- Prepaid Property Taxes. The HUD-1 settlement statement itemizes closing costs, including prepaid items such as real property taxes and mortage interest.

- Mortgage Points. Generally, mortgage loan discount points are tax-deductible in the tax year that you purchase and close on your primary residence.

- Prepaid Mortage Interest. If the transaction closes on any day before the calendar day that your mortgage payments are due, then you are assessed pre-paid interest at closing for the ...

- Non-Deductible Settlement Charges. Some expenses on the HUD-1 settlement statement simply are not tax deductible. ...

Are HUD-1 Settlement charges tax deductible?

Only those charges that are deemed prepaid interest, such as points, are deductible from your taxes. If your HUD-1 settlement document notes other items named as origination charges, ask your closing agent or a tax expert if they may be tax deductible on your income taxes.

Are settlement statements tax deductible?

Of course, your settlement statement is comprised of more than interest, points, and real estate taxes. Unfortunately, most of the other items are not tax deductible. These are standard fees you pay for a loan closing that you cannot deduct.

Is mortgage interest on A HUD-1 loan tax deductible?

The mortgage interest paid for the remainder of the month in which the loan funds is also indicated on the HUD-1 statement and is tax deductible. Itemizing your taxes is the best way to take advantage of these deductions.

What are the most common HUD-1 expenses?

Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments. The mortgage interest paid for the remainder of the month in which the loan funds is also indicated on the HUD-1 statement and is tax deductible.

What is tax deductible on a HUD Settlement Statement?

Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What is deductible on a HUD?

The only HUD-1 tax deductions t are mortgage interest or real estate taxes. You can't deduct any service fees.

Are all settlement charges tax deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

What closing costs are tax deductible when refinancing?

You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. You closing costs are not tax deductible if they are fees for services, like title insurance and appraisals.

What items on Settlement Statement are tax deductible?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

How do you read a settlement statement for tax purposes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What can be included in cost basis of property?

Your cost basis typically includes: The original investment you made in the property minus the value of the land on which it sits. Certain items like legal, abstract or recording fees incurred in connection with the property. Any seller debts that a buyer agrees to pay.

What home improvements are tax deductible 2021?

"You can claim a tax credit for energy-efficient improvements to your home through Dec. 31, 2021, which include energy-efficient windows, doors, skylights, roofs, and insulation," says Washington. Other upgrades include air-source heat pumps, central air conditioning, hot water heaters, and circulating fans.

What home expenses are tax deductible 2021?

That said, you should be aware of some nondeductible home expenses, including:Fire insurance.Homeowner's insurance premiums.The principal amount of mortgage payment.Domestic service.Depreciation.The cost of utilities, including gas, electricity, or water.Down payment.

Are HOA fees tax deductible?

If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly HOA fees, you cannot deduct the HOA fees from your taxes. However, if you purchase or use the property as a rental property, then the IRS will allow you to deduct HOA fees.

What part of a refinance is tax deductible?

interestWith any mortgage—original or refinanced—the biggest tax deduction is usually the interest you pay on the loan. Generally, mortgage interest is tax deductible, meaning you can subtract it from your income, if the following applies: The loan is for your primary residence or a second home that you do not rent out.

Can you write off refinancing fees?

When refinancing for a second time, or paying off a loan early, a taxpayer may deduct all the not-yet-deducted points from the first refinancing when that loan is paid off. Other closing costs, such as appraisal fees and processing fees, generally are not deductible.

What qualifies as attendant care expenses?

You can claim: the entire amount you pay for your full-time care in a nursing home (in most cases) the cost of salaries and wages paid for attendant care in your home or someone else's home, a retirement home, a seniors home or other institution.

What is a non deductible medical expense?

You may not deduct funeral or burial expenses, nonprescription medicines, toothpaste, toiletries, cosmetics, a trip or program for the general improvement of your health, or most cosmetic surgery. You may not deduct amounts paid for nicotine gum and nicotine patches that don't require a prescription.

How does HUD calculate adjusted gross income?

Adjusted Income is defined as Annual Income minus any HUD allowable deductions. So, to calculate your Adjusted Income, you must first calculate your Annual Income, and then subtract certain amounts deemed “deductible” by HUD.

What are considered medical expenses?

Medical expenses are any costs incurred in the prevention or treatment of injury or disease. Medical expenses include health and dental insurance premiums, doctor and hospital visits, co-pays, prescription and over-the-counter drugs, glasses and contacts, crutches, and wheelchairs, to name a few.

What is a point on a HUD loan?

Points. Points are origination charges shown on your HUD-1 settlement document presented at closing of your mortgage loan. One point equals 1 percent of your mortgage amount. Points come in two varieties. Origination points are those paid to mortgage lenders for giving you the loan.

