When you settle your student loans, you’ll have to pay the settled amount in a lump sum. This amount could be 50 percent to 90 percent of your outstanding loan balance, depending on what your lender agrees to. You may also have to continue paying collection fees and interest in the meantime.

Full Answer

How do federal student loan settlements work?

Federal student loan settlements typically fit into one of these 3 options: 1 You pay the remaining principal and interest, plus any collection costs are waived. 2 You pay the principal and half of the unpaid interest accrued since the loan went into default. 3 You pay 90% of the current principal and interest balance.

How much student loan debt can you settle?

Some might be willing to settle for 50 percent of your loan, although this is extremely rare. Most will require you to pay more — often upward of 90 of your loan balance. Not all student loan lenders are willing to entertain settlement offers. But some might accept a settlement if it’s the only way they expect you to pay off your outstanding debt.

Can a collection agency settle a student loan case?

Student loan settlement is usually possible only in cases where the borrower can offer a lump sum. Collection agencies are authorized to accept three types of settlement offers without getting approval from the Department of Education: Settlements that don’t fit into one of these three categories are uncommon.

What are my private student loan settlement options?

Your private student loan settlement options depend on your lender. Some lenders might require you to pay at least 90 percent of your loan, while others might be more lenient and accept less. The longer you go without making a payment, the less you might need to pay when you request a student loan settlement.

How much does a student loan settlement take?

Experts say some lenders may not accept less than 80% of the total owed, whereas other lenders will take less than 50%.

Why are settlements more common for student loans?

Settlements for defaulted private student loans are more common because these lenders don’t have the collection leverage of their federal counterparts. A private loan holder may accept a settlement in the following instances:

How to pay off student loans?

If you’re struggling with your student loan debt, first speak with your servicer or lender to: 1 Discuss repayment options. 2 Take a temporary payment pause. 3 Temporarily reduce your monthly payments.

Why are student loans not settled?

Federal student loan settlements are not common because the Department of Education and other federal student loan holders have ways to get money from defaulted loans, such as wage and tax refund garnishment . They may make an exception in the following situations:

What happens if you default on a loan?

If you’ve re-defaulted on the same loan, your loan holder may be more willing to work with you due to your limited options. Your loan holder can’t collect the debt. Your loan holder may accept a debt settlement because it can’t get the money from you any other way.

What to do if you are not getting student loan help?

If your problem is with your lender or servicer or you’re not getting the help you need, look for a legitimate student loan help organization that offers counseling. Consider these vetted resources for student loan help; they are established organizations with verified histories:

How long does it take for student loans to default?

Timelines vary for private student loans, but default often occurs after 90 days of missed payments, according to the Consumer Financial Protection Bureau. Federal and private student loans are rarely discharged via bankruptcy. Federal student loans have other options that could eliminate your debt.

When can I settle my student loans?

You typically can’t settle if your student loans are in good standing and you make timely payments every month. Even if you’re a little late on your last payment, you’re usually not considered eligible until your loan is in default. However, it’s not a good idea to intentionally default in order to reach a settlement — lenders typically won’t agree to settle until they’ve exhausted all of their tools for collecting the debt.

What to do if your loan servicer requests a different settlement offer?

Be open if your loan servicer requests a different settlement offer, and don’t be discouraged if you end up going with a backup plan.

What to do if you have trouble paying your student loan?

If you’re having trouble making payments, you may want to negotiate your student loan payoff with your lender and try to settle for less than you owe. You might want to consider a student loan settlement if: Your loans are in default (or near it). You have a lump-sum payment to settle your outstanding debt.

How long does it take to pay off student loans?

It can take years — and sometimes decades — to pay off your student loans. With home payments, utility bills, auto loans and living expenses demanding your attention, student loan payments might not be high up on your priority list. If you’re having trouble making payments, you may want to negotiate your student loan payoff with your lender and try to settle for less than you owe.

