What is a partial settlement in a personal injury case?

What is a Partial Settlement? A partial settlement can occur when the parties agree to settle, but they don’t actually settle on all of the legal issues involved. For example, in an automobile accident lawsuit, the defendant may agree to settle regarding payment for the person’s injuries.

Should I make a partial or full settlement offer?

if you are not short of money so you could repay the debts now, be able to afford the deposit for your next house and you want to move soon, then full payment is the sensible option. If you want to make a partial settlement offer, read my Guide to Full & Final Settlement offers first.

What does it mean to partially settle my account?

Partially settling your account means that we have come to an arrangement that sees the outstanding balance of your debt reduced to zero, despite the full amount not being repaid. If you have a sum of money but it falls short of the total amount owed, you can make an offer of repayment.

How long will a partial settlement show on my credit report?

They will just be happy you have one less debt that you still owe; the partial settlement will only show on your credit record for 6 years if the debt isn’t defauled; if the debt is defaulted, it will drop off your credit record 6 years after the default date.

What is a partial settlement?

A partial settlement is a repayment which is less than the total amount of debt owing. Sometimes, depending on circumstances - such as how long it will take to pay your debt off and the amount of your current repayment – your creditors may be prepared to write off a chunk of your balance if you can pay them a lump sum.

What is a partial settlement offer?

A partial settlement is an agreement on the repayment of debt. Partially settling your account is an agreement between you and the creditor to settle the account for less than the total owed.

What is a full settlement?

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

What does settle mean in legal terms?

1. An agreement that ends a dispute and results in the voluntary dismissal of any related litigation. Regardless of the exact terms, parties often choose to keep their settlement agreements private.

Is it good to partially settle debt?

If you see a 'partially settled' status code, this means that your creditor has accepted an offer of final settlement that is less than the full amount owed. This does negatively affect your credit score, as it shows you have failed to pay the full amount required.

How long does a partial settlement stay on your credit file?

6 yearsthe partial settlement will only show on your credit record for 6 years if the debt isn't defauled; if the debt is defaulted, it will drop off your credit record 6 years after the default date.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What happens if a company does not give full and final settlement?

What happens if an employer doesn't process a full and final settlement on time? If the employer fails to pay the amount due for FnF settlement, the employee can take legal action against the employer and demand the payment of a penalty for the delay.

What percentage should I offer a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

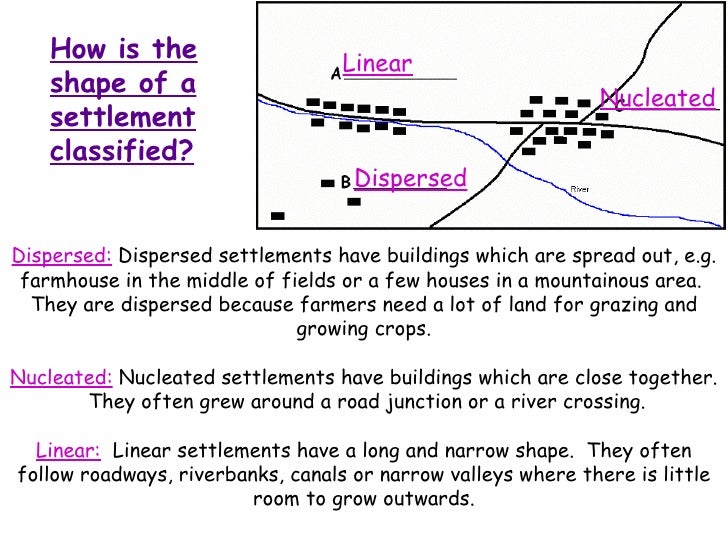

What are the types of settlement?

The four main types of settlements are urban, rural, compact, and dispersed. Urban settlements are densely populated and are mostly non-agricultural. They are known as cities or metropolises and are the most populated type of settlement. These settlements take up the most land, resources, and services.

When should you settle a lawsuit?

Whether you are the plaintiff or the defendant, if the total time spent in litigation is not worth a good outcome in court, then settlement is probably a better option. The outcome of the case is unpredictable. If your case appears to be a toss-up, you are probably better off settling.

What is the difference between a settlement and a lawsuit?

A settlement is the formal resolution of a lawsuit before the matter is taken to court. You can reach a settlement at any point during litigation, and many cases can even be settled before a formal lawsuit is filed. Or, they can be settled the day before, or even the day the lawsuit goes to court.

What is a settlement offer from a debt collector?

Debt settlement is a practice that allows you to pay a lump sum that's typically less than the amount you owe to resolve, or “settle,” your debt. It's a service that's typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor.

What is the credit card settlement rate?

To successfully negotiate a debt settlement plan, it is important to stop minimum monthly payments on that debt, which will incur late fees and interest and damage your credit score. Typical debt settlement offers range from 10% to 50% of what you owe.

How do I write a letter to offer a settlement?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What does a statutory offer mean?

During a WorkCover claim you may have heard the term WorkCover counter offer or WorkCover statutory counter offer referred to. This is an offer made on your behalf (usually) by your lawyer, during a common law lump sum claim. It occurs after you have obtained a serious injury certificate.

Examples of Partial Cash Settlement in a sentence

Partial Cash Settlement The Company may, in its absolute discretion, satisfy part of the application for in specie redemption in cash, for example in cases in which it believes that a security held by a Fund is unavailable for delivery or where it believes that an insufficient amount of that security is held for delivery to the applicant for redemption in specie..

Related to Partial Cash Settlement

Cash Settlement shall have the meaning specified in Section 14.02 (a).

What does it mean to partially settle your account?

Partially settling your account means that we have come to an arrangement that sees the outstanding balance of your debt reduced to zero, despite the full amount not being repaid. If you have a sum of money but it falls short of the total amount owed, you can make an offer of repayment. However, even if the offer is accepted, ...

Does a note on your credit file indicate that it was partially settled?

Your credit file will be updated with an outstanding balance of zero, but a note will indicate it was ‘partially settled’. This may negatively affect your credit score and could affect your ability to get access to credit in the future.

How long does partial settlement show on credit report?

They will just be happy you have one less debt that you still owe; the partial settlement will only show on your credit record for 6 years if the debt isn’t defauled; if the debt is defaulted, it will drop off your credit record 6 years after the default date.

How long does it take for a partial settlement to drop off your credit?

if the debt is defaulted, it will drop off your credit record 6 years after the default date. Partial settlement does not change this. So it may vanish quite soon!

Do settlements reappear on credit?

They will not reappear on your credit record whatever happens. Only the creditor will know whether you settled these partially or in full.

Do debt collectors accept settlements?

Debt collectors will often accept a settlement offer – they may have paid very little when they bought your debt. But they would prefer you to pay the whole amount…

Can you get a partial settlement marker?

You may decide that there isn’t any point in getting a partial settlement marker on your file if it’s not going to save you much money; if you are not short of money so you could repay the debts now, be able to afford the deposit for your next house and you want to move soon, then full payment is the sensible option.