This must be depreciated. 103. Settlement Charges to Borrower: This is an information line. This amount is also seen on line 1400, and the expenses that make up this amount will fall into all three tax categories.

Full Answer

Are settlement fees and closing costs tax deductible?

Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including: Any amounts the seller owes that you agree to pay (such as back taxes or interest, recording or mortgage fees, sales commissions and charges for improvements or repairs).

What is depreciated cost?

Depreciated cost is the remaining cost of an asset after reducing the asset’s original cost by the accumulated depreciation. Understanding the concept of a depreciation schedule

Are closing costs included in the depreciation of rental property?

Those costs that are basis adjustments can be part of your yearly depreciation deduction for the rental property. Several closing costs cannot be deducted and are not added to basis. For a list of these costs please refer to IRS Publication 527 Residential Rental Property under the sub-heading Basis of Depreciable Property.

How does depreciation affect home insurance claims?

Depreciation is the amount your property drops in value since you first bought it. When you need to replace your property, depreciation can affect your insurance claims. If you have to file an insurance claim, chances are you're already stressed out. A thief may have violated your right to privacy and raided your home.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-632166593-1--5731f4e05f9b58c34c8ef567.jpg)

Can I write off my settlement charges?

If you were awarded money from a legal settlement or case, it's likely that the award amount will be taxable and should be included in your gross income reported to the IRS. Generally, the only exception is if the money was awarded to you as a result of a lawsuit for physical injury or sickness.

Are settlement charges added to basis?

Settlement costs. You can't include in your basis the fees and costs for getting a loan on property. A fee for buying property is a cost that must be paid even if you bought the property for cash.

What closing costs can be depreciated?

Generally, deductible closing costs are those for interest, certain mortgage points and deductible real estate taxes. Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including: Abstract fees.

Should closing costs be capitalized?

In addition to the capitalized closing costs tied to your property, most costs associated with obtaining a loan must be capitalized rather than immediately deducted. These include loan origination/processing/underwriting fees, purchased points, appraisals, credit reports, etc. Add them up from your closing statement.

What can be added to the cost basis of property?

Common improvements that might increase your cost basis include (but are not limited to) bathroom or kitchen upgrades, home additions, new roofing, the addition of a fence or desk, and various landscaping enhancements.

Are closing costs tax deductible in 2021?

In The Year Of Closing If you itemize your taxes, you can usually deduct your closing costs in the year in which you closed on your home. If you close on your home in 2021, you can deduct these costs on your 2021 taxes.

Do you amortize or depreciate closing costs?

Closings costs on a rental property fall into one of three categories: Deduct upfront in the current year. Amortize over the loan term. Add to basis (capitalize) and depreciate over 27.5 years.

Can you subtract closing costs from capital gains?

Capital Gains Tax The price you paid for the home is also called the tax basis. The closing costs associated with selling the rental property that are tax deductible, discussed above, can be used to lower overall basis (or price you paid for the home), thus potentially lowering the capital gains tax.

Are closing costs amortized over the life of a loan?

When a business acquires a loan there are typically closing costs involved. Generally Accepted Accounting Principles (GAAP) require these financing costs to be amortized (allocated) over the life of the loan.

How do I record closing costs?

Add a home's purchase price to the closing costs, such as commissions, to determine the home's total cost. Write “Property” in the account column on the first line of a journal entry in your accounting journal. Write the total cost in the debit column. A debit increases the property account, which is an asset account.

How do I record a settlement statement in Quickbooks?

4:0022:25How to Use QuickBooks Online to Record a HUD 1 Final Settlement ...YouTubeStart of suggested clipEnd of suggested clipSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going toMoreSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going to enter a bunch of debits and credits. So the purchase price on the surface looks like 43,000.

Can soft costs be capitalized?

Soft costs are more intangible costs not directly related to a specific construction task. Soft costs related to the construction of a building or improvements should generally be capitalized and included in the depreciable cost basis in a cost segregation study.

What is included in cost basis?

Simply put, your cost basis is what you paid for an investment, including brokerage fees, “loads,” and any other trading cost—and it can be adjusted for corporate actions such as mergers, stock splits and dividend payments.

What assets do not get a step-up in basis?

Assets That Cannot Be Valued on a Stepped-up BasisRetirement accounts that include IRAs and 401(k)s.Money market accounts.Pensions.Tax-deferred annuities.Certificates of deposit.

How does IRS verify cost basis?

Preferred Records for Tax Basis According to the IRS, taxpayers need to keep records that show the tax basis of an investment. For stocks, bonds and mutual funds, records that show the purchase price, sales price and amount of commissions help prove the tax basis.

Do home improvements increase basis?

Improvements you make to your home may add to your cost basis. In order to add to your cost basis, an improvement must adapt your home or part of your home to a new use, prolong your home's useful life or add to the value of your home.

Is the seller credit deductible?

