Is a settlement statement the same thing as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is the most commonly used form for settlement statements?

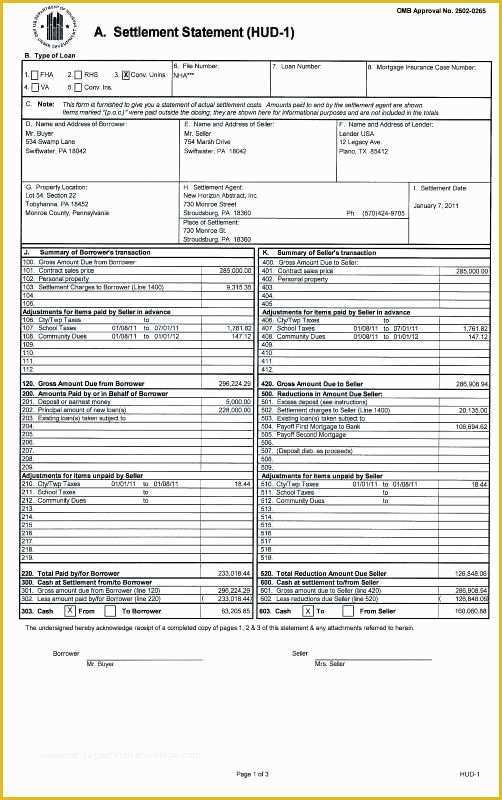

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What does closing statement look like?

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

What is estimated Settlement Statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

Who provides the HUD Settlement Statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Who typically prepares the closing statement?

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

What is a good closing statement?

Typical Closing Arguments a summary of the evidence. any reasonable inferences that can be draw from the evidence. an attack on any holes or weaknesses in the other side's case. a summary of the law for the jury and a reminder to follow it, and.

How do you read a settlement?

0:217:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What is FnF in salary?

What is full and final settlement? Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

How is FnF amount calculated?

Calculation of per day basic: (number of days of non-availed leaves * basic salary) / 26 days ( Avg paid days in a month). As per Section 7 (3) of the Payment of Gratuity Act 1972, Gratuity should be offered within 30 days of the resignation. If you fail to do so you need to pay with interest.

What happens if employee does not pay full and final settlement?

File a complaint with the labour commissioner against the company for paying all your dues salary and gratuity whatever is remaining the labour commissioner shall try to mitigate with the company if company fails to pay the matter shall be put on board with the labour court .

What is included in full and final settlement?

The full and final settlement includes the unpaid salary for the number of days for which the employee has worked for since his resignation date and his last working day.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What is a Settlement Statement?

The Settlement Statement or closing statement is a document that outlines what the buyer has to pay to the vendor on settlement day. It includes all payments and receipts that are related to the settlement. This may include stamp duty, the First Home Owner Grant and the Statement of Adjustments. It also includes the total purchase price less any deposit paid. The Settlement Statement is usually put together by your conveyancer or property lawyer when they are getting ready to settle the property purchase.

What is a settlement?

Real estate settlement happens when the land is transferred over to the buyer. Settlement day usually marks the end of the transaction. Aside from handing over keys, there are several things that happen on settlement day. A settlement day checklist includes:

What is included in a statement of adjustment?

Some of the most common include: Municipal Rates: The seller is liable to pay for the rates up to settlement day.

How is a statement of adjustments calculated?

The Statement of Adjustments will be calculated assuming that all of the expenses have been paid. If they haven’t then they will be paid out of the total money that is to be paid to the seller. This means that the seller will effectively pay them up to settlement date. Sometimes this involves having a bank cheque for settlement drawn up so that these expenses can be paid.

How are water and sewerage charges adjusted?

Water and sewerage charges: These are adjusted based on the number of days, rather than the amount of water consumed, up to settlement date . Because water meters are usually read every quarter, the Statement of Adjustment may use the average usage in the period preceding the sale to estimate the amount of water and sewerage charges that the seller must pay.

Why do you need to adjust settlement dates?

Because settlements rarely occur at the end of the year or month, adjustments need to be done to make sure both the buyer and the seller only pay (and receive) their fair share. If for some reason the settlement date is delayed, then the adjustments will need to be recalculated.

Why are settlement statements included in the Statement of Adjustments?

Settlement Statements are usually incorporated into the Statement of Adjustments because the income and expenses related to the property also need to be settled between the parties. These expenses may include things like municipal rates, land tax and other periodic expenses related to the property.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What does a HUD-1 look like?

The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a government form that was used widely before 2015 when buying, selling, and refinancing real estate. It lists all the charges and credits to the buyer and seller in a real estate settlement or a mortgage refinance. You will also hear people refer to it as a settlement or closing statement.

What is page 3 of HUD?

