A letter to an insurance company for claim settlement is a brief statement of facts written by an insurance policyholder

Insurance

Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier or underwriter. A person or entit…

How to write a demand letter to settle your claim?

What to Emphasize in Your Demand Letter

- Liability. Start by describing how the accident happened and why the insured person was at fault. ...

- Comparative Negligence. ...

- Your Injuries and Treatment. ...

- Medical Expenses. ...

- Lost Income. ...

- Other Losses. ...

- Your Settlement Demand Figure. ...

How to write a successful settlement demand letter?

Include in the letter:

- Your full name and address

- The description of the unfair or deceptive act or practice, with dates and details, including any law you believe has been broken

- The injury you suffered, in measurable terms, including loss of money, damage to something you own, or being the victim of an unfair practice

- Your demand for relief, including the money you want

How long after a demand letter does a settlement take?

Typically, after your attorney has sent a demand letter to the insurance adjuster or other party, it can take anywhere from a few weeks to a couple of months to obtain your settlement. Unfortunately, it’s impossible to determine exactly how long after a demand letter a settlement will take.

What is included in a settlement demand letter?

What to Include

- Evidence backing the account of events as detailed in the settlement demand letter.

- An outline of the original event and stating all the underlined factual arguments.

- A summary of all the appropriate legal standards applicable to the issue.

- A settlement offer as well as the timeline and terms for acceptance.

What is an insurance settlement letter?

Settlement letters should summarize the purpose of the claim and communicate to the insurance company a fair value for the claim. Insurance companies generally try to settle claims for as little money as possible, making it difficult to reach a satisfactory outcome.

Is a settlement the same as a claim?

A settlement refers to resolving a claim through the insurance claims process alone. A settlement is an amount of money an insurance provider offers to resolve a dispute with a claimant.

How do I respond to a settlement claim?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do you request a settlement for demand?

How To Write A Demand Letter To Settle Your ClaimOutline The Incident. You will need to start by outlining the details of the accident. ... Detail Your Injuries. ... Explain All Of Your Damages. ... Calculate Your Settlement Demand. ... Attach Relevant Documents. ... Get Help From An Attorney.

What is settlement claim?

Settlement of claims means all activities of the insurer or its agent which are related directly or indirectly to the determination of the compensation that is due under coverage afforded by the insurance policy or insurance contract. This includes, but is not limited to, the requiring or preparing of repair estimates.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How do you counter offer a settlement letter?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

How do you reject a settlement?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

How do insurance companies negotiate settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

Are demand letters successful?

Bottom line: you should generally not expect a demand letter to yield a quick and effective resolution, except in the rarest of cases where the stars align (enormous damages, clear liability, and reasonable defendant and opposing counsel on the other side).

How much can I ask for in a settlement agreement?

The rough 'rule of thumb' that we generally use to determine the value of a reasonable settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary (in addition to your notice pay, holiday pay etc., as outlined above).

How is settlement amount calculated?

Settlement amounts are typically calculated by considering various economic damages such as medical expenses, lost wages, and out of pocket expenses from the injury. However non-economic factors should also play a significant role. Non-economic factors might include pain and suffering and loss of quality of life.

What is the difference between a settlement and a lawsuit?

A settlement is the formal resolution of a lawsuit before the matter is taken to court. You can reach a settlement at any point during litigation, and many cases can even be settled before a formal lawsuit is filed. Or, they can be settled the day before, or even the day the lawsuit goes to court.

What happens after you agree to a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

Is Settling the same as suing?

The victim will likely have to sign an agreement stating that he or she will not make any further claims against the defendant or their insurance company. Settlement money can then be exchanged. When negotiation fails to bring all parties to an agreement, the victim has the right to sue.

How is settlement value calculated?

How Do Insurance Companies Determine Settlement Amounts?The type of claim you are making. ... The policy limits and amounts allowed for recovery. ... The nature and extent of your injuries. ... The long-term effects of your accident on your life. ... The strength of your case. ... The distribution of fault. ... Previous matters.

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.

What is a settlement demand letter?

A settlement demand letter is a letter in which the writer expresses their willingness to settle a case out of court and offers a settlement. You might write a settlement demand letter if you have received a claimant’s demand letter and wish to respond with a settlement counteroffer. This letter is a written response to ...

How to dispute a claim in a letter?

