What is a HUD 1 settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception—reverse mortgages.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What type of loan uses HUD 1?

Which loan types require a HUD-1 settlement statement?

- HELOCs. A HELOC is a mortgage-based line of credit that works much like a credit card. ...

- Reverse mortgages. A reverse mortgage is a specialized type of mortgage for homeowners that are 62 or older. ...

- Mortgages for manufactured homes not secured by real estate. Manufactured homes can be an affordable alternative to conventional homes built on a foundation. ...

Is HUD 1 statement required for refinancing?

What is a HUD-1 Settlement Statement? The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What is the purpose of the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is the difference between HUD-1 and settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is the HUD-1 called now?

The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

Where can I find my HUD-1?

HUD-1 Forms | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Is a HUD-1 required for a cash sale?

Federal law does not require the use of the HUD-1 or the new Closing Disclosure in all cash transactions. While some states have laws requiring the use of a state promulgated form in cash transactions, in general the HUD-1, the Closing Disclosure or any other settlement statement can be used in cash transactions.

What does HUD mean in real estate?

U.S. Department of Housing and Urban DevelopmentHUD Homes | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What form do you use for a refinance loan?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a form used for real estate closings used to process and approve reverse mortgages and non government loans that are not RESPA compliant.

How many sections are there in HUD 1?

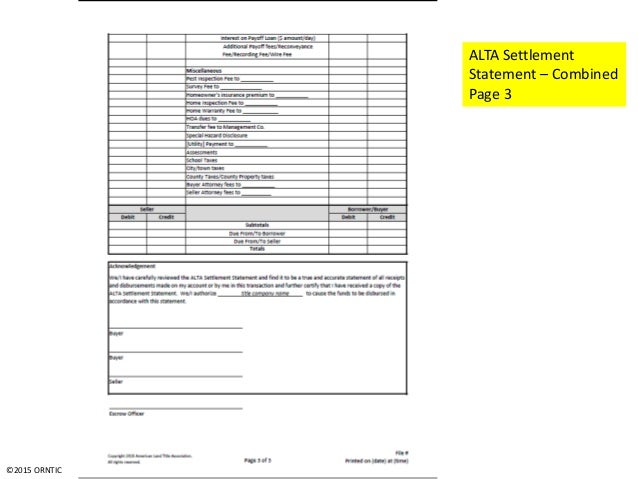

Let's dig into the HUD-1 Settlement Statement and look into each section of the document to give you a thorough understanding. There are a total of 5 sections in the HUD form.

What is a 501 excess deposit?

501 Excess deposit is generally the earnest money of the buyer that is held by the seller’s broker. 502 Settlement charges that the seller must pay. The last section 1400 gives a detailed account of the same. 503 This applies if the buyer is taking over the existing title and any lien that comes with that.

What is a 400s?

The 400s deal with price components that the seller is about to receive. 401 The gross sales price of the property the seller is supposed to receive. 402 The price of any appliance or other article that the seller has sold along with the house to the buyer. The seller will be supposed to receive this amount.