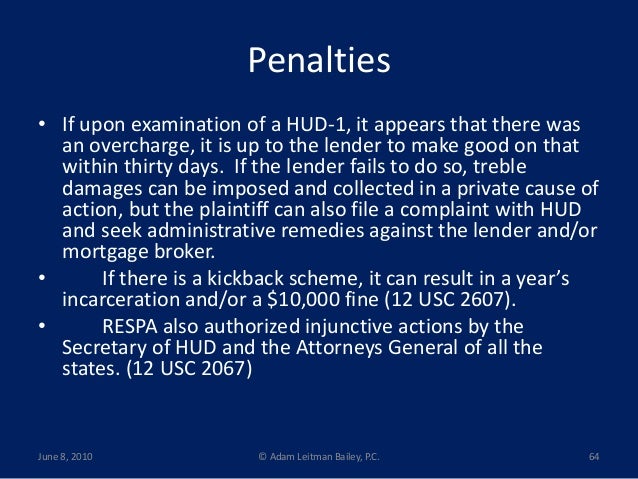

Is HUD 1 settlement tax deductible?

Most origination charges on your HUD-1 settlement document are tax deductible. However, the timing of your deduction depends on when and how you paid any points needed to get your mortgage loan. Along with how and when you paid origination charges, the IRS has requirements to be met to determine the deductibility of origination fees.

Is origination fee deductible?

Therefore, if you pay origination charges in cash before or at closing, they are deductible in the year paid. However, if you included origination charges in the mortgage amount, you must deduct these fees over the term of the loan, typically 30 years, one-thirtieth per year.

Is HUD-1 loan origination tax deductible?

IRS Criteria. Origination charges on your HUD-1 are deductible if your loan is secure d by your primary residence, your charges were common for your location, they did not include other non-deductible fees typically included on settlement statements, were not borrowed funds and the settlement fees ...

Can HUD-1 origination fees be deducted from your taxes?

If your HUD-1 settlement document notes other items named as origination charges, ask your closing agent or a tax expert if they may be tax deductible on your income taxes. Only those origination fees that are a percentage of your mortgage amount usually qualify as tax deductions. av-override.

What is a HUD-1 settlement statement?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What Are Seller Deductions?

Any prorated real estate taxes a home seller pays at closing are tax deductible. However, many of the closing costs listed on a settlement statement are deducted from sale proceeds. Lowered net proceeds reduce the capital gains the home seller may have garnered, thus reducing associated taxes. A capital gain is the improvement between a home's past purchase price and its later sale price, minus sale expenses.

Can you deduct mortgage insurance premiums?

Prepaid mortgage interest and mortgage insurance premiums are tax deductible, as are upfront real estate tax payments made from mortgage escrow funds.

Can you deduct points on a refinance?

However, on mortgage refinances, points paid are normally deducted as a prorated amount over the life of the loan.

Is a refinance loan deductible?

Homeowners who refinance are also given settlement statements. For homeowners, some of the costs for refinancing a mortgage loan are tax deductible. As with homebuyers, a refinanced mortgage's loan interest prepaid at closing is usually tax deductible. For property located in the San Francisco area, loan interest can become a significant expense and deduction. When you refinance your mortgage, points paid to lower your loan's interest rate can be deducted as well. However, on mortgage refinances, points paid are normally deducted as a prorated amount over the life of the loan.

Do home sellers pay closing costs?

Also, home sellers sometimes pay all or a portion of the buyer's closing costs. The closing costs sellers pay for buyers are deductible by buyers only, though the payment of such costs by sellers reduces those sellers' net capital gains and any taxes due.

Is mortgage interest deductible on HUD?

The mortgage interest paid for the remainder of the month in which the loan funds is also indicated on the HUD-1 statement and is tax deductible. Itemizing your taxes is the best way to take advantage of these deductions.

How to make sure you get all your deductions?

The best way to make sure you get all of your tax deductions is to talk to your tax advisor. With the Tax Reform and tax deductions changing so drastically, it’s best to get a professional opinion. As long as you make sure you tell your advisor about your home purchase, sale, or refinance and prove payment of the tax-deductible expenses, you may be able to lower your tax liability.

Who is responsible for taxes on a home?

Real estate taxes – Sellers are responsible for the portion of the taxes that are billed for the time they lived in the home. For example, if the bill comes out in September, and you close in August, you’ll owe the taxes for the entire year up to September. The buyer will be responsible for the taxes from September through the end of the year. You can then deduct the taxes that you owed on your tax return.

What is prepaid mortgage interest?

Prepaid mortgage interest – Any interest you pay upfront (at the closing) may be written off on your tax returns. You’ll usually prepay interest for the remainder of the month that you are closing. For example, let’s say you close on March 15 th.

What is origination fee?

Investment properties are often subject to different rules. Loan origination fees – An origination fee is something the lender charges to process your loan. Sometimes they reserve this fee for ‘difficult to process’ mortgages. Some lenders, however, charge this fee on every loan.

Can you deduct interest paid on May 1st?

This means the May 1 st payment would cover the interest from April. That leaves half of March’s interest unpaid. You pay it at the closing and then get to deduct it on your taxes. Real estate taxes – If you pay real estate taxes at the closing, you may be able to deduct them on your taxes.

