The most common of these closing costs are title fees/insurance, surveys, recording fees, legal fees, and transfer taxes. Any amount you agree to pay on behalf of the seller, such as back taxes or real estate commissions, is also capitalized. Find each of these lines on your closing statement and add them up.

Full Answer

What is an Alta statement and why do I need one?

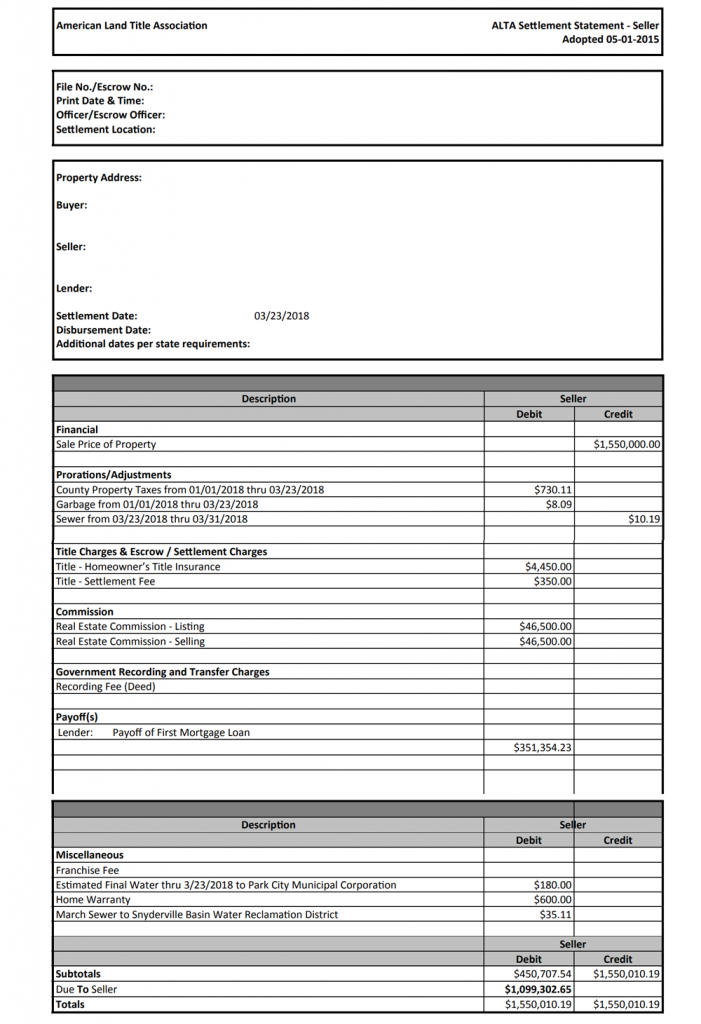

What is an ALTA Statement? The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is included in the Alta settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted.

