A billing and settlement plan (BSP) (also known as "Bank Settlement Plan) business process is an electronic billing system designed to facilitate the flow of data and funds between travel agencies and airlines.

Full Answer

What is a billing and Settlement Plan (BSP)?

A billing and settlement plan (BSP) (also known as "Bank Settlement Plan ) business process is an electronic billing system designed to facilitate the flow of data and funds between travel agencies and airlines.

How does the settlement bank work?

The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is a settlement plan and why is it important?

As discussed in chapter 4, the Settlement Plan is a plan detailing what you and members of your group will do to orient and support the newcomer(s) during the sponsorship. It will provide your group with a framework for working through the many details of who will do what, when, how, with what resources and where those resources will come from.

How long does it take to settle a credit card transaction?

If available funds are deducted and sent through the processing network to the settlement bank which settles the transaction for the merchant. The settlement bank will typically deposit funds into the merchant’s account immediately. In some cases, settlement may take 24 to 48 hours.

What is BSP flight?

A BSP is the central point through which data and funds flow between travel agents and airlines. Instead of every agent having an individual relationship with each airline, all of the information is consolidated through the BSP. Agents make one single payment to the BSP (remittance), covering sales on all BSP Airlines.

What is BSP and ARC?

What are BSP and ARC? BSP or Billing and Settlement Plan is an IATA electronic billing system to run and simplify the interchange of data and funds between travel agencies and airlines. Sounds complicated, but in plain English, BSP is a payment mediator between airlines and travel agents.

What are the advantages of BSP?

The advantages for airlines Simplification of the system of monetary settlements. Hassle-free receipt of money. Obtaining the completed infrastructure of the bank, a unified agent network, which allows you to cover the entire market by attracting agents.

What is Isbsp?

BSP is a system designed to simplify - airlines receive one settlement covering all agents - and assist the selling, reporting and remitting procedures and improve financial control and cash flow.

What is BSP refund?

BSP - Ticket Refund 24hrs. Refund within 24 Hours of Ticket Issuance. Tickets may be refunded within 24 hours only using the following options: Note: Does not apply to PNRs booked as group blocked space. GDS (Automated Refund)

How does a BSP operate?

BSP Finance provides Finance Leasing and Commercial loans for its Lending customers and Term Deposits for its investments customers. Lending products are priced on a case by case basis according to the clients credit worthiness. Fees are fair with no hidden costs or surprises.

How do you pay BSP?

Contact the Information Department at 514 748-7480 or our toll-free number at 1 877 748-7483 and dial 1 to speak to an agent. You will be able to pay your annual fees by credit card, prepaid credit card or Visa Debit.

What are the disadvantages of BSP?

Disadvantages of BSP BrushesBSP is very slow if a lot of brushes are used; lots of brushes can hinder performance and often causes geometry errors (missing brush faces, flickering geometry)BSP isn't as intuitive and user friendly as it is in older engines such as Source or Quake.More items...•

What does BSP stand for in banking?

A billing and settlement plan (BSP) (also known as "Bank Settlement Plan ) business process is an electronic billing system designed to facilitate the flow of data and funds between travel agencies and airlines.

What is ARC in airline industry?

ARC (Airlines Reporting Corporation) gives out these numbers to accredited agencies, which in turn allows those travel agencies to issue airline tickets. But the use of an ARC number extends beyond air tickets—travel agencies will use it to book everything from a hotel to a cruise ship.

What is ARC data?

Powered by Global Air Sales ARC is the trusted provider of settlement services between airlines and travel agencies, accrediting travel agencies, including travel management companies, leisure and online travel agencies, to sell airline tickets.

What is BSP link?

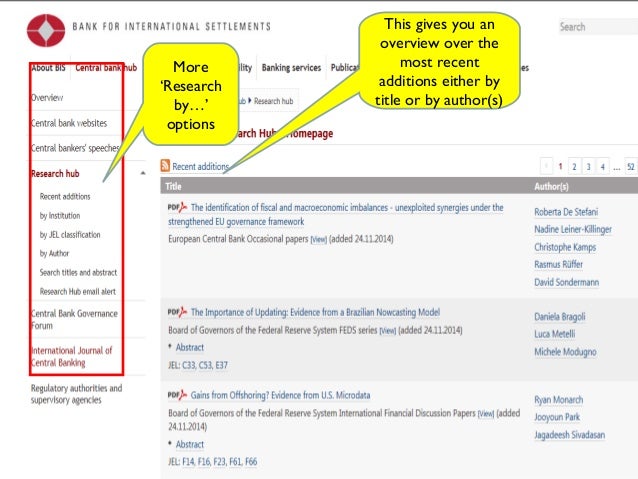

IATA provides services for the settlement of financial transactions between travel agents and the airlines. BSPlink consolidates the amounts involved in these transactions between agents and airlines and enables the settlement to be made through one single financial transfer for each participant.

How do travel agents pay airlines?

