What is a DC settlement?

A DC Settlement is the Debit/Credit settlement. Here’s how a signature (not PIN-based) debit or credit card transaction actually works under the covers; it’s a two step process: Step 1: You (or the merchant) swipes the card in a card reader. The card reader connects to the acquirer; this is the credit card processing company.

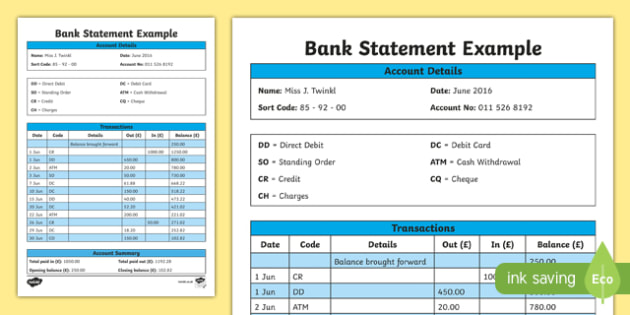

What does DC mean on a bank statement?

What does DC On a bank statement mean? Short guess, shorter abbreviation for Debit Card. Longer guess, Damage Claim? Better Guess, Deferred Credit, which means that you paid but the transaction wasnt settled yet?

What are the similar charges for chkcard D/C set?

CHKCARD D/C SETTLEMENT Similar Charges DC PARKING METERS D.C. SARNIES DEERFIELD IL D/C SET 877-4880757 VA D/C SETTLEMENT D/C SETTLEMENT APL*ITUNES.COM/BILL LOC:866-712-7753 D/C SETTLEMENT CERO UNO LOC: CHIHUAHUA CHI

How long does it take to settle a credit card transaction?

If available funds are deducted and sent through the processing network to the settlement bank which settles the transaction for the merchant. The settlement bank will typically deposit funds into the merchant’s account immediately. In some cases, settlement may take 24 to 48 hours.

What does debit and credit mean?

Debit and Credit simply mean ‘left’ and ‘right’ .

How does credit affect assets?

A Credit decreases an Asset Account, Increases a Liability Account and increases a Revenue account.

How long does a hold on a credit card last?

Holds eventually expire on their own, if no batch settlement happens, but at the top end, you are talking maybe 8 days for a debit card hold, and 30 days for a credit card hold, so it can take a while — during which you may believe you have more money than you actually do.

What is DC settlement?

A DC Settlement is the Debit/Credit settlement . Here’s how a signature (not PIN-based) debit or credit card transaction actually works under the covers; it’s a two step process: Step 1: You (or the merchant) swipes the card in a card reader. The card reader connects to the acquirer; this is the credit card processing company.

What is double hold gas?

Another place a double hold typically happens is gas stations ; gas pumps tend to authorize and hold a set amount, like $75 or $100, up front. This protects them in case you try to game the pump in multiple locations before the transactions on all of them finalize (you get the gas at all locations, but only one location actually gets paid).

Where is the DR on a bank statement?

The letter DR (should really be dr.) indicate a debit entry, and should be shown in figures on the left hand coloumn of your accounting sheet, whether that be balance sheet, profit & Loss account of bank statement.

How many people use Wise?

Get the world's most international account. Join 10 million people using Wise.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

What Is a Settlement Bank?

A settlement bank is the last bank to receive and report the settlement of a transaction between two entities. It is the bank that partners with an entity being paid, most often a merchant. As the merchant’s primary bank for receiving payment, it can also be referred to as the acquiring bank or the acquirer .

Why do merchants partner with settlement banks?

Merchants partner with a settlement bank to ensure efficient settlement of transactions in electronic payment processing. To facilitate electronic transactions, the merchant must first open a merchant account and sign an agreement with an acquiring bank detailing terms for processing and settlement of transactions for the merchant.

What is interbank settlement?

Often times, the payer of a transaction will be a customer of a different bank from the receiver, and so an interbank settlement process must occur. A settlement bank also provides merchant services to businesses such as transaction processing.

What is the main entity involved in electronic payment?

When processing an electronic payment transaction, there are typically three main entities involved: the cardholder’s bank, the settlement bank and a payment processor. The settlement bank, also known as the acquiring bank is the lead facilitator of communication on the transaction. Merchants partner with a settlement bank ...

What is a payment brand network?

The payment brand network contacts the cardholder’s bank, also known as the issuing bank to ensure that funds are available. If available funds are deducted and sent through the processing network to the settlement bank which settles the transaction for the merchant. The settlement bank will typically deposit funds into ...

Why is it important for merchants to have good relationships with settlement banks?

With a significant majority of customers seeking to make electronic payments, it is important that merchants have good relationships with processing entities including settlement banks to ensure a fast and efficient payments system for their business and their clients .

How long does it take for a bank to settle a transaction?

The settlement bank will typically deposit funds into the merchant’s account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.