In the body of your letter, dispute the claim and offer your perspective of the incident. Backup your viewpoint with evidence, such as a police report. Enclose a copy of any evidence you discuss in your letter.

Why Offer a Settlement?

Settling a case out of court can save you money, time, and stress. Because a court case can be long-term and expensive , you might decide to settle even if you disagree with the claimant’s version of the incident that caused their loss. A settlement demand letter allows you to express your disagreement and offer a lower settlement amount.

What to do when a claimant sends a demand letter?

Offer a Reasonable Settlement. When a claimant sends a demand letter, they ask for a larger amount of money than they expect to receive. Their demand letter opens negotiation. Your settlement demand letter continues that negotiation. Offer a smaller amount than the claimant demands but large enough to tempt the claimant to settle out of court.

How to negotiate a settlement offer?

Discuss the Terms of Your Offer. Clearly outline the terms of your settlement offer. Often settlements require confidentiality agreements and a stipulation that both parties will release any legal claims arising from the incident. Include a time frame for the claimant to accept the offer. Be sure to include the date the offer expires in your letter.

Why do you settle out of court?

Note: You might decide to settle out of court because you are not required to admit guilt to offer a settlement. You can deny responsibility for the incident and still offer to settle. Offering to settle might be preferable to a court case in which a jury determines your guilt or innocence.

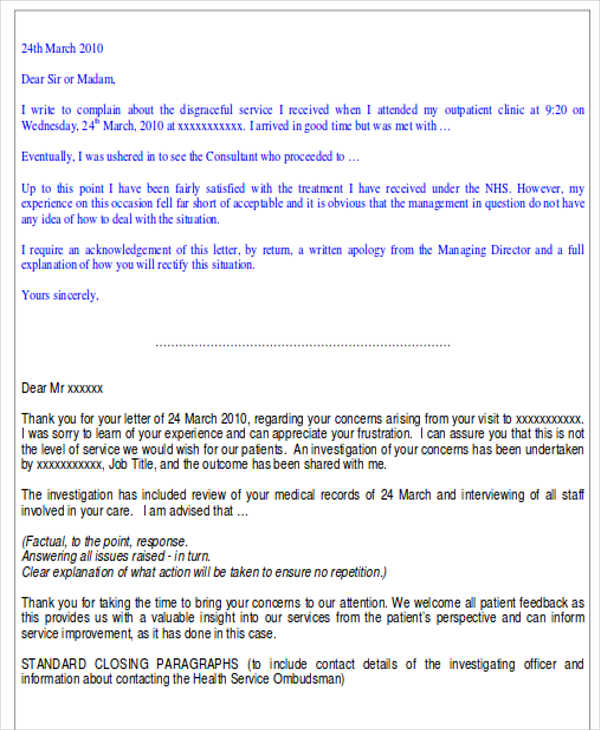

What is a claim letter?

A claim letter is a formal letter written to express the intention of seeking compensation for the damages incurred, unsatisfactory service, incomplete work, or personal injuries. It mainly serves as a written notice and is commonly drafted by a customer or a buyer to communicate their displeasure about the services or products purchased.

How to write a claim letter?

Hence, keep your situation in mind and draft a letter by including all the necessary information. Use a polite tone and request the claim for the expenses incurred or the damages done.

What to include after writing from and to address?

After writing from and to address, include a subject line and concisely mention the type of claim you wish to make.

What is a well crafted letter?

A well-crafted letter will help you to resolve your issue at the earliest. So, once the claim letter is formatted, proofread and rectify the errors if there are any. Also, make a note to include all the details related to the contract and the services or products purchased along with the relevant documents as evidence to fortify the claim.

What information do you need to claim a settlement?

as additional details to gain the settlement. Also, make a note to include your correct name and contact information.

How to explain the purpose of a claim?

The body should explain the purpose of the claim in a brief form including all the necessary details. Never deviate from the topic, the content should be to the point. For better readability, segment the content as paragraphs.

When to write a letter 2021?

Mention the date on which you are writing the letter. The date should be written in an expanded form as 05 June 2021 or June 05, 2021. Avoid writing the date as 05.06.2021

What Should a Claim Settlement Letter Include?

Insurance companies deal with hundreds, even thousands of claims daily. That is why your letter to an insurance company should stand out.

How to send a letter to insurance company?

Send your letter by certified mail with a requested return receipt since you will need to document the date your insurance company received it.

