- First, unfair claims settlement practices is what happens when an insurer unreasonably tries to delay, avoid, or reduce the size of an insurance claim.

- With this in mind, you should know that these practices are illegal.

- Moreover, many states have passed unfair claims settlement practices laws to protect insured parties from this type of behavior

- In fact, individual states enforce Unfair Claims Settlement Practices Acts, rather than the federal government.

Are You violating the False Claims Act?

Violating the False Claims Act can result in severe financial penalties for those who defraud the federal government by submitting a false claim. The exact penalty will depend on several factors, including the amount of money improperly taken from the government and the amount of cooperation, if any, the violator provides to the federal government.

How to avoid unfair dismissal claims?

How to avoid unfair dismissal claims. The best way to lessen the risk of an unfair dismissal claim or have a solid defence to a claim are to have valid reasons for the dismissal, to follow a fair procedure leading to the termination and only offer a genuine redundancy.

Are False Claims Act settlements fully deductible?

Damages paid by a business after a settlement or judgmentaregenerallydeductibleiftheyarenotafine or penalty. False Claims Act payments are paid to the government and may appear to be penalty-like, but most businesses deduct them. With IRS scrutiny of these payments increasing, this article addresses what companies should consider.

What is civil False Claims Act?

The False Claims Act is a Civil War-era statute passed in response to concerns that contractors and suppliers were regularly defrauding the Union Army by selling items such as moth-eaten blankets, injured cavalry horses and boxes of sawdust instead of guns.

What is an example of an unfair claims settlement practices?

An example of an unfair claim settlement practice would include: Trying to discourage a claimant from arbitrating a claim by implying that arbitration might result in an award lower than the amount offered is an unfair claim settlement practice.

What is an unfair claim settlement?

Unfair claims settlement is the improper handling of policyholder claims on the part of insurers that violates state laws on unfair claims settlement. Such laws are typically a variation of the National Association of Insurance Commissioners' (NAIC) Unfair Claims Settlement Practices Act (UCSPA).

What is the difference between an unfair claim practice and an unfair trade practice?

These unfair trade practices also serve to define those practices that may be harmful or deceptive to consumers. Unfair claims settlement practices acts, as legislated by the states, protect consumers from some of the more egregious claims settlement and delay practices.

What are the four major categories of unfair trade practices in the insurance industry?

Unfair business practices include misrepresentation, false advertising or representation of a good or service, tied selling, false free prize or gift offers, deceptive pricing, and noncompliance with manufacturing standards.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What are unfair trade practices in insurance?

The phrase unfair trade practices can be defined as any business practice or act that is deceptive, fraudulent, or causes injury to a consumer. These practices can include acts that are deemed unlawful, such as those that violate a consumer protection law.

What are the examples of fair practices?

Fair Business PracticesSecurity Export Control.Ensuring Fair Trade.Exclusion of Antisocial Forces.Protection of Intellectual Property and Copyrights.Information Security and Protection of Personal Information.Crisis Control Measures.Policy Regarding Material Suppliers.

Who regulates an insurance claim settlement practices?

The NAICThe NAIC has promulgated the Unfair Property/Casualty Claims Settlement Practices and the Unfair Life, Accident and Health Claims Settlement Practices Model Regulations pursuant to this Act.

What does twisting mean in insurance?

Definition of twisting : the use of misrepresentation or trickery to get someone to lapse a life insurance policy and buy another usually in another company.

How are consumers protected from unfair trading practices?

They impose a general prohibition on traders in all sectors from engaging in unfair commercial practices with consumers. Specifically, they protect consumers from unfair or misleading trading practices and ban misleading omissions and aggressive sales tactics.

What kind of business practices is considered unfair competition?

Examples of Unfair Competition Activities Product disparagement (making false claims about a competitor's product) Stealing a competitor's trade secrets or confidential information. Trade dress violation (copying the physical appearance of a product from a competitor) Breach of a restrictive covenant.

What does twisting mean in insurance?

Definition of twisting : the use of misrepresentation or trickery to get someone to lapse a life insurance policy and buy another usually in another company.

How long does an insurance company have to investigate a claim in Minnesota?

Insurance companies in Minnesota have 45 business days to settle a claim after it is filed. Minnesota insurance companies also have specific timeframes in which they must acknowledge the claim and then decide whether or not to accept it, before paying out the final settlement.

How do I dispute an insurance claim?

