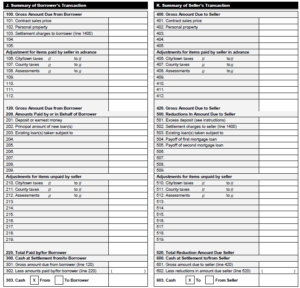

The Settlement Statement is also called the Seller’s Closing Statement.

- Property sale price

- Personal property

- Earnest money

- Loan amount

- Existing loan amount

- Seller credit

- Excess deposit

Full Answer

What Settlement Statement items are tax deductible?

What on the HUD-1 Statement Is Deductible on Federal Taxes?

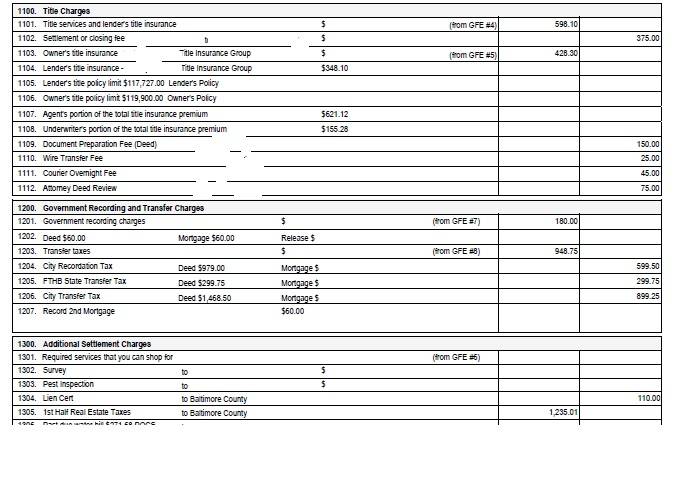

- Prepaid Property Taxes. The HUD-1 settlement statement for taxes itemizes closing costs, including prepaid items such as real property taxes and mortgage interest.

- Mortgage Loan Points. When taking a look at a HUD statement example, you'll find mortgage loan discount points listed. ...

- Prepaid Mortgage Interest. ...

- Non-Deductible Settlement Charges. ...

What is HUD 1 settlement statement?

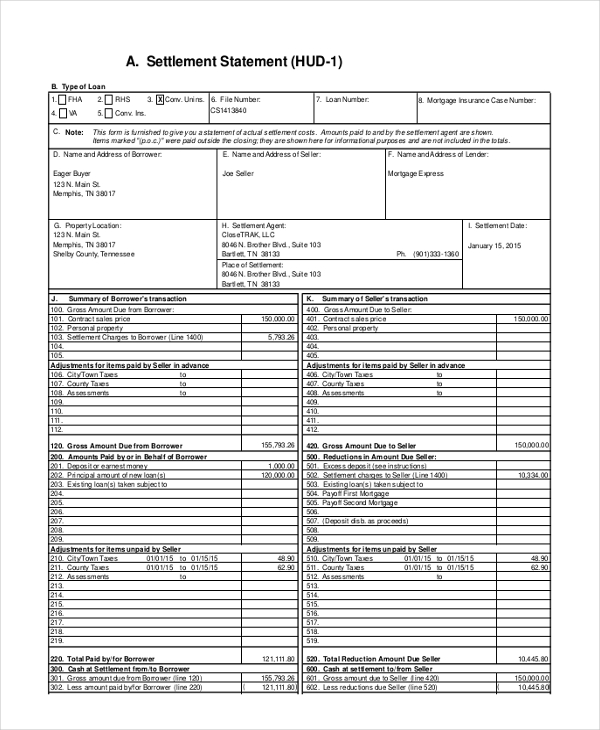

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is the seller's closing statement?

The Settlement Statement is also called the Seller's Closing Statement. Property sale price Personal property Earnest money Loan amount Existing loan amount Seller credit Excess deposit

What are buyers closing statement?

What is a buyers closing statement? A closing statement is a document that records the details of a financial transaction. A homebuyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What does close settlement mean?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What is a closing statement?

4 days agoA closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What not to do after closing on a house?

So to raise the odds that all goes smoothly, here are five things you should never, ever say at closing.'I quit my job this morning' ... 'I can't wait to get all the new furniture we bought' ... 'I can't believe the appraisal came in $20,000 above the sales price' ... 'I can't wait to gut the house'More items...•

Can a mortgage fall through after closing?

Mortgage approvals can fall through on closing day for any number of reasons, like not acquiring the proper financing, appraisal or inspection issues, or contract contingencies.

Who is responsible for reviewing the settlement statement before closing?

the buyer and the seller have a right to review a filled-in Uniform Settlement Statement (HUD-1 Form) at least 1 business day before closing.

Who typically prepares the closing statement?

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

What is another term for the closing statement?

The final or definitive pronouncement on or decision about a subject. the last word. concluding remark. final remark. final say.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

What is included in full and final settlement?