What to do if your insurance company rejects your claim?

In case your insurance company rejects your claim, send them an appeal letter and try to make them reconsider the decision. DoNotPay can help with this issue, too!

How long does it take to file a claim with your insurance provider?

Should you have insurance for your property, car, health, or any other, you might be in a position to file a claim with your insurance provider one day.

What to include in an accident letter?

Photographs and videos of the accident, all the damage, and your injuries. You should include any additional documentation supporting your case. Both you and the insurance provider should have copies of all the evidence.

Does DoNotPay speed up the process of filing insurance claims?

DoNotPay also speeds up the process of filing insurance claims, claiming warranties, reducing property tax, and drafting various legal docs.

How to write a settlement letter?

If you do wish to write the settlement demand letter on your own, take your time and make sure it is as strongly written as possible for the insurance company to take you seriously. Keep your language clear, concise and grammatically correct. Avoid long narrations about your accident or injuries. Simply state the facts of your case.

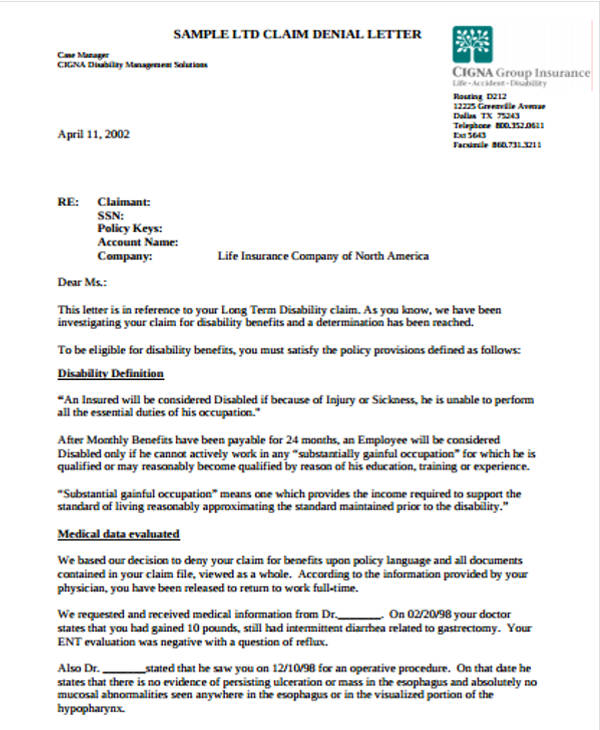

What Is a Settlement Demand Letter?

A settlement demand letter is one of the most important pieces of communication between you and the insurance company receiving your claim. This might be your own insurance company if you caused the accident or were injured by an uninsured party, or it might be someone else’s insurance carrier if that person caused your injury. Either way, do not underestimate the importance of the settlement demand letter.

How to write a personal injury claim letter?

A strong personal injury demand letter includes: 1 The defendant’s name and address 2 Your name and contact information 3 A brief description of the accident 4 Why you believe the insurance company is liable 5 The extent of your injuries and your official diagnosis 6 A description of the medical treatments you require 7 Details of any income lost 8 A description of your pain and suffering 9 An amount you’re demanding in damages to settle the claim 10 One sentence stating that your attorney can go to trial, if necessary

What is a demand letter for insurance?

The main parts of an insurance demand letter are the introduction, description of the accident, settlement demand figure and closing statements. A strong personal injury demand letter includes: The defendant’s name and address. Your name and contact information.

What is a strong personal injury letter?

A strong personal injury demand letter includes: The defendant’s name and address. Your name and contact information. A brief description of the accident. Why you believe the insurance company is liable. The extent of your injuries and your official diagnosis. A description of the medical treatments you require.

What is a victim's request letter?

In most personal injury cases, the victim’s request is an amount of financial compensation the victim is demanding in return for dropping the lawsuit against the defendant and releasing him or her from further liability. Your demand letter is the key to obtaining the best possible outcome for your personal injury claim in Dallas.

Who is the attorney for settlement demand letter in Dallas?

For assistance drafting a successful settlement demand letter in Dallas, Texas, consult with a personal injury lawyer from the Law Firm of Aaron A. Herbert, P.C.

What is an example of a claim letter?

The insurance claim letter an individual writes to claim against their own or somebody else’s insurance policy is another good example.

How to write a claim letter?