Step 1: Contact your insurance agent or company again. Before you contact your insurance agent or home insurance company to dispute a claim, you should review the claim you initially filed. ... Step 2: Consider an independent appraisal. ... Step 3: File a complaint and hire an attorney.

What is an example of rebating?

An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. Rebates can be made in the form of cash, gifts, services, payment of premiums, employment, or almost any other thing of value.

What is the Unfair Claims Settlement Practices Act?

Called the Unfair Claims Settlement Practices Act, it protects insurance buyers from unjust behavior by insurers in the claims settlement process. Specifics of the law vary from state to state.

What Is Unfair Claims Practice?

Unfair claims practice is the improper avoidance of a claim by an insurer or an attempt to reduce the size of the claim. By engaging in unfair claims practices, an insurer tries to reduce its costs. However, this is illegal in many jurisdictions.

Why are unfair claims practices illegal?

Many states have passed unfair claims practices laws to protect insured parties from bad behavior on the part of insurers in the claims settlement process.

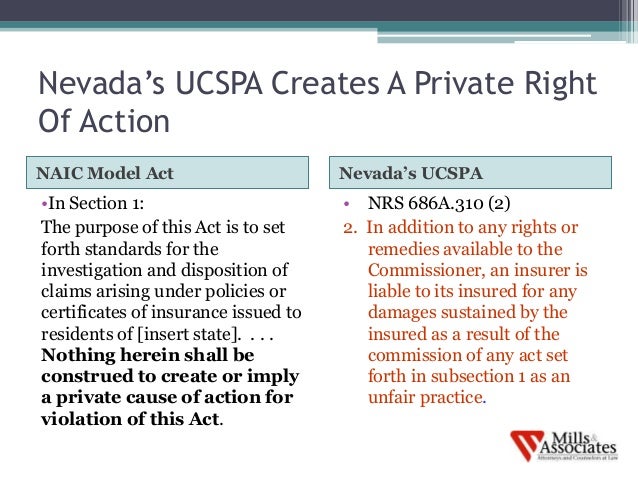

Is UCSPA a federal law?

Specifics of the law vary from state to state. Unfair Claims Settlement Practices Acts (UCSPA) are not federal law; instead, they are enforced by individual state insurance departments.

How Does Unfair Claims Settlement Practice Work?

When you buy an insurance policy, you’re signing an agreement with your insurance company. That agreement states that your insurance company is legally required to cover certain damages when they take place under certain circumstances.

What is unfair claims practice?

In most states, however, unfair claims practice is defined under something called the Unfair Claims Settlement Practices Act (UCSPA), which protects insurance buyers from bad behavior by insurance companies. It’s important to note that the UCSPA is not federal law, and the specifics of the law vary widely between states.

What does it mean when an insurance company doesn't respond to a claim?

Failing to respond promptly to communications from insurance customers; if you filed a claim six months ago and haven’t had a response from the insurance company, for example, then your insurance company might be engaging in unfair claims practices related to timeliness

How do insurance companies settle claims?

Finally, some insurance companies engage in unfair claims settlement practices through unfair acts, including: 1 Refusing to pay claims without conducting a reasonable investigation; the insurer may deny your claim after an adjuster performs a single, cursory check of the damages, for example 2 The insurance company might deny that the incident ever occurred, or they may refuse to send an adjuster to your property to inspect the damages 3 The insurance company fails to pay your fair settlement promptly even though you’ve submitted a valid claim

What is the purpose of unfair settlement laws?

One of the key requirements of this legislation is for clear communication between the insurer and the insured. Because of this legislation, many states have implemented unfair claims settlement practice laws, making it easier for consumers to receive coverage from their insurance company – even if that insurance company is acting in a deceptive ...

How do insurance companies engage in unfair claims practices?

In other cases, insurance companies engage in unfair claims practices simply by delaying, and continuing to delay a claim.

What is misrepresentation in insurance?

Misrepresentation or Alteration. An insurance company might misrepresent or alter an insurance policy in various ways, leading to allegations of unfair claims settlement practices. Some of the ways a company does this is by: Misrepresenting relevant facts or policy provisions, including changing specific aspects of your building ordinance;

What is unfair settlement practice?

Unfair claim settlement practices. A. A person shall not commit or perform with such a frequency to indicate as a general business practice any of the following: 1. Misrepresenting pertinent facts or insurance policy provisions relating to coverages at issue . 2. Failing to acknowledge and act reasonably and promptly upon communication s ...

What does "failing to promptly settle claims" mean?