I believe TaxGuyBill is correct. Any "sellers credit" is treated like a reduction in the sales price and therefore, goes to the depreciation basis. You still get credit for all the closing costs that are deductible. In other words, if the contract was for $100,000, and there were $10,000 of closing costs and a $5000 seller credit, you treat the transaction as if the sales price was $95,000 and you paid all the closing costs.

Can you deduct closing costs on a property?

Obviously the usual rules still apply. You can only deduct property taxes for the dates you owned the property, even if the closing costs included back taxes that the seller owed. And any closing costs that aren't deductible are added to the basis. So instead of having a $110,000 basis and then worrying about how to allocate the $5000 sellers credit, you just have a $105,000 basis (more or less).

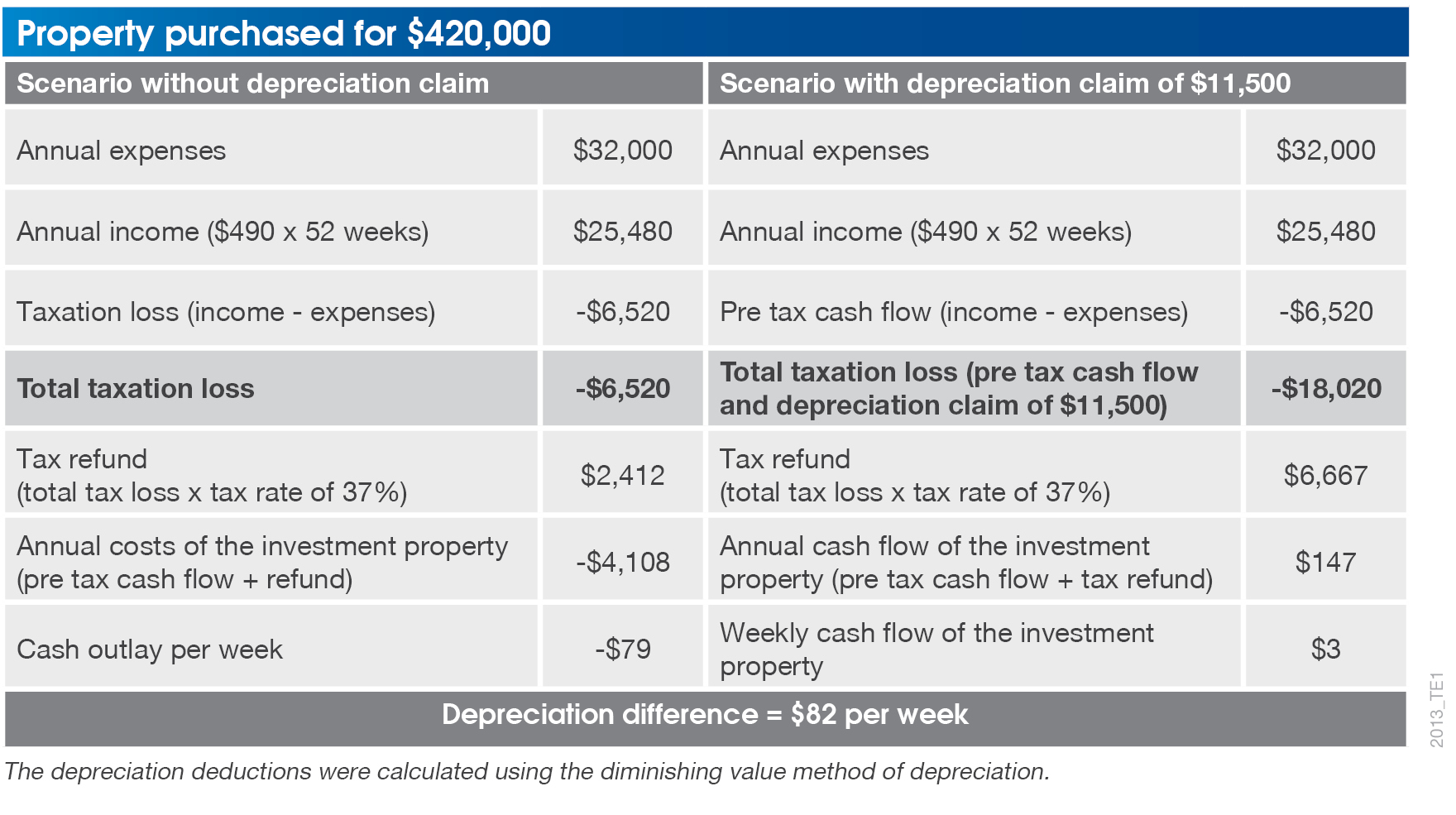

Why is depreciation important?

The bigger your basis is the better because your depreciation expense will be higher and your taxable rental income lower. Here’s how a large amount of depreciation can reduce rental income tax.

How many closing costs can be deducted in the same year?

Let’s begin by discussing the deductible closing costs on a rental property that can be deducted right away. According to the IRS, there are only three closing costs that can be deducted in the same year the property is purchased:

What Are Closing Costs?

Closing costs on a rental property are the fees and expenses paid to close escrow, above and beyond the down payment you make for the home.

How to reduce rental income tax?