What Should I Include in My Claim Letter? 1 A clearly written statement outlining your intent to make a claim to the organization or individual referenced; 2 Any relevant policy codes, product numbers or other transaction-related identifiers; 3 Concise (but clear) description of the circumstances that led to the claim (vehicular accident, a trip resulting in injury, insufficient goods or services, etc.); 4 The action you want the organization or individual to take in response to your claim (usually a full or partial refund); 5 A clearly stated deadline for the action outlined above; 6 Your next step if the appropriate actions aren’t taken to settle your claim (legal proceedings). 7 Your contact details and an invitation to speak with you directly via phone or email; 8 Copies of any relevant documentation (receipts, policy documents, service contracts, etc).

What is a claim letter for lost goods?

This is a claim letter written to an individual or organization responsible for the safe transportation of goods to notify them that you have not received the goods as promised. It outlines your intentions to recover any fees paid for goods you purchased but cannot access.

What is a refund letter?

This is a letter written to a provider, supplier, or contractor who has not delivered the goods or services promised according to the terms agreed. It makes clear your intent to seek a full or partial refund rather than giving the provider another opportunity to fulfill their responsibilities.

Why do you need a claim letter?

Claim letters may be used as legal evidence, so they should always be composed in an appropriate tone. Even if the dispute between yourself and the offending party is fairly antagonistic, you’re advised to take a formal (and well mannered) stance. It increases the chances of you settling your claim without legal proceedings, and it demonstrates good character if the dispute does make it to court.

What is a letter written to your insurance company?

This is a letter written to your insurance company, notifying them of your intention to claim against a policy. It may be used after a car accident to claim for repairs or after a burglary to recover the value of lost items.

What to include in a claim letter for damaged goods?

Don’t forget, if you’re writing a claim letter for damaged goods, include the receipt (where possible) and any unique customer references.

What is a settlement agreement letter?

The Settlement Agreement letters are legally binding and can be used in the court of law for any dispute between the parties arises. The terms and conditions mentioned in a Settlement Agreement letter are mutually agreed upon by both the parties. Both the parties before finalizing negotiate terms and conditions given in the letter.

Who is the settlement participant?

Customarily, it is an employer and employee (or former employee) who are the contracting participants to a settlement agreement. These letters can be agreed upon by the employee and the employer so that both parties are satisfied and the perspectives of both the parties are stated.

What is a transfer letter?

This letter is an agreement letter which indicates the conditions and guidelines regarding the transfer of funds from one party to the other. The important viewpoints of such a letter include the amount, time, interest, and other similar aspects.

What should a letter specify?

The letter should specify the important details.

What is a Puja Gold letter?

This letter is the settlement between the company and the client about the taking back his gold guaranteed in our company Puja Gold. A contract was prepared three years back, and the client has not been able to pay the interests of any sort till the day.

What is settlement demand?

In lawyer talk, a “settlement demand” refers to your request for a specific amount of money to settle the case (i.e., “we will accept $150,000 to settle this case, that is our demand.”) This can happen before a lawsuit is filed or after.

What is an injury impact statement?

A car accident impact statement, sometimes called an injury impact statement, is an exhibit (a separate document) that is attached to your demand letter and included as part of the settlement demand package that you send to the insurance adjuster to begin negotiations to settle your claim.

What happens if you write a demand letter for an accident?

If your case does not settle, and you wrote your own demand letter, you can (in limited circumstances in under specific scenarios) be cross-examined and impeached on your summary of the accident in that letter. The phrasing you used to describe the accident can be craftily used by an insurance lawyer to kill your case.

What is demand letter?

The demand letter gives the insurance company that knowledge. It really is just what it sounds like – a letter, sent to the insurance company for the driver that caused your accident. If multiple other cars/drivers caused your accident, the letter would be sent to all of them.

How to write a police report for a demand letter?

1: Keep the Liability Story Short and Simple. Assuming the police report’s narrative is helpful for you, include a copy of the police report and use that description in your demand letter. Do NOT add any more to that description. Remember, anything you say can and will be used against you.

What does a lawyer do when you have a personal injury claim?

In most, but not all, personal injury claims, the lawyer will write a demand letter to the insurance company to get that money for you.

How long does it take to understand a personal injury case?

It takes years, and hundreds of cases, to understand case values in personal injury cases and calculating their worth . Kindly put, you do not know how much your case is worth.