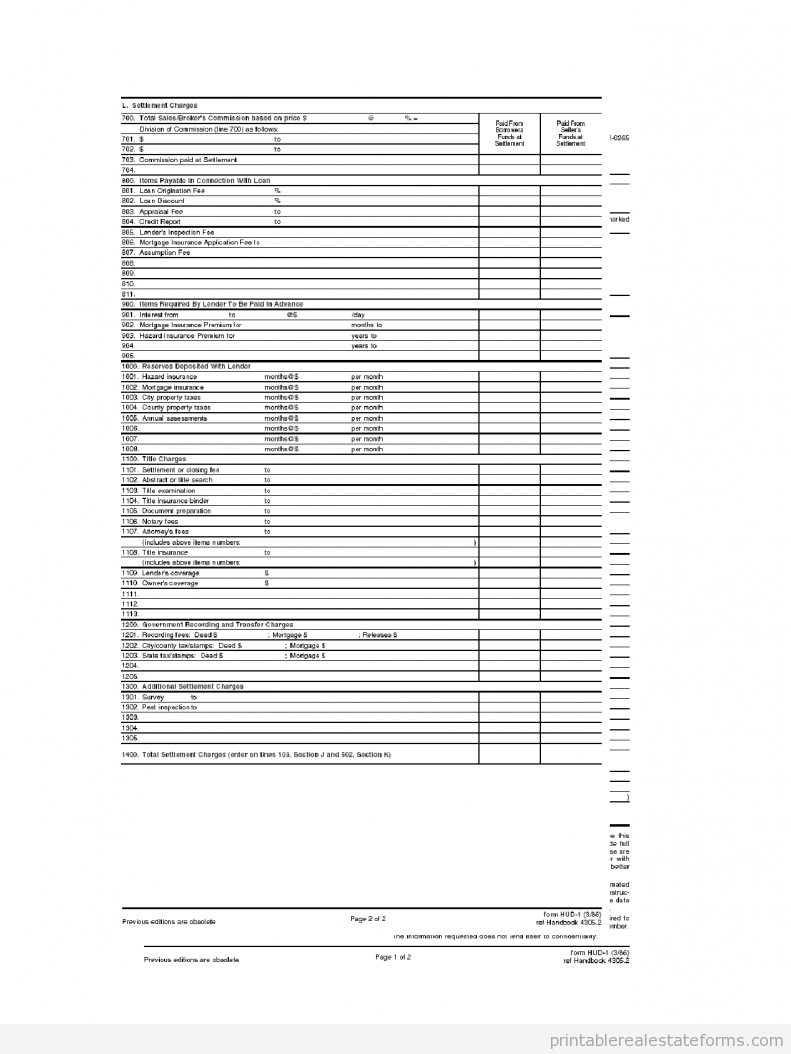

What is settlement charge?

Settlement charges also called the section L and feature prices that both parties are supposed to pay to transfer the title and complete the transaction. Costs on the left column are paid by the buyer, and costs shown in the right column must be paid by the seller. The settlement charges are segregated into 7 different categories. These are as follows:

Can a buyer and seller incur settlement charges?

The buyer and seller may both incur settlement charges that appear in the 3rd and 4th sections already. This section gives a detailed breakup on the total settlement charges for both the parties involved and shows if there is an increase in the cost compared to what’s given on the good faith estimate or GFE. This section is divided into 4 sub sections. Let’s look into all 4 subsections.

Who pays the buyer's costs?

These costs must be paid by the buyer to the respective third parties. They may also be paid as deposits so that the lender can pay them on their behalf. The sellers can also promise to pay some of the costs and hence they will be paid by the seller in advance.

What is HUD-1 form?

In a sentence, the HUD-1 form is a document that itemizes every financial transaction that is happening between all parties involved in the transfer of property. That’s the short of it.

Who prepares HUD forms?

The HUD is prepared by the settlement or closing agent at closing time. You have the right to inspect this form one day prior to settlement. Compare the HUD to the GFE to make sure you weren’t overcharged for a loan, title, escrow fees, or document recording.

What information is on a closing statement?

There is a lot of data on the closing statement. Information re the buyer seller, lender, property details, and settlement agent is listed. The majority of the document is a lot of figures. It’s not practical to list them all here, but here are a few examples.

What is the HUD?

HUD refers to the Department of Housing and Urban Development, which is the arm of the federal government that makes legislation relating to home ownership and property development.

How long has Colony Title been in business?

Colony Title has been in business since 1995 and handles over 2,000 real estate closings per year. If you have any questions or would like to speak to a representative about closing, please give us a call at 410-884-1160 or visit our website for more information.

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is a RESPA?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

What is HUD 1?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America. The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, ...

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

When is the HUD form required?

According to the RESPA act, the HUD form is to be used by all lenders of loans providing funds for real estate purchases and refinances of real estate loans and must be given to the borrow at least one day prior to the date of settlement.

What is a HUD-1?

The HUD-1 is a settlement statement and full of helpful and important information. HUD-1s may be simple and contain small amounts of information, while others may be complicated and jammed pack with data. When buying investment property (buy-and-hold), all HUD-1s have one thing in common, and that is the tax treatment of each line item.

What is the 804. appraisal fee?

804. Appraisal Fee: If required to obtain a loan, the cost is amortized over the life of the loan. If an appraisal is not required, the cost is added to the basis of the property and depreciated over the life of the property.

What is 102 in real estate?

102. Personal Property: The price of any personal property included in the sale. This must be depreciated.

When are loan points deductible?

This is an area for confusion, as loan points are deductible as a current expense when paid in connection with a primary residence.

Is a 1001 escrow account deductible?

1001. Initial Deposit for Your Escrow Account: This amount will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

Is 1002-1004 a current expense?

1002-1004 are deposited with your lender and will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.