How to pay off a federal loan?

If you have federal loans, there are a few standard options: 1 Pay the remaining principal and interest without any collection charges. 2 Pay the principal and half of the unpaid interest that has accrued since the loan went into default. 3 Pay 90 percent of the current balance of principal and interest.

How much do you have to settle a mortgage?

Some might be willing to settle for 50 percent of your loan, while others might require you to pay more — upward of 90 percent of your loan. Not all lenders do this, but some will accept a settlement if it’s the only way they expect you to pay off your outstanding debt.

Do you need to settle a loan if you are behind on it?

If you’re behind on your loan and just need a little more time to catch up, or you want to pay your loan but need a different plan, you may not need settlement and should look into other options.

What is a settlement in education?

A settlement is a settlement, not a new payment plan. When seeking a settlement, offer a lump sum payment for satisfaction of the debt in full. The US Department of Education will want to receive full payment of the settlement amount within a single fiscal year. The federal government’s fiscal year runs from October 1 to September 30. In most cases the US Department of Education will want the settlement to be paid in full within 90 days of the date of the settlement offer. In some cases the US Department of Education will allow a defaulted borrower to pay part of the settlement amount in monthly installments, but these installments will generally be paid within the same fiscal year.

When do federal income tax refunds count as settlement?

Offsets of federal income tax refunds can count as part of the settlement payment if they occur after the date of the settlement offer and before the 90-day deadline for paying the settlement amount. Offsets that post after the settlement is paid in full will be refunded to the borrower.

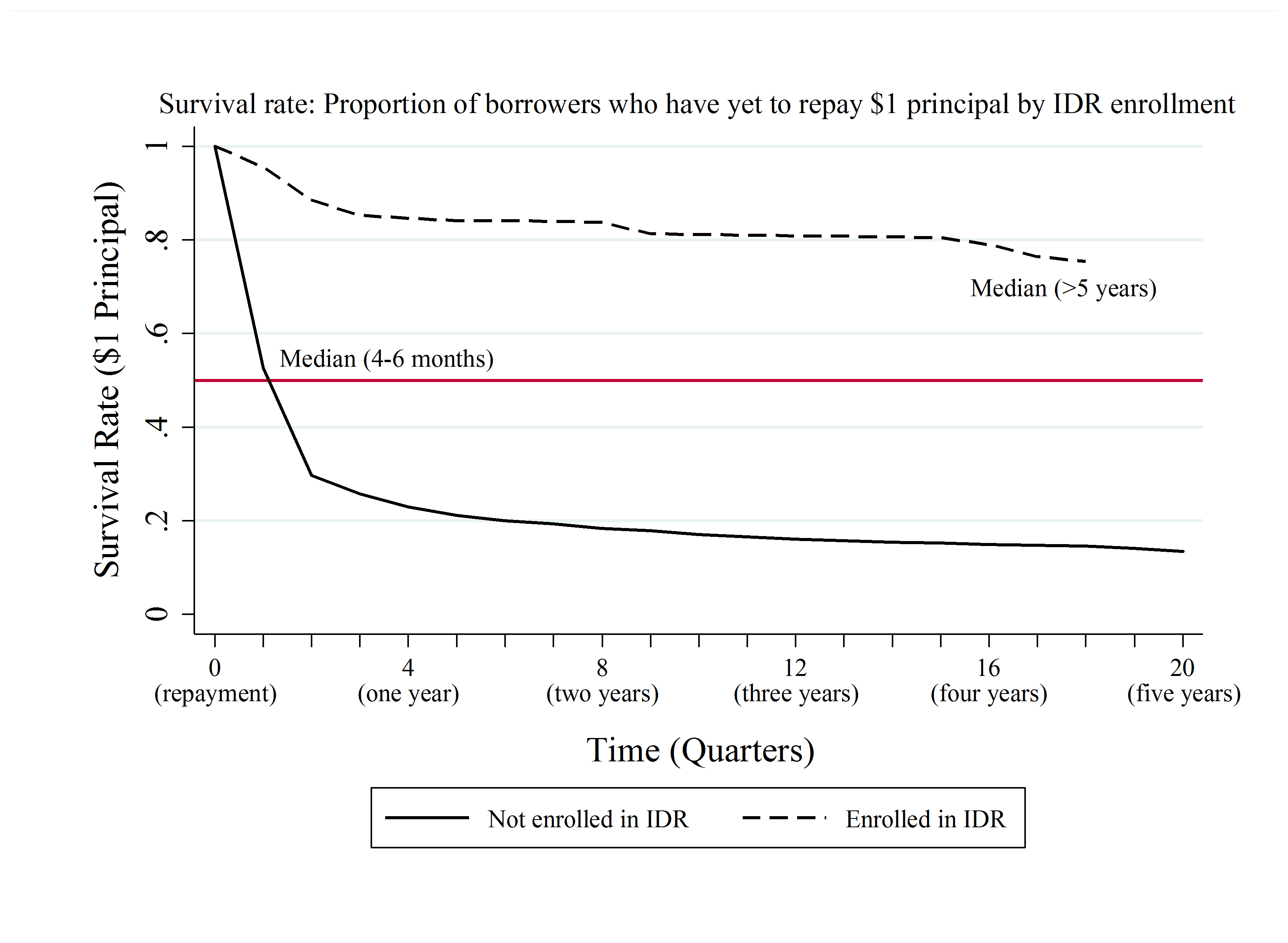

How much is income based repayment?

This bases the monthly payment on a percentage of your discretionary income, which is the amount by which your adjusted gross income exceeds 150% of the poverty line. This is an affordable amount for most borrowers, since it is based on your income, not the amount you owe, and often is less than 10% of gross income. If your income is less than 150% of the poverty line, your monthly payment is zero under income-based repayment. To obtain income-based repayment, you may need to rehabilitate your loans first. This may mean paying a higher monthly payment for 9 months before being able to switch to income-based repayment. The monthly payment under income-based repayment is lower than the monthly payment under administrative wage garnishment for low and moderate-income borrowers and for borrowers with larger families. The monthly payment under income-based repayment is 15% of discretionary income (10% of discretionary income for new borrowers on or after July 1, 2014). The monthly wage garnishment amount is up to 15% of disposable pay, which is the amount that is left after deducting any amounts required by law to be deducted, such as federal income tax withholdings. Wage garnishment amounts may be lower, as the borrower must be left with weekly earnings after garnishment that are at least 30 times the Federal minimum wage ($7.25 an hour since July 24, 2009). (Social Security benefits may be garnished up to 15%, but the garnishment is typically reduced if the remaining benefit payment is less than $750.) But even so the income-based repayment amount will usually be lower than the wage garnishment amount.

What is the number to call for a collection agency?

If you are getting nowhere with the collection agency (e.g., they refuse to offer any settlement amount), try calling the US Department of Education’s Default Resolution Group at 1-800-621-3115 or TTY 1-877-825-9923 or sending email to [email protected].

Can you pay a defaulted student loan in installments?

In some cases the US Department of Education will allow a defaulted borrower to pay part of the sett lement amount in monthly installments , but these installments will generally be paid within the same fiscal year.

Is it a good idea to have a settlement agreement reviewed by an attorney?

It’s generally a good idea to have the settlement agreement reviewed by an attorney. In some cases borrowers thought they were settling a loan in full, but were lied to by a collection agency who applied the payments to the debt without settling it.

Does the Department of Education settle student loans?

But the US Department of Education does occasionally settle debt for less than what is owed.

What is student retention rate?

Student retention rate shows the percentage of students that are re-enrolling at the institution from year-to-year. The average starting salary shows potential earnings of new graduates when they enter the workforce. Additionally, scholarships and grants show the amount of financial backing colleges are endowing to their student body on a per-person basis.

