If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records. Plan for making a realistic repayment or settlement proposal

Full Answer

What is a debt settlement company?

Debt settlement companies may also be known as “debt relief” or “debt adjusting” companies. The companies generally offer to contact your creditors on your behalf, so they can negotiate a better payment plan or settle or reduce your debt. They typically charge a fee, often a percentage of the amount you’d save on the settled debt.

How do I negotiate a settlement with a debt collector?

Before negotiating a settlement with a debt collector, learn about the debt and plan for making a realistic proposal. All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords.

How do I propose a debt settlement with a specific creditor?

If there’s no specific individual, make a phone call and get the name of a person likely to be in a capacity to work with your proposal. The “reference” line should include the relevant account number. This must be included so the creditor will know exactly which debt you’re proposing to settle.

How can a credit counselor Help Me Settle my credit card debt?

It is possible to negotiate directly with creditors and settle your debt for less than you owe, but you may want the help of a professional. A quick counseling session from a certified credit counselor can help you discover your options and choose the right path forward. Home » Credit Card Debt Relief » What Is Debt Settlement?

What percentage will creditors settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

How do I offer creditors to my settlement?

A 6-step DIY debt settlement planAssess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

What should I offer a debt collector for a settlement?

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. The debt collector may still demand to collect the full amount that you owe, but in some cases they may also be willing to take a slightly lower amount that you propose.

Will Debt collectors settle for 30 %?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Can I negotiate with creditors yourself?

Tips to Negotiate with Creditors on Your Own. It is possible to negotiate directly with creditors and settle your debt for less than you owe, but you may want the help of a professional. A quick counseling session from a certified credit counselor can help you discover your options and choose the right path forward.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Do settlements hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What if a creditor refused my offer of payment?

Speak to the Original Creditor Inform the original creditor that you want to find a way to settle the debt, and ask if they're willing to negotiate. The creditor may choose to accept your initial offer, negotiate a new amount, or refuse outright and refer you back to the collection agency.

Can a debt collector refuse to negotiate?

Refused Offers A creditor isn't required to negotiate a settlement offer with a debtor, according to the Federal Trade Commission, but does so at its own discretion. This applies to a collection agency as well.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Can you negotiate with creditors to remove negative reports?

You can negotiate with debt collection agencies to remove negative information from your credit report. If you're negotiating with a collection agency on payment of a debt, consider making your credit report part of the negotiations.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

How do I write a letter to debt collector settlement?

When writing a debt settlement letter, it's important to be explicit and detailed. Treat the letter as a contract between you and your creditor. Include your personal information and account number for easy identification. You'll need to outline the amount you can pay and what you expect in return.

How do you negotiate a personal loan settlement?

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Why is it important to ask for a specific reporting status to the credit bureau?

After you’ve settled on a specific dollar amount for the debt to be considered paid in full, it’s important to also ask for a specific reporting status to the credit bureau. Ask the creditor if they will report your agreement as “Paid as agreed upon” instead of “Settled” because the former is more favorable on your report than the latter.

How to settle credit card debt before calling creditors?

Have the facts in place before you call. Before you call the creditors you owe, it’s important to get a copy of your credit report or have a current letter in hand from your creditor verifying the amount of money that you owe. Proper settlement of credit card debt can more easily occur if you have your facts straight.

What to do if you are behind on credit card payments?

Have you fallen behind on your credit card payments? Do you have old credit card debts that haven’t been serviced for a while? Then you may be able to create a settlement plan with your creditors to help you to avoid bankruptcy and put a plan in place that is both affordable for you and ensures repayment to those you owe.

What to do if customer service representative can't help you?

If the customer service representative can’t or won’t help you, calmly ask if there is a supervisor or crisis specialist that you can talk to. Professionalism is important in creditor negotiations, so no matter how frustrated you might become during the call, it’s vital to remain cool and calm during negotiations.

How to explain a sob story to creditors?

For this reason, it’s important to make them aware of the situation in a calm and honest manner. Be clear and concise as you explain your predicament. Explain calmly that because of your financial situation you can’t afford to pay them the full amount due and ask them who you can talk with to figure out a plan that will benefit both them and you.

What to do if you haven't paid your debt?

If you haven’t paid anything on your debt in a while, you may want to check and see if the collection amount is past the statute of limitations. It’s important to do this before you call any creditors so that you do not accidentally reactivate the account and start the statute of limitations timeline over again.

What to do before calling creditors?

When you call your creditors, tell them exactly how much you can afford to pay them and ask them how you can negotiate with them to get to that amount.

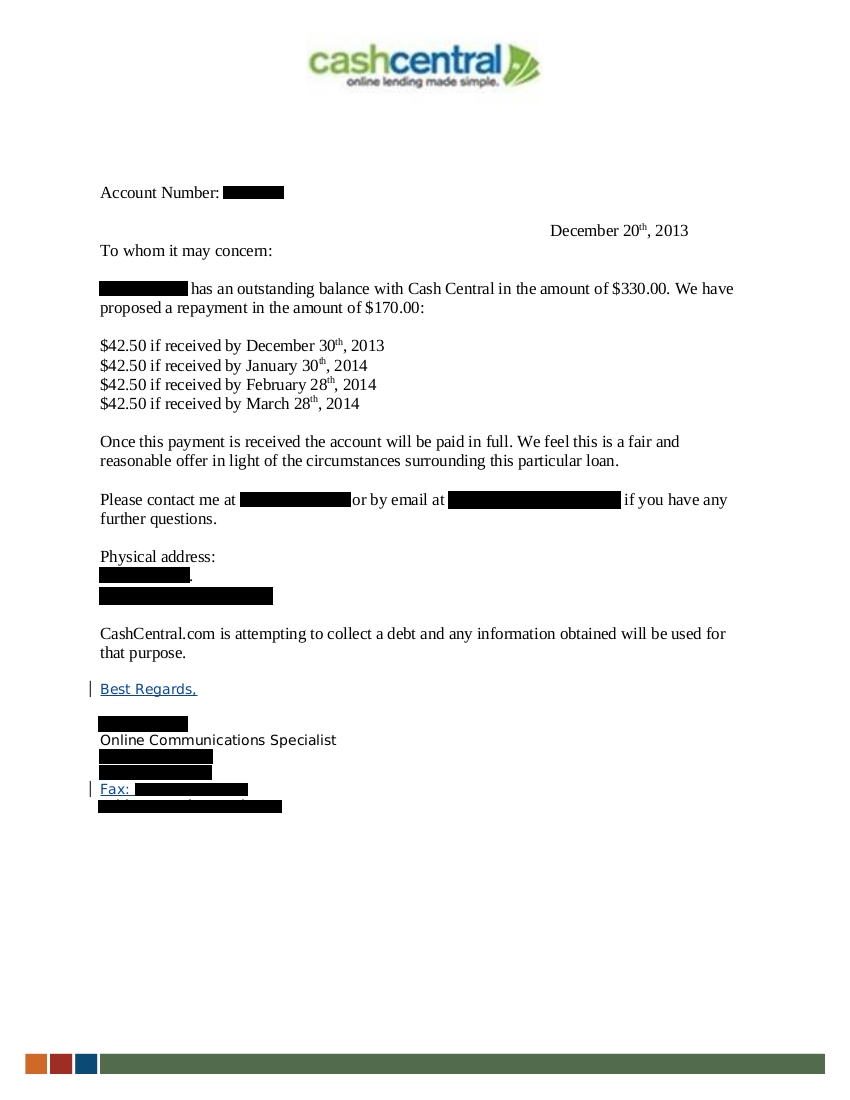

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

What to do if you don't recognize the creditor?

If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

How many steps to take when you head down the DIY road of debt settlement?

Here are seven steps you can take when you head down the DIY road of debt settlement.

Why do you do it yourself debt settlement?

A DIY settlement avoids the fees you might pay to a professional debt settlement company .

What are the downsides of DIY debt settlement?

Downsides of DIY Debt Settlement. Regardless of whether you take on the task yourself or reach out to a debt settlement company, you may face a tax burden if you do reach a settlement. If at least $600 in debt is forgiven, you’ll likely pay income taxes on the forgiven amount. Another downside to either DIY or professional debt settlement is ...

