Full Answer

What is a structured settlement and should you choose one?

The plaintiff can decide to get a lump sum payment or opt for a structured settlement. What is a structured settlement, and should you choose one? Here’s everything that you need to know about structured settlements. What is a Structured Settlement? With that said, a structured settlement is a payment made by the defendant in an annuity. Structured settlements are typical in civil cases including:

What are the characteristics of a settlement?

- Size: As a rule, in the same country and at the same period, the size of an urban community is much larger than that of a rural community.

- Density of population: ADVERTISEMENTS:

- Family:

- Marriage:

- Occupation:

- Class extremes:

- Social heterogeneity:

- Social distance:

What is a trust agreement or a declaration of trust?

What is a Declaration of Trust?

- Beneficiaries and Trustees. ...

- Analyzing the Declaration of Trust. ...

- Benefits of Holding Assets in Trust. ...

- Declaration of Trust (England & Wales) In England and Wales, the declaration of trust refers to a legal agreement that confirms the true owner of a property.

- More Resources. ...

What is a non judicial settlement?

Non-judicial settlement agreements allow the trust beneficiaries to resolve disputes regarding the terms of the trust while avoiding the need for litigation. A trust settlement agreement can also provide everyone involved flexibility.

What Is a Trust Fund?

How Do Trust Funds Work?

What is a living trust?

What is the role of a trustee in a trust?

What are the most common types of trust funds?

Why do you need a grantor retained annuity trust?

Why do people set up trust funds?

See 4 more

About this website

What is a settlement of a common trust fund?

Settlement of a trust estate involves the process necessary to transfer asset ownership from the deceased person's trust to the parties entitled to receive the assets, according to the provisions of the decedent's trust.

What is a settled trust?

Self-settled trust (also called a spendthrift trust) is a type of trust allowed in a small number of states where a person that creates the trust is also the beneficiary of the trust. The assets are permanently in the trust and controlled by the trustee which keeps the assets from the reach of most creditors.

How do trust fund payments work?

