Getting a settlement offer on a debt you couldn’t afford to pay in full may be the perfect opportunity to take care of an old account. You can avoid the anxiety of initiating the conversation with the creditor. Plus, you don't have to convince the creditor to settle because they’ve already made that decision.

Full Answer

Should I write a debt settlement offer letter?

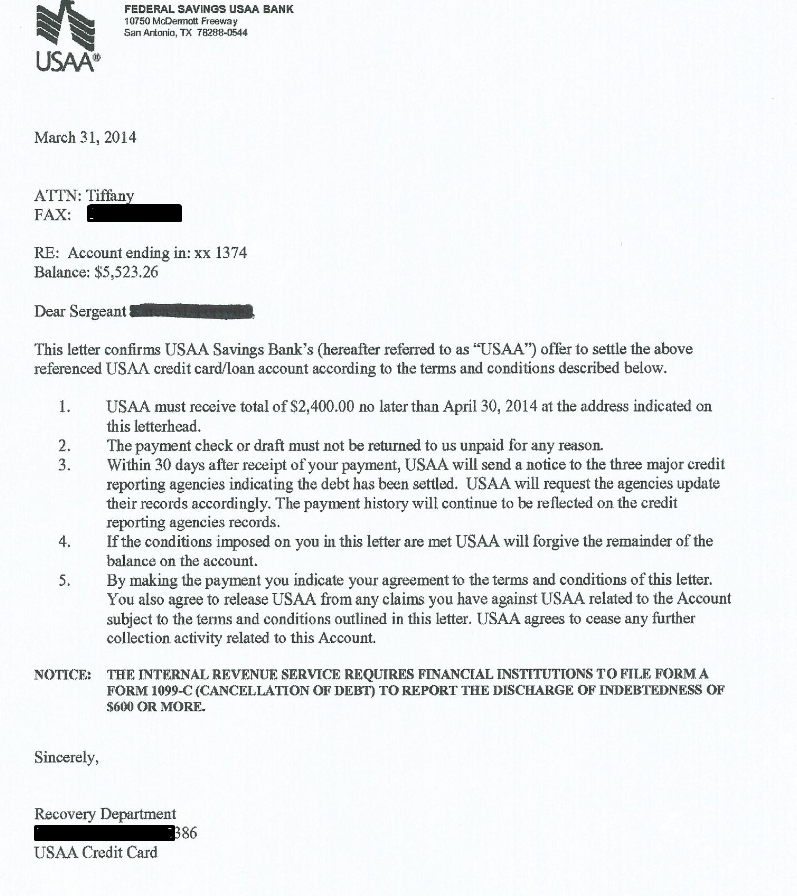

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How much should I offer to settle a debt?

When entering negotiations, make sure to:

- Know your rights. You can’t be harassed, lied to, threatened, or even spoken to out of business hours.

- Consider your debt. What type of debt do you owe? This will help in understanding what you could ask for.

- Speak calmly and logically.

- Make your offer. Debt collectors may settle for around 50% of your debt. ...

What percentage should I offer to settle debt?

- Credit Cards, Department Store Cards 40%

- Citibank Accounts 65%

- Discover Accounts 65%

- Cell Phones (Collections over $750) 50%

- Apartment Lease Re-letting Fees 40%

- Medical Debts, Collections 50%

- Judgments/Garnishments, Repossessions 80%

- Pay Day Loans, Signature Loans 40%

- Collection Balance Greater than $750 Settlements 40%

How to negotiate a debt settlement?

If you want to make a proposal to repay this debt, here are some considerations:

- Be honest with yourself about how much you can pay each month. ...

- Write down a summary of your monthly take-home pay and all your monthly expenses (including the amount you want to repay each month and other debt payments). ...

- Decide on the total amount you are willing to pay to settle the entire debt. This could be a lump sum or a number of payments. ...

What is a reasonable offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Is it good to pay settlement offers?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Is it better to settle a debt or let it fall off?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What does it mean when a debt collector offers a settlement?

Debt settlement is a practice that allows you to pay a lump sum that's typically less than the amount you owe to resolve, or “settle,” your debt. It's a service that's typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

Should I pay off a 2 year old collection?

If you have a collection account that's less than seven years old, you should still pay it off if it's within the statute of limitations. First, a creditor can bring legal action against you, including garnishing your salary or your bank account, at least until the statute of limitations expires.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

How settlement affect your credit?

Loan settlements impact on the CIBIL score When a loan is termed settled, it is viewed as a negative credit behaviour and the borrower's credit score drops by 75-100 points. The CIBIL holds this record for over 7 years.

Do debt collection agencies have to accept an offer?

It's important to know that collection agencies aren't legally obligated to accept or agree to payment plans. Debt collectors don't have to work with you or agree to any payment schedules based on what you're reasonably able to afford. Their goal is to collect as much of the debt as they can as quickly as they can.

What are the disadvantages of a debt settlement?

Disadvantages of Debt SettlementDebt Settlement Fees. Many debt settlement providers charge high fees, sometimes $500-$3,000, or more. ... Debt Settlement Impact on Credit Score. ... Holding Funds. ... Debt Settlement Tax Implications. ... Creditors Could Refuse to Negotiate Your Debt. ... You May End Up with More Debt Than You Started.

How much should I ask for a settlement?

A general rule is 75% to 100% higher than what you would actually be satisfied with. For example, if you think your claim is worth between $1,500 and $2,000, make your first demand for $3,000 or $4,000. If you think your claim is worth $4,000 to $5,000, make your first demand for $8,000 or $10,000.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

How do I remove a settled account from my credit report?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

Why would a credit card company drop you?

In other words, your lender may drop you as a client because of your poor track record of paying back what you owe.

How to negotiate a credit card?

Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.”. Explain how dire your situation is.

Is debt settlement good for you?

Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Can a credit card company seize a debt?

Credit cards are unsecured loans, which means that there is no collateral your credit card company—or a debt collector —can seize to repay an unpaid balance. While negotiating with a credit card company to settle a balance may sound too good to be true, it’s not.

What does it mean to settle a debt?

A settled debt simply means that a creditor has agreed to accept less than what’s owed as final payment. There are companies that offer debt settlement or debt relief services, and it’s also possible to work out a settlement with creditors yourself.

How many payments do you have to make to settle a debt?

That last part is important, as debt settlement usually requires you to make a lump sum payment. Some creditors may allow you to break it up into two or three payments in the case of larger debts. But this still means you’ll need to have cash on hand to settle with.

What is a debt counselor?

A credit counselor or debt counselor can look at your debts, income and spending to help you create a realistic budget. They can also discuss different options for debt repayment, including whether a debt management plan (DMP) might be right for you. This debt payoff strategy involves making one payment to the credit counselor, who then distributes the payment among your creditors.

What is debt consolidation loan?

A debt consolidation loan is another option. Debt consolidation loans allow you to pay off multiple debts and then make one payment to the loan going forward. A debt consolidation loan or personal loan could make sense for paying off debt if you need to borrow a larger amount of money and if you can qualify for a lower interest rate.

How long do you have to be behind on your credit card payments to settle?

So, you may need to be 90 to 180 days behind on your payments before a creditor may be willing to settle for less in lieu of charging off the debt altogether. If the creditor is reporting those late payments to the credit bureaus, then those late payments have already done their damage.

How to deal with debt when overwhelmed?

Being overwhelmed by debt can make you feel as if your options are limited; in fact, you have a full range of options—from debt consolidation, to debt management, to debt settlement—as well as resources that can help you, including debt counselors. By looking carefully at your debt and your available options, the best choice will become clearer.

How long does a late payment on a credit report last?

Late payments can linger on your credit reports for up to seven years, although their impact on your scores does fade over time. A settled debt status could add to the negative impact, at least in the near term until those accounts age on your credit reports.

How to deal with a debt settlement?

You can accept the settlement offer and pay the settlement account in full. This is the easiest and fastest way to deal with the debt, assuming you’ve received a legitimate settlement offer. Read the settlement offer carefully or have an attorney review the offer to be sure it’s legally binding – that the creditor or collector can’t come after you for the remaining balance at some point in the future.

What percentage of a debt is typically accepted in a settlement?

Debt settlement agreements often range between 30% and 60% of the total amount owed, but there will also be substantial fees on top of that amount.

How long does debt settlement stay on your credit report?

Generally, settled accounts stay on your credit report for seven years after the original date of delinquency. A debt settlement will negatively affect your credit, but not as much as failing to pay the debt will. 6

How to stop a third party debt collector from collecting my credit report?

You can stop communication from a third-party debt collector by sending a written cease and desist letter. 4

What is a settlement letter?

A settlement letter could be a debt collector ploy to get you to make one or more partial payments on a time-barred debt, that is one whose statute of limitations has expired. The payment would restart the statute of limitations giving the collector more time to sue you for the debt 1 .

Can a creditor accept a lower settlement?

Your creditor may be willing to accept a lower settlement than the one offered in the letter. Because the door for settling the debt is already opened, you can use this opportunity to see if the creditor is willing to accept a lower payment.

Do you have to convince a creditor to settle?

Plus, you don't have to convince creditor to settle because they’ve already made that decision. Don’t get too excited about the prospect of finally being rid of this debt. Before you pay or even speak to anyone about the settlement (particularly a debt collector), you need to be sure the settlement offer is legitimate.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

What percentage should I offer to settle debt?

For example, the National Foundation for Credit Counseling (NFCC) reports that the typical credit card settlement percentage is worth about 40%-50% of your total debts.

What is a debt settlement?

Debt settlement generally involves contacting your creditors and asking them to accept a lump-sum payment in exchange for considering your debts settled. Typically, this lump sum payment is worth less than the total of what you currently owe.

What factors are considered when settling debt?

If you’ve gone over the pros and cons of settling your debts and decided that it is the right move for you, the next step is to better understand what factors are considered in a debt settlement. Knowing what matters to your creditors will give you a leg up when deciding how much to offer for your settlement. In light of that, we’ve taken a closer look at these factors below.

Why would a creditor settle for a smaller amount of debt?

In this case, the creditor will be more likely to settle for a smaller portion of your debt if you can prove that you are going through a period of financial hardship. Likewise, if it looks like you have plenty of money coming in each month and your debts are mostly the result of extravagances like shopping trips or going out to eat, your creditor is probably going to be less willing to strike a deal with you.

What happens if you settle your debt?

On the one hand, if you choose to settle your debt, there’s a good chance that you will get away with paying less than you owe, and your settled account balances will be brought to zero, which means your creditors will stop calling.

What is the best place to start negotiating?

With that in mind, it’s a good idea to do some research into who you’ll be negotiating with before you make the call. The Better Business Bureau (BBB) is a good place to start gathering that information.

Do you have to settle a debt with a collection agency?

Still, it’s crucial to remember that your debt settlement offer is just a starting point when negotiating. No creditor or collection agency is required to settle with you, which means they may come back with a higher number or refuse to settle the debt at all. That’s part of why it’s a good idea to have a professional in your corner as you undertake this process.

How to negotiate a debt settlement?

Now, both you and the debt collector are aware that paying outrightly is not an option, otherwise, you would have cleared the debt beforehand. This is where debt settlement negotiations come in. When entering negotiations, make sure to: 1 Know your rights. You can’t be harassed, lied to, threatened, or even spoken to out of business hours. 2 Consider your debt. What type of debt do you owe? This will help in understanding what you could ask for. 3 Speak calmly and logically. 4 Make your offer. Debt collectors may settle for around 50% of your debt. Just remember to negotiate low, so when they counter, you still have room.

What is debt settlement?

Debt settlement is an agreement between two parties - one a borrower and the other a lender - for a one-time payment to cancel out the remaining debt balance. Most times, creditors realize that full payment for a debt might not be possible, so they opt for debt settlement.

What Percentage Should I Ask a Creditor To Settle for After a judgment?

First of all, you should know that a lender is more likely to agree to a debt settlement agreement if they view the debt as likely to be written off. Another reason is that they, too, could be in need of cash at the moment. Since most loans involved in debt settlements are unsecured - meaning there is no property to seize in place of repayment defaulting - the creditor is often better off accepting part payment, as opposed to getting nothing at all.

What is unsettled debt?

Unsettled debts pose a problem for everyone involved. For the borrower, a debt they can’t pay up is often a financial nightmare, accompanied by unhealthy amounts of anxiety. For the creditor, it spells trouble. That’s where debt settlement comes in. Debt settlement is an agreement between two parties - one a borrower and ...

How late can you settle a debt?

In fact, settlement is more likely for debts that are approximately five months late.

What is the most important part of negotiating with creditors?

Now it’s time to bell the cat. Negotiating with your creditors will be tricky, requiring persuasion and persistence. This is perhaps the most important part of the process.

What percentage of debt should be settled?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder’s financial situation and available cash on hand. When contemplating the answer to the question “What percentage should I offer to settle the debt?” consider other factors, such as the term of the debt, as well.

The Basics of Debt Settlement

The Downsides of Debt Settlement

- Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before. First, debt settlement generally requires you to come up with a substantial amount of cashat one time. This is ...

Should You Do It Yourself?

- If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, …

Appearances Matter

- Whether you use a professional or not, one of the key points in negotiations is to make it clear that you’re in a bad position financially. If your lender firmly believes that you’re between a rock and a hard place, the fear of losing out will make it less likely that they reject your offer. If your last few months of card statementsshow numerous trips to five-star restaurants or designer-boutique sh…

The Negotiating Process

- Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.” Explain how dire your situation is. Highlight the fact that you’ve scraped a little bit of cash together and are hoping to settle one of your accounts before the money gets used up elsewhere. By mention…

The Bottom Line

- While the possibility of negotiating a settlement should encourage everyone to try, there’s a good chance you’ll hear a “no” somewhere along the way. If so, don’t just hang up the phone and walk away. Instead, ask your credit card company if it can lower your card’s annual percentage rate(APR), reduce your monthly payment, or provide an alternative payment plan. Often your cre…