Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What happens after Closing Disclosure?

What happens after signing closing disclosure? After the lender receives the signed Closing Disclosure from all borrowers, they can begin preparing loan documents. Once the loan documents are prepared, they are delivered to the escrow company. Signing. Signing typically takes place 1-2 days before closing.

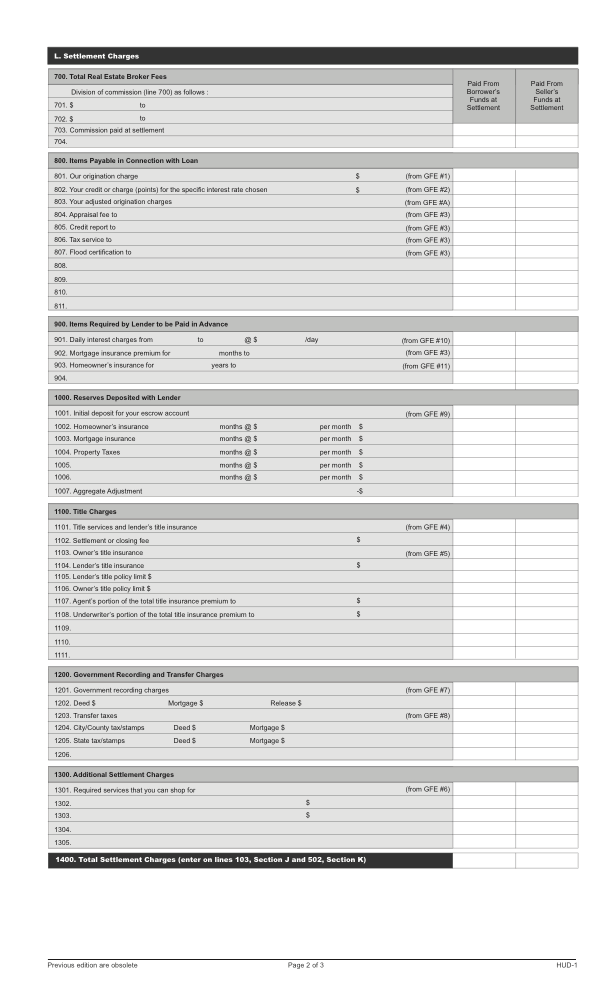

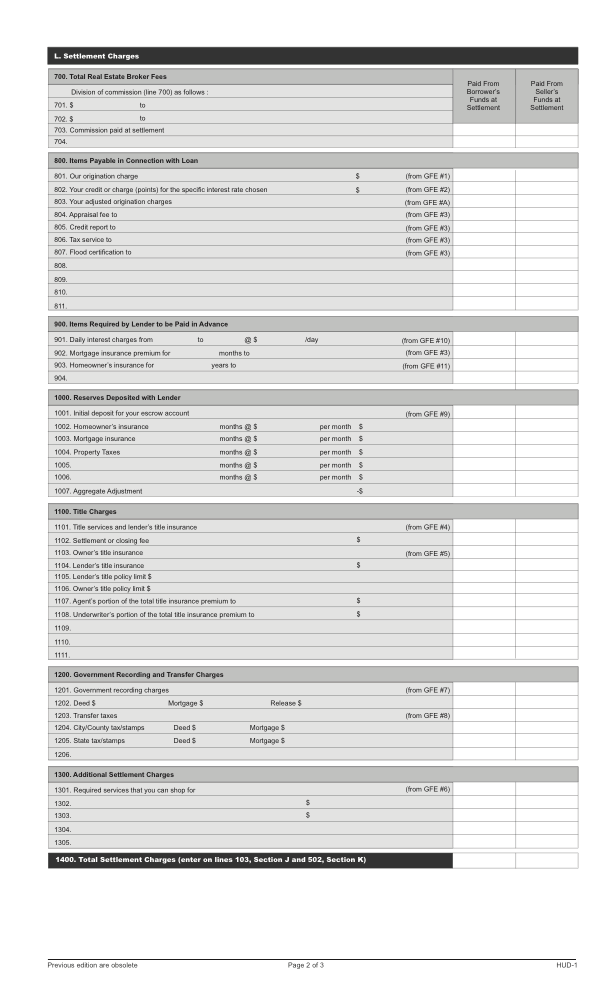

Which type of loan will use A HUD-1 in place of a Closing Disclosure?

A HUD-1 form is most commonly used for reverse mortgages and mortgage refinance transactions. As of Oct. 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions; however, if you applied for a mortgage on or before Oct. 3, 2015, you would receive a HUD-1.

What is the 3 Day Closing Disclosure rule?

Your lender is required by law to give you the standardized Closing Disclosure at least 3 days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

Is there another name for a closing disclosure?

Prior to these rules, home buyers received two documents: the HUD-1 Settlement Statement and the Truth in Lending Disclosure Statement (instead of the Closing Disclosure).

Is the HUD-1 Settlement Statement the same as the closing disclosure?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

Is closing date the same as settlement date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

Where do I find closing statements?

If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase. Other parties that may have copies of the settlement documents include your real estate agent, or the financial institution that holds the loan for the property.

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

How long after settlement can I move in?

six weeksTwo months is the most common duration in all states except New South Wales, where six weeks is the preferred time.

Do you get the keys on settlement day?

Once the documents have been signed by both parties, they're sent to the titles office to register you as the new owner of the property. On settlement day, you can pick up your keys and move into your new home.

What is FnF in salary?

What is full and final settlement? Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

How is FnF amount calculated?

