Settling your debt can hurt your credit score, but can also save you money. It’s worth noting that settlement is usually only an option once a lender writes your debt off as a loss, which happens when someone is very overdue on debt payments. Ideally, you’ll always make your minimum debt payments on time.

Full Answer

What are the pros and cons of a debt settlement?

There definitely are some things to like about debt settlement, such as:

- If you’re organized and persistent, you can attempt debt settlement on your own. ...

- If, instead, you require representation and all goes well, you can be clear of your unsecured debt in 24 to 48 months, at a fraction of what you owed — ...

- You won’t owe an add-on fee as each debt is settled; that’s already worked into your escrow account deposits.

What is the best way to settle debt?

Part 1 of 3: Negotiating the Debt Amount Download Article

- Read the judgment. Debtors and creditors should review the court order (judgment) to determine the total amount due and any specific payment instructions ordered by the court.

- Evaluate your financial situation. Whether you are the creditor or the debtor, you should review your finances before negotiating the amount of the debt.

- Contact the other party. ...

Can I negotiate a debt settlement by myself?

Negotiating a debt settlement with a creditor on your own can save you time and money. Here’s how DIY debt settlement negotiations work, how it compares to settlement through a company and how ...

Is it better to pay off debt or settle debt?

It is alway preferable to pay off your debt in full, IF possible. Although settling your debt for a smaller amount will not hurt your credit as much as not making any payments, it is still considered a red flag for lenders. However, there are times when settling your debt can be a smart move.

Is it better to settle debt or not pay?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

Does paying off a settlement hurt your credit?

Debt settlement can negatively impact your credit score, but it won't hurt you as much as not paying at all. You can rebuild your credit by making all payments on time going forward and limiting balances on revolving accounts.

Is it better to pay full amount or settle?

According to Latham, a "settled in full" status on your credit report is preferable to "unpaid" or "in default," but it's not great. Settling an account rather than paying it in full and on time signals that you're a risky borrower, which will be reflected in your credit score.

How much should you pay to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do I remove a settled debt from my credit report?

You can remove a settled account that's past the 7-year rule from your credit report. If it still appears on your credit report, then you have to file a dispute with the credit bureaus to delete it.

Should I pay a 5 year old collection?

If you have a collection account that's less than seven years old, you should still pay it off if it's within the statute of limitations. First, a creditor can bring legal action against you, including garnishing your salary or your bank account, at least until the statute of limitations expires.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

What happens when I settle a debt?

Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. To successfully negotiate a debt settlement plan, it is important to stop minimum monthly payments on that debt, which will incur late fees and interest and damage your credit score.

Can I negotiate with debt collectors?

Occasionally, when a debt goes to collections you may be able to negotiate with the collector to accept a smaller amount than what you originally owed. An agent may decide it's worthwhile to accept partial payment now rather than go through a prolonged collection process.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

How long do settlements stay on credit report?

seven yearsA settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached. Your credit report represents the history of how you've managed your accounts.

What's the difference between settled and paid in full?

Paying in full means paying the total amount of your debt. Settling in full means coming to an agreement with your creditor or collection agency on an updated payment plan.

Why trust us?

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money .

Summary

If you find yourself with enough cash to pay off maxed-out card debt, consider your options first, including impact on your score, taxes and fees.

I have a lump sum I can use to pay off maxed-out cards. Should I pay them in full or settle for less?

Since both paying in full and settling will eliminate your credit card debt, you should consider cost savings and the impact of your score of each possible option.

Cost savings of paying off card debt

Like it or not, paying full price is often the quickest and most convenient way to resolve a problem account.

Score recovery due to paying off card debt

While we know your score has dropped almost 200 points to 498, and your cards are maxed out, we don’t know how timely you’ve paid these cards in the past.

When card debt is reported as charge-off

Once a charged-off debt has been settled, the creditor will typically begin reporting the account to the credit bureaus as having been “settled for less than the full amount due.”

When card debt is sent to collections

Whereas a recent debt settlement can hurt the score when replacing a charge-off as the latest negative status, the worst, and last, step along this timeline is much less complicated.

How many payments do you have to make to settle a debt?

That last part is important, as debt settlement usually requires you to make a lump sum payment. Some creditors may allow you to break it up into two or three payments in the case of larger debts. But this still means you’ll need to have cash on hand to settle with.

What does it mean to settle a debt?

A settled debt simply means that a creditor has agreed to accept less than what’s owed as final payment. There are companies that offer debt settlement or debt relief services, and it’s also possible to work out a settlement with creditors yourself.