A travel agent makes money by charging fees for separate elements of travel. For example, instead of charging a commission for booking tickets with airlines or hotel rooms, travel agents earn money by charging a service fee for each booked part.

Why are settlements greater than DSP fees?

of all settlements produced savings greater than the related DSP fees — in part because clients have the power to veto any proposed settlement for any reason.

Where does the money come from in a debt settlement?

The money for those payments comes from an FDIC-insured escrow account — established in your name and managed by a bank or other third-party service provider. Each month, you deposit an agreed amount of money into that escrow account to fund the debt settlement effort. Those funds represent a portion of the monthly minimum payments you had been making before entering into the debt settlement plan.

What is DSP in bankruptcy?

The DSP option enables debtors to discharge their debts one at a time — an option not available either through DMPs or Chapter 13 bankruptcies. In those cases, debts are paid down simultaneously, and a failure to complete the program means no debts ever get discharged and collection activity — for the original loan terms — resumes. With that in mind, the 2017 AFCC report found that:

How many DSP clients settled at least one?

That number rises to 67 percent when still active accounts are included in the mix. And 42 percent of terminated cases settled at least one account.

How long does a client stay in the DSP program?

More than half of the clients that stay active for six months or more complete the program. And that rate increases to more than 60 percent for clients that stay in the program for more than two years.

What is debt relief?

Debt relief provides consumers repayment relief so they can get out of debt. Repayment relief can come in many forms like interest concessions, lower payments, and reduction of what’s owed. If you have money coming in every month but are struggling to make all your payments on time or are unable to pay down your debt, getting professional help can be a good idea.

What happens when you default on a DSP?

Under the DSP, you stop making payments on the bills identified for settlement, and when the accounts go into default, the debt specialist negotiates a lower pay-off price with the creditor. You pay the settlement amount, plus the debt settlement company’s fee and your debt is gone.

What is the main feature of settlement systems in the market?

So, the main feature of the settlement systems in the market is the use of common standard ticket forms. When the BSP system is operating in the country, the airlines participating in the BSP system stop selling their services through an agent network with their own transportation documents.

What is BSP in insurance?

BSP (Billing and Settlement Plan) is a universal settlement system that replaces individual schemes of relations between agents and carriers. It is designed for the effective interaction of participants through the consolidation of information and financial flows. The advantage of the BSP is the work with the electronic ticket ...

What is the advantage of BSP?

The advantage of the BSP is the work with the electronic ticket of the standard sample. Nowadays, more than a hundred countries are using the BSP system in order to simplify settlements. A distinctive feature is the use of the single ticket by all member countries.

How many parts are there in the third stage of the payment cycle?

During the third stage, the system is introduced and the cycle is launched, during which the payment is made monthly, and each month is divided into 4 parts.

Who can participate in BSP?

Participation in a BSP is open to all airlines (IATA members and non-members) serving the country or area concerned.

What is BSP airline?

BSP is a system designed to facilitate and simplify the selling, reporting and remitting procedures of IATA Accredited Passenger Sales Agents, as well as improve financial control and cash flow for BSP Airlines.

How many countries are BSP?

A truly worldwide system: there are BSP operations in some 180 countries and territories. The system currently serves more than 370 participating airlines with an on-time settlement rate of 99.999%. In 2017, IATA's BSP processed $236.3 billion.

What is an account settlement?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero.

What is settlement date accounting?

With settlement date accounting, enter the transactions into your general ledger when the transaction happens. This method ensures that everything on your general ledger has actually happened with the exact amount recorded. You settle the account at the time you record the transaction.

What happens to the clearing account balance after employees deposit their checks?

After the employees deposit their checks and you remit the taxes, the clearing account balance is zero. So, you settled the account.

What is an example of an outstanding balance?

For example, you have one outstanding balance in an account. Customer A owes the entirety of the balance because of Invoice A. When Customer A pays the invoice, the account is now settled.

Why do you settle your accounts?

When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books only when you fulfill the transaction.

Is a settlement an account payable?

If you record payments you owe to a lender or other business until you pay off the fund s you owe, the account you settle is an account payable ( i.e., a liability account).

Do the values of the two accounts settle the account?

Even though the values of the two are not equal, the exchange of value in the agreement settled the account.

What is a settlement plan?

As discussed in chapter 4, the Settlement Plan is a plan detailing what you and members of your group will do to orient and support the newcomer(s) during the sponsorship. It will provide your group with a framework for working through the many details of who will do what, when, how, with what resources and where those resources will come from. This Plan should be used as a guide with the understanding that circumstances may change and that it may need to be revised and updated to reflect these changes during the settlement period. Your settlement planning should also take into account the settlement needs of non-accompanying family members listed on the IMM 0008, as your group will be expected to sponsor them as well if they submit an IMM 0008 within one year of the arrival of the principal applicant.

When you decide to sponsor, do you take on a significant financial obligation?

If you need to raise funds, it may be useful to set up a committee to deal strictly with fundraising. You will want to ensure that finances are carefully and appropriately monitored. When planning fundraising activities, think about: