Do you have to fill out a W-9 for alarm com?

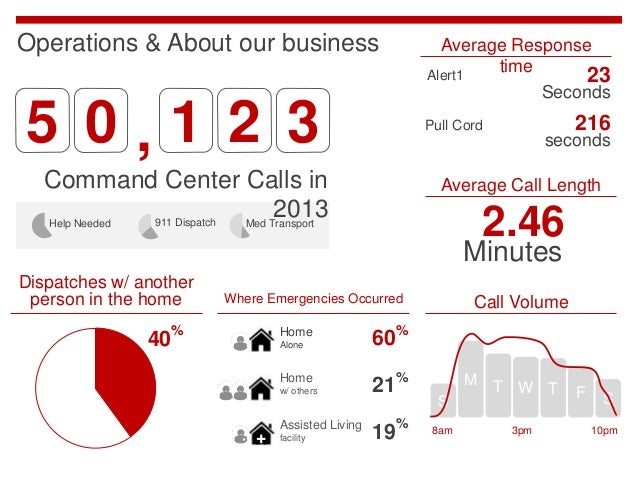

Alarm.com class action settlement Class Members may need to fill out a W-9 due to payout amounts being higher than originally estimated. Originally, claimants in the Alarm.com settlement were projected to receive payments between $94 and $140. More recently, it was confirmed that some Class Members are eligible for payments of more than $600.

Do I need to file a W-9 for a settlement?

W-9 tax forms allow people to report a variety of income, including significant payouts earned from settlements. According to the settlement approval order, Class Members will have their payments reduced to $599 if they do not submit a valid and timely W-9 tax form.

What is the status of the alarm com settlement?

The Alarm.com settlement was granted final approval on Aug. 15, 2019. If Class Members have further questions, they can contact the settlement administrator KCC Class Action Services LLC at 1-855-256-2243.

What is a ‘W9 form’ and when is it due?

W-9 forms were reportedly due to the settlement administrator by Dec. 14, 2019. Plaintiffs in the Alarm.com class action lawsuit claimed that they received unsolicited phone calls from the company using an automatic dialing system or pre-recorded voice.

What is a W-9?

A W-9 is (as others have noted) a legitimate form used when you may need someone’s tax ID number for some purpose - I once had to get that from a daycare center to arrange a corporate grant for them.

How long does it take to get a W-9 card?

We’ll send the card out within 2 weeks of receiving your W-9 form.

Is it a crime to request a W-9?

Requesting that someone fill out a W-9 is not a crime, but what someone does with that information might be. Failure to pay according to contract terms is probably not a crime either, but could be pursued using legal means.

Did they send the real SSN?

Yes, they sent the real thing. My biggest concern is the giving out of the SSN. She wrote back requesting more info, we’ll see what they say.

Is there a word to describe how foolish you would be to actually go through with this scam?

There’s no word in the English language to describe how foolish you would be to actually go through with this scam.

Is only name, address and SSN useful?

HOWEVER - “only” name, address and SSN would seem to be quite useful information for someone planning on conducting a little identity theft.

This settlement is closed!

Please see what other class action settlements you might qualify to claim cash from in our Open Settlements directory!

Join a Free TCPA Class Action Lawsuit Investigation

If you were contacted on your cell phone by a company via an unsolicited text message (text spam) or prerecorded voice message (robocall), you may be eligible for compensation under the Telephone Consumer Protection Act.

421 Comments

I received a check too for 23.14 and was returned. Stating a duplicate check! I was charged a returned fee also!

What happens if you don't agree to a W-9?

Usually, if they don’t agree the money simply will not be paid, or the payor will withhold 24% and send it to the IRS. Still, the Form W-9 may make you uneasy.

What is a W-9?

A Form W-9 verifies your taxpayer ID number, typically your Social Security Number, or if you are a company, your employer identification number. If you want to be paid, refusing to hand over a W-9 may not make sense. The IRS says that anytime a payor thinks they may have to report a payment on an IRS Form 1099, they should ask for a Form W-9.

What to report if you receive a 1099?

Thus, if you receive a Form 1099, report it, even if you are claiming that the money should be tax free. Form W-9, Request for Taxpayer Identification Number and Certification. Say that a lawyer settles a case for $1 million, with payment to the lawyer’s trust account. Assume that 60 percent is for the client, and 40 percent is for the lawyer.

Does a lawyer receive a 1099?

The lawyer is sure to receive a Form 1099 reporting the full $1 million as gross proceed s. The lawyer can report as income the $400,000 fee without worrying about computer matching, since gross proceeds do not count as income. The client isn’t so lucky.

Can you file a lawsuit for 1099?

Recipients may not like this, and lawsuits for issuing Forms 1099 are filed on occasion. Most such suits don’t seem to go very far, perhaps precisely because it is often possible to justify whatever was issued. So, while you probably will have to provide an IRS Form W-9 to get paid if that form is requested, try to head off Form 1099 issues ...

Is a W-9 worth fighting about?

Thus, when a payer requires a Form W-9, it is usually not worth fighting about providing it , especially if there is already an understanding about which Forms 1099 will be issued. Disputes about Forms 1099 are common. The Form 1099 regulations are complex, which causes many businesses to err on the side of issuing the forms.

Can a company require a W-9?

Thus, many companies have a policy of requiring signed Forms W-9 for any payment. It doesn’t appear to be commonly invoked, but there is a potential penalty for refusing to provide a signed Form W-9 when requested.

Is there a check in the mail for fraud?

Tens of millions of dollars are being re-paid to victims of fraud. The Federal Trade Commission says checks are in the mail--but they also warn that scammers may be taking this opportunity to try to steal your money.

Do the FTC call you to pay fees?

The FTC will never call and tell you to pay fees. They'll never ask you for personal information like a Social Security number or bank account information. Those are all red flags for a scam.

Why did the class action lawsuit ruse re-emerge?

The class action lawsuit ruse re-emerged to take advantage of today’s economic troubles. In this scam, consumers are notified out of the blue—usually via incoming e-mail or an unsolicited telephone call—that they are entitled to thousands of dollars because of a recent settlement.

Do you need to provide bank account numbers for class action lawsuits?

And in real judgments against banks or credit card companies, consumers do not need to provide bank account numbers so the award can be direct-deposited—consider such a request a red flag for fraud.

Do you have to pay a lawsuit up front?

Don’t take the bait, as these ploys are sure signs of a scam. In legitimate lawsuits, you never have to pay up front. And, as always, be suspicious of any check you receive unexpectedly. Among the other red flags of a bogus lawsuit scam:

Does the Better Business Bureau make phony calls?

Another recent scheme, reports the Better Business Bureau, involves phony notifications to owners of small businesses that they are being sued. The callers pretend to be from the BBB—they claim that the business owner can avoid the lawsuit by paying a fee to have complaints removed from BBB files. In reality, the BBB makes no such calls. Business owners should contact their local BBBchapter if they receive such notifications.

How do scammers use the IRS?

Scammers use the regular mail, telephone, or email to set up individuals, businesses, payroll and tax professionals. The IRS doesn't initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Recognize the telltale signs of a scam. See also: How to know it’s really ...

What is a scam email?

Scam emails are designed to trick taxpayers into thinking these are official communications from the IRS or others in the tax industry, including tax software companies. These phishing schemes may seek information related to refunds, filing status, confirming personal information, ordering transcripts and verifying PIN information.

What is the Security Summit?

Security Summit - Learn more about how the IRS, representatives of the software industry, tax preparation firms, payroll and tax financial product processors and state tax administrators are working together to combat identity theft and refund fraud.

Where to report IRS phishing?

To report tax-related illegal activities, refer to our chart explaining the types of activity and the appropriate forms or other methods to use. You should also report instances of IRS-related phishing attempts and fraud to the Treasury Inspector General for Tax Administration at 800-366-4484.

What do criminals steal?

Criminals target tax professionals to steal data such as PTINs, EFINs or e-Service passwords.

Is the IRS using tax transcripts as bait?

The IRS and Security Summit partners today warned the public of a surge of fraudulent emails impersonating the IRS and using tax transcripts as bait to entice users to open documents containing malware.

Can a website ask for information to file a false tax return?

The sites may ask for information used to file false tax returns or they may carry malware, which can infect computers and allow criminals to access your files or track your keystrokes to gain information.