What to ask when entering a payment plan?

If you do enter a payment plan, ask whether the creditor will lower the interest rate on the debt to ease your financial burden. During your negotiations, maintain a written record of all your communication with a creditor. Last but not least, keep your cool and be honest.

How do debt collectors make money?

Debt collectors make money by collecting past-due debts that originated with a creditor, such as a credit card company. When dealing with debt collectors, be patient. It may take several attempts to get the type of settlement you’re comfortable with.

Why is debt settlement considered a last resort?

Debt settlement is considered a last resort strategy because of the damage it does to your credit. Other options that require you to pay back the full principal debt amount—and thus do not negatively affect your credit score—include debt consolidation and debt management plans.

Can you negotiate a DIY debt settlement?

If you choose to negotiate a DIY debt settlement, you don’t relinquish your personal control over the timing of the process.

What is do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed.

How much does a debt settlement company charge?

With a debt settlement company, you’ll likely pay a fee of 20% to 25% of the enrolled debt once you agree to a negotiated settlement and make at least one payment to the creditor from an account set up for this purpose, according to the Center for Responsible Lending.

What company did the CFPB take legal action against?

In 2013, the CFPB took legal action against one company, American Debt Settlement Solutions, saying it failed to settle any debt for 89% of its clients. The Florida-based company agreed to effectively shut down its operations, according to a court order.

What is the difference between debt settlement through a company and doing it yourself?

Time and cost are the main distinctions between debt settlement through a company and doing it yourself.

What does "settled" mean on credit report?

Settled debts are generally marked as “Settled” or “Paid Settled,” which doesn’t look great on credit reports. Instead, you'll try to get your creditor to mark the settled account “Paid as Agreed” to minimize the damage.

How long can you be behind on a debt settlement?

Debt settlement is an option if your payments are at least 90 days late, but it’s more feasible when you're five or more months behind. But because you must continue to miss payments while negotiating, damage to your credit stacks up, and there is no guarantee that you’ll end up with a deal.

How long does it take to settle a debt?

While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

Who can check if a debt settlement company is licensed?

The state attorney general’s office can also check if the company is required to be licensed and whether it meets your state’s requirements. The Better Business Bureau has consumer reviews of businesses that could help you as you research a debt settlement service provider.

What is debt settlement?

Debt settlement is a practice that allows you to pay a lump sum that’s typically less than the amount you owe to resolve, or “settle,” your debt. It’s a service that’s typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor. Paying off a debt for less than you owe may sound great at first, but debt settlement can be risky, potentially impacting your credit scores or even costing you more money.

What is a resolve?

Why Resolve stands out: Resolve is a debt management service that provides users with features such as debt settlement and negotiation as well as budgeting tools and credit score monitoring.

How does debt settlement work?

The companies generally offer to contact your creditors on your behalf, so they can negotiate a better payment plan or settle or reduce your debt.

How many payments do you have to make to a debt collector?

Once the debt settlement company and your creditors reach an agreement — at a minimum, changing the terms of at least one of your debts — you must agree to the agreement and make at least one payment to the creditor or debt collector for the settled amount.

What happens if you stop paying debt?

If you stop making payments on a debt, you can end up paying late fees or interest. You could even face collection efforts or a lawsuit filed by a creditor or debt collector. Also, if the company negotiates a successful debt settlement, the portion of your debt that’s forgiven could be considered taxable income on your federal income taxes — which means you may have to pay taxes on it.

Can a company settle all of your debt?

Keep in mind that there is no guarantee the company will be able to reach a debt settlement agreement for all of your debts.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

Can a letter to a company end up in a dead letter?

If you simply address the letter to the company, it may never find its way to an individual who will act on your proposal. In a very large organization, correspondence not directed to a specific individual can easily end up in the dead letter file.

Can a creditor accept a reduced payment?

If you send a reduced payment without having written confirmation of your settlement proposal from the creditor, they may accept your payment as a partial payment on the full amount owed, then continue efforts to collect the balance.