Page 3 relates to the figure in the Good Faith Estimate (GFE) which has been replaced by the Loan Estimate. The lender would have supplied GFE estimate figure to the settlement agent upon application of the loan. The HUD figures are listed side by side with the GFE so that a comparison can be made and discrepancies highlighted. The standard loan terms shown here will include the origination fee, interest rate, term, and payment.

What is the second page of a transaction?

The second page details the associated fees and charges involved in the transaction. There are again two columns with charges that the buyer and seller pay. This page features the following:

Can you search for unlisted properties on Marketproof?

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today and get a 7-day free trial.

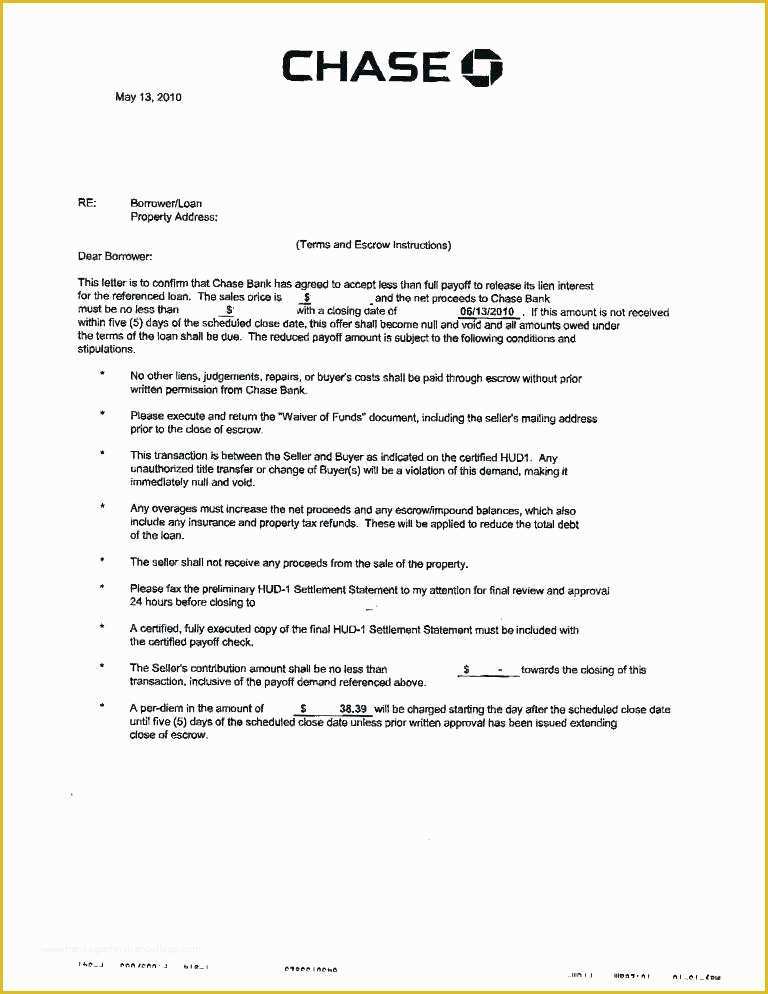

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

What is a HUD-1 settlement statement?

This five-page document combines the previous HUD-1 Settlement Statement, the Truth in Lending Act disclosures and the Good Faith Estimate. On its own, however, a settlement statement can be defined as a document which fully summarizes all fees that both a borrower and lender will be required to pay during the settlement of a loan.

What is page 2 of closing costs?

Page 2 is dedicated to all the details associated with your closing costs. It is here that you'll want to examine origination charges, like application and underwriting fees, and service fees, such as appraisals and credit reports. There's also a section for other costs that include things like taxes and government fees, initial escrow payments due at closing and real estate commissions.

What is page 4 on a loan?

Page 4 is exclusively for loan disclosures. It is here that you will learn how much a late payment will cost you, if the lender will accept a partial payment and whether or not you will have an escrow account. Should the lender not require an escrow account, page 4 will reveal if you are being charged an escrow waiver fee.

When is a closing disclosure required?

All lenders are required to provide a Closing Disclosure at least three business days prior to any settlements or refinance closing dates. This time gives you a chance to review the terms of the document and ensure they are close to or match the estimates that were given by the lender at the beginning of the process.

What is included in closing disclosure?

The first is for your loan calculations, which include the total number of payments you'll make over the life of the loan, your finance charges and your APR. Section two lists other disclosures, such as your appraisal and contract details. The third section contains contact details for the lender, the buyer's real estate agent, the seller's agent and the settlement agent. The final section is where you sign and date that you have received and reviewed the document.

Who is Alicia Bodine?

Alicia Bodine is a New Jersey-based writer specializing in finance. With more than 13 years of experience, her work has appeared in LendingTree, GoBankingRates, Sapling, Zacks and Pocket Sense.