In other words, a debt settlement is a debt reduction agreement reached between a creditor and borrower. Understanding a Debt Settlement A debt settlement is entered into by a borrower when they lack the capacity to pay the outstanding amount of debt to their creditors.

How to negotiate a debt settlement?

If you want to make a proposal to repay this debt, here are some considerations:

- Be honest with yourself about how much you can pay each month. ...

- Write down a summary of your monthly take-home pay and all your monthly expenses (including the amount you want to repay each month and other debt payments). ...

- Decide on the total amount you are willing to pay to settle the entire debt. This could be a lump sum or a number of payments. ...

Is a debt settlement worth it?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you’re able to offer a lump sum of money to settle your debt. If you’re carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. There are numerous debt settlement and credit card companies that promise to help you settle your debt for half or even a small fraction of the total balance you owe, but is debt settlement really a good idea?

When is debt settlement worth it?

Debt settlement is a repayment strategy where you negotiate with a creditor to pay less than you owe. If you have a lot of unsecured debts, then a settlement might be the best way to get rid of them in the shortest time possible. Settling is difficult, however, and it comes with a few drawbacks such as credit score damage and the stress of negotiating with creditors. So, is debt settlement worth it? Questions To Ask Yourself if Debt Settlement is Worth It.

How to settle debt on your own?

To settle debt on your own you will need to:

- Learn the steps to settle debt on your own – What to say when negotiating, what to send to creditors in writing, and the overall order of operations.

- Obtain debt settlement letter templates, negotiating letters, counteroffers, settlement acceptance letters and much more. ...

- Understand the pros and cons when settling debt on your own. ...

What is debt settlement and how does it work?

Debt settlement is when your debt is settled for less than what you currently owe, with the promise that you'll pay the amount settled for in full. Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company, although you could do it by yourself.

How do I get out of a debt settlement agreement?

Generally, those options are to:Continue to handle the debt on your own.Contact the creditors for help.Settle the debt either on your own or with the assistance of a third party.Work with a nonprofit credit counseling agency through a debt management plan. ... Seek legal protection through bankruptcy.

What is a reasonable offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What happens if you cancel a debt management plan?

When you cancel, the provider will tell your creditors, so they might start charging you interest and late payment fees again, as well as expecting you to resume higher payments. You'll also have to deal with your creditors yourself again. Think about how you're going to cope with this.

What happens if you stop paying debt review?

Your creditors will issue you with a Section 129 letter which confirms you are in arrears. This will be followed by a summons and if ignored leads to a default judgement. It is at this point that a warrant of execution is issued, and your car can be repossessed and sold at auction to cover some of your debt.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Do settlements hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Can you dispute a debt if it was sold to a collection agency?

Can you dispute a debt if it was sold to a collection agency? Your rights are the same as if you were dealing with the original creditor. If you don't believe you should pay the debt, for example, if a debt is statute barred or prescribed, then you can dispute the debt.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

Do settlements hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

Who Helps With Debt Settlement Agreements?

Lawyers with backgrounds working on debt settlement agreements work with clients to help. Do you need help with an debt settlement agreement?

What are the benefits of debt settlement?

There are many benefits of a debt settlement agreement, such as: avoiding bankruptcy, saving money on interest charges and getting back on your feet quicker.

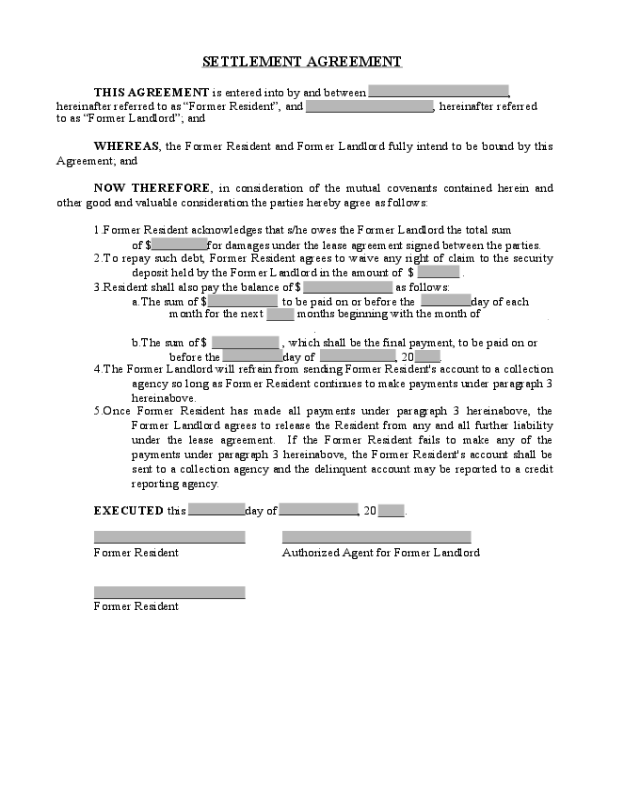

What is the entire agreement?

This Agreement and the instruments referenced herein contain the entire understanding of the parties with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, no party makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement may be waived or amended other than by an instrument in writing signed by the party to be charged with enforcement.

