The Settlement Report shows the withdrawals from your payment account at WePay and all the transactions that are included in that withdrawal. This is sometimes referred to as a deposit report, however, since not all settlements are deposits we use WePay's terminology and call it the Settlement Report.

What is the settlement process for payments?

Settlement is the process where we ensure payments made to a merchant eventually end up in the merchant’s bank account. There are several steps in this process, starting when the payer first confirms the payment and ending when the money is in the merchant’s bank account.

What are WePay’s terms of service?

All transactions are subject to WePay terms of service and exclusions therein, including risk assessment and fraud monitoring, which may result in delays. Before a payment can be included in a settlement, the following requirements must be met:

How long does it take to withdraw money from WePay?

We use the ACH system to withdraw payments from the merchant’s WePay account to their bank account. ACH transfers take 1-3 business days depending on the bank account receiving the payment. Some bank accounts (such as Wells Fargo) are faster and take only 1 business day.

How does same-day deposit work with WePay?

WePay offers automatic Same-Day Deposit capabilities for merchants on your Platform. If a merchant adds a Chase Bank Account where funds are to be deposited, they will receive their cash same day for all payments approved ( released API state) by the cutoff time Sunday-Friday. Plus, Saturday transactions will be deposited Sunday morning.

What is settlement of a transaction?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank.

What is a settlement deposit?

Key Takeaways. A settlement bank refers to a customer's bank where payments or transactions finally settle and clear for customer use. Often times, the payer of a transaction will be a customer of a different bank from the receiver, and so an interbank settlement process must occur.

What does settlement pending mean on a credit card payment?

Once authorized the processor sends the confirmation to the merchant bank who notifies the merchant and begins the deposit settlement process in the merchant's account. Once the transaction has been confirmed by the issuing bank and merchant bank it is considered authorized and will post as pending.

How much does WePay charge per transaction?

If the Platform does not set transaction processing fees otherwise, then WePay charges the Platform's Merchants 2.9% + $0.30 for transaction processing; $15.00 per chargeback (in addition to the amount of the chargeback); $15.00 per ACH return (in addition to the amount of the return); and a $25.00 research fee (if an ...

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

How do I clear my credit card settlement?

What is the credit card settlement processVisit the issuer or a debt settlement agency.Explain your inability to make payments via a credit card settlement letter and mention that you're open to negotiating other repayment terms.Offer a lump sum or inform the issuer of your plans to file for bankruptcy.

What is pending settlement mean?

Related Definitions Pending Settlement means the agreement between the Company and its shippers in the Company's FERC tariff rate case filed on July 1, 2013 (Docket Number RP13-1031), which agreement has received certification from the presiding administrative law judge and is awaiting final approval from the FERC.

How long does a transaction take to settle?

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

Is WePay safe to use?

Is WePay secure? WePay uses tokenization and encryption technology for security, and is PCI Level 1 compliant. Additionally, WePay holds user funds in FDIC-protected banks. You can also set your custom risk preferences to protect yourself from fraud.

What companies use WePay?

Who uses WePay?CompanyWebsiteCompany SizeLaunch Academylaunchacademy.com200-500UPMC Health Plan Incupmchealthplan.com1000-5000University of Pittsburghpitt.edu>10000Rakuten Group, Incrakuten.co.jp>100001 more row

How does WePay earn?

WePay makes money through transaction fees on credit cards and other payments like ACH payments. It also charges a research fee and chargeback fee. The number of medium and small business customers is high. It is the reason behind WePay's success and growth.

What should I do with settlement money?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

Where do settlement funds go?

Where the Money Goes. Attorneys general usually keep some settlement money to cover the costs of cases and to help finance future litigation. But distribution of damage recoveries or awards can be set by law, such as reimbursing Medicaid for fraud.

How long does it take for settlement money to clear?

Two months is the most common duration in all states except New South Wales, where six weeks is the preferred time.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

Tokenization

WePay provides a JavaScript Library for tokenization of settlement information such that no sensitive information is transmitted through a partner’s server.

Loading the JavaScript Library

You must load the WePay JavaScript Library ( kyc.1.latest.js ). See the example at right. You must set the endpoint to production when you make your app live.

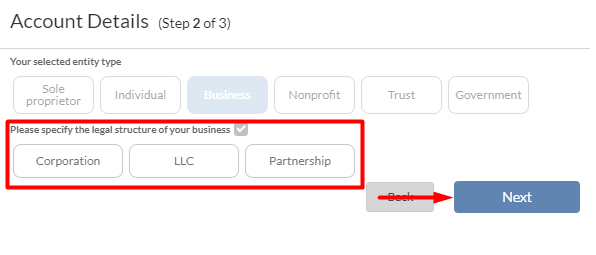

How to set up WePay on Authorize.net?

Click on "Settings" on the menu on the left-hand side. Under "Settings", click on the "Settlement Details" tab. Authorize.net users may log in to https://home.wepay.com and follow the steps below: Click on "Settings" on the left menu. Scroll down to the Settlement Options section. Additional Questions.

How long does it take for a Chase bank to process a settlement?

Depending on your bank’s processing times, you can generally expect to see a settlement post to your bank within 1-2 business days (same-day for Chase banks), however, there are other factors that may delay your settlement from processing. Your settlement may be under a standard 1-2 business day review with our Trust & Safety team.

Can WePay be delayed?

All settlements to Merchants are subject to review for risk and compliance purposes and can be delayed or postponed at WePay's, Platforms , or the Bank's respective sole discretion.

What is a blockchain payment rail?

Blockchain is also an example of a Payment Rail. Payee: The person/business/organization that receives a payment. Payment Service Provider (PSP): Provides online services for accepting electronic payments by a variety of payment methods including credit card, direct debit, bank transfer, and others. WePay is a PSP.

What does it mean when a cardholder has enough funds in their account?

Authorization: The process of checking and approving that a cardholder has enough funds in their account for the proposed transaction. A positive check means an authorization code is created and funds are set aside for the proposed transaction.

How long does it take for a bank to charge back a transaction?

The period varies by transaction type from 45 to 180 days.

What is the primary focus of a payment?

Maximum revenue over time: Your primary focus is on engagement, driving users to your platform. Payments is more about how your users experience your business via merchant onboarding, the payer experience, and customer support.

What payment solutions does a processor use?

Processors offer similar payment solutions. The two dominant types are credit cards and eChecks (ACH). It is also worth considering whether the processor supports mobile wallets, including Apple Pay, Android Pay, and Samsung Pay. Some even support cryptocurrencies like Bitcoin.

Why do processing costs differ based on the payment processor?

The reason processing costs will differ based on the payment processor is because payment processors vary in what they are providing and what they will do for your bottom line. For customers who just want to enable payments, they want to be the lowest buy rate possible. But the buy rate a processor offers, after a certain point of scale, ...

How do payment processors differ from other payment processors?

Payment processors differ in their ability to support your operations in different countries. Moreover, their capabilities will likely differ depending on the individual country. If you are interested in a processor that can support multiple geographies, you should inquire whether the processor contracts with a vendor to support that or whether the processor themselves has a local entity in country, has in-market acquiring, and has treasury capabilities (i.e. settlement) in each market it supports. Payment processors may also require multiple different integrations for additional countries and may also have different card present processing capabilities depending upon the country.

Why should payment processors offer webhooks?

Payment processors should offer webhooks to allow you to monitor transactions from each stage of the process. Your payment processor should provide you bulk reports, including transaction and settlement reports, so you can take the data and render it in your own application.

Is payment your end game?

Data: Payments is not your end game. You want to control access to the transaction data on your platform. Perhaps you want to offer your users analytics, or maybe you want to offer small business loans. To do this, you need a provider who enables you to monitor and understand the data.