Full Answer

What is net settlement?

What is Net Settlement? A net settlement is an inter-bank payment settlement system wherein banks collect data on transactions throughout the day and exchange the information with the clearinghouse and the central bank to settle any outstanding amounts.

What is an alternative payment/settlement system?

An alternative payment/settlement system is the Real-Time Gross Settlements System (RTGS), in which each transaction is settled with immediate payments, unlike net settlements, which are summed up and aggregated at the end of the day, before being paid.

What is continuous net settlement (CNS)?

Continuous Net Settlement (CNS) is a settlement process used by the National Securities Clearing Corporation (NSCC) for the clearing and settlement of securities transactions. CNS includes a centralized book-entry accounting system, which keeps the flows of securities and money balances orderly and efficient.

What is a bilateral net settlement system?

Bilateral net settlement systems are payment systems in which payments are settled for each bilateral combination of banks. Banks that send out more funds in transfers than they receive (i.e., banks with a positive net settlement balance) are credited with the difference, and banks with a negative net settlement balance pay the difference. 2.

What is net settlement in accounting?

Net settlement is a payment settlement system between banks, where a large number of transactions are accumulated and offset against each other, with only the net differential being transferred between banks.

What is net settlement system?

A net settlement is an inter-bank payment settlement system wherein banks collect data on transactions throughout the day and exchange the information with the clearinghouse and the central bank to settle any outstanding amounts.

What is net settlement and gross settlement?

Gross settlement is where a transaction is completed on a one-to-one basis without bunching with other transactions. On the other hand a Deferred Net Basis (DNS), or net-settlement means that the transactions are completed in batches at specific times. Here, all transfers will be held up until a specific time.

What is a net settlement fund?

Net Settlement Fund means the net amount of the Settlement Fund after payment of court approved attorneys' fees and costs, any service award allowed by the Court, and any fees and costs paid to the Settlement Administrator.

What is a continuous net settlement?

Continuous Net Settlement (CNS) is a settlement process used by the National Securities Clearing Corporation (NSCC) for the clearing and settlement of securities transactions. CNS includes a centralized book-entry accounting system, which keeps the flows of securities and money balances orderly and efficient.

What is net settlement Derivative?

Net Settlement. The derivative terms require or permit net settlement, which can readily be settled net by a means outside of the contract, or it provides for delivery of an asset that puts the recipient in a position not substantially different from net settlement.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What is deferred net settlement?

deferred net settlement (DNS) A net settlement mechanism which settles on a net basis at the end of a predefined settlement cycle. Updated: 16 Apr 2012. Related terms: hybrid system, real-time gross settlement (RTGS), retail payment system.

What does net clearing mean?

Related Definitions Clearing Network means SEI's proprietary Mutual Fund Clearing Network capability, which enables the automated processing of mutual fund transactions and related accounting, reconciliation, income payment, confirmation, and settlement activity.

What is a settlement account?

an account containing money and/or assets that is held with a central bank, central securities depository, central counterparty or any other institution acting as a settlement agent, which is used to settle transactions between participants or members of a commercial settlement system.

What is net settlement in Neft?

A net settlement is a payment system used for inter-bank transactions. It is the process by which banks calculate the collective total of all transactions through designated times each day.

What is net settlement in Zerodha?

The net settlement amount in your Funds statement in Console is the money due to you (Credit) or is receivable from you (Debit) for your equity trades. The net settlement amount in your Funds statement will match the net amount receivable or payable as per the contract note .

What is the purpose of an RTGS system?

Ans. The acronym 'RTGS' stands for Real Time Gross Settlement, which can be explained as a system where there is continuous and real-time settlement of fund-transfers, individually on a transaction by transaction basis (without netting).

What Is Net Settlement?

Net settlement is a bank's routine resolution of the day's transactions at the end of the business day.

Why do banks use net settlement?

Net settlement makes it easier for banks to manage their liquidity. That is, they need to know that they have enough real cash on hand to pay out to their customers over the counter and at the ATMs. There are two types of net settlement systems:

What is real time gross settlement?

Large-value interbank funds transfers usually use real-time gross settlement. These often require immediate and complete clearing, which are typically organized by the nation's central bank. Real-time gross settlement can reduce a bank's settlement risk overall as the interbank settlement occurs in real-time throughout the day, ...

Why is real time settlement important?

Real-time gross settlement can reduce a bank's settlement risk overall as the interbank settlement occurs in real-time throughout the day , rather than all together at the end of the day as with net settlement. This type of gross settlement eliminates the risk of a lag in completing the transaction.

What is bilateral settlement?

Bilateral settlement systems require the final resolution of payments made between two banks over the course of a day. These are due to be settled at the close of business, typically via a transfer between their accounts at the central bank.

Is real time settlement higher than net settlement?

Real-time gross settlement often incurs a higher charge than net settlement processes.

