What is Actual Cash Value (ACV)?

What Is Actual Cash Value? Actual cash value (ACV) is the amount equal to the replacement cost minus depreciation of a damaged or stolen property at the time of the loss. The actual value for which the property could be sold, which is always less than what it would cost to replace it. How Actual Cash Value Works

Is there such a thing as ACV insurance?

There isn't a type of insurance called ACV insurance, for example, that's a misconception. Actual cash value (ACV) represents the amount equal to the replacement cost minus depreciation of a damaged or stolen property at the time of the loss. The actual cash value is different than the actual value of a piece of property, car, or personal object.

What does ACV stand for in real estate?

Actual Cash Value (ACV) Definition. Actual cash value is the depreciated value of an item of property at the time of the loss. This type of settlement does not allow you to replace what you've lost. Rather, it compensates you for the value of the item as if it was being sold at a garage sale.

What is actual cash value in a settlement?

Actual cash value is the depreciated value of an item of property at the time of the loss. This type of settlement does not allow you to replace what you've lost. Rather, it compensates you for the value of the item as if it was being sold at a garage sale.

What does ACV mean on an insurance claim?

Actual Cash ValueIf you have Replacement Cost Value (RCV) coverage, your policy will pay the cost to repair or replace your damaged property without deducting for depreciation. If you have Actual Cash Value (ACV) coverage, your policy will pay the depreciated cost to repair or replace your damaged property.

What is the difference between ACV and replacement cost?

Actual cash value insurance pays for less but saves you money on premiums. The difference is that replacement cost insurance pays for the full replacement cost of your items, whereas actual cash value insurance only pays for the depreciated value.

Which is better ACV or RCV?

Actual cash value (ACV) policies typically have lower premiums than RCV policies, and for good reason: they provide less in compensation when a claim is made.

What is ACV roof settlement?

Actual cash value coverage means that your insurance company agrees to pay you for the value of your roof in its current state. Essentially, depreciation is factored into your claim settlement.

Do insurance companies pay replacement value?

Replacement cost value definition If your personal belongings are stolen, damaged or destroyed in a covered loss, and your policy includes coverage for RCV, your insurer will reimburse you for the full cost to replace the items at their current price.

How do insurance companies determine replacement value of home?

As far as insurance companies are concerned, replacement costs are the costs necessary to rebuild or repair your home with building materials of similar type, quality, and style that were used in the initial construction of your home. That's what insurance companies look at when evaluating the replacement value.

What is the 80% rule in insurance?

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR.

Can you get recoverable depreciation?

Recoverable Depreciation is the gap between replacement cost and Actual Cash Value (ACV). You can recover this gap by providing proof that shows the repair or replacement is complete or contracted.

What is an ACV homeowners policy?

What is actual cash value coverage? A homeowners insurance policy with actual cash value coverage typically determines value by taking the cost to replace your personal belongings and reducing that amount due to depreciation from factors such as age or wear and tear, says the Insurance Information Institute (III).

What happens if you don't use insurance money for repairs?

You must keep your home up to your home insurance company's standards. If you don't make required repairs, you could have future claims denied and even lose your policy altogether. If you have a mortgage on your home, your claims checks may be payable to both you and your mortgage lender.

How long does a 20 year roof last?

Your asphalt roof is about 20 years old As long as your roof has been properly ventilated and installed you should get pretty close to that 25 years of roof life.

What is ACV for roof replacement?

An ACV policy stands for Actual Cash Value. This means the insurance company only pays you for your roof's current value as it stands today. Once your claim is approved, you'll get a check for the actual cash value and pay the cost difference for your new roof out of pocket.

Is ACV the same as trade in value?

ACV vs. Your car's ACV is equivalent to it's trade-in value. That's how much you'd get if you sold it to a dealer. The replacement cost is how much you'd pay to buy a new version of the same car, or a similar one.

What is cost of replacement?

What Is a Replacement Cost? Replacement cost is a term referring to the amount of money a business must currently spend to replace an essential asset like a real estate property, an investment security, a lien, or another item, with one of the same or higher value.

Is actual cash value the same as replacement cost?

