the year to May 1, 2022, the mutual fund generated an annual return of 60.64 percent.

What is the most popular Vanguard index fund?

The Vanguard 500 Index Fund is one of the most renowned index funds on the market today, and a good buy-and-hold option, according to Azoury. It gives you exposure to 500 of the largest U.S. companies trading on the stock market.

Are Vanguard money market funds safe?

So when interest rates rise, money market mutual funds like Vanguard's Cash Reserves Federal Money Market Fund become more attractive to investors. Like all mutual fund money market funds, VMRXX is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC).

What is the interest rate on Vanguard settlement fund?

The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%. The one-year return as of March 31 was 0.14%.

What are settlement funds?

Settlement Funds means money to be paid by the City pursuant to Part 5 of this Settlement Agreement, consisting of the Reversionary Amount, the Non-Reversionary Payments, and the Unconditional Individual Amount to be paid to each member of the Settlement Class.

How do I withdraw money from my Vanguard money market account?

How do I make a withdrawal?Log into your account.Select 'Payments' from the 'My Portfolio' menu.Select 'Money out'Any money held as cash and available for withdrawal will be shown here. Select 'Withdraw cash'Follow the on-screen instructions.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

Preserve your cash until you decide how to use it

Money market mutual funds offer you a place to store your cash and potentially earn income—without as much risk to your investment as stock or bond funds.

Are you investing outside of an IRA or other retirement account?

If you're in one of the highest tax brackets and investing outside of your retirement account, you may be able to reduce your tax exposure with a tax-exempt money market fund.

How to learn more about Vanguard money market funds?

To learn more about Vanguard money market funds, visit the provider's website.

What is Vanguard cash reserve?

With a history going back to 1975, Vanguard Cash Reserves Federal Money Market Fund ( VMMXX) is Vanguard's oldest money market fund. Holdings are made up of cash, U.S. government securities and/or repurchase agreements collateralized by U.S. government securities.

What Are Money Market Funds?

Not to be confused with a money market account, a money market fund is a type of mutual fund that holds cash and high-quality, ultra-short-term cash-equivalent securities.

What is a VMSXX?

3. Vanguard Municipal Money Market Fund. For investors residing in states other than California or New York, the Vanguard Municipal Money Market Fund ( VMSXX) is a good choice for a money market fund in a taxable brokerage account. Tax-exempt at the federal level, VMSXX holds short-term, high-quality debt securities.

Does Vanguard have cash?

But just about every Vanguard investor's assets are held in one of these cash accounts, even if only for a brief period. Thus, it's wise to know how Vanguard's money market funds work, and which one is best for your needs.

Do Vanguard funds get attention?

Vanguard money market funds don't get a lot of love from the investment community, nor do they receive much attention in financial media.

Is Vanguard money market tax exempt?

If the investor holds a money market fund with tax-exempt bonds issued in their state of residence, interest may also be tax-exempt at the state level. All Vanguard non-taxable money market funds have a minimum initial investment of $3,000.

How much investment is required for mutual funds?

A $3,000 minimum initial investment is required for a mutual fund account (no minimum if you're using the fund as your brokerage settlement fund).

Is Vanguard a treasury?

Yes the default settlement account for vanguard is vmfxx, their federal (note not 100% treasuries!) Money market fund.

What is the minimum investment for Vanguard California Municipal Money Market Fund?

The $3,000 minimum investment and 0.16% expense ratio are worth considering. It has an average one-year return of 0.25%.

What is the risk of investing in money market mutual funds?

As with other conservative investments, the main risk in owning money market mutual funds is one of opportunity cost. That is, when the market is moving higher, money stuck in these types of funds will likely earn far less than riskier types of assets.

Why are money market mutual funds good?

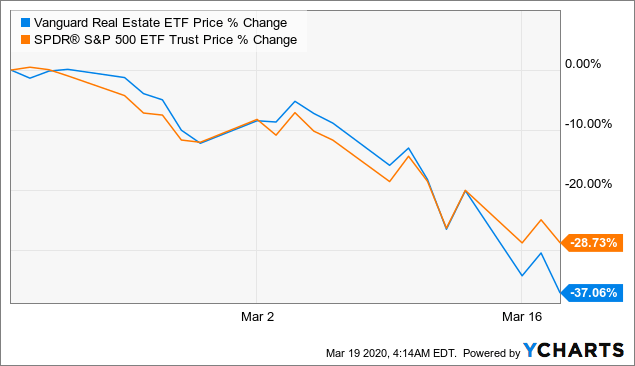

The liquidity and safety offered by money market mutual funds can offer a good place for investors to stash emergency cash for times when the market experiences severe pullbacks , like in the first quarter of last year amid the pandemic.

