A claim settlement ratio of an insurance company is the number of claims settled against the number of insurance claims filed. When a life insurance policyholder

Insurance

Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier or underwriter. A person or enti…

What is Claim Settlement Ratio in life insurance?

Simply explained, claim settlement refers to the process whereby a life insurance company pays out the sum assured and other benefits as laid out in the policy document. Every company uses a metric called claim settlement ratio to record the percentage of these claims it has settled or paid during a financial year from the total claims received.

What is the death claim settlement process?

Death claim settlement process 1 Step One: Intimation to the insurance company about the Claim#N#The nominee should inform the insurance company as soon as... 2 Step Two: Documents required More ...

What is'insurance claim'?

What is 'Insurance Claim'. The insurance company validates the claim and, once approved, issues payment to the insured or an approved interested party on behalf of the insured. Insurance claims cover everything from death benefits on life insurance policies to routine and comprehensive medical exams.

What is the process of life insurance claim?

Life Insurance Claim Process 1 Death Claims. The nominee should intimate about the claim in written form to the insurance company as early as possible. 2 Maturity Claims. Under this claim process, the insurance company makes payment to the policyholder on completion of the policy or maturity date. 3 Rider Claims. ...

What do you mean by settlement of claim?

Settlement of claims means all activities of the insurer or its agent which are related directly or indirectly to the determination of the compensation that is due under coverage afforded by the insurance policy or insurance contract. This includes, but is not limited to, the requiring or preparing of repair estimates.

What are the types of claim settlement?

The claim settlement is the final stage of the claim process in insurance....4 Major Types Of Claims SettlementPayment of money.Replacement of the item covered.Reinstatement.Paying for repairs.

How long does a life insurance claim take to settle?

between 14 and 60 daysOnce a valid claim has been made, it will typically take between 14 and 60 days to receive the payment from the insurance company, and usually it occurs within 30 days.

What is a settlement in insurance?

Insurance settlement. The payment of proceeds by an insurance company to the insured to settle an insurance claim within the guidelines stipulated in the insurance policy.

Why is claim settlement important?

If the claims are not resolved, the entire point of purchasing insurance coverage is defeated. To put it another way, the settlement ratio is the ratio of the total number of insurance claims paid out by an insurance company to the total number of claims received.

How do I calculate my claim amount?

The actual amount of claim is determined by the formula: Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability of the Insurance Company. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum.

What reasons will life insurance not pay?

If you commit life insurance fraud on your insurance application and lie about any risky hobbies, medical conditions, travel plans, or your family health history, the insurance company can refuse to pay the death benefit.

What happens if beneficiary does not claim life insurance?

If you don't name a life insurance beneficiary, or all your beneficiaries pass away before you do, your estate becomes the beneficiary. This means the life insurance proceeds go into estate probate, a long legal process during which your debts are settled and your estate is divided.

How much is the average life insurance payout?

However, some industry experts estimate that the average payout for a life insurance policy is between $10,000 and $50,000.

How is claim settlement done?

Claim settlement is one of the most important services that an insurance company can provide to its customers....Claims ProcessClaim intimation/notification. ... Documents required for claim processing. ... Submission of required documents for claim processing. ... Settlement of claim.

What is insurance settlement cost?

The settlement of claim means the offering of compensation to policyholders for damage or loss to their cars. The car insurance claim can be settled in two ways which are cashless and reimbursement claim settlement, where the former is more preferred. Read More. Car insurance starting from Rs. 2072/year*

What is settlement amount?

Settlement amount means the par amount of each security that we redeem, multiplied by the price we accept in a redemption operation, plus any accrued interest.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

What are the basic objectives in settling claims?

Claim Settlement Objectives The objectives of any claim settlement is to verify the loss and that it was covered by the policy; to pay the claim promptly and fairly; and, in some cases, to provide personal assistance to the insured.

What is a class action lawsuit settlement?

A class action is a legal proceeding in which one or more plaintiffs bring a lawsuit on behalf of a larger group, known as the class. Any proceeds from a class-action suit after legal fees, whether through a judgment or a settlement, are shared among all members of the class.

How do settlements work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

Who can make a claim under a life insurance policy?

Only the beneficiaries can make a claim under a life insurance policy. In case you are a legal heir but not designated as beneficiary, then you can...

Who can be the beneficiary of a life insurance policy?

