Settlement charges paid by the buyer. Any amounts due from the buyer. Adjustments for items that have been settled in advance by the seller may be shown as miscellaneous expenses. Credits will list the amount paid by the buyer or those paid on behalf of the HUD Settlement Statement buyer: Deposit made by the buyer.

Full Answer

What is a HUD settlement statement?

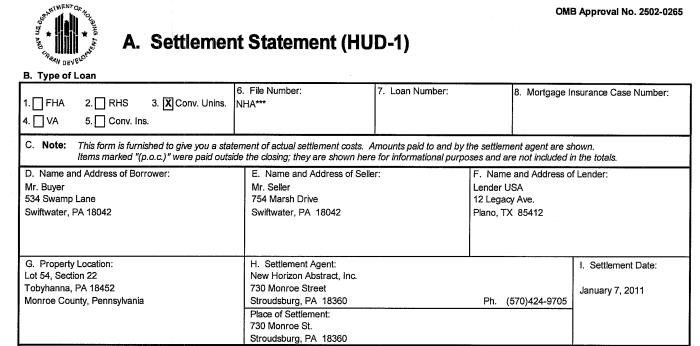

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What are the settlement charges in real estate?

Settlement charges are split between basis (added to fixed asset) and loan amortization if directly loan related and not actual purchase (think of difference if you had won the mega-millions and were paying cash). Loan costs can be amortized over the life of the loan which is usually shorter than the depreciation life of the property.

How are settlement charges listed on the hud-1/1-a form?

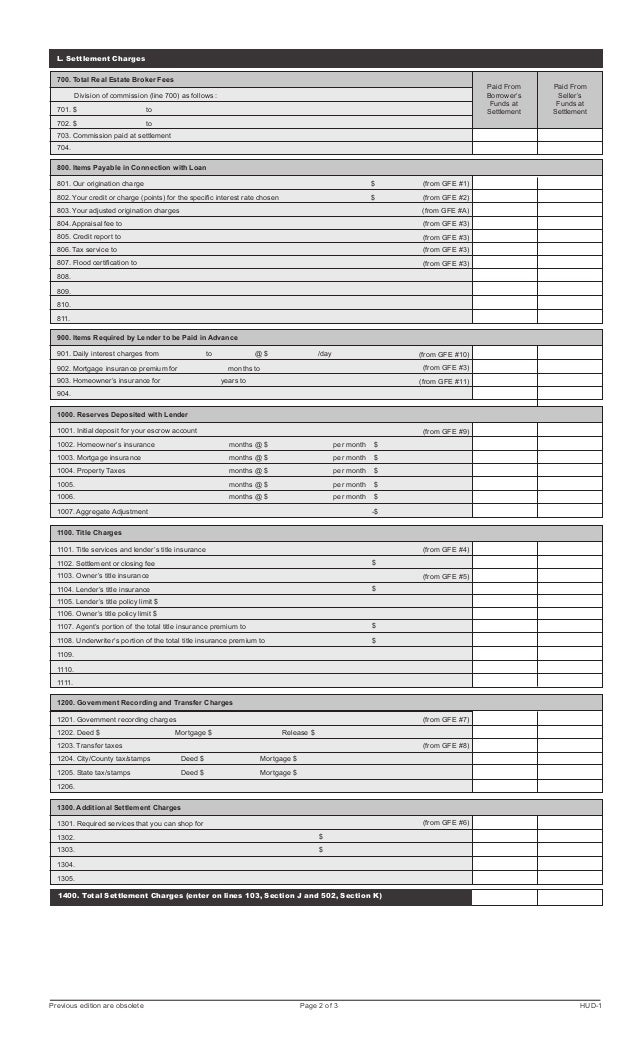

The amounts must be listed in either the borrower's or seller's column. Line 1400 must state the total settlement charges as calculated by adding the amounts within each column. The HUD-1/1-A is a statement of actual charges and adjustments.

Do manufactured home borrowers receive HUD-1 Settlement statements?

Some manufactured home borrowers may receive a Truth-in-Lending disclosure instead of a HUD-1 settlement statement or closing disclosure. In the past, most borrowers received a HUD-1 settlement statement before closing. However, since October 2015, the majority of mortgage borrowers now receive closing disclosures rather than settlement statements.

Is a settlement statement the same as a HUD?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is a loan settlement fee?

Also known as early-exit fees, settlement fees are charged when borrowers pay out their home loan in full within a specified time period. This covers the losses your lender might incur due to the early termination of the home loan.

What is the HUD settlement cost booklet?

The HUD Settlement Cost Booklet provides you with collaborative mortgage information in an effort to ease the home biying process for the home buyer. practices by settlement service providers during the home-buying and loan process.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

Do you get penalized for paying off your mortgage early?

A mortgage prepayment penalty is a fee that some lenders charge when you pay all or part of your mortgage loan off early. The penalty fee is an incentive for borrowers to pay back their principal slowly over a longer term, allowing mortgage lenders to collect interest.

What kind of loan transaction requires the settlement cost booklet?

The Real Estate Settlement Procedures Act (RESPA) requires lenders and mortgage brokers to give you this booklet within three days of applying for a mortgage loan. RESPA is a federal law that helps protect consumers from unfair practices by settlement service providers during the home-buying and loan process.

What is the name of the special information booklet which explains the settlement process?

“Your Home Loan Toolkit” is a resource we revised to help make the mortgage process more understandable. Congress required us to revise an existing booklet, called the Settlement Costs Booklet or the Special Information Booklet, to include some additional information.

What is the name of the special information booklet which explains the settlement process and is due three business days after receipt of a loan application?