What is a debt counselor?

A credit counselor or debt counselor can look at your debts, income and spending to help you create a realistic budget. They can also discuss different options for debt repayment, including whether a debt management plan (DMP) might be right for you. This debt payoff strategy involves making one payment to the credit counselor, who then distributes the payment among your creditors.

What is debt consolidation loan?

A debt consolidation loan is another option. Debt consolidation loans allow you to pay off multiple debts and then make one payment to the loan going forward. A debt consolidation loan or personal loan could make sense for paying off debt if you need to borrow a larger amount of money and if you can qualify for a lower interest rate.

How long do you have to be behind on your credit card payments to settle?

So, you may need to be 90 to 180 days behind on your payments before a creditor may be willing to settle for less in lieu of charging off the debt altogether. If the creditor is reporting those late payments to the credit bureaus, then those late payments have already done their damage.

How to deal with debt when overwhelmed?

Being overwhelmed by debt can make you feel as if your options are limited; in fact, you have a full range of options—from debt consolidation, to debt management, to debt settlement—as well as resources that can help you, including debt counselors. By looking carefully at your debt and your available options, the best choice will become clearer.

How long does a late payment on a credit report last?

Late payments can linger on your credit reports for up to seven years, although their impact on your scores does fade over time. A settled debt status could add to the negative impact, at least in the near term until those accounts age on your credit reports.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

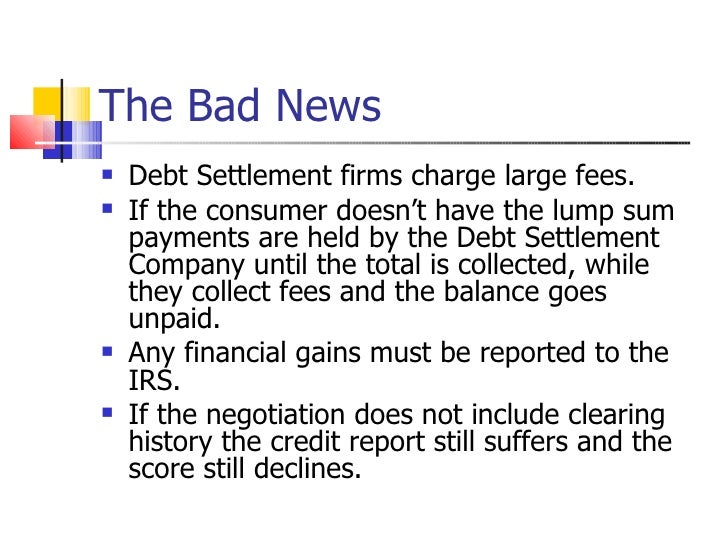

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

Why would a credit card company drop you?

In other words, your lender may drop you as a client because of your poor track record of paying back what you owe.

How much can you cut your credit card balance?

With a little bit of knowledge and guts, you can sometimes cut your balances by as much as 50% to 70%.

How long to cut down on credit card spending?

To raise your chances of success, cut your spending on that card down to zero for a three- to six-month period prior to requesting a settlement.

How to negotiate a credit card?

Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.”. Explain how dire your situation is.

How to settle debt?

The pros of settling debt: 1 Your credit score damage decreases as your credit utilization decreases . Notice the difference between the heading of this paragraph and that of #1 above. This paragraph heading doesn't mention an increase in your credit score. It does, however, get rid of any lingering score damage caused by having accounts with high credit utilization. So although it does help stop more score damage from occurring, settling debt most likely won't increase your score. 2 Lower monthly payments. Since your debts will be "settled", you will pay less than you initially owed on the account. Sometimes, the amount you'll pay can be 50% less than you were paying for the original debt - saving you money down the line.

What happens when you stop paying debt settlement?

This adds up to more late fees, interest and other potential penalties.

What are the pros and cons of paying off debt?

A con of paying off a debt in full is that the money you used to pay off the debt can't be used elsewhere. If you want to save, invest or spend the money on education, you'll have to wait until you start to build up more resources. You'll have to make the decision which is more important to you: using the money for something else or paying off debt. This can sometimes be a very difficult choice.

How does paying off debt feel?

You'll have less stress in your life. Paying off debt can sometimes feel like a huge weight has been taken off your shoulders. You've thought about it... worried about it... wondered what to do about it...

How long does a settled account stay on your credit report?

