What trade settlement means?

Following a trade of stocks, bonds, futures, or other financial assets, trade settlement is the process of moving securities into a buyer's account and cash into the seller's account. Stocks over here are usually settled in three days.

What happens when a trade settles?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

What are the types of trade settlement?

The important settlement types are as follows:Normal segment (N)Trade for trade Surveillance (W)Retail Debt Market (D)Limited Physical market (O)Non cleared TT deals (Z)Auction normal (A)

Why is trade settlement important?

Knowing the settlement date of a stock is also important for investors or strategic traders who are interested in dividend-paying companies because the settlement date can determine which party receives the dividend.3 That is, the trade must settle before the record date for the dividend in order for the stock buyer to ...

How do I know if my trade is settled?

0:244:26Understanding Stock Settlement Dates and Avoiding Good Faith ...YouTubeStart of suggested clipEnd of suggested clipThis means if you sold a stock on monday you wouldn't receive the cash until wednesday. Or if youMoreThis means if you sold a stock on monday you wouldn't receive the cash until wednesday. Or if you sold your shares on friday you wouldn't receive the cash until tuesday when the trade settles.

How long does a trade take to settle?

two business daysWhen does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What is the settlement process?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

Why do trades take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

How do I settle a buy and sell trade?

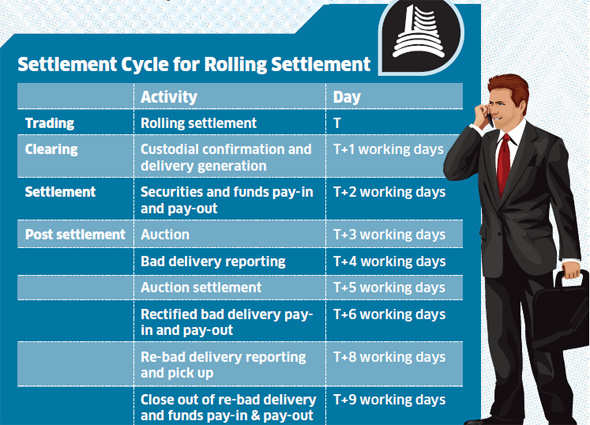

The clearing and settlement process is divided into three: Trade Execution – where the buy or sell order is executed by you. This happens on T Day. Clearing – where the responsible entity identifies the number of shares that the seller owes and the amount of money that the buyer owes for every trade.

What is trade clearing and settlement?

Clearing and settlement directly follows a trade. Clearing is what comes immediately after the trade, where all the terms of the deal are double-checked. Settlement is the final stage, in which the transfer of securities and money takes place.

What happens during the settlement period?

Settlement, or completion, is the final process in the sale of a property that takes place after the seller and buyer exchange contracts of sale. It all culminates on settlement day when the title is transferred to the buyer and they take physical and legal ownership of the property.

Why do trades take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What happens during the settlement period?

Settlement, or completion, is the final process in the sale of a property that takes place after the seller and buyer exchange contracts of sale. It all culminates on settlement day when the title is transferred to the buyer and they take physical and legal ownership of the property.

What happens if you sell a stock before it settles?

If you bought the stock (or other type of security) using settled cash, you can sell it at any time. But if you buy a stock with unsettled funds, selling it before the funds used to purchase have settled is a violation of Regulation T (a.k.a. a good faith violation, mentioned above).

How are trades settled in stock market?

In the stock market, there is always a buyer and a seller. So, when a person buys a certain number of shares, there is another trader who sells the shares. This trade is settled only when the buyer receives the shares and the seller receives the money.