1 Accredited Debt Relief Accredited Debt Relief is one of the largest and most reputable debt consolidation companies in the United States. Founded in 2008, they have helped nearly 300,000 clients consolidate and rid themselves of $4.77 billion dollars of combined debt....read more. Visit Website

Full Answer

What are the best debt settlement companies?

Top 5 Best Debt Settlement Companies ( BBB A+ Rated )

- Top 5 Best Debt Settlement Companies:

- NATIONALDEBTRELIEF. National Debt Relief is a BBB A+ accredited business that helps consumers get out of debt without loans or bankruptcy.

- NEWERADEBTSOLUTIONS. Credit counseling, debt management, and debt consolidation programs to help you get out of debt. ...

- GUARDIANDEBTRELIEF. ...

- FREEDOMDEBTRELIEF. ...

- PACIFICDEBT. ...

Can you really trust a debt settlement company?

You can also trust a debt settlement company if it’s been in business for five or 10 years. The con artists generally open up under one name, scam as many people as they can, close down and then open up a few months later under a new name. Legitimate debt settlement companies are accredited by the Better Business Bureau and belong to ...

Why use a debt settlement company?

Why Use A Debt Settlement Company When I Can Negotiate My Debts Myself?

- Experience. Settlement companies handle hundreds of accounts daily. They understand the system and know how it works. ...

- Time. Negotiating with creditors is not a one-phone-call, 10-minute-conversation ordeal. ...

- Emotions. Debt and financial burden can often be a very personal, embarrassing issue, and creditors take great advantage of this. ...

What is the best debt relief?

First look:

- Best debt relief program overall - National Debt Relief

- Best debt relief program for tax debt - CuraDebt

- Best choice for credit card debt relief - DMB Financial

- Best program for customer satisfaction - New Era Debt Solutions

- Best program for debt settlement - Accredited Debt Relief

- Best interactive debt relief program - Freedom Debt Relief

How do I know if a debt settlement company is legitimate?

Ask the caller for a name, company, street address, telephone number, and professional license number. Many states require debt collectors to be licensed. Check the information the caller provides you with your state attorney general . Your state regulator may be of assistance if your state licenses debt collectors.

Is there really a debt relief program?

National Debt Relief is a debt settlement company that negotiates on behalf of consumers to lower their debt amounts with creditors. Consumers who complete its debt settlement program reduce their enrolled debt by 30% after its fees, according to the company.

How do I choose a debt settlement company?

Debt settlement companies generally negotiate with your creditors to pay off your debt for less than what you owe....Here's what to look for when choosing a debt settlement company:Accreditation. ... Fees. ... Time in business. ... Customer satisfaction and experience. ... Digital experience.

What is the success rate of debt settlement?

Completion rates range from 35% to 60%, with the average around 45% to 50%. While most companies defined a completion as having all debts settled, there were two that considered a client completed if they had settled at least 80% of the debt and one if they had settled at least 50% of the debt.

Why is debt relief bad?

Debt settlement will negatively affect your credit score for up to seven years. That's because, to pressure your creditors to accept a settlement offer, you must stop paying your bills for a number of months.

Does debt settlement hurt your credit?

Debt settlement can negatively impact your credit score, but it won't hurt you as much as not paying at all. You can rebuild your credit by making all payments on time going forward and limiting balances on revolving accounts.

What's the best debt relief company?

The 6 Best Debt Relief Companies of 2022Best Overall: National Debt Relief.Best for Debt Settlement: Accredited Debt Relief.Best for High-Interest Credit Card Debt: DMB Financial.Best for Customer Satisfaction: New Era Debt Solutions.Best for Tax Debt Relief: CuraDebt.Best Interactive Program: Freedom Debt Relief.

How Much Do debt settlement companies charge?

a 15% to 25%Debt settlement companies typically charge a 15% to 25% fee to tackle your debt; this could be a percentage of the original amount of your debt or a percentage of the amount you've agreed to pay.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

What is the lowest a debt collector will settle for?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

How much less will debt collectors settle for?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

When should you consider applying for a debt relief program?

When you should seek debt relief. Consider bankruptcy, debt management or debt settlement when either of these is true: You have no hope of repaying unsecured debt (credit cards, medical bills, personal loans) within five years, even if you take extreme measures to cut spending.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

Is there credit card forgiveness?

Most credit card companies are unlikely to forgive all your credit card debt, but they do occasionally accept a smaller amount in settlement of the balance due and forgive the rest. The credit card company might write off your debt, but this doesn't get rid of the debt—it's often sold to a collector.

How do I get out of the National Debt Relief Program?

ProcessFind the Notice of Cancelation form in Your Debt Relief Agreement.Sign and Date the Cancelation Form.Fax Cancellation Form to 1-866-460-5541 or scan and email the cancellation form to [email protected] up on cancellation requests by calling the office at 888-660-7427.