To calculate the depreciation expense we need to do two things: Deduct the value of the land or lot from the basis, because land does not depreciate. Divide this amount by 27.5 years to determine the annual depreciation expense allowed by the IRS.

How long do you have to deduct real estate taxes?

Real estate taxes are prorated from the day you purchase the property through the end of the year and are deducted in full for each year that you own the property. For example, if property taxes are $2,700 for the year and you close escrow on June 1st, you would be entitled to deduct the remaining seven months of property taxes.

What is the initial cost basis for a rental property?

Your initial cost basis when you buy a rental property is the price paid for the property. After that, certain closing costs are added to the initial basis to arrive at an adjusted basis. Settlement fees and closing costs that become additions to your basis include: Abstract fees. Utility installation service charges.

What are professional fees?

Professional fees paid to an attorney or financial advisor to assist you with drawing up and reviewing the closing documents. Mortgage fees such as loan application, credit report, origination, and underwriting fees. Prepaid and impound amounts for property taxes, mortgage interest, homeowners insurance, and HOA fees.

What are settlement fees and closing costs?

Other settlement fees and closing costs for buying the property become additions to your basis in the property. These basis adjustments include: Any amounts the seller owes that you agree to pay, such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions.

What is a seller's owe?

Any amounts the seller owes that you agree to pay, such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions.

Can title insurance be deducted from a rental?

Title insurance. Any amounts the seller owes that you agree to pay, such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions. Those costs that are basis adjustments can be part of your yearly depreciation deduction for the rental property. Several closing costs cannot be deducted and are ...

Is depreciation considered tax planning?

Depreciation and amortization are advanced tax planning topics. There are several different methods for depreciating property. You may wish to consider obtaining the advice of a qualified tax professional for information pertaining to your specific situation.

Does amortization lower your basis?

However, the amortization process will gradually lower your basis, all other things being equal, even as it lowers your tax bill. Attach the completed Form 4562 to your tax return. If you file as an individual, then attach it to your Form 1040.

Can you deduct closing costs for refinancing?

Although you cannot generally deduct costs associated with purchasing or refinancing your personal residence , you can normally deduct the closing and refinancing costs associated with a rental property. The difference is that your rental activities are part of a trade or business intended to generate a profit.

What is depreciation in insurance?

Both your home and its contents had an initial purchase price or value. It’s what the item was worth when you first bought it. Over time and with use, the value goes down due to wear and tear, as it goes out of style, the technology advances, or it doesn’t work like it once used to.

What is depreciation in accounting?

Depreciation is the difference between what you paid for an item and what it’s now worth, based on any number of factors. Here’s an example:

Why does the value of a home go down?

Over time and with use, the value goes down due to wear and tear, as it goes out of style, the technology advances, or it doesn’t work like it once used to.

Does iPod depreciate?

In the example, your iPod depreciated since the technology is years old, it’s no longer in demand, and it’s very well used. The same goes for your home and belongings. How much depreciation there is might be different, but the premise is the same.

Does insurance cover loss based on cash value?

Many insurance policies compensate you for your loss based on the actual cash value of the item. That’s what you would’ve been able to sell the item for if you had a buyer for it immediately preceding the loss. It’s the depreciated value of an item, in other words.

Can you present a receipt to a claims adjuster?

If you have a recent receipt for the item that you’re claiming or if you have comparable listings for the item in a similar pre-loss condition, you can present that information to the claims adjuster. At their discretion, they might reconsider their valuation.

Does depreciation affect insurance?

Although depreciation affects almost every aspect of ownership, whether a home or property inside it, how it applies to your insurance claim can differ. It depends on the homeowners insurance policy you purchased. Do you have an actual cash value policy or a replacement cost policy?

What is depreciated cost?

The depreciated cost of an asset is the purchase price less the total depreciation taken to date. The depreciated cost equals the net book value if the asset is not written off for impairment. The depreciated cost of an asset is determined by the depreciation method applied.

How to calculate depreciated cost?

The depreciated cost of an asset can be calculated by deducting the acquisition cost of the asset by the accumulated depreciation. The formula is shown below:

How is depreciation determined?

The depreciated cost of an asset can be determined by a depreciation schedule that a company applies to the asset. There are several allowable methods of depreciation, which will lead to different rates of depreciation, as well as different depreciation expenses for each period.

What is depreciation expense?

Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. Tangible Assets. Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment.

What is depreciation in accounting?

In accounting, depreciation is an accounting process of reducing the cost of a physical asset over the asset’s useful life to mirror its wear and tear. It can be applied to tangible assets, of which the values decrease as they are used up.

What is accumulated depreciation?

Accumulated depreciation is the summation of the depreciation expense taken on the assets over time. It is a contra-asset account and is displayed together with the asset on the balance sheet.

How much is depreciation expense for a 20 year machine?

If the machine’s life expectancy is 20 years and its salvage value is $15,000, in the straight-line depreciation method, the depreciation expense is $4,750 [ ($110,000 – $15,000) / 20].