What is a debtholder's authorization?

a. Authorization; Enforcement. This Agreement has been duly and validly authorized by the Debtholder. This Agreement has been duly executed and delivered on behalf of Debtholder, and this Agreement constitutes valid and binding agreement of Debtholder enforceable in accordance with its terms.

What is debt settlement?

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly. Get Debt Help.

What do debt settlement companies have to explain?

Debt settlement companies must explain price and terms, including fees and any conditions on services.

Why Work with a Debt Settlement Company?

Often there’s a good reason – a layoff or reduction in pay, big medical bills, an unexpected emergency expense. No matter what the reason, it can be difficult to get out from under overwhelming debt on your own. This is particularly true for credit card debt or other revolving debt, that never seems to decrease, even if you’re paying monthly.

How long does it take for a debt settlement to pay?

Meanwhile, the company will negotiate with your creditors to settle for a lower amount. Once you’ve paid the amount the agreement is for into the escrow account, the debt settlement company will pay your creditor. This process can take 2-3 years.

How much does a debt settlement company charge?

Debt settlement companies charge a fee, generally 15-25% of the debt the company is settling. The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings. The report gives an example of a debt settlement client whose $4,262 account balance was reduced to $2,115 with the settlement. So, at first it would seem she saved $2,147, the different between what she owed and what the settlement amount was. But she also paid $829 in fees to the debt settlement company, so she ended up saving $1,318.

What happens when you settle a debt?

In debt settlement, the company will instruct you to stop making payments to the creditors. Your accounts become delinquent, and the debt settlement company tries to negotiate a settlement on your behalf. In the meantime, you give your money to the debt settlement company, who also is not paying the creditor with it.

How much money did a debt settlement save?

The report found that debt settlement clients settled an average of about 50% of what was originally owed, but realized savings of about 30%.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

How to negotiate a credit card?

Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.”. Explain how dire your situation is.

Is debt settlement good for you?

Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Can a credit card company seize a debt?

Credit cards are unsecured loans, which means that there is no collateral your credit card company—or a debt collector —can seize to repay an unpaid balance. While negotiating with a credit card company to settle a balance may sound too good to be true, it’s not.

What Is Debt Settlement and How It Works?

Debt settlement is a legal debt relief program that allows creditors to alter the original loan agreement. In most cases, it includes reducing the payoff and repayment terms. Instead of making small monthly payments forever, the creditor accepts a lower payoff in exchange for a lump sum or short series of payments.

What is the Cost of Debt Settlement?

The direct cost of debt settlement is the fee you pay the company for their professional services. In most cases, you pay 20 or 25% of the enrolled balance.

What is debt settlement agreement?

The Debt Settlement Agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. This is usually in the case when an individual wants to make a final payment for a debt that is owed. The debtor offers a payment that is less than the outstanding due (usually between 50% to 70%) if ...

What is debt settlement?

Debt Settlement. It is understood amongst the Parties that the Debtor has an outstanding debt with the Creditor. Through the mutual interest of the Parties, they agree that this outstanding debt shall be marked as paid if Debtor shall make payment of $______________ by ______________, 20___.

What happens after a debt payment is made?

After the payment has been made by the Debtor the Creditor shall make any and all efforts to remove the outstanding debt from the Credit Reporting Agencies. Furthermore, the Creditor declares that they will not make additional information that could harm the Debtor’s credit report.

How to sign a debt agreement?

The Debtor must sign this Agreement to formally enter it. He or she will need to locate the words “Debtor’s Signature” then sign the blank line after them. Adjacent to this he or she should enter the current Date. Finally, the Debtor must print his or her Name on the blank line labeled “Debtor’s Name.” The Creditor must sign his or her Name on the “Creditor’s Signature” line, then supply the Date he or she signed this document on the empty line next to it. Below this, the Creditor must sign his or her Name. If the Creditor is a Business Entity, then an individual who is authorized by that Business Entity to sign this document on its behalf must sign his or her Name. When Printing his or her Name, the Signature Party should follow it with the Legal Name of the Business Entity as reported in the first paragraph (i.e. John Doe, 1X Corp.).

What happens after payment?

After Payment – After the last payment is complete the Creditor will agree to remove all harmful postings from the Debtor’s credit report.

What is debt settlement agreement?

A Debt Settlement Agreement is a document used by a Debtor (the person who owes money) or Creditor (the person who is owed money) to resolve an outstanding debt that is owed. Often, a Debtor finds themselves unable to pay the full amount of a debt that they owe to a Creditor.

What are the laws of debt settlement?

Debt Settlement Agreements are governed by state-specific laws in the United States, which cover debt principles, like a necessary executed written acknowledgment, as well as general contract principles like formation and mutual understanding.

What is included in a debtor agreement?

The document then includes the most important characteristics of the agreement between the Parties, including the original amount that is owed, the new amount that the Debtor will pay to the Creditor, the manner in which the repayment will occur, and the final date when the Debtor will finish repaying the Creditor. Finally, the document can include optional details about the agreement, such as the Parties agreeing to refrain from suing each other or keep the details of their agreement confidential.