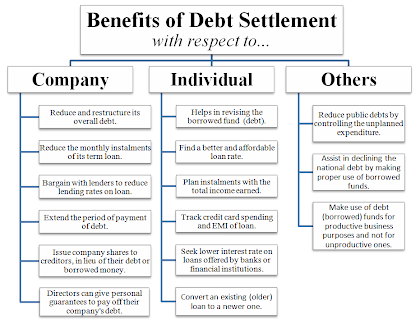

How does debt settlement work?

Debt settlement programs generally negotiate with your creditors on your behalf to pay off your debt at a lower amount than the original principal...

What must a debt settlement company disclose?

By law, debt settlement companies are required to disclose certain information before you sign up for services. This includes: fees and terms for a...

What are alternatives to debt settlement?

Debt settlement is generally considered a last resort. Several other potentially less costly and less risky alternatives fall under the broader umb...

How much does a debt settlement company charge?

Debt settlement companies usually charge a service fee of anywhere from 15% to 20% of your debt amount. Also, because debt settlement involves missing monthly payments, your creditors could tack on late payment fees.

What is debt settlement?

Debt settlement is a debt relief program for consumers who want to lower the payoff amount of their existing debt. A debt settlement company offers to settle your debt for an amount lower than the amount you owe. Your debt settlement company will require you to make fixed monthly payments to an escrow account.

How does debt settlement work?

Debt settlement works when negotiators call a consumer’s creditors and attempt to convince them to allow the consumer to pay one large lump sum to pay off their debt. This lump sum is less than the total amount of debt originally owed. In exchange for this payment, the creditor forgives the debt owed by the consumer.

How long does it take for a debt settlement to affect your credit score?

These settled debts can leave a negative mark on your credit report for up to seven years. You also typically stop making payments to your creditors during debt settlement, which also affects your credit score. For this reason, only opt for debt settlement if you fall within one of the scenarios above and do not intend to make a big purchase anytime soon. If you decide to settle your debt and do not accrue further debt, over time as your debts are paid off, you can improve your score.

What type of debt does CreditAssociates settle?

Types of debt settled: CreditAssociates only works with unsecured debt.

What is Liberty Debt Relief?

Liberty Debt Relief’s team of experts has helped thousands of clients struggling with debt with quick and easy solutions.

What to look for in a debt settlement company?

The American Fair Credit Council (AFCC) sets the standard in debt settlement, so looking for an agency that holds a membership with them is a good place to start. Accreditation with the International Association of Professional Debt Arbitrators (IAPDA) is another good sign.

How long does Incharge debt solution last?

Debt management programs through this nonprofit organization last anywhere from three to five years and primarily help with unsecured credit card debt.

What is ACCC credit?

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling agency. Accredited by the NFCC, it offers transparency and relatively low fees. In business for three decades, it has a long history of high customer satisfaction and gets an A+ from the Better Business Bureau. Its debt management program can help with unsecured debts, including credit cards, medical bills, signature loans and collection accounts.

What is MMI debt management?

Money Management International (MMI) was founded in 1997, but it has roots dating back to 1958, giving it the longest history of all the organizations on our list. It gets an A+ from the Better Business Bureau and 4.9 out of 5 stars from Trustpilot. Its debt management program helps with all types of unsecured debt. Programs are designed to complete repayment in five years or less, but MMI says that, on average, its clients are debt-free in less than four years.

How does debt management work?

Debt management companies work with your creditors and restructure your debt in a way that makes it easier to pay off. They do this by creating a debt management plan (DMP) tailored to your situation. DMPs—the best of which are offered by nonprofit consumer credit counseling agencies—roll your unsecured debts into a single monthly payment, simplifying the repayment process.

How much does DMCC charge for debt management?

It doesn’t list a monthly fee on its website for its debt management program, but it does for its debt reduction program, which is very similar. The monthly fee for its debt reduction program is $27 per month.

What is DMCC credit counseling?

(DMCC) is a nonprofit organization with high customer satisfaction. Accredited by the NFCC, DMCC offers certified credit counselors and debt management plans designed to pay off the enrolled debt in five years or less.

How to get started with debt management?

If you’re interested in debt management services from DMCC, you can get started by calling or filling out a form online. Debt Management Credit Counseling Corp. says on its website that its debt management plan is available “in most states,” but it doesn’t disclose which states—check with the company to make sure the DMP is available in your location.

What is the best settlement option for credit card debt?

Accredited Debt Relief is the best settlement option based on its proven results and success on this type of debt relief with high-interest credit card debt over $10,000.

How long does a debt settlement program last?

Generally speaking, programs from this firm last for 24 to 48 months.

What is DMB Financial?

Founded in 2003, DMB Financial has a long history of helping clients establish debt settlement programs. This company reports real-time results for its clients on its website, many of which show clients settling debts for many thousands of dollars less than what they owed. DMB Financial is also a member of the American Fair Credit Council, which includes a select number of debt settlement companies that commit to the highest standards for their clients.