Do you include prepaid interest on closing statement?

Don’t forget to include the prepaid interest on your Loan Closing Statement in your taxes. Points paid – Again, lenders may charge origination fees or discount points. Luckily, the IRS lets you deduct these items even if you refinance. The difference, however, is how you deduct them.

Can you deduct refinance costs on settlement?

Even if you refinance, you may be able to deduct some of the costs on your settlement statement.

What is a HUD-1?

The HUD-1 is a settlement statement and full of helpful and important information. HUD-1s may be simple and contain small amounts of information, while others may be complicated and jammed pack with data. When buying investment property (buy-and-hold), all HUD-1s have one thing in common, and that is the tax treatment of each line item.

When are loan points deductible?

This is an area for confusion, as loan points are deductible as a current expense when paid in connection with a primary residence.

What is the 804. appraisal fee?

804. Appraisal Fee: If required to obtain a loan, the cost is amortized over the life of the loan. If an appraisal is not required, the cost is added to the basis of the property and depreciated over the life of the property.

What is closing cost?

Closing costs can amount to a significant outlay of capital, so it’s important to understand when you can recover that capital. Closing costs may fall into one of the following three categories: Deductible as a current expense. Added to the cost basis of the property and depreciated.

Is a 1001 escrow account deductible?

1001. Initial Deposit for Your Escrow Account: This amount will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

Is interest on a loan deductible?

Of course, interest on loans is deductible as payments are made ; however on the onset, you will not separate these three line items out individually and deduct, depreciate, or amortize them, as they have already been included in the 100 section. 206.

Is city tax deductible on line 210?

106. City/Town Taxes: Deductible as a current expense, but only the portion greater than the value found on line 210.

What is escrow payment?

Escrow Payments. Setting up an escrow often means paying real estate taxes upfront. It pays to know exactly how much you paid towards your real estate taxes at the closing. These funds are tax deductible, just like the real estate taxes you pay directly to the county.

How much is a discount point on a loan?

They are a percentage of your loan amount. One point equals one percent of your loan. On a $100,000 loan, one point equals $1,000. You can deduct these points on your tax returns. Again, you can deduct the full amount of the points on a purchase. If you refinanced, you’ll prorate the deduction over the life of the loan.

Can you deduct points on your tax return?

Whatever the case may be, you may be able to deduct those points on your tax return. Lenders look at points as prepaid interest. Since you get to deduct the interest you pay on your mortgage on an annual basis, it makes sense that you can deduct the points.

Can you deduct home insurance premiums?

You cannot, however, deduct the homeowner’s insurance premiums you pay upfront, so you’ll need to differentiate from the two. Make sure to ask your lender how much of the escrow account that you set up is comprised of real estate taxes. This way you know exactly how much you can claim on your taxes for deductions.

Can you deduct points on a mortgage?

If you purchased a home, you can deduct the full amount of the points during the year that you paid them. If you refinanced a mortgage, you must prorate the points over the term of the loan. For example, if you took out at 15-year loan, you’d write off a portion of the points every year for 15 years.

Can you deduct interest on a mortgage when closing?

Any interest you pay at the time of the closing can also be deducted. You prepay interest because you will not owe a mortgage payment the next month. Let’s say you close on November 15 th. You would not make a mortgage payment until January 1 st. This leaves all of the interest for the rest of November to be paid. The mortgage payment you make in January will cover December’s interest, though. If you close early in the month, you could pay a decent amount of money for interest that is worth deducting on your taxes.

Do you pay origination points on a mortgage?

Origination Points. It’s not unusual to pay origination points on a mortgage. Whether you have a less than perfect credit score or have a unique situation, lenders often charge points up front. Sometimes, those points are in place of itemized closing costs and other times they are in addition to the costs.

What is a seller's owe?

Any amounts the seller owes that you agree to pay, such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions.

Do you add points to the basis of a mortgage?

If you pay points to obtain a loan (including a mortgage, second mortgage, line of credit, or a home equity loan), don't add the points to the basis of the related property. Generally, you deduct the points over the term of the loan. For more information on how to deduct points, see Points in chapter 4 of Pub. 535.

Can you deduct points on a mortgage?

If certain requirements are met, you can deduct the points in full for the year in which they're paid. Reduce the basis of your home by any seller-paid points. For more information, see Points in Pub. 936, Home Mortgage Interest Deduction.

Does commission add to cost basis?

Any commission paid out of your gain on the sale, is also added to your cost basis. Typically, that's about the only thing the seller can add to their cost basis. If you've got a HUD-1 closing statement, you'll note that "just about" all of the fees related to the transfer of the property (not the loan) are under the buyer's column.

Do you have to pay title transfer fees to sell a house?

as the seller, the only expenses you have are all related to the disposition of the property. You don't have any expenses related to the acquisition or disposition of a mortgage. So for you, expenses related to the disposition of the property are added to your cost basis of the property. As an example, that would include title transfer fees if you the seller actually paid those fees. (typically, the buyer pays all the property acquisition fees - but not always.)