When signing a life insurance policy, you are required to nominate the beneficiary(s). You can nominate more than one beneficiary and specify their...

What is the Claim Settlement Ratio?

Claim Settlement Ratio is the number of claims settled against the number of claims filed during a financial year. It is a measure to find how good...

How will I receive the claim amount?

You will get the claim amount in the mode selected by you at the time of submitting claim documents. It is recommended to opt for electronic funds...

Which are the top three life insurance companies in terms of the Claim Settlement Ratio?

Top three life insurance companies in terms of claim settlement ratio are Max Life Insurance, HDFC Life Insurance, and Tata AIA Life Insurance with...

What is a life insurance claim settlement?

Life insurance claim settlement is a process where the claimant/beneficiary can make a request to the policyholder's insurance company to avail the death benefits under the life insurance of the insured in case of the policyholder’s death. With this, the claimant/beneficiary can file a claim request for critical/terminal illness, accidental death benefit, accidental total/permanent disability if required.

What is the claim settlement ratio?

Claim Settlement Ratio is the number of claims settled against the number of claims filed during a financial year. It is a measure to find how good an insurance company is in settling health insurance claims. Hence, you must check the CSR when selecting a life insurance policy.

What is a death claim?

2. Death Claims: In death claims, the claimant can make a request for death benefits upon the demise of the policyholder. This means a sum assured amount is settled towards the beneficiary upon the death of the policyholder in any case. The sum assured is paid to the beneficiary only after the death of the policyholder is intimated to the insurance company. The death intimation includes policy number, date of death, cause of death, and the policy term upon which the company investigates the death claim. Amounts received as the death claim are considered to be tax-free as per the current Income Tax Act under Section 10 (10D).

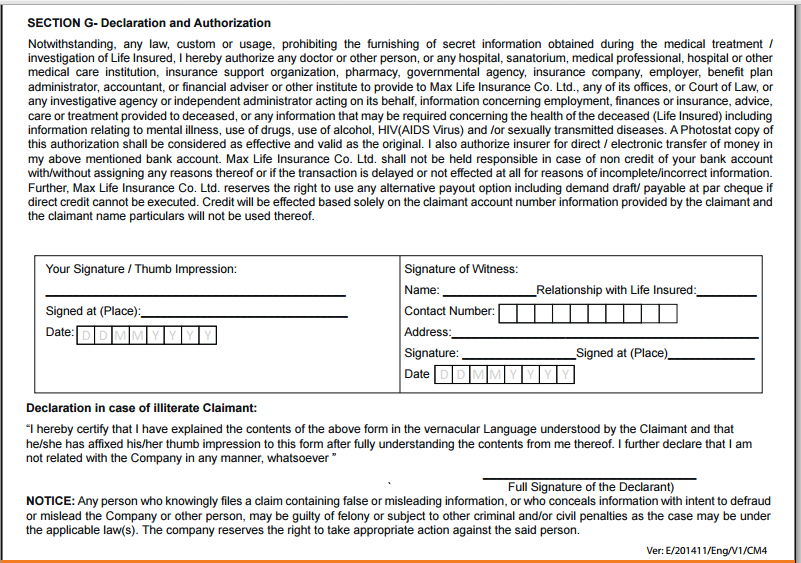

What is the second step in a claim settlement?

Step 2: Submission of Documents: The insurance company requires some documents to settle the claim, which the beneficiary is required to submit within the stipulated time. With help of the relevant documents, the insurance company will be able to carry out an investigation if required or ask for any additional documents required. Submission of relevant documents at this stage is necessary to avoid any possibility of fraud.

What is a cause of death that is not covered by insurance?

Causes of death that are not covered by the insurance policy such as suicide before the completion of the first policy term, accidental death caused by overconsumption of alcohol/drugs.

When are maturity claims paid?

1. Maturity Claims: Maturity claims are payable at the time of maturity of the life insurance policy. This means when the policy tenure ends and the policyholder survives the whole policy tenure a certain amount is paid to the policyholder itself. Maturity claims are only paid when the policy term ends and the premiums are paid on time. The policyholder is required to fill a duly signed discharge form to avail maturity claim. The amount received from the maturity claim is considered to be tax-free as per the current Income Tax Act.

Can life insurance be used for drug overdose?

9. Death Due Drug/Alcohol Abuse: Life insurance does not settle claims for death of life assured caused by drug overdose or excessive alcohol consumption. In fact, life insurance companies rarely issue a life insurance policy for people who consume alcohol on a daily basis or consume narcotics substances. In case life assured has not disclosed these habits at the time of policy issuance, the insurance company is entitled to withhold the death benefit. If the life assured passes away due to excessive alcohol/narcotics substance consumption, the insurance company will not provide a death benefit to the nominee/beneficiary under such circumstances.

What is rider claim?

The amount paid by the insurer to the insured due to claims made on add-on facilities of life insurance policy is called rider claim. Presenting proper documents is the key to smooth rider claim settlement.

What is the lump sum amount received by the policy holder on survival through the term of the policy?

The lump sum amount received by the policy holder on survival through the term of the policy, at the time of maturity of the insurance plan is called maturity claim. For survival benefit Life insurance claim settlement, the policy owner needs to fill out a discharge form, sent by the insurance company to the insured in advance. The filled in form along with the following documents need to be sent to the insurer:

What is the reputation of an insurance company?

Reputation of an insurance company is mainly based upon its claim settlement ratio. People usually prefer those insurance houses that show higher percentage of claim settlement ratio. Higher percentage of claim settlement suggests more number of claims have been accepted and paid by the company.

How long does it take for an insurance company to settle a claim?

As per the regulation 8 of the IRDAI (Policy holder's Interest) Regulations, 2002, the insurer is obligated to settle a claim within 30 days of receipt of all necessary documents including extra documents sought by the insurer. If the claim requires further investigation, the insurer needs to complete its procedures within 6 months from receiving the written intimation of claim.

Why are life insurance claims delayed?

In many cases, life insurance claims have been delayed or denied due to lack of proper documentation or simply because the proper claim process was not followed. Hence, it is recommended that the claimant should be aware of the claim process in order to have a hassle-free claim settlement process during the emotionally draining time especially while filing a death claim. Coverfox has taken a great initiative in NASPRO ( Nominee Assistance Program) which is specially aimed at assisting nominees to have a smooth claim settlement experience.

What are riders in life insurance?

The riders can be accidental rider, critical illness rider, waiver of premium rider etc. For different riders, different claim proceedings are required. Some riders may be valid with the death claim like accidental death rider or some riders need to processed standalone like waiver of premium rider in case of disability.

What information is required for a nominee to inform the insurance company?

The details required for intimation are policy number, name of the insured, date of death, cause of death, place of death, name of the nominee etc.

What is the main requirement for buying life insurance?

Selection of the right policy from a good life insurance company with a healthy claim settlement ratio is the main requirement for buying a life insurance. The main function of an insurance company is to ensure easy and timely settlement of a valid claim in return for the premium paid by the insurer/ policy holder.

How does an insurance company inform the policy holder of a cancellation?

The insurance company informs the policy holder in advance by sending bank discharge form for filling details in it. The form needs to be returned back to the insurance company with original policy document, ID proof, Cancelled Cheque and copy of pass book.

What is the purpose of taking an insurance policy?

The main purpose of taking an insurance policy is that it should come in use in the times of crises. In this article, we will look at the different types of life insurance claims and how the settlement process works.

How long does it take for an insurance company to settle a claim?

Any other documents requested by the insurer. 3 Claim Settlement. The insurer needs to settle the claim within 30 days of receipt of all documents submitted by the insured. However, there might be a case where an insurer requires further investigation.

How long does it take to settle a claim?

The nominee will be asked to present given below documents to the insurer: The insurer needs to settle the claim within 30 days of receipt of all documents submitted by the insured.

How to avail claim intimation form?

The nominee can avail the claim intimation form by visiting the nearest branch of the insurance company or can download from the official website of the insurance provider. To get your claim settled easily, it is required that you should submit your relevant documents.

What is the claim process for insurance?

Under this claim process, the insurance company makes payment to the policyholder on completion of the policy or maturity date. The amount that is payable consists of sum assured plus any bonus/incentives.

What is a Rider in Life Insurance?

Riders are defined as an additional benefit offered by the insurer by paying an extra premium with the basic plan. Life insurance policy can be attached with different riders such as Accidental Rider, Critical Illness Rider, Hospital Cash Rider, Waiver of Premium Rider, etc.

How to intimate a claim to an insurance company?

The nominee should intimate about the claim in written form to the insurance company as early as possible. The details should consist of the policy number, name of the insured, date of death, place of death, name of the claimant, etc. The nominee can avail the claim intimation form by visiting the nearest branch of the insurance company or can download from the official website of the insurance provider.