The fact that your account (s) was settled and that you didn't pay the full amount, remains on your credit report for 7 years. This could make it more difficult to get future credit from lenders. Tax Consequences. Yes, the IRS is on the lookout for those who have settled accounts.

Does credit score increase with debt?

Your credit score could increase as your credit utilization decreases. Since the debt has probably negatively impacted your payment history (and possibly other credit score factors), your score won't immediately shoot through the roof. However, over time, if no more debt is accumulated, you should see your score rise.

Does settlement affect credit score?

Credit Score Impact. Settling debt, like charging-off it off, is seen as derogatory. It will have a negative impact on your credit score - as will missing payments while negotiating the settlement.

What is debt settlement?

Debt settlement companies are companies that say they can renegotiate, settle, or in some way change the terms of a person's debt to a creditor or debt collector. Dealing with debt settlement companies can be risky. Debt settlement companies, also sometimes called "debt relief" or "debt adjusting" companies, often claim they can negotiate ...

What happens if you stop paying debt settlement?

This can have a negative effect on your credit score and may result in the creditor or debt collector filing a lawsuit while you are collecting settlement funds. And if you stop making payments on a credit card, late fees and interest will be added to the debt each month. If you exceed your credit limit, additional fees and charges may apply. This can cause your original debt to increase.

How to avoid paying credit card debt?

Avoid doing business with any company that promises to settle your debt if the company: 1 Charges any fees before it settles your debts 2 Represents that it can settle all of you debt for a promised percentage reduction 3 Touts a "new government program" to bail out personal credit card debt 4 Guarantees it can make your debt go away 5 Tells you to stop communicating with your creditors 6 Tells you it can stop all debt collection calls and lawsuits 7 Guarantees that your unsecured debts can be paid off for pennies on the dollar

What is an alternative to a debt settlement company?

An alternative to a debt settlement company is a non-profit consumer credit counseling service. These non-profits can attempt to work with you and your creditors to develop a debt management plan that you can afford, and that can help get you out of debt.

What happens if you stop paying your credit card bills?

If you stop paying your bills, you will usually incur late fees, penalty interest and other charges, and creditors will likely step up their collection efforts against you.

Is forgiven debt taxable income?

If a portion of your debt is forgiven by the creditor, it could be counted as taxable income on your federal income taxes. You may want to consult a tax advisor or tax attorney to learn how forgiven debt affects your federal income tax. Read full answer.

Can a debt settlement company settle all your debts?

In many cases, the debt settlement company will be unable to settle all of your debts. If you do business with a debt settlement company, the company may tell you to put money in a dedicated bank account, which will be managed by a third party. You may be charged fees for using this account.

Why are debt collection companies better than lenders?

Because these companies specialize in tracking down alleged debtors, they're better suited to collecting unpaid debt than lenders themselves. They employ a small army of sleuths equipped with the world's best search tool: the internet. Against these odds, an alleged debtor is hopeless. Debt collection agents can track their prey using anything from bank records to voting data - even internet providers!

What happens if you refuse to pay a debt collection agency?

If you refuse to pay a debt collection agency, they may file a lawsuit against you. Debt collection lawsuits are no joke. You can't just ignore them in the hopes that they'll go away. If you receive a Complaint from a debt collector, you must respond within a time frame determined by your jurisdiction.

What If the Collection Agency Sues Me?

If the collection agency sues you, stick to your guns: you can win. This flowchart shows you the path to victory in a debt collection lawsuit. Pre-lawsuit, make sure to send the collector a Debt Validation Letter telling them you dispute the debt and requesting validation of the debt.

What happens if a collection agency can't show ownership of a debt?

If the collection agency can’t show ownership of the debt. Frequently, the sale of a debt from a creditor to a collector is sloppy. A collection agency hounding you may not be able to show they actually own your debt. If they can’t, then you aren’t obligated to pay them.

What to do if you don't owe someone money?

If you don’t owe the debt. Rule #1 of life: don’t pay people money you don’t owe them. If an agency is hounding you for a debt you don’t owe, send them a Debt Validation letter to get them off your tail.

What is debt collection agency?

This helps lenders to recoup some of their losses. A debt collection agency is a company that buys unpaid debt from a creditor. Debt collection agencies usually buy these debts for pennies on the dollar. Then, they attempt to track down a debtor and force them to pay.

How long does it take for a debt collector to garnish your wages?

For most areas in the US, that time frame is 14-30 days. If a debt collection agency wins their lawsuit, they have several options available. For example, debt collectors may garnish earnings to collect a debt. A garnishment is a court order that takes money directly from a debtor's earnings.