How long does it take to complete a transaction in the active market?

2) An active market is not defined in the FASB literature, however, a rule of thumb is that in an active market it should not take longer than 3 to 7 days to complete a transaction.

What does "standard contract" mean?

This means there is a standard contract that can be signed without excessive due diligence.

Does liquidation of net position require significant transaction costs?

3) Liquidation of the net position does not require significant transaction costs.

Why is net settlement used?

Net settlement is used because it reduces the amount of money that has to be held in the settlement medium compared to gross settlement , which requires immediate payment of each individual transaction. It also reduces inter-bank risks. Net settlement is a multilateral transaction, usually with the central bank for the currency being used.

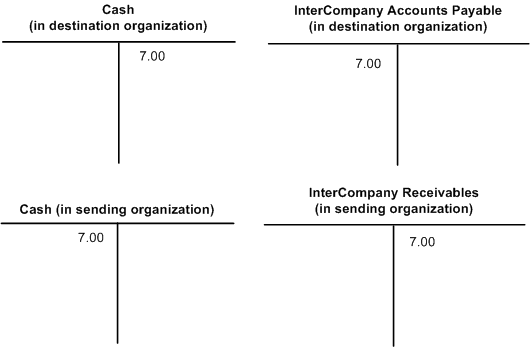

What is net settlement in multilateral settlement?

Multilateral net settlement occurs when there are three or more parties involved. In this example, A pays B $200, B pays C $150, and C pays A $175. The net obligations in the multilateral model are for A and C to each pay $25 into the settlement 'pot', and for B to receive $50.

What happens if one of the participants in a net settlement system is unable to settle its obligations at the end?

Furthermore, if one of the participants in a net settlement system is unable to settle its obligations at the end of the settlement cycle, it prevents the settlement from completing for all parties: this may require unwinding all the transactions that have been placed into that settlement cycle.

What happens if a net settlement is not binding?

If the application of transactions to the netting is not legally binding, in the event of the insolvency of a participant, the other participants may end up legally owing their gross obligations to the failed participant, and not be due any settlement from the failed participant in return. Furthermore, if one of the participants in a net settlement system is unable to settle its obligations at the end of the settlement cycle, it prevents the settlement from completing for all parties: this may require unwinding all the transactions that have been placed into that settlement cycle.

What is derivative ASC 815?

To meet the definition of a derivative, a financial instrument or other contract must require or permit net settlement. The scope of ASC 815 excludes instruments linked to unlisted equity securities when such instruments fail the net settlement requirement and are, therefore, not accounted for as derivatives.

Is option a derivative under GAAP?

Some instruments, such as option and forward agreements to buy unlisted equity investments, are accounted for as derivatives under IFRS but not under US GAAP.

Does IFRS require net settlement?

IFRS does not include a requirement for net settlement within the definition of a derivative. It only requires settlement at a future date. Under IFRS, instruments linked to unlisted equity securities are required to be recorded at fair value.

What is an account settlement?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero.

What is settlement date accounting?

With settlement date accounting, enter the transactions into your general ledger when the transaction happens. This method ensures that everything on your general ledger has actually happened with the exact amount recorded. You settle the account at the time you record the transaction.

What happens to the clearing account balance after employees deposit their checks?

After the employees deposit their checks and you remit the taxes, the clearing account balance is zero. So, you settled the account.

What is an example of an outstanding balance?

For example, you have one outstanding balance in an account. Customer A owes the entirety of the balance because of Invoice A. When Customer A pays the invoice, the account is now settled.

Why do you settle your accounts?

When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books only when you fulfill the transaction.

Can you hold multiple payments in a clearing account?

You may choose to hold multiple payments in the clearing account until you receive the total balance due on an invoice.

Is a settlement an account payable?

If you record payments you owe to a lender or other business until you pay off the fund s you owe, the account you settle is an account payable ( i.e., a liability account).

What Is Continuous Net Settlement?

Continuous Net Settlement (CNS) is a settlement process used by the National Securities Clearing Corporation ( NSCC) for the clearing and settlement of securities transactions. CNS includes a centralized book-entry accounting system, which keeps the flows of securities and money balances orderly and efficient.

How many NSCC entries will there be in 2021?

There were more than 3,480 NSCC member entries in 2021, and many of them were for divisions of a single company. 1 The NSCC acts as a sort of "honest broker" between brokerages in the continuous net settlement process. The CNS process helps the NSCC to reduce the value of payments exchanged by an average of 98% daily.

What is the CNS process?

During the CNS process, reports are generated that document the movements of money and securities. This system processes most broker-to-broker transactions in the United States that involve equities, corporate bonds, municipal bonds, American depositary receipts ( ADRs ), exchange-traded funds (ETFs), and unit investment trusts. NSCC is a subsidiary of the Depository Trust Clearing Corporation (DTCC).