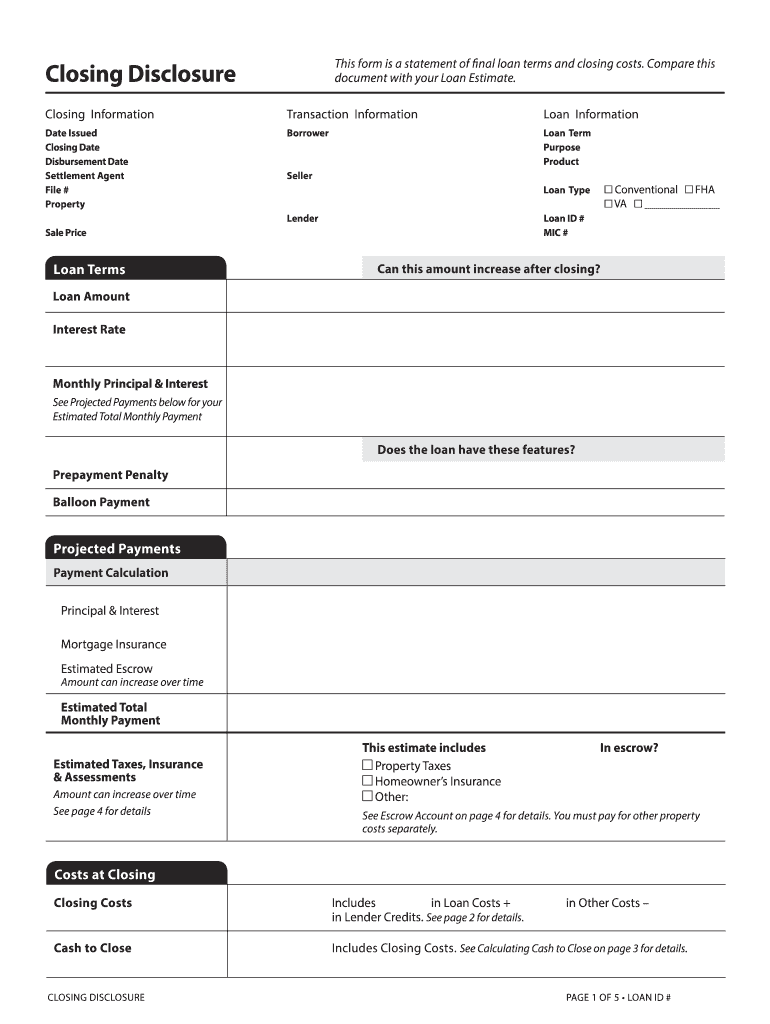

What is an Alta Closing Disclosure?

The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer. ALTA statements were put into use to provide thorough breakdowns for agents and brokers to receive at the end of the transaction. Are ALTA Settlement Statements the Same as Net Sheets?

Will the Alta settlement statement replace the CFPB Closing Disclosure?

The ALTA Settlement Statements are not meant to replace the CFPB's Closing Disclosure.

What is the difference between Alta and closing statement?

Unlike the Closing Disclosure that is meant to show the closing costs exclusively to the borrower (buyer), the ALTA statement is like a receipt given to agents and brokers on both sides of the transaction.

Is the settlement statement the same as the closing?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is Alta the same as settlement statement?

ALTA has developed standardized ALTA Settlement Statements for title insurance and settlement companies to use to itemize all the fees and charges that both the homebuyer and seller must pay during the settlement process of a housing transaction.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What appears on the closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is tax deductible on settlement statement?

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are Mortgage Interest and certain Real Estate (property) taxes. These can be deducted in the year you buy your home if you itemize your deductions.

Is a HUD-1 the same as a closing disclosure?

The HUD-1 form, listing all closing costs, is given to all parties involved in reverse mortgage and mortgage refinance transactions. Since late 2015, a different form, the Closing Disclosure, is prepared for the parties involved in all other real estate transactions.

What's the term for a charge that either party has to pay at closing?

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

How do you balance a closing statement?

4:0613:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

What document lets a buyer and seller see the costs involved with closing the transaction?

A purchase agreement is often referred to as an escrow agreement. The HUD-1 lets the buyer and seller see the costs involved with closing the transaction.

Which of the following charges will appear as a debit to them on the settlement statement?

Which of the following charges is generally a debit to the seller on the settlement statement? The seller is generally responsible for real estate sales commission as agreed to in the listing agreement and again in the purchase and sale agreement. a credit to the buyer and a debit to the seller.

What is a closing statement called?

Virtually any other type of loan comes with its own closing statement. This document may also be called a settlement sheet or credit agreement.

Is HUD settlement statement the same as closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Is a closing disclosure the same as clear to close?

A Closing Disclosure is not technically the same as being declared clear to close, but the disclosure typically comes after you have been cleared. After reviewing your Closing Disclosure, you can look forward to a final walkthrough of the home and closing day itself.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is appraisal fee?

Appraisal Fee to. Paid to the lender or an appraisal company to determine the current value of the property.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.

Who levies title and mortgage costs?

These costs are levied by the county for recording the new title and mortgage for the new owner.

How many types of ALTA statements are there?

There are 4 types of ALTA Statements in total. Read our guide on ALTA settlement statements to learn more.

What is a Closing Estimate?

A Closing Estimate is a document with a myriad of costs that the buyer is supposed to pay during the closing process. Closing estimates come in multiple formats that are specifically made according to the transaction type and stage of the transaction.

What are Closing Costs?

Closing costs are an itemized list of fees or cost components paid by the buyer for the services to get the mortgage approved. While the majority of the costs are paid by the buyer, some of the costs can be paid by the seller if both parties have agreed to do so.

How much are Closing Costs?

Closing costs generally range between 2% - 5% of the total property value . That means a property worth $500,000 may cost you somewhere between $10,000 to $25,000 as closing costs.

What Closing Costs are Part of Escrow?

All the taxes and insurance related costs are clubbed as escrow costs. All states have different due dates and schedules for collecting taxes. If you have an escrow account, the escrow evens that cost out throughout the year and pays it on your behalf. This is particularly useful for buyers who may not be residing in the state where the property is physically located.

What is a seller net sheet?

A seller's net sheet shows an estimated amount the seller is supposed to receive after all the deductions after the transaction. These deductions are nothing but the various costs deducted from the seller’s account during the closing process. The seller net features around 17-18 cost components in total. Read our blog to learn about seller net sheets in detail.

How many closing estimate types are there?

Overall, there are 6 major closing estimate types that help both parties navigate through the closing process with transparency. Let’s briefly look into these closing estimate types.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is an ALTA Statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is the difference between seller disclosure and closing disclosure?

The difference between a seller disclosure and closing disclosure is simple – the seller will receive a seller’s disclosure, which provides a breakdown of costs and fees that factor into the cash they will receive at the transaction’s end. Due to TRID regulations, agents will have nothing to do with the closing disclosure.

What is closing disclosure?

The closing disclosure is provided to the buyer and pertains a list of fees and costs and how they work into the buyer’s total expense. It is important to note that only the lender can provide the Closing Disclosure to the buyer 3 days prior to closing? And only the buyer should be able to see it unless they allow the release of it by signing a release disclosure. You should also know that the lender is obligated under the TRID regulations, and the lender can be penalized for failing to disclose 3 days after they’re loan application is approved and again 3 days prior to closing.

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

What is a HUD-1?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer.

Why is a standard form required for title insurance?

Having a standard form for nearly all title insurance policy transactions maintains that all exchanges of land are done smoothly and efficiently.

How many versions of ALTA Settlement Statement are there?

There are four versions of the ALTA Settlement Statement available:

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

Who pays settlement fee?

Settlement: This fee is paid to the settlement agent or escrow holder. Responsibility for payment of this fee can be negotiated between the seller and the buyer.

What is document preparation fee?

Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed.

What is origination fee?

Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. Origination services include taking and processing your loan application, underwriting and funding the loan, and other administrative services.

What is appraisal charge?

Appraisal: This charge pays for an appraisal report made by an appraiser.

Who pays the surveyor fee?

Survey: The lender may require that a surveyor conduct a property survey. This is a protection to the buyer as well. Usually the buyer pays the surveyor’s fee, but sometimes this may be paid by the seller.

Can you pay points at closing?

You can pay points at closing to receive a lower interest rate. Alternatively, you can choose to have points paid to you (also called lender credits) and use them to cover some of your closing costs. Underwriting: Paid to the lender, this fee covers the cost of researching whether or not to approve you for the loan.

What are closing costs?

The most common of these closing costs are title fees/insurance, surveys, recording fees, legal fees, and transfer taxes. Any amount you agree to pay on behalf of the seller, such as back taxes or real estate commissions, is also capitalized.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement: This form lists both the buyer’s and seller’s side of the transaction and is signed by both parties. It is published by the US Department of Housing and Urban Development. You’ll want to look at the buyer’s side, which is separated into credits and debits.

WHAT IS MY BUYER'S CLOSING STATEMENT?

Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete the transaction. Different forms are used depending on the requirements of the transaction and the lawyers involved. The three most common are:

What expenses are deductible on a closing statement?

These include property taxes, prepaid mortgage interest, assessments from an HOA, and insurance. There is no difference in reporting for these expenses when they occur as part of closing than in any other case.

Why is it important to record closing statements?

Getting it right is important because the journal establishes your basis for the lifetime of your property and may contain substantial deductible expenses.

Why do you need a journal entry on closing statement?

Creating a journal entry from your buyer’s closing statement is one of the more complex transactions on the way to properly keeping books as a real estate investor. It is also one of the more important - calculating your basis in a new property is the starting point for all future depreciation, capital gains, or 1031 exchanges. Additionally, many expenses that can be immediately deducted as an investor are on the closing statement; if you miss them you’ll be stuck with a higher tax bill than necessary.

Why do buildings and land appear as debits in your journal?

Both buildings and land appear as debits in your journal to establish them as assets on the balance sheet. Calculating this split is important because the building value will depreciate over the course of your ownership of the property while the land will not.