The full and final settlement includes the unpaid salary for the number of days for which the employee has worked for since his resignation date and his last working day.

How do I get a full and final company settlement?

Full and Final Settlement commonly known as FnF process is done when an employee is leaving the organization. At this time, he/she has to get paid for the last working month + any additional earnings or deductions. The procedure has to be carried out by the employer after the employee resigns from their services.

What is the purpose of a settlement agreement?

A settlement agreement is a type of legal contract that helps to resolve disputes among parties by coming to a mutual agreement on the terms. Primarily used in civil law matters, the settlement agreement acts as a legally binding contract. Both parties agree to the judgment's outcome in advance.

What does full and final settlement mean?

By contrast, a payment "in full and final settlement" can usually be interpreted as an offer to settle a dispute on terms that, in exchange for the sum tendered, the creditor will give up the rest of its claim.

How Does a Closing Statement Work?

The closing statement for a mortgage should mostly be a review of another document you received earlier in the process—the loan estimate. Within three days of applying for your loan, the loan estimate should arrive and outline the term, interest rates, and fees of the loan. 2

How long do you have to give closing statement?

A lender is required to give you the closing statement at least three business days before you close on a mortgage loan. This provides enough time to compare terms and costs, and ask any questions you may have. 1

What is closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page.

Why do interest rates change between closing statements?

For instance, interest rates on an offer do change, so they may no longer be able to offer the exact interest rate that was estimated earlier, depending on the loan product you are getting.

When do you receive a closing statement for a mortgage?

If you’ve applied for and been approved for a mortgage loan, you’ll receive a summary document containing key details of the agreement about a week before the closing date. This will be the most up-to-date picture of your loan’s term, interest rate, and any fees or penalties included in the mortgage loan product. You’ll review it and, ideally, ask and resolve any questions before closing.

Do you get a disclosure when selling a home?

It will outline what they’ll be paid at closing, as well as any relevant fees on their end and commissions that will be deducted from the sale price. These disclosures on both sides prevent surprises the day of closing, allowing an important and large financial transaction to proceed without hiccups.

What is the closing settlement statement?

One document, the closing settlement statement, plays a big role in closing out the property transfer process.

What is closing statement?

For sellers, the closing statement consists of all the commission and fees they’ve had to pay. They will receive the closing statement from a settlement agent working with the title company selected to close the transaction.

What happens before a closing statement is drafted?

Before drafting a closing statement, the seller and the buyer meet with the attorney or closing agent to discuss and finalize the particulars of the deal. Once the document is prepared, they review it to confirm that everything is correct.

How much is closing cost?

Closing costs are typically 3% to 5% of the purchase price which can be a substantial amount. Here are ways that you can reduce closing costs:

Who drafts a seller's closing statement?

A seller’s closing statement is drafted by a settlement agent and includes all commissions and costs that the seller must pay.

What is closing cost information booklet?

1) The borrower receives a closing cost information booklet that explains all costs associated with real estate transaction;#N #2) The borrower is informed if the lender requires a special escrow agent to close the transaction; and#N#3) The borrower must get an estimate of the settlement price.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What Is a Closing Statement?

A closing statement is a document that records the details of a financial transaction. A homebuyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

What information should be included in a closing statement?

Financial information. The closing statement should also detail the purchase price of the home, deposits paid by the buyer, and seller credits.

How long does it take to get a final closing disclosure?

The final closing disclosure must be given to the borrower at least three business days before closing.

What is a seller closing disclosure?

A seller’s Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

What is the Truth in Lending Disclosure?

The Truth in Lending Disclosure provides important information about the cost of credit, including your annual percentage rate (APR).

Why is it important to review the closing statement of a mortgage?

It’s important to carefully review the mortgage closing statement, to ensure that everything is correct and to check for any discrepancies.

What is included in the final disclosure of a loan?

It also will include the details of the loan, including the interest rate, the amount of the monthly payments, and the payment schedule.

What is a closing statement?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. Everything from the sale price, loan amounts, school taxes, and other important information is contained in this document. Sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs. So, it’s good to see exactly where that money is going.

What is settlement statement cash?

Settlement Statement Cash – This version is used for liquid cash transactions for property sales.

What fees would a seller pay?

Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents. This would be listed in your seller’s disclosure statement. You might also pay your prorated portion of the property taxes, or homeowners insurance for the period you’re still living in the home.

What happens if you offer to pay buyer fees?

If you as the seller offer to pay any of the buyer’s fees for obtaining a loan, you’ll probably receive a version of the Closing Disclosure , which outlines the lender’s charges.

How long does it take to get a closing disclosure?

Since the subprime lending crisis of the 2000s, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure no later than 3 days before closing. It outlines loan costs among other fees and information pertinent to the borrower,

What is the net sheet of a home sale?

A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make.

What is due when closing a mortgage?

The Big Stuff. Anything you owe on the mortgage is due when you close the sale. That’s the first big thing to think about from a seller’s perspective. Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents.