What is a family settlement asset trust?

A Family Settlement Asset Trust (FSAT) is a discretionary trust usually coupled with a life interest used to protect assets which may be property, cash, bonds and so on.

What is a family trust?

What Is a Family Trust? At the core of a family trust, there are three parties: a grantor, a trustee and the beneficiaries. The grantor is the person who makes the trust and transfers their assets into it.

How do I set up a family trust?

Setting up a trust, whether a family trust or any other type, is basically a two-step process: Create and execute a trust agreement document. This document will list the beneficiaries, name a trustee (or trustees), and set forth instructions for how the assets should be managed. Transfer assets into the trust.

Who is the grantor of a family trust?

At the core of a family trust, there are three parties: a grantor, a trustee and the beneficiaries. The grantor is the person who makes the trust and transfers their assets into it. The trusteeis the person who manages the assets in the trust on behalf of the beneficiaries.

What are the disadvantages of a family trust?

Disadvantages of a Family Trust You must prepare and submit legal documents, which the court charges a fee to process. The second financial disadvantage of a family trust is the lack of tax benefits, especially when it comes to filing income taxes. When the grantor dies, the trust must file a federal tax return.

What is a settled trust?

Self-settled trust (also called a spendthrift trust) is a type of trust allowed in a small number of states where a person that creates the trust is also the beneficiary of the trust. The assets are permanently in the trust and controlled by the trustee which keeps the assets from the reach of most creditors.

What is a family settlement agreement Pennsylvania?

A Family Settlement Agreement is often the easiest way to close an estate in PA because it does not involve any judicial proceedings. If all of the heirs and administrators of the estate agree, a contract can be prepared detailing all of the distributions and payments that have been made.

How do you structure a trust?

Specify the purpose of the Trust. ... Clarify how the Trust will be funded. ... Decide who will manage the Trust. ... Legally create the Trust and Trust documents. ... Transfer assets into the Trust. ... Not choosing the right Trustee. ... Not being clear about the goals of the Trust. ... Not including asset protection provisions.More items...

Is a settlement deed the same as a trust deed?

A settlement in trusts law is a deed (also called a trust instrument) whereby real estate, land, or other property is given by a settlor into trust so the beneficiary has the limited right to the property (for example, during their life), but usually has no right to sell, bequeath or otherwise transfer it.

Are self-settled trusts irrevocable?

A self-settled trust, as it is referred to in the estate planning community, is generally an irrevocable trust that allows the creator (commonly referred to as the “settlor” or “grantor”) to be one of the beneficiaries, while providing many of the same benefits applicable to trusts where only family members are ...

Can an administrator of an estate take everything?

The simple answer is no. The executor has the authority to hold the assets for a certain time for safe-keeping before distributing it. But he cannot withhold assets for any selfish benefit. In a few rare situations, the fee of an executor exceeds the value of the estate in which case he will have to take everything.

Who owns a property during probate?

When Assets Go Through Probate. As the name suggests, probate assets must go through a court-supervised probate process after the owner dies, because probate is the only way to get the asset out of the deceased owner's name and into the names of the beneficiaries.

How much does an estate have to be worth to go to probate in PA?

$50,000Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.

Are family trusts a good idea?

So transferring assets to a family trust can make life much easier for your family in this way. You can use an irrevocable family trust to insulate assets from creditors. Most importantly, a family trust can help to minimize estate taxes once the trust grantor passes away.

How can I leave money to my son but not his wife?

Set up a trust One of the easiest ways to shield your assets is to pass them to your child through a trust. The trust can be created today if you want to give money to your child now, or it can be created in your will and go into effect after you are gone.

Should I set up a family trust?

Family trusts can be beneficial for protecting vulnerable beneficiaries who may make unwise spending decisions if they controlled assets in their own name. A spendthrift child, or a child with a gambling addiction can have access to income but no access to a large capital sum that could be quickly spent.

What does settled property mean?

The two categories of settlement are: settled property in which one or more beneficiaries enjoys an interest in possession; and. settled property in which there is no interest in possession (commonly held in a discretionary trust).

What is a settlement of a common trust fund?

Settlement of a trust estate involves the process necessary to transfer asset ownership from the deceased person's trust to the parties entitled to receive the assets, according to the provisions of the decedent's trust.

What type of trust is a personal injury trust?

The simplest type of trust is called a 'bare trust' and this is often the most appropriate for personal injury funds. In this type of trust, the money still belongs to the person with the injury and they can close the trust at any time if they wish.

Does Florida allow self-settled trusts?

Florida law does not allow self-settled domestic asset protection trusts. Instead, Florida has consistently followed a public policy against self-settled trust providing asset protection for the trustmaker.

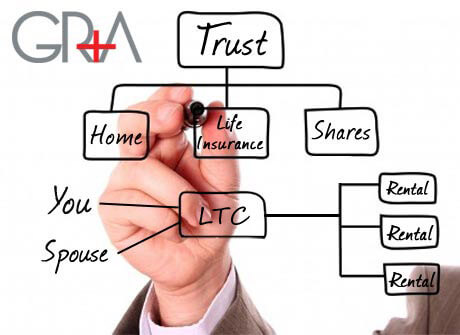

What is a Family Settlement Asset Trust (FSAT)?

This is a discretionary trust usually coupled with a life interest used to protect assets such as property , cash, bonds and so on. It is usual for the client (settlor) to reserve the right to use the assets in the trust (to continue to occupy property for example) or have income from them. In these cases, such a right of occupation or right to income is known as a Gift with Reservation of Benefit.

Why is it important to challenge a trust?

This best practice is adhered to by many professionals in the industry, but it is becoming more common for a local authority to challenge a trust on the grounds of ‘deliberate deprivation of assets’ and succeed in getting them overturned. That’s why it’s crucial a trust is set-up with the right intention and the clients is fully clear of their commitments and the impact on surrounding relatives.

What happens when a spouse dies?

When a spouse dies, the survivor may become vulnerable following the bereavement of their life partner. They may struggle to make decisions alone that previously they would have taken jointly. However, with an FSAT the trustees can take decisions with regard to the property, its maintenance and repairs. The survivor is not alone.

Can a surviving spouse make a new will?

The surviving spouse may be persuaded to make a new Will or may not even get round to making a new Will on re-marriage. This means assets may go to the new spouse without taking into account the interests of the previous family. But with an FSAT, the re-marriage of a surviving spouse is irrelevant, the assets are protected and sideways dis-inheritance is avoided.

What Is a Family Trust?

A family trust is any trust you set up that benefits members of your family. It’s often used as a legally binding agreement to establish who will receive portions of your wealth after you pass away.

Types of Family Trusts

There are many different types of trusts. The main differences between them include who the trust benefits, how the proceeds are taxed and when the beneficiaries receive the assets.

Why Do You Need a Family Trust?

If you have assets that you want to pass on to your loved ones after you’re gone, then a family trust will legally make sure they are left on your terms.

How to Set Up a Family Trust

There are online options that can help you set up a family trust yourself. However, since this is an important, legally binding document, it’s best to meet with an estate planning attorney or financial advisor to determine the best type of family trust for you and to ensure the trust is set up correctly.

What is a family trust?

A family trust is a specific type of trust that families can use to create a financial legacy for years to come. There are several benefits to creating one, including ensuring your family members receive your wealth.

How to create a trust for a family?

The first step in creating a family trust is typically talking with an estate planning attorney to make sure this type of trust is right for you. There are a variety of trust options you can use in estate planning, something with very specific purposes and others that are more general.

What is irrevocable trust?

An irrevocable trust is permanent. With a revocable family trust, you can act as your own trustee, naming successor trustees to take over the reins if you become incapacitated or pass away. With an irrevocable trust, you’d have to name someone else to act as the trustee.

Why do you need a trust for your family?

Most importantly, a family trust can help to minimize estate taxes once the trust grantor passes away. Estate and gift taxes could take a significant bite out of your wealth but trusts can be helpful for minimizing the tax burden for wealthier investors.

What is Totten Trust?

Beneficiaries can access assets only at a predetermined time. Totten Trust. This trust is payable-on-death to the beneficiary named in the account.

What is a trust for surviving spouse?

Overview of Different Types of Trusts. Marital Trusts (“A” Trust) Established by one spouse for the benefit of the other. The surviving spouse gets assets in the trust along with any income. This allows surviving spouses to avoid paying taxes on assets during their lifetimes.

Why do we need a trust?

Trusts are used to manage estate taxes, shelter assets from creditors and pass on wealth to future generations. A family trust is a specific type of trust that families can use to create a financial legacy for years to come. There are several benefits to creating one, including ensuring your family members receive your wealth and avoiding public disclosure of trust assets. However, not every family necessarily needs a family trust, as there are other options too. If you have questions about your family’s situation, consider speaking with a local financial advisor.

How do settlements help?

Settlements can help reduce litigation costs and facilitate dispute resolution – however, parties should exercise caution and diligence before executing a settlement agreement. The parties should ensure that they understand (and agree with) the scope and meaning of all relevant terms and anticipate potential disputes after the agreement is executed—they may (and likely do) prevent future claims if settlement remorse later sets in.

Why did the parties work to achieve a once and for all settlement of all claims?

the parties were working to achieve a once and for all settlement of all claims so they could permanently part ways.

What happens to beneficiaries after the death of their father?

Following the death of their father, the beneficiaries of an estate realized that their distributions would be delayed until a federal estate tax return had been filed. Seeking to speed up the distribution process, the beneficiaries entered into a family settlement agreement (“FSA”) with all interested parties. The FSA was negotiated by the parties, who acknowledged that they were either represented by counsel, or consciously chose not to be represented by counsel.

Is a settlement agreement good?

However, settlement agreements do not come without risk . Settlement agreements should be entered into with care and with an understanding of the terms—and their implications. Austin Trust Co. v. Houren presents a good example of these considerations. In Austin Trust, an agreement contained language in a release that barred the parties from bringing future claims. The case serves as a cautionary tale to parties who wish to settle.

What is a Trust Settlement Agreement?

A trust settlement agreement, also called a non-judicial settlement agreement, is a contract between the trust’s beneficiaries. According to the trust agreement, the beneficiaries of the trust are the people or nonprofit institutions who received assets from the trust.

Who Can Enter a Trust Settlement Agreement?

Any person can enter into a non-judicial settlement agreement that is legally binding. These types of settlement agreements do not need to be supported by consideration.

Benefits of a Trust Settlement Agreement

Many benefits come from entering into a trust settlement agreement. The settlement agreement gives everyone involved versatility regarding the matters the agreement addresses. The non-judicial settlement agreement can address many different legal matters, including, but not limited to, the following:

Trust Settlement Mediation

If you cannot agree on the provisions of your trust settlement, you may benefit from going to mediation, whether court-ordered or voluntary. Mediation is a process in which a neutral third party facilitates communication between disputing parties to help them reach a mutually acceptable agreement.

Your Trust Agreement Must be in Writing

Whether you go through a mediation process or negotiate using your trust attorneys, the final trust agreement must be in writing. The mediator will typically create a document at the end of the process that includes a short summary agreement during the mediation process.

Discuss Your Case with a Trust Lawyer

Entering into a trust settlement agreement can give you a versatile and effective way to modify an irrevocable or revocable trust. These types of agreements are also effective for settling disputes. Many trust settlements resolve issues regarding the interpretation of a trust agreement or the administration of the agreement.

Who settles a trust after the trustee dies?

The person named as the successor trustee (s) to settle the trust, as well as anyone named trustee (s) of any trusts that need to be created, now that the trustmaker has died

How to settle a revocable trust?

The first step in settling a revocable living trust is to locate all of the decedent's original estate planning documents and other important papers. Aside from locating the original revocable living trust agreement and any trust amendments, you will need to locate the decedent's original pour-over will .

What is the purpose of a successor trustee?

Most people have little experience being named as the successor trustee in charge of settling their loved one's revocable living trust after the loved one's death . The purpose of this guide is to provide a general overview of the six steps required to settle and then terminate a revocable living trust after the trustmaker dies.

How long does it take to administer a trust?

If administration of the trust is expected to take more than a year , the successor trustee should work closely with the trust attorney and accountant to plan for setting aside enough assets to pay the ongoing trust expenses and then making distributions to the trust beneficiaries in multiple stages instead of in one lump sum.

What assets can pass outside of a trust?

Assets that can pass outside of the trust may include those that were owned as tenants by the entirety or joint tenants with right of survivorship; payable-on-death or transfer-on-death accounts; and life insurance, IRAs, 401 (k)s, and annuities with named beneficiaries. Take the time to understand what the non-probate assets are, too.

Who is the beneficiary of a residuary trust?

Beneficiaries of the decedent's residuary trust. The person named as the successor trustee (s) to settle the trust, as well as anyone named trustee (s) of any trusts that need to be created , now that the trustmaker has died. The date and location where the trust agreement was signed.

When are taxes due for successor trustee?

The final federal income tax return will be due on April 15 of the year after the decedent's year of death. For tax year 2020, that deadline has been extended to May 17, 2021. 1