What happens when you eliminate debt?

Your debt-to-income ratio decreases. When you eliminate a debt, you decrease your debt load and your debt-to-income ratio. It is good for your overall financial health. Lenders and creditors will be more willing to give you new credit when you have no outstanding obligations.

What are the benefits of paying off a collection?

2. You have no unpaid collections influencing your credit score. Paying off a collection account gives you points in the payment history portion of your credit score. Your debt-to-income ratio decreases.

Why do creditors question my creditworthiness?

Potential creditors and lenders question your creditworthiness when they see collection accounts on your credit report, especially recent collections. Because of that, you might find it harder to get approved for new credit cards and loans. 2

How long is the statute of limitations on a mortgage?

The statute of limitations varies from 3 to 15 years de pending on your state and the type of debt.

What is the moral obligation to pay?

A Moral Obligation to Pay. If the debt is legitimately yours, the right thing to do is repay it. You’ve already consumed the goods or services financed by the debt, it’s your responsibility to pay for it.

Is debt collection bad for credit?

It’s no secret that debt collections are bad for your credit report. Any past due account, debt collections included, can have a negative effect on your credit score for as long as it's listed on your credit report. 1.

Do lenders give you credit if you have no debt?

Lenders and creditors will be more willing to give you new credit when you have no outstanding obligations. Many lenders, especially mortgage lenders, require you to take care of all unpaid debts before they’ll offer a loan to you.

What can go wrong when paying a debt collector?

Things like you authorizing a payment for $125.00, and whoops… $1,250.00 was drafted from your bank account instead, just does not happen much today. Not unless you are dealing with a scam debt collector from the go.

How long does it take to get a debt collector to resolve a complaint?

While there are places you can go to and file complaints to get an issue resolved with a debt collector like Portfolio Recovery (mainly the CFPB for more rapid response to something like this), the resolution can take a few weeks. That could mean you are late on rent, your hungry, and your bank account with auto drafts going through gets overdrawn.

Can I send a payment without a settlement agreement?

I would not send payment without a written outline in hand that clearly spells out what it is that you and the debt collector have agreed to. There are instances with some debt collectors where I would refuse to pay anything without the settlement agreement like you have in hand. But there are other times where I will encourage making the payment. Readers should check out that link for workarounds when you cannot get something in writing (like recording your phone call, and telling the debt collector why you are doing so).

Can you use Western Union to pay a debt collector?

Do not use Western Union or Money Gram type products to pay a debt collector. There is just too much hassle to get proof that you sent the payment and that it was received on the other end.

Do you need to get your billing statements from your creditors?

If you are using a third party debt relief company, do not rely on them to have the documentation that will meet your needs. If you are in a debt management plan with a credit counselor, you should still get your billing statements from your original creditors, but that may not be the case if you enrolled accounts with debt collectors. And if you are working with a debt negotiator or settlement company, get copies of all settlement and payment agreements along with screen shots from your special purpose account to show the payment dates.

Can the CFPB prove their claim?

They may not be able to prove their claim. Happens a lot actually. It is to the point that the CFPB is currently involved in rule making to prevent this type of thing at a national level.

Does PRA send settlements?

PRA is terrible about sending settlements in writing. The attorneys they hire are good about it though. But not all attorneys will send the settlement agreement through an email. They look to fax or send via USPS.

The Basics of Debt Settlement

The Downsides of Debt Settlement

- Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before. First, debt settlement generally requires you to come up with a substantial amount of cashat one time. This is what makes the debt settlement attract…

Should You Do It Yourself?

- If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, …

Appearances Matter

- Whether you use a professional or not, one of the key points in negotiations is to make it clear that you’re in a bad position financially. If your lender firmly believes that you’re between a rock and a hard place, the fear of losing out will make it less likely that they reject your offer. If your last few months of card statementsshow numerous trips to five-star restaurants or designer-boutique sh…

The Negotiating Process

- Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.” Explain how dire your situation is. Highlight the fact that you’ve scraped a little bit of cash together and are hoping to settle one of your accounts before the money gets used up elsewhere. By mention…

The Bottom Line

- While the possibility of negotiating a settlement should encourage everyone to try, there’s a good chance you’ll hear a “no” somewhere along the way. If so, don’t just hang up the phone and walk away. Instead, ask your credit card company if it can lower your card’s annual percentage rate(APR), reduce your monthly payment, or provide an alternative payment plan. Often your cre…