What happens when a debtor is unable to pay the full amount of a debt?

Often, a Debtor finds themselves unable to pay the full amount of a debt that they owe to a Creditor. This Agreement allows the two Parties to negotiate and come to a consensus about a lesser amount of money that the Debtor will pay to take care of the debt.

What a Debt Settlement Agreement Must Include

After you have negotiated a debt settlement with a creditor, such as a credit card company, you will need to formalize your agreement in writing. You can write the agreement yourself and send two copies to your creditor so that they can send a signed copy back to you. Or it may be easier to have your creditor draft up a letter and send it to you.

Sample Debt Settlement Letter Template

Here is a general template that you can use to draft your debt settlement agreement. You can add to, remove, or modify the information contained in this agreement to match your circumstances. The agreement letter can be either simple or complex, depending upon your specific financial situation and the type of debt that you owe.

How to make a debt settlement agreement?

Borrowers and creditors typically negotiate and make debt settlement agreements verbally by phone. And in many cases, you’ll have to make several calls to your lender or collection agency to reach an agreement that you both accept. This process can take months if you and your creditor cannot agree on a fair settlement amount. Other times, your creditor will mail or email you a debt settlement offer. Either way, once you reach an agreement, you can move forward with payment arrangements.

What is a debt settlement letter?

This is especially important because many debt settlements happen via telephone. A debt settlement agreement letter is a tool you can use to do this. It must include key information about you, your account, your lender, and the repayment terms you've agreed to.

How to make a verbal agreement legally binding?

To make a verbal agreement legally binding, you must put it in writing. You can do this by drafting, or having the creditor draft, a debt settlement agreement letter. Once the letter is signed by both parties, it’s a valid legal document that outlines the details of your agreement and the new terms of repayment. It will include details like the names of the parties involved (you and your creditor), how much debt you owe, the settlement amount, and the terms of repayment.

What happens if you don't write a settlement agreement?

If you don’t write the agreement yourself, it’s important to insist that all this information is included in the final document. Don’t hesitate to walk away if your original creditor or collection agency seems reluctant to do this. If your creditor refuses to honor your request, then they risk getting nothing at all from you. Though you may need to bend a little in some circumstances. For example, some large banks will not send a settlement letter until they set up your payment information in their system.

What happens if you can't get a creditor to sign a document?

If you can’t get the creditor to agree to and sign a comprehensive document with all the above details, you can walk away. Just realize that your credit score will most likely suffer if you can’t come to an agreement. That’s because your payment history — including late or missed payments and accounts that have been charged-off or sent to collections — is the biggest factor in your credit score.

Do you need a separate letter for each debt settlement?

If you’re trying to settle several debts with different creditors, you will need a separate letter for each settlement offer . If you have hired a debt settlement company to negotiate on your behalf, then the company will do this for you.

Practical Example

- A borrower is required to make monthly debt payments of $10,000 to her creditor for a period of three months. The debt payment schedule is as follows: Due to unforeseen events, the borrower is unable to satisfy the debt payment schedule shown above – the borrower is left with $0 in her s…

Advantages of A Debt Settlement

- 1. Lowering the amount of debt outstanding

A debt settlement would lower the amount of debt outstanding. In the example above, although the borrower owed $30,000 in debt, the borrower only ended up paying $24,000. - 2. Avoiding bankruptcy

A debt settlement allows the borrower to avoid bankruptcy. Depending on the country, consumer bankruptcy can last up to ten years – significantly impacting the credit score of a borrower. In addition, declaring bankruptcy can potentially impact employability.

Implications of A Debt Settlement

- Although a debt settlement lowers the amount of debt outstanding and allows the borrower to avoid bankruptcy, there are significant repercussions to be considered, such as:

More Resources

- CFI offers the Financial Modeling & Valuation Analyst (FMVA)™certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following CFI resources will be helpful: 1. Credit Administration 2. Debt Covenant 3. Intercreditor Agreement 4. Loan Servicing

The Basics of Debt Settlement

The Downsides of Debt Settlement

- Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before. First, debt settlement generally requires you to come up with a substantial amount of cashat one time. This is what makes the debt settlement attract…

Should You Do It Yourself?

- If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, …

Appearances Matter

- Whether you use a professional or not, one of the key points in negotiations is to make it clear that you’re in a bad position financially. If your lender firmly believes that you’re between a rock and a hard place, the fear of losing out will make it less likely that they reject your offer. If your last few months of card statementsshow numerous trips to five-star restaurants or designer-boutique sh…

The Negotiating Process

- Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.” Explain how dire your situation is. Highlight the fact that you’ve scraped a little bit of cash together and are hoping to settle one of your accounts before the money gets used up elsewhere. By mention…

The Bottom Line

- While the possibility of negotiating a settlement should encourage everyone to try, there’s a good chance you’ll hear a “no” somewhere along the way. If so, don’t just hang up the phone and walk away. Instead, ask your credit card company if it can lower your card’s annual percentage rate(APR), reduce your monthly payment, or provide an alternative payment plan. Often your cre…