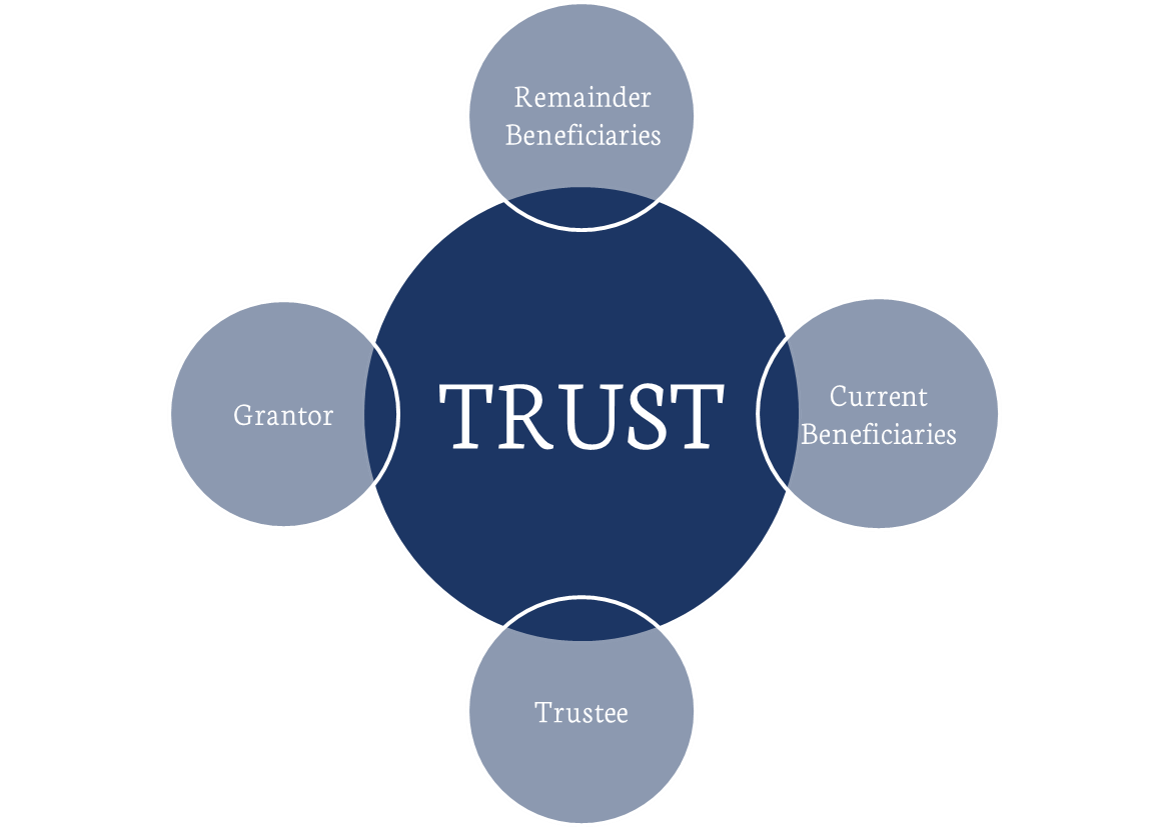

How Do Trust Funds Work? Trust funds are legal entities that provide financial, tax, and legal protections for individuals. They require a grantor, who sets it up, one or more beneficiaries, who receive the assets when the grantor dies, and the trustee, who manages it and distributes the assets at a later date.

Can I withdraw money from my trust fund?

Yes, you could withdraw money from your own trust if you're the trustee. Since you have an interest in the trust and its assets, you could withdraw money as you see fit or as needed. You can also move assets in or out of the trust.

Is a settlement deed the same as a trust deed?

A settlement in trusts law is a deed (also called a trust instrument) whereby real estate, land, or other property is given by a settlor into trust so the beneficiary has the limited right to the property (for example, during their life), but usually has no right to sell, bequeath or otherwise transfer it.

What does settled property mean?

The two categories of settlement are: settled property in which one or more beneficiaries enjoys an interest in possession; and. settled property in which there is no interest in possession (commonly held in a discretionary trust).

What are the disadvantages of a trust fund?

Some charge a percentage of the value of the assets under management, while others charge per transaction. One final disadvantage of a trust fund is that it will need to pay federal income taxes on any income it receives from its investments and does not distribute to its beneficiaries.

How much money is usually in a trust fund?

Less than 2 percent of the U.S. population receives a trust fund, usually as a means of inheriting large sums of money from wealthy parents, according to the Survey of Consumer Finances. The median amount is about $285,000 (the average was $4,062,918) — enough to make a major, lasting impact.

How long does it take to get inheritance money from a trust?

You cannot receive your inheritance until the estate has been properly administered. This generally takes between nine and 12 months, although it can take longer in complex estates.

How does a beneficiary receive money from a trust?

The grantor can set up the trust, so the money distributes directly to the beneficiaries free and clear of limitations. The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

How long does it take to settle a trust after death?

Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

Can I access my trust fund early?

If you want to access your trust fund early and access your money, you will need the co-operation of the trustees, and you'll need to know the exact terms of the trust. It's likely that if you're trying to access a trust set up by a family member, it's a discretionary trust backed by a letter of wishes.

What type of trust is a personal injury trust?

The simplest type of trust is called a 'bare trust' and this is often the most appropriate for personal injury funds. In this type of trust, the money still belongs to the person with the injury and they can close the trust at any time if they wish.

Does Florida allow self-settled trusts?

Florida law does not allow self-settled domestic asset protection trusts. Instead, Florida has consistently followed a public policy against self-settled trust providing asset protection for the trustmaker.

Is a settlor the same as a trustee?

A settlor is a person or company that creates the trust. There can be more than one settlor of a trust. The trustees are the people who manage the trust.

What is the role of a settlor in a trust?

The settlor is the party that creates a trust, usually the donor. The settlor transfers legal title in some asset to the trustee. The settlor then provides in the trust instrument how that trust property is to be used for the beneficiaries. In the case of the inter vivos trust, the settlor can also be the beneficiary.

How Much Money Do You Need for a Trust Fund? | The Motley Fool

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium ...

What Is a Trust Fund & How Do They Work? | Trust & Will

Have questions about trust funds? Read this article to answer all your questions about trust funds, from definitions to beneficiaries and more.