Failing to promptly settle claims if liability has become reasonably clear under one portion of the insurance policy coverage in order to influence settlements under other portions of the insurance policy coverage.

What is the purpose of making known to insureds or claimants a policy of appealing from arbitration awards in favor of?

Making known to insureds or claimants a policy of appealing from arbitration awards in favor of insureds or claimants for the purpose of compelling them to accept settlements or compromises less than the amount awarded in arbitration. 13.

What is a compelling insured?

8. Compelling insureds to institute litigation to recover amounts due under an insurance policy by offering substantially less than the amounts ultimately recovered in actions brought by the insureds.

What is the definition of "delaying the investigation or payment of claims"?

Delaying the investigation or payment of claims by requiring an insured, a claimant or the physician of either to submit a preliminary claim report and then requiring the subsequent submission of formal proof of loss forms, both of which submissions contain substantially the same information.

What is a denial of liability for a claim under a motor vehicle liability policy?

Denying liability for a claim under a motor vehicle liability policy in effect at the time of an accident without having substantial facts based on reasonable investigation to justify the denial for damages or injuries that are a result of the accident and that were caused by the insured if the denial is based solely on a medical condition that could affect the insured's driving ability.

What is an unfair claims settlement practice?

The unfair claims settlement practices section which had been part of the Unfair Trade Practices Act defined an unfair claims settlement practice as one which was committed or performed with such frequency as to indicate a general business practice.

What was the unfair trade practice in 1971?

In 1971 the Unfair Trade Practices Subcommittee identified several areas where they thought changes needed to be made to the Unfair Trade Practices Act. One of those areas was related to claims practices, particularly unreasonable delay or refusal.

What happens if an insurer violates a cease and desist order?

An insurer that violates a cease and desist order of the commissioner and, while the order is in effect, may, after notice and hearing and upon order of the commissioner, be subject, at the discretion of the commissioner, to:

How Unfair Claims Settlement Works

- In 1990, the NAIC drafted a set of model laws known as the UCSPA that set forth standards for the investigation and settlement of claims under all types of insurance policies except workers compensation, boiler and machinery (equipment breakdown), fidelity, and surety. Although a maj…

Types of Unfair Claims Settlements

- While the scope of unjust practices may differ from one state to another, the UCSPA prohibits acts by insurers that broadly fit into four unofficial categories: 1. Misrepresentation or alternation 2. Timeliness issues 3. Unreasonable requirements 4. Lack of due diligence

How to File A Complaint of Unfair Claims Settlement

- If you suspect that your insurer is mishandling your claim, the first step is to raise it to your claim agent, and if that fails, escalate it to the claims department manager at your insurance company. If you can't resolve the matter with your insurer, speak with your state insurance department. A representative of the department can tell you how the law applies in your state and how to file a …

What Are The Penalties?

- Once a policyholder has filed a complaint with the state, the state regulator (typically the insurance commissioner) will determine if the insurer's behavior violates the law. If it does, the regulator may issue a statement of charges to the insurance, set up a hearing, and then do one or more of the following: 1. Issue a cease-and-desist order: This is a notice to the insurer to stop en…

What Is Unfair Claims Practice?

Understanding Unfair Claims Practice

- The National Association of Insurance Commissioners(NAIC) has created model unfair claims practice legislation that mandates claims be handled fairly and that there be clear communication between the insurer and the insured. States, not the federal government, regulate insurance; many jurisdictions have implemented unfair claims practices laws modeled after the NAIC's model act…

Example of Unfair Claims Practice

- Consider a small business owner that insures his company's building and business personal property under a commercial property policy. Unfortunately, a fire broke out in the building, causing $100,000 in property damage. The insurance company delays payment, rendering the business owner unable to repair any of the damage. The insurance company continues using de…

Other Examples of Unfair Claims Practice

- Misrepresenting relevant facts or policy provisions.For instance, your commercial property policy states that Building Ordinance coverage is included, but your insurer insists the coverage is exclu...

- Making a significant alteration in an application without your consent and then settling a claim based on the alteration.For instance, in your application, you requested a $50,000 limit for Uti…

- Misrepresenting relevant facts or policy provisions.For instance, your commercial property policy states that Building Ordinance coverage is included, but your insurer insists the coverage is exclu...

- Making a significant alteration in an application without your consent and then settling a claim based on the alteration.For instance, in your application, you requested a $50,000 limit for Utility...

- Settling claims for less than what you would reasonably expectbased on a written advertisement you received. For instance, an ad announces a $50,000 limit for damage caused by flooding. However, th...