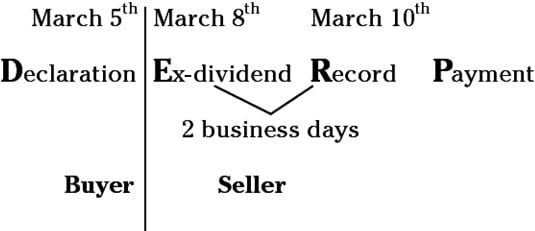

One factor complicating the discussion of the dividend date is settlement. When you purchase a stock, it takes three business days for ownership to be transferred. This transfer of ownership is referred to as settlement. Therefore, you have to purchase the stock at least three business days before the record date to receive a dividend.

What is the settlement date for dividends?

As a result, one way to express the rule is that, in order to receive the dividend, your settlement date must happen on or before the record date the company has set for the dividend. If it's after, you won't receive the dividend. Why the ex-dividend date is important

What happens to stock dividends when you sell a stock?

The procedures for stock dividends may be different from cash dividends. The ex-dividend date is set the first business day after the stock dividend is paid (and is also after the record date). If you sell your stock before the ex-dividend date, you also are selling away your right to the stock dividend.

What is a dividend?

A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.

What is the difference between ex-dividend and dividend payment?

Rather, the dividend payment is made to whoever owned the stock the day before the ex-dividend date. Key Takeaways. Ex-dividend stocks are those which are trading without the value of the next dividend. The ex-dividend date of a stock is the day on which the stock begins trading without the subsequent dividend value.

How long does it take dividends to settle?

The payment date is usually about one month after the record date.

Are dividends paid on trade or settlement date?

As a result, one way to express the rule is that, in order to receive the dividend, your settlement date must happen on or before the record date the company has set for the dividend. If it's after, you won't receive the dividend.

How does settlement date affect ex-dividend?

A purchase exactly three days early will put the settlement date on the record date and the investor will receive the dividend. This means an investor who buys two days before the record date will not receive the dividend. This is the day the stock goes ex-dividend.

Will I get dividend if I sell on ex-date?

Selling On The Ex-Dividend Date That means they can sell their shares on the ex-dividend date and still receive the dividend. However, investors who buy shares on the ex-dividend date will not receive the payment. Additionally, those who sell before the ex-dividend date will not receive a dividend payment.

How do dividends get paid out?

Dividends are payments made by companies to their shareholders based on the number of shares they own. Dividends are usually paid when a company has excess cash that is not being reinvested into the company. This excess cash is divided up among shareholders and paid out to them.

What are the 3 important dates for dividends?

What are the Important Dividend Dates?Declaration Date. The declaration date is the date on which the board of directors announces and approves the payment of a dividend. ... Ex-Dividend Date. The ex-dividend date is the first day that a stock trades without a dividend. ... Record Date. ... Payment Date.

Why do stocks drop after dividend?

After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Dividends paid out as stock instead of cash can dilute earnings, which can also have a negative impact on share prices in the short term.

Should I buy before or after ex-dividend?

If you buy stocks one day or more before their ex-dividend date, you will still get the dividend. That's when a stock is said to trade cum-dividend. If you buy on the ex-dividend date or later, you won't get the dividend. The ex-dividend date is in place to allow pending stock trades to settle.

Can I sell stock on settlement date?

If you bought the stock (or other type of security) using settled cash, you can sell it at any time. But if you buy a stock with unsettled funds, selling it before the funds used to purchase have settled is a violation of Regulation T (a.k.a. a good faith violation, mentioned above).

Why is it called ex-dividend?

The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. Usually, but not necessarily, the opening price is the last closing price less the dividend amount.

Should I sell before dividend?

You must have acquired your shares before the ex-dividend date in order to receive a dividend. If you acquired your shares on or after the ex-dividend date, the previous owner will receive the dividend. Sell your shares on or after the Ex-Dividend Date and you'll receive the dividend.

Which company gives highest dividend?

Highest Dividend Yield SharesS.No.NameCMP Rs.1.Vedanta263.102.NMDC121.903.REC Ltd108.204.Standard Inds.24.2022 more rows

Is record date on trade date or settlement date?

When you purchase a stock, it takes three business days for ownership to be transferred. This transfer of ownership is referred to as settlement. Therefore, you have to purchase the stock at least three business days before the record date to receive a dividend.

What is difference between ex date and record date?

The ex-date or ex-dividend date is the trading date on (and after) which the dividend is not owed to a new buyer of the stock. The ex-date is one business day before the date of record. The date of record is the day on which the company checks its records to identify shareholders of the company.

How does dividend record date work?

The record date is the cut-off date used to determine which shareholders are entitled to a corporate dividend. To be eligible for the dividend, you must buy the stock at least two business days before the record date.

How are life insurance dividends calculated?

The dividend is the difference between the accumulated value (reflecting actual company experience) and the guaranteed accumulated value at the end of the year. The annual dividend is paid on the policy anniversary.

How are dividends paid out?

These are paid out pro-rata, Prorated In accounting and finance, prorated means adjusted for a specific time period. For example, if an employee is due a salary of $80,000 per year.

What is a special dividend?

Special – a special dividend is one that’s paid outside of a company’s regular policy (i.e., quarterly, annual, etc.).

How does a dividend work?

How a dividend works. A dividend’s value is determined on a per-share basis and is to be paid equally to all shareholders of the same class (common, preferred, etc.). The payment must be approved by the Board of Directors. When a dividend is declared, it will then be paid on a certain date, known as the payable date.

What is EBITDA margin?

EBITDA Margin EBITDA margin = EBITDA / Revenue. It is a profitability ratio that measures earnings a company is generating before taxes, interest, depreciation, and amortization. This guide has examples and a downloadable template

What is retained earnings?

Retained Earnings are part. that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend. The annual dividend per share divided by the share price is the dividend yield.

Why do companies do share buybacks?

The reason to perform share buybacks as an alternative means of returning capital to shareholders is that it can help boost a company’s EPS. By reducing the number of shares outstanding, the denominator in EPS (net earnings/shares outstanding) is reduced and, thus, EPS increases.

What are the two types of distributions that managers can make to shareholders?

Managers of corporations have several types of distributions they can make to the shareholders. The two most common types are dividends and share buybacks. A share buyback is when a company uses cash on the balance sheet. Balance Sheet The balance sheet is one of the three fundamental financial statements.

Why is the settlement cycle shortened?

The shortened cycle benefits investors so they can make trades faster while also reducing potential trading and margin costs. The rule also helps broker-dealers with much needed liquidity while reducing their overall risk.

How does the ex dividend date work?

Another major difference is how this new change affects dividends. According to NYSE Rule 235 and Nasdaq Rule 11140 (b) (1), the ex-dividend date cycle has been shortened from two days to one day before the record date. Issuers with a record date on or after Thursday, September 7, 2017, will abide by the new one-day ex-dividend cycle. This is important for dividend investors because it shortens the timing of when a stock needs to be purchased for the holder to be eligible for the upcoming dividend. For example, Wal-Mart Stores ( WMT ) has its next ex-dividend date on December 7, 2017. Prior to this change, the record date was supposed to be two business days after, or December 11, 2017. However, since the cycle has shortened to only one day, the new record date is December 8, 2017. So an investor for the dividend would only be eligible if they purchased WMT prior to December 7. This would also be applicable to investors that sold their WMT shares prior to the ex-dividend date, as they sold their right to the upcoming dividend away.

What is dividend payment?

A dividend, also called a stockholders’ dividend, is a payment made by a company to its owners and shareholders. Dividends compensate equity investors for their capital contribution. Generally, the dividend is a portion of current year net earnings, but sometimes special dividend payments are made, funded with retained earnings or asset sales.

What Is a Dividend?

A dividend, or stockholders’ dividend, is a payment made by a company to its owners and stockholders. The dividend payment represents a portion of the company’s current net earnings, but special dividend payments, funded with retained earnings or asset sales, are sometimes made.

Why do established companies pay dividends?

As a result, established firms often return more cash to their stockholders in the form of dividends.

What is a stable dividend policy?

A stable dividend policy is the most common and easiest to administer. The objective is to pay a steady and predictable dividend over time, regardless of earnings volatility.

Why are dividends important?

That said, dividends are very important to income-focused investors and especially important to retirees, who often rely on the income to live. For these investors, tracking the consistency of a company’s dividend over time is a smart way to assess the reliability of the income.

How often do companies pay dividends?

Most companies pay dividends once per quarter, but the frequency can vary. Some companies pay a monthly dividend, while others pay an annual dividend. Others pay no regular dividend at all.

What is the determination of a dividend?

The determination of a dividend is unique to the company who is paying it. Deciding on the amount of a dividend is a big strategic decision for a company, given the focus many investors put on the amount of income produced by their investments.

What is dividend paying company?

Dividend-paying companies are typically established, with stable cash flow, and beyond the growth stage.

What Is a Cash Dividend?

A cash dividend is the distribution of funds or money paid to stockholders generally as part of the corporation's current earnings or accumulated profits. Cash dividends are paid directly in money, as opposed to being paid as a stock dividend or other form of value.

How to compare dividends?

The easiest way to compare cash dividends across companies is to look at the trailing 12-month dividend yields, which are computed as a company's dividends per share for the most recent 12-month period divided by its current stock price. This computation standardizes the measure of cash dividends concerning the price of a common share.

How often are cash dividends paid?

Cash dividends are often paid on a regular basis, such as monthly or quarterly, but are sometimes one-time-only payouts, such as after a settlement.

What is the date of a company's dividend?

After that notification, the record date is established, which is the date on which a firm determines its shareholders on record who are eligible to receive the payment.

What happens if a bank's profits decline?

If profits decline, dividend policy can be postponed to better times.

How much is Nike's dividend?

Nike is a mature firm that pays quarterly cash dividends. In February 2019, the famous sportswear brand announced a quarterly cash dividend of 22 cents per share on outstanding Class A and Class B Common Stock payable April 1, 2019. The company had enjoyed increased revenues in the second quarter of 10 to 14%.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

When did Walmart pay dividends?

The payment went to shareholders who had purchased Walmart stock prior to the ex-date of December 5, 2019. The company had previously declared the dividend on February 19, 2019, and the record date was set as December 6, 2019. 2 Only shareholders who had purchased Walmart stock prior to the ex-date were entitled to the cash payment.

What Is an Ex-Dividend?

Ex-dividend describes a stock that is trading without the value of the next dividend payment. The ex-dividend date or "ex-date" is the day the stock starts trading without the value of its next dividend payment.

Why does the ex dividend date occur before the record date?

The ex-dividend date occurs before the record date because a stock trade is settled "T+1" meaning that the record of that transaction isn't settled for one business day.

Can a stock drop if it has a dividend?

On average, a stock can be expected to drop by a little less than the dividend amount. Given that stock prices move on a daily basis, the fluctuation caused by small dividends may be difficult to detect. The effect on stocks from larger dividend payments can be easier to observe.

What is the record date of a dividend?

They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date.". When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend.

When is the ex dividend set?

Excluding weekends and holidays, the ex-dividend is set one business day before the record date or the opening of the market— in this case on the preceding Friday. This means anyone who bought the stock on Friday or after would not get the dividend. At the same time, those who purchase before the ex-dividend date on Friday will receive the dividend.

What happens if you buy stock on ex-dividend date?

If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend. Here is an example: Declaration Date. Ex-Dividend Date.

How long after dividend is paid is the ex-dividend date deferred?

In these cases, the ex-dividend date will be deferred until one business day after the dividend is paid.

When does XYZ declare dividends?

Tuesday, 10/3/2017. On September 8, 2017, Company XYZ declares a dividend payable on October 3, 2017 to its shareholders. XYZ also announces that shareholders of record on the company's books on or before September 18, 2017 are entitled to the dividend. The stock would then go ex-dividend one business day before the record date.

When can you sell stock without being obligated to deliver additional shares?

Thus, it is important to remember that the day you can sell your shares without being obligated to deliver the additional shares is not the first business day after the record date, but usually is the first business day after the stock dividend is paid .

When a company pays dividends, what is the date?

When a company pays a dividend, it sets what's called the record date. That's the date when the company looks at its official list of shareholders to decide who will receive the dividend. It then sets a payment date that's anywhere from a few days to several weeks later; it's on this day that shareholders actually receive their dividend payments.

When do you receive dividends?

As a result, one way to express the rule is that, in order to receive the dividend, your settlement date must happen on or before the record date the company has set for the dividend. If it's after, you won't receive the dividend.

What is the ex dividend date?

The ex-dividend date is defined as the day on which a trade will settle too late to give the buyer the dividend payment. Simply put, the ex-dividend date is typically two business days before the record date.

Why is the ex dividend date important?

The problem is that traders don't really focus on the settlement date of their trades, and so it's important for them to understand exactly when they can buy and sell shares on the open market and still receive dividend s. The concept of the ex-dividend date makes that simpler.

How long does it take for a stock to settle?

That would be straightforward if stock trades were instantaneous. However, stock exchanges still use rules that give brokers three business days to settle stock trades. That means that, if you make a stock trade to buy shares, they won't officially land in your account until three business days later, which is known as the settlement date.

Do settlement dates have to occur before the ex dividend date?

The short answer: No. The simple answer to the question in the headline is that the settlement date doesn't necessarily have to occur before the ex-dividend date in order for the shareholder to receive the dividend.

Do dividends get paid?

Dividends are a key source of investment income, but there's a lot of confusion about the mechanics of how dividends actually get paid. In particular, when you buy a stock close to when it will pay a dividend, it's important to know whether you'll actually receive the dividend payment or not. That's where concepts like the record date, ex-dividend ...