Calculation of per day basic: (number of days of non-availed leaves * basic salary) / 26 days ( Avg paid days in a month). As per Section 7 (3) of the Payment of Gratuity Act 1972, Gratuity should be offered within 30 days of the resignation. If you fail to do so you need to pay with interest.

What if company is not paying FnF?

Answers (2) Send a letter to the HR of the Company including the managing director telling all situation and that fnf has not been done. If they do not respond or reply in negative then a legal notice then a case in labour court is legal remedy.

What is F&F process?

The F&F process is mainly a financial settlement such as unpaid salary (including annual benefits - leave travel allowance) and arrears, unpaid bonus, payment for non-availed leaves or earned leave, and Gratuity if one completes four years and 240 days, and pension.

Is the closing disclosure more accurate than the loan estimate?

In the meantime, the Closing Disclosure is given to you three days prior to your closing date and includes information similar to the Loan Estimate...

Does closing disclosure mean final approval?

Closing Disclosure is a final accounting of the interest rate and rates of your loan, the closing costs of your mortgage, your monthly mortgage pay...

Is a closing disclosure a commitment to lend?

Once you have selected a lender and executed the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides...

What comes first close or closed disclosure?

Once you are free to close, you will receive a Closing Disclosure to sign from your provider. You will receive this letter three days before your s...

What is a closing disclosure for buyer?

Closing Disclosure is a five-page form that describes in detail the critical aspects of your mortgage loan, including the purchase price, loan rate...

What is closing disclosure form?

What is a closing disclosure form? Put simply, it’s a form outlining the terms and costs of your mortgage—and one of the most important pieces of paperwork to check before you close on a home.

What is LE disclosure?

The LE outlined the approximate fees you would be expected to pay if you move forward with a lender to close on a home. But your closing disclosure is the real deal, which is all the more reason to scrutinize it carefully.

How much does closing cost for a home?

But in general, home buyers can expect typical closing costs to amount to about 3% to 4% of the home’s sale price.

What happens if you lock in your interest rate?

Interest rate: If you locked in your rate, it should remain the same.

When is a HUD-1 settlement statement required?

Before Aug. 1, 2015, the CD was known by another name: the HUD-1 settlement statement. Yet this document was long and confusing, and required by federal law to be distributed to home buyers only on the day of closing—which didn’t give them much time to address any issues. This is why the settlement statement was replaced by the much more streamlined five-page closing disclosure, and laws were changed so that lenders are required to provide this document at least three business days before closing.

When did the CD replace HUD 1?

If this is your first time purchasing a home—or you purchased your last home before Aug. 1, 2015 (when the CD replaced the HUD-1)—sit down and review a sample CD from the CPFB. If you have any questions, ask your loan officer or real estate agent for a line-by-line explanation of the form. Trust us, this extra dose of oversight is well worth it!

Do real estate agents have errors on CDs?

Think such errors aren’t common? A recent survey of real estate agents by the National Association of Realtors® found that half of agents have detected errors on CDs. In other words, it really pays to check this document carefully and ask your real estate agent for help.

Settlement Statements, Closing Disclosures, and HUD-1s

There are a number of different ways to finance a real estate purchase. Some buyers are able to pay cash, but many work with financial institutions to obtain the funds to buy the property. Even when working with a lender, there are multiple options available for financing.

Settlement Statements

At a high level, the settlement statement is a document reflecting all the ways that money will change hands between parties at closing.

Closing Disclosures

A closing disclosure (CD) is a document given specifically to buyers who are working with a lender to finance a transaction. The CD provides all the relevant information regarding the buyer’s loan. It is provided by the lender and typically includes, but is not limited to:

What is closing disclosure?

The Closing Disclosure is a five-page form that describes, in detail, the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes and insurance, closing costs and other expenses. It’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take ...

How long do you have to give closing disclosure?

Your lender is required by law to give you the standardized Closing Disclosure at least 3 days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

What Is A Loan Estimate?

The Loan Estimate is a three-page document you receive three days after applying for a mortgage. It provides a summary of the loan terms, the costs associated with the mortgage, the loan size, interest rate and payments. It lays out whether there are any balloon payments, prepayment penalties or more. The document also includes a schedule of your payments and the estimated taxes and insurance payments. Closing costs are outlined in the Loan Estimate as well.

What to do if you find a discrepancy between closing disclosure and loan estimate?

If you find a discrepancy between the Loan Estimate and the Closing Disclosure, the first step is to contact your lender or real estate agent immediately to correct the errors. These mistakes can be as minor as misspelled names or as serious as a change in the interest rate.

Why is negative amortization risky?

This can be a risky feature because a negative amortization loan is never paid in full. For example, you may make partial interest payments during the first 5 – 10 years of the loan, and any remaining interest payments are added to the original principal balance of the loan.

Why is it important to read the closing disclosure?

The reason for this is that once you sign, you’re committing to the conditions presented, regardless of whether there are any mistakes in the paperwork. That means it’s crucial that you carefully read the Closing Disclosure your lender sends you.

What documents were used before the HUD-1 settlement?

Prior to these rules, home buyers received two documents, the HUD-1 Settlement Statement and the Truth in Lending Disclosure Statement (instead of the Closing Disclosure). There were two problems with these previous documents: they were confusing, and they were only provided at closing – which offered home buyers very little opportunity to review and make sense of them.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

Closing Disclosure

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Cash For Closing

Sometimes, cash is required in the closing process. The settlement statement you receive will let you know how much if any, cash is needed at the closing table. However, the term “cash for closing” can be a little misleading. It does not necessarily mean bringing paper money to the closing. In fact, it usually requires a check.