Pre-settlement disclosure statement This is the final statement that makes up the trio of disclosure statements to be provided to the buyer. The seller must provide this statement no later than the fifth working day before the settlement date.

What is Prepayment Disclosure Statement?

Prepayment Disclosure Statement is statement on the amount outstanding on a FHA insured mortgage loan and the requirements that the borrower must fulfill to meet upon prepayment to prevent accrual of interest after the date of prepayment.

Comments

We were unable to load Disqus. If you are a moderator please see our troubleshooting guide.

Closing Disclosure

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Cash For Closing

Sometimes, cash is required in the closing process. The settlement statement you receive will let you know how much if any, cash is needed at the closing table. However, the term “cash for closing” can be a little misleading. It does not necessarily mean bringing paper money to the closing. In fact, it usually requires a check.

When is a HUD-1 settlement statement required?

Before Aug. 1, 2015, the CD was known by another name: the HUD-1 settlement statement. Yet this document was long and confusing, and required by federal law to be distributed to home buyers only on the day of closing—which didn’t give them much time to address any issues. This is why the settlement statement was replaced by the much more streamlined five-page closing disclosure, and laws were changed so that lenders are required to provide this document at least three business days before closing.

What is closing disclosure form?

What is a closing disclosure form? Put simply, it’s a form outlining the terms and costs of your mortgage—and one of the most important pieces of paperwork to check before you close on a home.

What is LE disclosure?

The LE outlined the approximate fees you would be expected to pay if you move forward with a lender to close on a home. But your closing disclosure is the real deal, which is all the more reason to scrutinize it carefully.

Do real estate agents have errors on CDs?

Think such errors aren’t common? A recent survey of real estate agents by the National Association of Realtors® found that half of agents have detected errors on CDs. In other words, it really pays to check this document carefully and ask your real estate agent for help.

Can closing disclosures be postponed?

In some cases, though, the closing may have to be postponed so that a new closing disclosure can be sent out with a new three-day review period.

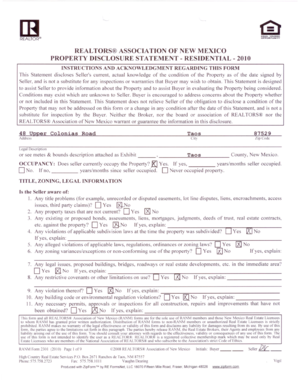

What is a property disclosure statement?

Property disclosure statements essentially outline any flaws that the home sellers (and their real estate agents) are aware of that could negatively affect the home’s value. These statements are required by law in most areas of the country so buyers can know a property’s good and bad points before they close the deal.

Why do we need disclosure statements for property?

Property disclosure statements save everyone time, hassle, and expense by preventing deals from falling apart— and that benefits both buyers and sellers.

What types of flaws must be disclosed?

Sellers are required to complete a variety of disclosure documents, which are often in the form of a government-issued checklist where they mark whether their home has (or once had) a variety of problems such as the following:

What to do if disclosure reveals something bad?

If you spot something on a disclosure statement that you don’t understand or that raises concerns, have your real estate agent bring it up with the sellers (or their listing agent).

What happens if a buyer reads a disclosure?

If, on the other hand, buyers spot something worrisome, it’s in their interests to delve further.

Do you get a disclosure statement when you buy a home?

While it varies by area, most buyers will receive property disclosure statements after their offer has been accepted, says Atlanta Realtor ® Bill Golden . That way, buyers can review this paperwork at about the same time that they typically hire a home inspector to check the property for any defects. In fact, disclosure statements can help point your inspector toward areas of a home you’d like to home in on, so try to read your disclosure statements before scheduling the inspection.

Do smart sellers inform buyers upfront?

But all in all, smart sellers inform buyers of everything they need to know upfront. While property disclosures exist mainly to protect the buyer from getting a lemon, this paperwork protects the seller, too.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

What is the first disclosure statement?

The first disclosure statement is called a "pre-contract disclosure statement".

When must a seller provide a disclosure statement?

The seller must provide this statement no later than the fifth working day before the settlement date.

How long does it take to get a disclosure statement from a buyer?

Once the agreement has been signed, a buyer may, within five working days of signing the agreement but no later than 10 working days before the settlement date, request an additional disclosure statement from the seller.

Who is responsible for the contents of a statement?

However, the onus falls on the seller to provide the statement to the buyer and, crucially, the seller is responsible for the content of the statement.

Is the information in a statement up to date?

Therefore it is vital that the information in the statements is up to date and accurate. There are also serious consequences if the buyer does not receive the statements within the specified timeframes set out in the Act, or if the seller does not provide the statements at all.

What is closing disclosure?

The Closing Disclosure is a form that lists all final terms of the loan you’ve selected, final closing costs, and the details of who pays and who receives money at closing. Your lender sends you a Closing Disclosure at least three business days before closing. Visit our interactive sample Closing Disclosure with tips and definitions.

What is an escrow statement?

The Initial Escrow Statement, which lists the estimated taxes, insurance premiums, and other charges the lender anticipates paying from your escrow account during the first year of your loan.

How long does it take to get a loan estimate?

The Loan Estimate is a form that lays out important information about the loan you applied for. The lender sends you a Loan Estimate within three business days of receiving your application. Visit our interactive sample Loan Estimate with tips and definitions.

What is a loan estimate?

They outline your key rights and responsibilities as a borrower, and record the transaction between you and your lender. The Loan Estimate is a form that lays out important information about the loan you applied for.

What is a promissory note?

A promissory note, which describes what you are agreeing to. It provides you with details regarding your loan, including:

Do you get a closing disclosure on a HELOC loan?

Note: You won’t receive a Loan Estimate or Closing Disclosure if you applied for a mortgage prior to October 3, 2015, or if you're applying for a reverse mortgage. For those loans, you will receive two forms—a Good Faith Estimate (GFE) and an initial Truth-in-Lending disclosure —instead of a Loan Estimate. Instead of a Closing Disclosure, you will receive a final Truth in Lending disclosure and a HUD-1 Settlement Statement. If you are applying for a HELOC, a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a GFE or a Loan Estimate, but you should receive a Truth-in-Lending disclosure.