The CFPB has issued an updated version of the home buying information booklet (also known as the special information or settlement cost booklet) required under RESPA and TILA.

Who prepares the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What is a settlement fee on a refinance?

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

Should you pay an upfront fee for a loan?

Never pay upfront fees for a loan. A regulated lender will never ask you to do this, no matter your credit score.

How much is a loan application fee?

Application fee The amount you pay can range from $0 to $500, and it's almost always a non-refundable charge. Application fees tend to be higher if you're working through a mortgage broker who serves as an intermediary. Meanwhile, some online lenders, such as Better Mortgage, don't charge application fees at all.

What is settlement funding?

You'll get money for living expenses: Settlement funding is a financing mechanism that allows people injured in accidents through no fault of their own to access cash they need for day-to-day expenses and medical costs while their personal injury cases are pending.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is HUD Settlement Statement?

The Housing and Urban Development Settlement Statement refers to a document issued when a borrower takes out a loan to purchase real estate. Furthermore, The HUD Settlement Statement lists all charges and credits to the buyer and the seller in a real estate settlement or all ...

Who will list the amount paid by the buyer on the HUD Settlement Statement?

Credits will list the amount paid by the buyer or those paid on behalf of the HUD Settlement Statement buyer:

What is a credit at closing?

Credits – will list the gross amount owed to the seller at the time of settlement closing:

What is a HUD-1 settlement statement?

This form is to be used as a statement of actual charges and adjustments paid by the borrower and the seller, to be given to the parties in connection with the settlement. The instructions for completion of the HUD-1 are primarily for the benefit of the settlement agents who prepare the statements and need not be transmitted to the parties as an integral part of the HUD-1. There is no objection to the use of the HUD-1 in transactions in which its use is not legally required. Refer to the definitions section of the regulations (12 CFR 1024.2) for specific definitions of many of the terms that are used in these instructions.

Where do you find the charges on HUD-1?

As a general rule, charges that are paid for by the seller must be shown in the seller's column on page 2 of the HUD-1 (unless paid outside closing), and charges that are paid for by the borrower must be shown in the borrower's column (unless paid outside closing).

What is line 101 in a mortgage?

Line 101 is for the contract sales price of the property being sold, excluding the price of any items of tangible personal property if Borrower and Seller have agreed to a separate price for such items.

What is P.O.C. on HUD?

Charges paid outside of settlement by the borrower, seller, loan originator, real estate agent, or any other person, must be included on the HUD-1 but marked “P.O.C.” for “Paid Outside of Closing” (settlement) and must not be included in computing totals.

Where should the charge be listed on the HUD-1?

However, in order to promote comparability between the charges on the GFE and the charges on the HUD-1, if a seller pays for a charge that was included on the GFE, the charge should be listed in the borrower's column on page 2 of the HUD-1.

Who completes HUD-1?

The settlement agent shall complete the HUD-1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

Which lines and columns in section J are left blank on the copy of the HUD-1?

Lines and columns in section J which relate to the Borrower's transaction may be left blank on the copy of the HUD-1 which will be furnished to the Seller. Lines and columns in section K which relate to the Seller's transaction may be left blank on the copy of the HUD-1 which will be furnished to the Borrower.

What is a HUD-1?

The HUD-1 is a settlement statement and full of helpful and important information. HUD-1s may be simple and contain small amounts of information, while others may be complicated and jammed pack with data. When buying investment property (buy-and-hold), all HUD-1s have one thing in common, and that is the tax treatment of each line item.

What is the 804. appraisal fee?

804. Appraisal Fee: If required to obtain a loan, the cost is amortized over the life of the loan. If an appraisal is not required, the cost is added to the basis of the property and depreciated over the life of the property.

What is closing cost?

Closing costs can amount to a significant outlay of capital, so it’s important to understand when you can recover that capital. Closing costs may fall into one of the following three categories: Deductible as a current expense. Added to the cost basis of the property and depreciated.

When are loan points deductible?

This is an area for confusion, as loan points are deductible as a current expense when paid in connection with a primary residence.

Is a 1001 escrow account deductible?

1001. Initial Deposit for Your Escrow Account: This amount will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

Is assessment a current expense?

108. Assessments: Deductible as a current expense but only the portion greater than the value found on line 212. If, however, the assessment is specifically labeled as a local improvement district, they must be amortized over the life of the loan.

Is interest on a loan deductible?

Of course, interest on loans is deductible as payments are made ; however on the onset, you will not separate these three line items out individually and deduct, depreciate, or amortize them, as they have already been included in the 100 section. 206.

What is settlement charge?

Settlement charges are split between basis (added to fixed asset) and loan amortization if directly loan related and not actual purchase (think of difference if you had won the mega-millions and were paying cash). Loan costs can be amortized over the life of the loan which is usually shorter than the depreciation life of the property.

What is the basis of HUD-1?

The HUD-1 has no clue what your basis is in property being sold. But starting with the price received as first entry against the asset account followed by adjustments for new costs of sale, recovery of any depreciation expense taken and addition of land value back to asset at the bottom , once the asset value itself is reduced to zero should be a figure that represents either the gain or the loss on the sale.

Is a prior down payment a credit?

Prior Down Payment in Escrow is a credit (previously should have posted to Escrow for Purchase) Loan from bank is credit (brand new liability, bank = vendor/supplier) any cash provided at closing is credit. Once you get down through it the debits and credits should be equal and you can save it.

Can you add a sub account for accumulated depreciation?

You can add a sub account for accumulated depreciation or you can keep just a single Accumulated Depreciation account, which can keep your Balance Sheet from becoming cluttered