What Is a Trust Fund & How Does It Work? - SmartAsset

What Is a Trust Fund? A trust fund is a legal entity that holds property or assets on behalf of another person, group, or organization. It is an estate planning tool that keeps your assets in a trust managed by a neutral third party or trustee.A trust fund can include money, property, stock, a business, or a combination of these.

What Is a Trust Fund and How Does It Work? - Fabric

Accidental Death Insurance policies (Form VL-ADH1 with state variations where applicable) and Term Life Insurance policies (Form ICC16-VLT, ICC19-VLT2, and CMP 0501 with state variations where applicable) are issued by Vantis Life Insurance Company (Vantis Life), Windsor, CT (all states except NY), and by The Penn Insurance and Annuity Company of New York (NY only).

How Are Trust Fund Earnings Taxed? - Investopedia

Trust fund earnings that are distributed are paid by the beneficiary. The trust pays taxes on retained earnings and principal increases.

What is a Trust Fund and How Does it Work?

A Trust Fund is a legal entity that contains assets or property on behalf of a person or organization. Trust Funds are managed by a Trustee, who is named when the Trust is created. Trust Funds can contain money, bank accounts, property, stocks, businesses, heirlooms, and any other investment types. These assets remain in the Trust until certain circumstances are met, at which point they will be distributed to the beneficiaries.

How much money is in a trust fund?

The amount of money in a Trust Fund will vary depending on the creator of the Trust, Trust type, and how much the account has grown since being established. In most cases , any interest gained on the money inside a Trust Fund will be distributed to the beneficiary as well.

What are the benefits of a trust fund?

The benefits of a Trust Fund are numerous, but perhaps the biggest perk is the control it provides over the management of your assets. Trust Funds can guarantee that your assets are properly taken care of until your beneficiaries come of age, while also allowing them to avoid probate. In some cases, Trust Funds can even be used to designate funds for certain purposes, such as healthcare or educational costs.

What is a beneficiary in a trust?

A Trust Fund beneficiary is the person who will receive the assets in a Trust. Read this overview if you are interested in learning more about the distribution of Trust assets to beneficiaries .

What is the difference between a trust and a trust fund?

The difference between a Trust and a Trust Fund is small but important when it comes to understanding Estate Planning. A Trust is an agreement used to specify how certain assets will be managed and distributed. A Trust Fund is the legal entity those assets are placed into when the Trust is created. The creation of a Trust and Trust Fund go hand in hand, which is why you may hear these words used interchangeably at times.

What are the different types of trust funds?

There are a few different types of Trust Fund that vary in how they operate: a Blind Trust Fund, a Unit Trust Fund, and a Common Trust Fund. It can be helpful to review the mechanics of each and understand their benefits.

Why do people use blind trust funds?

Blind Trust Funds are typically used when an individual wants to avoid a conflict of interest, for example if business or investments are involved in the Trust. Blind Trusts can also be used to provide an extra layer of privacy in the management of a Trust.

What is a trust fund?

Updated March 10, 2021. A trust fund is a special type of legal entity that holds property for the benefit of another person, group, or organization. There are many different types of trust funds and many provisions that define how they work. Learn more about trust funds and their benefits.

Who is involved in a trust fund?

Generally speaking, there are three parties involved in all trust funds: The grantor: This person establishes the trust fund, donates the property (such as cash, stocks, bonds, real estate, art, a private business, or anything else of value) to the fund, and decides the management terms. The beneficiary: This is the person for whom ...

What type of trust is used when the grantor dies?

They typically convert to an irrevocable trust on the death of the grantor. Irrevocable: This trust transfers assets out of the grantor's estate, and can't be altered once established. This type of trust has more protections from creditors and more tax benefits than a revocable trust.

Why are trust funds so popular?

There are several reasons trust funds are so popular: Intentions: If you don't trust your family members to follow your wishes after your passing, a trust fund with an independent third-party trustee can often alleviate your fears.

What is an irrevocable trust?

Irrevocable: This trust transfers assets out of the grantor's estate and can't be altered once established. This type of trust has more protections from creditors and more tax benefits than a revocable trust.

What happens to insurance when the grantor passes away?

When the grantor passes away, the insurance proceeds are distributed to the trust. That money is then used to acquire investments that generate dividends, interest, or rent for the beneficiary to enjoy.