What is the minimum investment for VUSXX?

As with all money market mutual funds, the returns are dependent upon the current interest rate environment. This fund has a minimum investment of $3,000 and charges a 0.09% expense ratio. It had an average one-year return of 0.22%.

Why are money market funds not yielding?

Because interest rates on short-term government debt are very low, money market funds aren't yielding very much. That said, their purpose really isn't to earn gobs of money. Rather, the purpose is to provide a relatively safe but also liquid place to put cash.

What is money market fund?

Money market funds are meant to provide a relatively safe but also liquid place to put cash. (Getty Images) When the stock market soars, as it has been recently, money market funds aren't very interesting. As markets turn south, however, investors might revisit the benefits of these assets. Don't confuse a money market mutual fund ...

Is Vanguard a tax exempt fund?

This tax-exempt Vanguard money market fund invests in short-term, high-quality municipal securities. It is suitable for investors in higher tax brackets, but it has a higher expense ratio at 0.15%. Still, the fund is yielding more than the previous three funds, with an average one-year return of 0.34%. Like the other Vanguard funds, the investment minimum is $3,000.

What is VMMXX fund?

Treasury bills and cash. VMMXX is a great option for investors who need immediate access to cash or for long-term investors who want to offset riskier investments.

What is a money market fund?

If you're looking to invest in highly liquid investment vehicles that come with short-term maturities, consider a money market fund. These mutual funds typically invest in cash, highly-rated debt securities, and cash equivalents. These funds were originally designed to offer liquidity, provide current income, and preserve an investor's principal by maintaining a fixed $1.00 share price.

Who Should Invest?

1 This makes the fund highly suitable for conservative investors whose tolerance for risk is low. It's also a great investment choice for anyone who may need quick access to money on a daily basis.

What is VMMXX?

VMMXX is a great option for investors who need immediate access to cash or for long-term investors who want to offset riskier investments.

What are the risks associated with investing in a mutual fund?

Here are some of the most common risks associated with the fund which could hurt your investment: Credit risk: You may experience a drop in security prices if issuers can't make the interest or principal payments. This risk, though, is very low, as the fund invests in high-quality securities.

Why is income risk higher in a fund?

That's because the fund relies heavily on short-term interest rates. As an investor, you can expect income risk to be higher because short-term rates tend to fluctuate over shorter periods of time.

Is VMMRX insured?

Like all mutual fund money market funds, VMMRX is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC). Investors concerned about the lack of insurance may wish to consider a money market fund account offered by a bank since the FDIC insures those accounts up to $250,000.

What is the yield of VMFXX?

VMFXX does have a yield right now of 0.04%. Investors who aren’t satisfied with this could choose a short-term bond fund like VBISX, the Vanguard Short-Term Bond Index Fund. This security is currently yielding about 0.25%.

Does Vanguard have an automatic investment program?

Automatic investment program for ETFs is not available. Vanguard also does not offer any automatic investment programs for stocks. Vanguard has excellent mutual funds and ETF's that will appeal to many investors. Although it has a complicated commission schedule, clients with large accounts can do well here.

Does Vanguard offer sweep programs?

Unfortunately, Vanguard does not offer any type of an FDIC-insured bank sweep program. This service moves money that is sitting in a brokerage account’s cash position to a bank where it earns interest and is fully insured by the U.S. federal government. Several brokers do offer some type of bank sweep program.

Is Vanguard better than Fidelity?

The Vanguard website is more difficult to navigate than TD Ameritrade's and Fidelity's websites. TD Ameritrade also has a very good browser-based trade ticket, which the Vanguard site lacks. The Fidelity mobile app has better market news than Vanguard's app. Charles Schwab's app offers live streaming of CNBC at no cost. Investors also can't trade non-Vanguard mutual funds on the broker's app. On the TD Ameritrade's app, in comparison, all mutual funds can be traded.

Is Vanguard a good broker?

Although it has a complicated commission schedule, clients with large accounts can do well here. Traders who need advanced trading tools will do better with another broker.

Does Vanguard cash sweep insurance cover brokerage accounts?

Vanguard Cash Sweep Insurance. Vanguard also does not provide an option to deposit money into a brokerage account and leave it as cash. Deposits are always sent to a Vanguard fund. One advantage of this policy, however, is that SIPC (the major insurer of U.S. brokerage accounts) offers $500,000 of protection for securities, ...