What happens if you miss a payment on a student loan?

Typically, if you miss payments, the interest you would have had to pay is added to your total debt. In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options.

What is the difference between subsidized and unsubsidized loans?

For students who are ineligible to receive subsidized loans, unsubsidized Stafford loans are available. These offer the same low interest rate as subsidized loans, but without the government-funded interest payments. That means that interest accumulates while you are in school, and is then added the amount you have to pay back (also known as your principal balance) once you graduate. While this may sound like a minor difference, it can add up to hundreds or thousands of dollars of debt beyond what you borrowed. A good student loan repayment calculator takes into account the difference between subsidized and unsubsidized loans.

What is the interest rate on a Stafford loan?

They offer a low origination fee (about 1% of the loan), the lowest interest rates possible (4.29% for the 2015-2016 academic year), and unlike auto loans or other forms of debt, the interest rate does not depend on the borrower’s credit score or income. Every student who receives a Stafford loan pays the same rate.

How much interest do private loans have?

Private loans generally offer far less favorable terms than federal loans, and can be harder to obtain. They can have variable interest rates, often higher than 10%. The interest rate, and your ability to receive private student loans, can depend on your credit record.

What are the factors that determine the best value colleges and universities?

Methodology SmartAsset looked at five factors to determine the best value colleges and universities in the U.S.: tuition, student living costs, scholarship and grant offerings, student retention rate and starting salary for new graduates.

What is Smartasset?

SmartAsset’s interactive map highlights the best value colleges in states across the U.S. The study compares schools based on a variety of data sources, including starting salary, tuition, living expenses, student retention rate and scholarships awarded. Zoom between state maps and the national map to see the top ranking colleges and universities in the country or in each state.

What is a student loan settlement?

A student loan settlement is when the loan holder agrees to accept less money than you currently owe after you've missed payments for several months.

What is a settlement for student loans?

In a student loan settlement, you (the borrower) and your student loan lender agree that you can satisfy a student loan for less than you owe. This requires you to pay a lump sum of a large percentage of the principal balance and accrued interest.

Can you settle student loans in good standing?

You cannot settle federal student loans or private student loans that are in good standing. With both federal and private loans, a student loan settlement doesn't become an option until you enter loan default — and that can take up to 270 days.

Does settling student loan debt hurt your credit?

Settling student loan debt may hurt your credit and FICO score. Lenders understand that settlements happen after delinquency and default, and the settlement will be on your credit history for years to come.

How much money will I save by settling my student loan?

Savings for private student loan settlements vary greatly depending on the lender. Some lenders will accept 40% of the current principal and interest. Other lenders will demand 75%.

Who can help you negotiate student loans?

Negotiate yourself. There's no law against you going the DIY route and contacting the debt collection agency that has your student debt to offer a settlement. However, be careful about resetting the clock on old private student loan debt by agreeing you owe the loans and setting up payment. Federal student loans never go away, so you don't have to worry about restarting the statute of limitations.

What to expect after settling?

After you make your payment and fulfill the terms of the settlement, you will receive a debt clearance letter. This letter will serve as proof that you are no longer financially responsible for the particular student loan.

Student Loan Forgiveness For Some Navient Private Student Loans

The settlement agreement for Navient provides for $1.7 billion in private student loan cancellation. Here are the details:

Restitution For Some Federal Student Loan Borrowers

While no federal student loans are being forgiven or cancelled under the settlement agreement with Navient, many borrowers will receive a modest financial award called restitution. About 350,000 borrowers will be eligible for around $95 million in restitution, which comes out to around $260 to $270 per borrower. There are eligibility criteria:

Do Student Loan Borrowers Need To Do Anything To Get Relief Under the Navient Settlement?

The relief being provided under the Navient student loan settlement will be distributed automatically. Borrowers should be notified sometime this summer if they qualify.