How does National Debt Relief work?

National Debt Relief helps consumers begin the process by offering a free consultation with one of its debt counselors. From there, you will have the option to explain your situation and talk over potential solutions, including using National Debt Relief for debt settlement.

What is accredited debt relief?

Like other debt relief companies, Accredited Debt Relief focuses its efforts on debt settlement. It starts potential clients with a free consultation with a certified debt specialist who can help them talk over their situation and options. If they are deemed a good candidate for debt settlement, Accredited Debt Relief helps them begin saving money in a separate account and stop using credit cards.

Why do we use Freedom Debt Relief?

We chose Freedom Debt Relief due to the fact it offers an interactive client dashboard that lets clients track their progress.

What is debt relief?

Using a debt relief company can help you manage your debt and avoid pesky interest fees. The best debt relief companies provide a path out of debt that could result in you paying less than what you owe. The strategy they use is also frequently referred to as “debt settlement” for this reason.

What companies sell debt settlement programs?

Businesses that bill themselves as debt consolidation companies, like Freedom Debt Relief and National Debt Relief, in fact sell debt settlement programs that require you to stop paying your bills and instead make monthly payments into a separate savings account.

How much does a debt settlement cost?

Enrolling in a settlement program can cost you in multiple ways: Service fees range from 18% to 25% of your enrolled debt, which translates into $900 to $1,250 on $5,000 of debt.

How much does it cost to settle a debt?

Here’s the short answer: Turn to debt settlement companies only as a last resort. Enrolling in a settlement program can cost you in multiple ways: 1 Service fees range from 18% to 25% of your enrolled debt, which translates into $900 to $1,250 on $5,000 of debt. There can also be fees for opening and maintaining the savings account. 2 Because you stop paying your bills, interest and late fees accrue on your balances. If the debt settlement company fails to settle your debt, you’ll end up responsible for these higher balances. 3 Your credit takes a beating, and you may receive debt collections and lawsuits from your creditors

What is the difference between debt consolidation and debt settlement?

A key difference between debt consolidation and debt settlement is who's in charge. Understanding the difference between the two approaches ensures you don’t end up losing money on a service or outcome you aren’t expecting. Debt consolidation is a do-it-yourself strategy that you control. Enrolling in a debt settlement program puts you in ...

What is debt consolidation?

Debt consolidation is a do-it-yourself strategy that you control. Enrolling in a debt settlement program puts you in the hands of debt relief companies that may or may not successfully settle your debt.

How long does it take for a debt settlement to work?

Once there’s enough money in that account, typically after six months, the debt settlement company will begin negotiations with your creditors. If they reach an agreement, you’ll pay the creditor the negotiated payment out of that account and pay the debt settlement company a fee for its service.

How to check if a company is registered?

Consult the Financial Counseling Association of America, National Foundation of Credit Counseling or the American Fair Credit Council to see if the company is registered. Reputable companies will likely be registered to maintain credibility.

What happens if you stop paying debt settlement?

This can have a negative effect on your credit score and may result in the creditor or debt collector filing a lawsuit while you are collecting settlement funds. And if you stop making payments on a credit card, late fees and interest will be added to the debt each month. If you exceed your credit limit, additional fees and charges may apply. This can cause your original debt to increase.

How to avoid paying credit card debt?

Avoid doing business with any company that promises to settle your debt if the company: 1 Charges any fees before it settles your debts 2 Represents that it can settle all of you debt for a promised percentage reduction 3 Touts a "new government program" to bail out personal credit card debt 4 Guarantees it can make your debt go away 5 Tells you to stop communicating with your creditors 6 Tells you it can stop all debt collection calls and lawsuits 7 Guarantees that your unsecured debts can be paid off for pennies on the dollar

What is an alternative to a debt settlement company?

An alternative to a debt settlement company is a non-profit consumer credit counseling service. These non-profits can attempt to work with you and your creditors to develop a debt management plan that you can afford, and that can help get you out of debt.

What is debt settlement?

Debt settlement companies are companies that say they can renegotiate, settle, or in some way change the terms of a person's debt to a creditor or debt collector. Dealing with debt settlement companies can be risky. Debt settlement companies, also sometimes called "debt relief" or "debt adjusting" companies, often claim they can negotiate ...

What happens if you stop paying your credit card bills?

If you stop paying your bills, you will usually incur late fees, penalty interest and other charges, and creditors will likely step up their collection efforts against you.

Can a debt settlement company file a lawsuit against you?

Working with a debt settlement company may lead to a creditor filing a debt collection lawsuit against you.

Is forgiven debt taxable income?

If a portion of your debt is forgiven by the creditor, it could be counted as taxable income on your federal income taxes. You may want to consult a tax advisor or tax attorney to learn how forgiven debt affects your federal income tax. Read full answer.