Actual cash value is equal to the replacement cost minus any depreciation (ACV = replacement cost – depreciation). It represents the dollar amount you could expect to receive for the item if you sold it in the marketplace.

What is ACV price?

What Is Actual Cash Value? After a loss, actual cash value (ACV) coverage pays you what your property is worth today. Actual cash value is calculated by taking what it would cost to buy your property new today, and subtracting depreciation for factors such as age, condition and obsolescence.

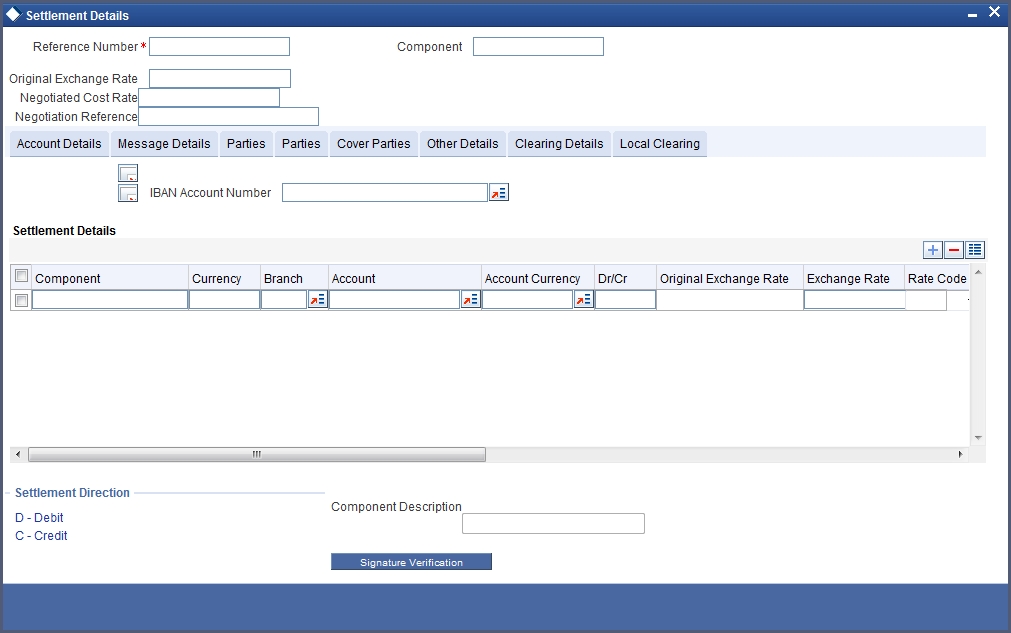

Loss Settlement Methods: RC vs ACV

When selecting property insurance coverage with NREIG, consider a choice of two loss settlement methods: Replacement Cost and Actual Cash Value.

REPLACEMENT COST (RC)

Replacement Cost coverage allows claims to be settled with reimbursable depreciation.

What does ACV mean in car insurance?

Comprehensive and collision insurance mean your car will be covered in the event of a total loss, but receiving the ACV of your car may not be enough for you to fully replace it with a similar vehicle. If you total a brand new car, that could mean a loss of thousands of dollars.

How do you calculate ACV?

Most car insurance providers use an industry formula to calculate your car’s ACV, taking into account how long you’ve had your car, how many miles it has on it, its make and model and whether it’s had any parts replaced. They’ll also consider how much comparable vehicles have sold for.

What is the ACV of a car?

Instead, they’ll pay out what’s called the actual cash value, or ACV, of your car. Actual cash value is a term used frequently in the insurance industry, but when it comes to car insurance, it means the value of your car as determined by your car insurance company. The ACV of your car takes into account usage, general wear and tear ...

Do insurance companies pay out the cash value of your car?

But, unless you’ve purchased extra coverage, they won’t pay you the same amount you originally paid for your vehicle. Instead, they’ll pay out what’s called the actual cash value, or ACV, of your car.

Why is ACV important?

The Actual Cash Value ("ACV") is important because most insurance policies require settlement of the claim at ACV, though a policy may also provide for a replacement cost benefit for some or all of the damages, as part of a residential or commercial property claim , a claim from an automobile wreck, or from a contents claim after a hurricane, fire or flood .

