What does it mean to be a settlement provider?

Settlement Service Provider means any person providing settlement services, as that term is defined under the Real Estate Settlement Procedures Act (12 U.S.C. § 2601 et seq .). Settlement Service Provider means a person who provides settlement services as that term is defined in 12 C.F.R. 1024.2, as in effect on January 12, 2014.

What is a mortgage settlement service?

Settlement service means any service provided in connection with a prospective or actual settlement, including, but not limited to, any one or more of the following: (1) Origination of a federally related mortgage loan (including, but not limited to, the taking of loan applications, loan processing, and the underwriting and funding of such loans);

Can a creditor permit a consumer to shop for settlement services?

Furthermore, a creditor may permit a consumer to shop for a settlement service provider if it permits the consumer to select the provider of the service, subject to reasonable requirements. But, the written list requirement does not apply if the creditor does not permit the consumer to shop for any of the settlement services.

What are settlement services under RESPA?

Settlement Services means a service provided in connection with a real estate settlement, including a title search, a title examination, the provision of a title certificate, services related Settlement Services shall have the same meaning as that term is defined under RESPA.

What is the definition of settlement service?

Settlement Services means a service provided in connection with a real estate settlement, including a title search, a title examination, the provision of a title certificate, services related to title insurance, services rendered by an attorney, preparing documents, a property survey, rendering a credit report or ...

What is not a settlement service?

Settlement services relate to the making of the federally-related mortgages that are covered under RESPA. Services that are provided after closing typically are not covered by RESPA and are not considered settlement services. 2.

Which of the following settlement services would not be covered by RESPA?

Which of the following are not covered by The Real Estate Settlement Procedures Act? -A timeshare purchase. The following transactions are not covered by RESPA: an all cash sale, a sale where the individual home seller takes back the mortgage, a rental property transaction or other business purpose transaction.

What are two things that RESPA prohibits?

RESPA Section 8(a) and Regulation X, 12 CFR § 1024.14(b), prohibit giving or accepting a fee, kickback, or thing of value pursuant to an agreement or understanding (oral or otherwise), for referrals of business incident to or part of a settlement service involving a federally related mortgage loan.

Who holds escrow money when a dispute occurs?

In the event a dispute arises over whether the earnest money should be returned (for example, if the seller argues that the buyer did not notify the seller in a timely manner of the intent to back out of the contract), the escrow holder will continue to hold the earnest money until the dispute is resolved.

Which of the following activities is not allowed under the real estate Settlements and Procedures Act?

Which of the following activities is not allowed under the Real Estate Settlements and Procedures Act? A broker having any business relationship with an insurance company that is involved in the broker's transaction.

What are the most frequent RESPA violations?

6 Most Common RESPA ViolationsKickbacks & Referral Fees. Violation: ... Requiring Excessively Large Escrow Accounts Balances. Violation: ... Responding to Loan Servicing Complaints. Violation: ... Inflating Costs. Violation: ... Not Disclosing Estimated Settlement Costs. ... Demanding Title Insurance.

What loans fall under RESPA?

The Real Estate Settlement Procedures Act (RESPA) is applicable to all “federally related mortgage loans,” except as provided under 12 CFR 1024.5(b) and 1024.5(d), discussed below.

What does RESPA mean in mortgage?

Real Estate Settlement Procedures ActReal Estate Settlement Procedures Act. RESPA seeks to reduce unnecessarily high settlement costs by requiring disclosures to homebuyers and sellers, and by prohibiting abusive practices in the real estate settlement process.

What is an example of a RESPA violation?

What is an Example of a RESPA Violation? Inflating closing fees, overcharging for services, adding hidden fees, and taking kickbacks for business settlement referrals are some examples of the more common violations of RESPA by unscrupulous companies and individuals.

What are TILA violations?

Some examples of violations are the improper disclosure of the amount financed, finance charge, payment schedule, total of payments, annual percentage rate, and security interest disclosures. Under TILA, a creditor can be strictly liable for any violations, meaning that the creditor's intent is not relevant.

Which would not be considered a RESPA violation?

Which would NOT be considered a RESPA violation? A thing of minimal value used in the course of sales such as pens, mementos, coffee cups, hats, etc. is permissible, but the other three arrangements could be considered violations of RESPA. To violate RESPA, the thing of value does not have to be money.

Which is not prohibited by RESPA?

RESPA Section 8 does not prohibit a lender or other settlement service provider from giving a consumer a gift or an incentive (e.g., a discount, refund of fees, chance to win a prize, etc.) for doing business with that entity.

Which of the following closings would be covered by RESPA?

The RESPA statute covers mortgage loans on a one-to-four family residential property. These include most purchase loans, assumptions, refinances, property improvement loans, and equity lines of credit.

What does RESPA stand for quizlet?

What does RESPA stand for? Real Estate Settlement Procedures Act. RESPA is also known as regulation.

Does RESPA apply to commercial loans?

Commercial or Business Loans Normally, loans secured by real estate for a business or agricultural purpose are not covered by RESPA. However, if the loan is made to an individual to purchase or improve a rental property of one to four residential units, then it is regulated by RESPA.

Examples of Settlement service provider in a sentence

This letter, when requested, provides a lender, a lessee, assignee of the Insured Mortgage, the warehouse Lender in connection with the Insured Mortgage, and a borrower or all-cash purchaser in a 1-4 family residence which is the principle residence of the purchaser, with certain protection against fraud, misappropriation of funds or failure to follow written closing instructions by the Settlement Service Provider subject to the provisions contained therein..

More Definitions of Settlement service provider

Settlement service provider means the Bank of England in its capacity as the provider of settlement services to the System.

Related to Settlement service provider

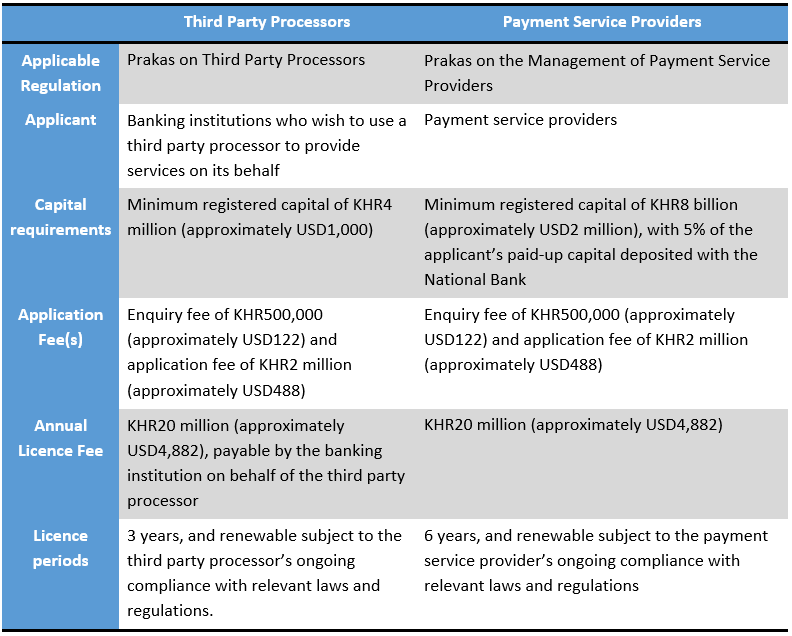

payment service provider means the categories of payment service provider referred to in Article 1 (1) of Directive 2007/64/EC of the European Parliament and of the Council (1), natural or legal persons benefiting from a waiver pursuant to Article 26 of Directive 2007/64/EC and legal persons benefiting from a waiver pursuant to Article 9 of Directive 2009/110/EC of the European Parliament and of the Council (2), providing transfer-of-funds services;.

What is settlement service?

Settlement Services means a service provided in connection with a real estate settlement, including a title search, a title examination, the provision of a title certificate, services related to title insurance, services rendered by an attorney, preparing documents, a property survey, ...

Can a custodian suspend a settlement?

The Custodian in good faith may terminate or suspend any part of the provision of the Contractual Settlement Services under this Contract upon reasonable notice under the circumstances to the Fund, including, without limitation, in the event of force majeure events affecting settlement, any disorder in markets, or other changed external business circumstances affecting the markets or the Fund.

Does the written list requirement apply to a settlement?

But, the written list requirement does not apply if the creditor does not permit the consumer to shop for any of the settlement services.

Can a creditor identify a provider on a list?

The creditor may identify on the list providers of services for which the consumer is not permitted to shop, provided the creditor clearly and conspicuously distinguishes those services from the services for which the consumer is permitted to shop. The list may accomplish this by placing the services under different headings.

Does a creditor have to disclose settlement services?

The CFPB has clarified that the creditor who permits a consumer to shop for settlement services must identify the settlement services required by the creditor for which the consumer is permitted to shop. The purpose of this revision was to clarify that the disclosure need not include all settlement services that may be charged to the consumer, but must include at least those settlement services required by the creditor for which the consumer may shop. [Revised Comment 19 (e) (1) (vi)-2, July 7, 2017]

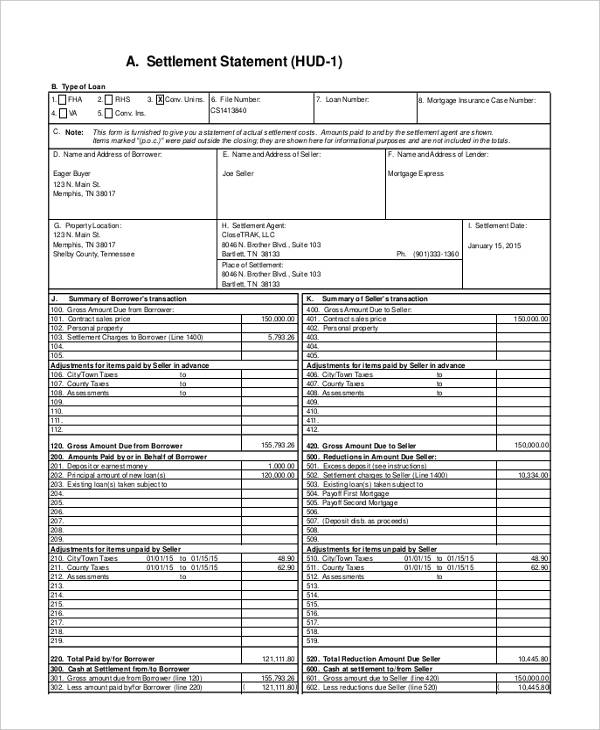

Thursday, October 16, 2014

We continually hear about the importance of the “Settlement Service Provider” in originating residential mortgage loans. But it seems sometimes that almost everybody involved in a loan transaction is such a company. Is there a list that we can go by to determine who is and who is not a Settlement Service Provider?

Defining a Settlement Service Provider

We continually hear about the importance of the “Settlement Service Provider” in originating residential mortgage loans. But it seems sometimes that almost everybody involved in a loan transaction is such a company. Is there a list that we can go by to determine who is and who is not a Settlement Service Provider?

Who must identify settlement service providers?

The CFPB also clarified that the creditor must identify settlement service providers, available to the consumer, for the settlement services required by the creditor for which a consumer is permitted to shop.

Does a written list of settlement services apply?

But, the written list requirement does not apply if the creditor does not permit the consumer to shop for any of the settlement services. If a creditor permits a consumer to shop for a settlement service it requires, the written list must identify at least one available provider of that service and must state that the consumer may choose ...

Can a creditor identify a provider on a list?

The creditor may identify on the list providers of services for which the consumer is not permitted to shop, provided the creditor clearly and conspicuously distinguishes those services from the services for which the consumer is permitted to shop.

Do you have to provide a written list of settlement service providers for which the creditor permits the consumer to shop for?

ANSWER. A creditor is required to provide a written list of the settlement service providers for which the creditor permits the consumer to shop for providers. Furthermore, a creditor may permit a consumer to shop for a settlement service provider if it permits the consumer to select the provider of the service, subject to reasonable requirements.

Does a creditor have to disclose settlement services?

The CFPB has clarified that the creditor who permits a consumer to shop for settlement services must identify the settlement services required by the creditor for which the consumer is permitted to shop. The purpose of this revision was to clarify that the disclosure need not include all settlement services that may be charged to the consumer, but must include at least those settlement services required by the creditor for which the consumer may shop. [Revised Comment 19 (e) (1) (vi)-2, July 7, 2017]