What is a multilateral net settlement system?

2. Multilateral net settlement system In a multilateral net settlement system, transfers received by a bank are offset against those sent out – here, “transfers” refer to the sum of all funds received and sent to banks that are part of the settlement system.

What is a single a settlement system?

A settlement system in which each settling participant settles (typically by means of a single payment or receipt) the multilateral net settlement position which results from the transfers made and received by it, for its own account and on behalf of its customers or non-settling participants for which it is acting.

What are the different types of net settlement systems?

Types of Net Settlement Systems 1 Bilateral net settlement system#N#Bilateral net settlement systems are payment systems in which payments are settled... 2 Multilateral net settlement system#N#In a multilateral net settlement system, transfers received by a bank are offset... 3 Deferred net settlement system More ...

What is a multilateral clearing system?

In a multilateral clearing, a high number of financial institutions are involved. But the principle is the same as for bilateral clearing. All the participant banks will exchange payments among each other up to a certain time. Then the netting will happen after which the final position will be calculated for each of the bank.

What is multilateral clearing?

In a multilateral clearing, a high number of financial institutions are involved. But the principle is the same as for bilateral clearing. All the participant banks will exchange payments among each other up to a certain time. Then the netting will happen after which the final position will be calculated for each of the bank.

How are banks connected to clearing houses?

And the clearing House is connected to the central Bank, the overseer of the banking market in a country or a region. Banks are connected through a clearing house. The central bank comes into play because as overseer of the banking system in the economy, it implements the settlement mechanism that banks uses to transfer funds among themselves. This is a crucial point to keep in mind: in almost all economies, banks do not exchange funds directly among themselves. They have to do it through the central bank.

Will the complexity of the netting increase?

With several hundreds of Banks, the complexity will obviously increase for the netting. Every time a new bank joins “the market”, it has to set up a connection with all the other banks if it wants to reach them directly. That will become also more and more difficult with the growing number of banks.

Does clearing system limit the number of transfers?

One might think wrongly that the clearing system computes the final position between each bank and each other participant bank. A clearing of this type would certainly limit the number of transfers of funds to carry out. But given the number of participant banks, the number of transfers would still be quite high. I have good news for you. The reality is much simpler. Each participant bank considers the clearing system as a single counterparty.

Examples of Multilateral Net Settlement Batch in a sentence

As stated in the Section 4 and access criteria for centralised payment systems, Clearing entities shall be permitted to submit Multilateral Net Settlement Batch (MNSB) file emanating from the ancillary payment systems managed by the Clearing entity.

Related to Multilateral Net Settlement Batch

Net Settlement Amount means the Gross Settlement Amount minus: (a) all Attorneys’ Fees and Costs paid to Class Counsel; (b) all Class Representatives’ Compensation as authorized by the Court; (c) all Administrative Expenses; and

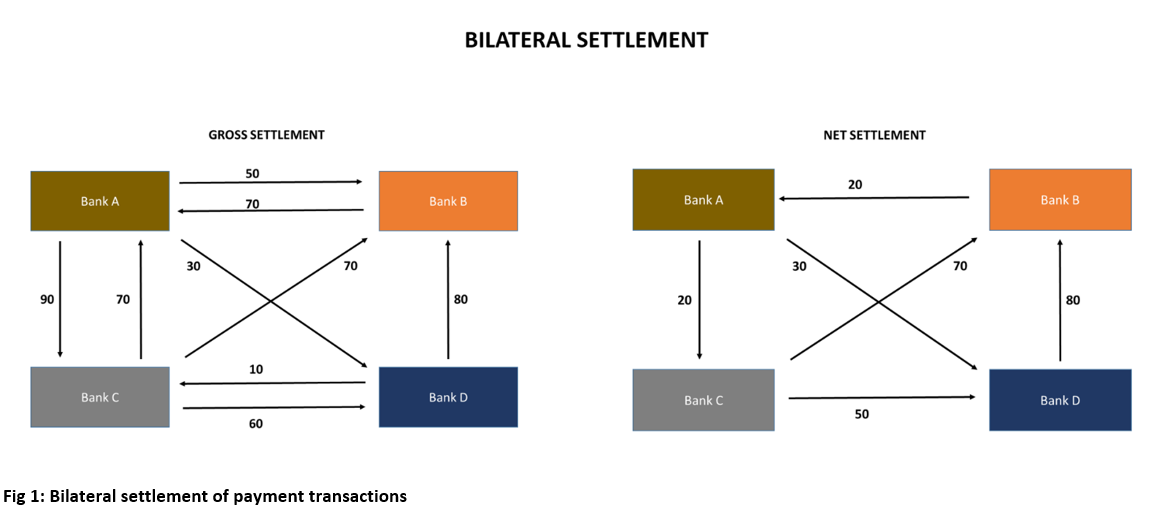

What is bilateral net settlement?

Bilateral net settlement systems are payment systems in which payments are settled for each bilateral combination of banks. Banks that send out more funds in transfers than they receive (i.e., banks with a positive net settlement balance) are credited with the difference, and banks with a negative net settlement balance pay the difference.

Why is the Net Settlement System Important?

The net settlement system allows banks to be flexible and gain more freedom in exchanging and transferring funds between each other.

What is net settlement?

A net settlement is an inter-bank payment settlement system wherein banks collect data on transactions throughout the day and exchange the information with the clearinghouse and the central bank. Federal Reserve (The Fed) The Federal Reserve is the central bank of the United States and is the financial authority behind the world’s largest free ...

What is the net settlement amount of Bank A and B?

At the end of the day (i.e., the exchange period), the clearinghouse processes the transactions and confirms that Bank A’s net settlement amount is –$600,000, and Bank B’s net settlement amount is $600,000.

What is RTGS in banking?

An alternative payment/settlement system is the Real-Time Gross Settlements System (RTGS), in which each transaction is settled with immediate payments, unlike net settlements, which are summed up and aggregated at the end of the day, before being paid.

What does "600000" mean in the bank?

It means that at the end of the day, Bank A owes Bank B the full $600,000.

When was the Bank for International Settlements established?

Bank for International Settlements (BIS) The Bank for International Settlements (BIS) started in 1930, and is owned by the central banks of different countries. It serves as a bank for member central banks

What Is Multilateral Netting?

Multilateral netting is a payment arrangement among multiple parties that transactions be summed, rather than settled individually. Multilateral netting can take place within a single organization or among two or more parties. The netting activity is centralized in one area, obviating the need for multiple invoicing and payment settlements among various parties. When multilateral netting is being used to settle invoices, all parties to the agreement send payments to a single netting center, and that netting center sends payments from that pool to those parties to which they are owed. Therefore, multilateral netting can be thought of as a way to pool funds to simplify the payment of invoices between parties to the arrangement.

What are the disadvantages of multilateral netting?

Although multilateral netting offers a host of advantages to member parties, it also has some disadvantages. To begin with, the risk is shared; hence, there is less incentive to evaluate the creditworthiness of each and every transaction carefully.

How many netting centers does a netting agreement send?

All parties in the agreement send their payments to one netting center.