What documents are needed to settle a claim?

Mentioned below are some of the important documents that are generally asked by the insurance company in settling the claims: 1 Duly filled in and signed claim form 2 Original policy certificate 3 Death certificate issued by the local authority 4 FIR 5 Post-mortem reports 6 Hospital discharge summary 7 KYC documents (like a copy of photo ID and address proof) of a beneficiary 8 Copy of cancelled cheque and bank statement 9 If the claim is made by someone other than the nominee or assignee, the person making a claim has to submit legal proof of his or her title

What Is an Insurance Claim?

An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event. The insurance company validates the claim (or denies the claim). If it is approved, the insurance company will issue payment to the insured or an approved interested party on behalf of the insured.

How does an insurance claim work?

A paid insurance claim serves to indemnify a policyholder against financial loss. An individual or group pays premiums as consideration for the completion of an insurance contract between the insured party and an insurance carrier.

Why do insurance companies file paper claims?

Ultimately, an insurance claim protects an individual from the prospect of large financial burdens resulting from an accident or illness.

What happens if you file too many claims?

In some cases, it's possible if you file too many claims that the insurance company may decide to deny you coverage.

Why is it important to minimize the number of claims you file?

Regardless of your situation, minimizing the number of claims you file is the key to protecting your insurance rates from a substantial increase. A good rule to follow is to only file a claim in the event of catastrophic loss.

How long does it take to file a death claim?

Generally, the process takes approximately 30 to 60 days without extenuating circumstances, affording beneficiaries the financial wherewithal to replace the income of the deceased or simply cover the burden of final expenses. Filing an insurance claim may raise future insurance premiums.

What is a property and casualty claim?

Property and Casualty Claims. A house is typically one of the largest assets an individual will purchase in their lifetime. A claim filed for damage from covered perils is initially routed via the Internet to a representative of an insurer, commonly referred to as an agent or claims adjuster .

What is Claim Settlement Ratio?

This is a ratio that measures the number of claims that are accepted and paid by the company. We can define it as the ratio of the number of claims settled to the number of claims that the company receives.

What is life insurance?

Life Insurance policies are long-term contracts with an insurance company. In exchange for a certain amount of premium payments, the life insurance company would provide a lump-sum amount to beneficiaries in the event of the insured's death. This lump-sum amount is known as a death benefit, and it would help the family of ...

What is lump sum death benefit?

This lump-sum amount is known as a death benefit, and it would help the family of the insured financially during tough times. So, it is essential for the beneficiaries that their claims are paid to them in full and promptly during these challenging times. Life Insurance companies give out insurance to policyholders so that they can pay ...

What happens if a policyholder cannot fill out a claim?

Delay in filing the claim - If the policyholder cannot fill the claim during the stipulated period of time, that might lead to the claim being rejected. Such cases often lead to investigations that the company conducts.

What does it mean when a company has a consistent settlement ratio?

Consistent ratios would mean that the company is more trustworthy.

Why do life insurance companies give out insurance?

Life Insurance companies give out insurance to policyholders so that they can pay the claims when needed, and they endeavor to do so. But this is not always the case. Due to several reasons, Life Insurance companies may not always be able to settle their claims.

What happens if a policy lapses?

Policy lapse - If the claim is filed after the policy's lapse, the claim will be rejected. For the claim to be approved, the premiums need to be paid on time, and if it is not paid on time, it should be paid within the grace period so that the policy is still in force. If the policy is not in force, then the claim will not be accepted.

What is the Claim Settlement Ratio?

The Claim Settlement Ratio (CSR) of an insurance company is the percentage of insurance claims settled in a financial year compared to the total claims filed. CSR indicates the credibility of the insurance company.

How is Claim Settlement Ratio Calculated?

The Claim Settlement Ratio of an insurer is calculated using the formula given below:

Why Is Claim Settlement Ratio Important?

The importance of life insurance lies in the assurance that, in the unfortunate event of the demise of the insured, his or her beneficiaries will be able to claim the insurance coverage. This, in turn, will help them look after their current and future financial needs in the absence of the insured.

Conclusion

At the end of the day, life insurance policies can only be as reliable as the insurance company that provides them. Thus, the Claim Settlement Ratio helps an insurance-seeker make an accurate judgement of the trustworthiness and competence of a potential insurer.