Why do people use trust funds?

A trust fund is often used as an estate planning tool. It's used to minimize taxes and avoid probate, which is the legal process used to distribute the assets of a deceased person.

Where are settlement funds deposited?

Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

What is settlement statement?

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

How long does it take to get a settlement check?

Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

What should a contingent fee agreement explain?

In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any. As an example, below is a sample of text that may be used in a contingent fee agreement.

What do you write on a trust check?

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

What is the best practice for handling settlement funds?

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any.

Can you write checks to all parties on a settlement?

Write checks and receive payments for your portion of the settlement. Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger.

Who settles a trust after the trustee dies?

The person named as the successor trustee (s) to settle the trust, as well as anyone named trustee (s) of any trusts that need to be created, now that the trustmaker has died

How to settle a revocable trust?

The first step in settling a revocable living trust is to locate all of the decedent's original estate planning documents and other important papers. Aside from locating the original revocable living trust agreement and any trust amendments, you will need to locate the decedent's original pour-over will .

What is the purpose of a successor trustee?

Most people have little experience being named as the successor trustee in charge of settling their loved one's revocable living trust after the loved one's death . The purpose of this guide is to provide a general overview of the six steps required to settle and then terminate a revocable living trust after the trustmaker dies.

How long does it take to administer a trust?

If administration of the trust is expected to take more than a year , the successor trustee should work closely with the trust attorney and accountant to plan for setting aside enough assets to pay the ongoing trust expenses and then making distributions to the trust beneficiaries in multiple stages instead of in one lump sum.

What assets can pass outside of a trust?

Assets that can pass outside of the trust may include those that were owned as tenants by the entirety or joint tenants with right of survivorship; payable-on-death or transfer-on-death accounts; and life insurance, IRAs, 401 (k)s, and annuities with named beneficiaries. Take the time to understand what the non-probate assets are, too.

Who is the beneficiary of a residuary trust?

Beneficiaries of the decedent's residuary trust. The person named as the successor trustee (s) to settle the trust, as well as anyone named trustee (s) of any trusts that need to be created , now that the trustmaker has died. The date and location where the trust agreement was signed.

When are taxes due for successor trustee?

The final federal income tax return will be due on April 15 of the year after the decedent's year of death. For tax year 2020, that deadline has been extended to May 17, 2021. 1

Qualified Settlement Funds: Benefits for Both Sides

In addition to the release of liability, the defendant is eligible to receive an immediate tax deduction for the payment. In the meantime, claimants gain the time they need to receive a proper settlement consultation and to determine their best settlement options.

Qualified Settlement Fund Services

Sage Settlement Consulting has built close relationships with industry leaders in qualified settlement fund administration. Services include:

What is a qualified settlement fund?

Be created by a court, and be subject to continuing court supervision; Qualify as a trust under state law. A qualified settlement fund allows defendants to conclude litigation and receive immediate tax benefits, and plaintiffs to receive immediate, responsible, and flexible control of their funds. When the QSF is created, ...

Who is appointed to manage a trust?

An independent, qualified trustee, often an accountant or a lawyer, is appointed to handle the trust. The trustee manages the funds, handles ongoing claim resolution, and works with the plaintiffs to determine the trust’s payout structure.

What happens when a QSF is created?

When the QSF is created, the defendants pay their share of the agreement into the fund. Under the regulation, they take a tax deduction on the day of payment, are fully released from the litigation, and cannot participate in the trust administration.

What is a 468b fund?

A qualified settlement fund – a 468b fund, or QSF – is a powerful tool that encourages and simplifies lawsuit settlements. Though commonly used in class action suits, QSFs are extremely flexible and can help to settle a variety of cases.

How long does it take to administer a trust?

There is no set timetable for completing a trust administration. A typical trust administration will take at least 4 to 6 months, however circumstances such as dealing with an active business or disposing of real property could extend the administration somewhat.

What is the responsibility of a trustee?

This is a very important task that should not be taken lightly. As trustee, you have a fiduciary responsibility to the Trust beneficiaries. They have a legal right to look over your shoulder, and unless they waive this requirement, you will need to give them a written accounting of all Trust receipts and expenses.

What are my responsibilities as a successor trustee?