What is Actual Cash Value?

"Actual Cash Value" is a phrase found in insurance policies, and generally means the value of a thing, in its current condition -- that is, the current market value between ready, willing and able buyers and sellers. For insurance claims, an adjuster estimates ACV just before the loss occurred, as if the loss had not happened. This value is its "used" value, as opposed to its current, new, replacement cost.

Does ACV make sense?

While estimating ACV makes sense where there is a commonly accepted market, for example, a used car, it makes less sense for each individual part of a house damaged by fire or flood -- for example, paint on the walls, or vinyl flooring. Even so, because the policy requires it, the estimate you get will address ACV for each line item in the estimate .

How to determine ACV?

Some insurance companies may use a proprietary formula to determine the ACV of a vehicle. But most use a third-party vendor that aggregates data about your specific vehicle to come up with an estimate of the ACV. Factors considered include the year, make, model, mileage, wear and tear, previous accidents, and more.

What factors affect ACV?

The ACV depends on multiple factors, including the year, make, model, vehicle options, mileage, wear and tear, and accident history. If you disagree with the insurance company’s estimate of your vehicle’s value, you may be able to negotiate with them for a higher payout. But before you do, it’s a good idea to gather some evidence to improve your chance of success.

What happens if an appraiser comes back with a higher ACV than the insurance company?

If the appraiser comes back with a higher ACV than the insurance company, you’ll have more leverage to negotiate. But if the estimates are comparable, you may need to accept what the insurance company offers.

What is ACV in real estate?

Actual cash value (ACV) is the depreciated value of an item of property at the time of the loss . This type of settlement does not allow you to replace what you've lost, at least not without some of the money to replace it coming out of your own pocket.

How many payments can you expect to receive from a loss settlement?

You can expect to receive two payments before being fully compensated when your loss settlement is on a replacement-cost basis. The first payment will be for the actual cash value of the items. Then, you must prove that you've replaced the items. At that point, you will typically receive the second and final payment.

How Much Will You Be Paid for Your Claim?

How much you can expect to be paid for your insurance claim depends on three key factors.

Is replacement cost better than ACV?

Replacement cost, on the other hand, provides you with the money needed to replace the lost items. It's far better than ACV, because it allows you to put yourself in the same financial position you were in prior to the loss. 4 . One common misconception about replacement cost is how it will be paid.

What Is Actual Cash Value (ACV)?

The actual cash value means the “fair market value,” which is the amount a buyer is willing to pay, and a seller is willing to sell under normal circumstances. Another definition would be the cost for a new item of like kind minus depreciation. You’ll, therefore, have to pay out of pocket to replace the item with a similar one or settle for one of lower quality.

What is loss settlement?

“What is loss settlement?” you might ask. Well, loss settlement is how your insurance company decides the amount to pay you for the loss of an insured item. The type of loss settlement option you have agreed to in your homeowner’s policy largely determines your payout.

Does cash value insurance cover depreciation?

Whereas, actual cash value insurance pays only for the depreciated value, i.e., the amount you could expect to receive for the item if you sold it in the marketplace.

How much does RCV cover?

Most standard policies cover your home at RCV. That means if your home is insured up to $250,000, then you may get up to that amount to rebuild if your home is destroyed.

Is RCV insurance good?

Replacement cost insurance is not always available for car insurance. For those companies that offer them, RCV policies are a good, but costlier, way to guard against auto depreciation. New cars may lose up to 11% of their value upon purchase.

Is ACV insurance more affordable?

Like most insurance questions, it depends on your situation. Actual cash value insurance is usually the more affordable option. But, ACV may not offer enough coverage if something is damaged. The payout amount you’ll get from your insurer will likely be higher with replacement cost insurance. So, it’s a trade-off.

Is personal property covered by ACV?

Your belongings are covered by “personal property” coverage on your policy. When insuring your belongings (meaning everything you own inside of your home and in storage), you can choose between ACV and RCV. Most insurance policies default as ACV, but you can usually switch to RCV for an increased price.