Most successor trustees use an attorney to help with trust administration. Usually the attorney then makes sure they do most of the work. It is not uncommon for an attorney to charge upwards of 1 percent of the net estate value for this service. While there are some legal requirements involved in settling a Living Trust, most of the steps can be completed without undue burden by the successor trustee, saving thousands to tens of thousands of dollars for the heirs.

How long does a trustee have to send a notice of death in California?

The notice must comply with Probate Code Section 16061.7 and must be sent within 60 days of the date of death.

What is a small estate affidavit?

Small Estate Affidavit. If there are assets not titled in the Trust, such as small bank accounts, those accounts can usually be transferred using a Small Estate Declaration under Probate Code Section 13100, so long as combined value of such accounts are worth less than $150,000.

Who do successor trustees work with?

The successor trustee will have to do the following or coordinate with the Estate Planning attorney or similar specialized service provider, such as AmeriEstate for a typical trust administration. These tasks are specific to a trust administration in California, although most of these steps are applicable to a trust administration in any state. You should seek appropriate guidance for the state in which your parent resided and where the trust administration occurs.

Can successor trustees review trust assets?

Most successor trustees can benefit from reviewing the Trust and Trust assets with an experienced professional. Use this time to request a detailed list of the specific tasks and to identify potential issues associated with the specific Trust.

What Is a Trust Fund?

The term trust fund refers to an estate planning tool that establishes a legal entity to hold property or assets for a person or organization. Trust funds can hold a variety of assets, such as money, real property, stocks and bonds, a business, or a combination of many different types of properties or assets. Three parties are required in order to establish a trust fund: the grantor, the beneficiary, and the trustee. Trusts can take many forms and can be established under different stipulations. They offer certain tax benefits as well as financial protections and support for those involved.

How Do Trust Funds Work?

They require a grantor, who sets up the trust, one or more beneficiaries, who receive the assets when the grantor dies, and the trustee, who manages the trust and distributes the assets at a later date.

What is a living trust?

A living trust, also known as a revocable trust, lets a grantor better control assets during the grantor’s lifetime. It is a type of trust in which a grantor places assets into a trust that can then transfer to any number of designated beneficiaries after the grantor's death. Most often it used to transfer assets to children or grandchildren, the primary benefit of a living trust is that the assets avoid probate, which leads to fast asset distribution to the beneficiaries. Living trusts are not made public, meaning an estate is distributed with a high level of privacy. While the grantor is still living—and not incapacitated—the trust details can be changed or revoked.

What is the role of a trustee in a trust?

The trustee manages the fund's assets and executes its directives, while the beneficiary receives the assets or other benefits from the fund. The most common types of trust funds are revocable and irrevocable trusts, but several other variations exist for specific purposes.

What are the most common types of trust funds?

The most common types of trust funds are revocable and irrevocable trusts, but several other variations exist for specific purposes.

Why do you need a grantor retained annuity trust?

A grantor retained annuity trust can be established to help to avoid gift taxes.

Why do people set up trust funds?

The primary motivation for establishing a trust fund is for an individual—or entity—to create a vehicle that sets terms for the way assets are to be held, gathered, or distributed in the future. This is the key feature that differentiates trust funds from other estate planning tools.

How Trust Funds Work

- Estate planning is a process that involves determining how an individual's assets and other financial affairs will be managed and how any property they have is distributed after they die. This includes any bank accounts, investments, personal property, real estate, life insurance, artwork, …

Special Considerations

- Wealth and family arrangements can grow quite complicated when millions (or even billions) of dollars are at stake for multiple generations of a family or other entity. As such, a trust fund can contain a surprisingly complex array of options and specifications to suit the needs of a grantor. But contrary to what most people believe, trust funds aren't just for the ultra-rich. In fact, they ca…

Revocable Trust Funds vs. Irrevocable Trust Funds

- Trust funds fall into two different categories: Revocable and irrevocable trust funds. The following are brief descriptions of the two.

Types of Trust Funds

- Revocable and irrevocable trust arrangements can be further classified into several types of trust funds. These types often have different rules and stipulations depending on the assets involved and, more importantly, the beneficiary. A tax or a trust attorney may be your best resource for understanding the intricacies of each of these vehicles. Keep in mind that this isn't an exhaustiv…