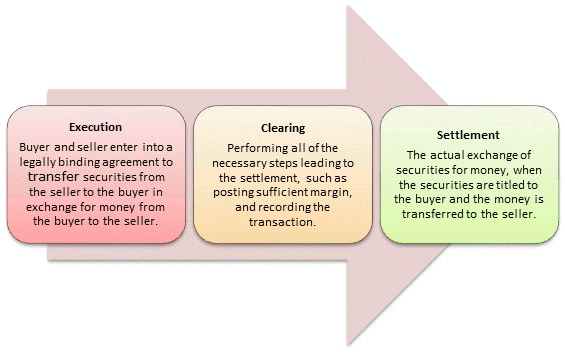

The clearing and settlement process is divided into three:

- Trade Execution – where the buy or sell order is executed by you. This happens on T Day.

- Clearing – where the responsible entity identifies the number of shares that the seller owes and the amount of money...

- Settlement – where the shares are moved from the seller’s account to the buyer’s account and the money is...

What is the difference between clearing and settlement in trading?

Settlement: The settlement process involves the delivery of securities from the seller to the buyer and the delivery of funds from the buyer to the seller. While clearing and settlement can occur on the same day, the timing may be longer depending on the complexity of the transaction.

Why is a strong clearing and settlement system important?

• It is important that a strong clearing and settlement system is set in place to maintain the smooth securities trading operations within financial markets. • Clearing is the process of settling claims of one set of financial institutions against the claims of other financial institutions.

What is a clearing process?

What Is a Clearing Process? Clearing is the process of reconciling an options, futures, or securities transaction or the direct transfer of funds from one financial institution to another.

What is bank clearing?

Clearing in the banking system is the process of settling transactions between banks. Millions of transactions occur every day, so bank clearing tries to minimize the amounts that change hands on a given day. For example, if Bank A owes Bank B $2 million in cleared checks, But Bank B owes Bank A $1 million, Bank A only pays Bank B $1 million.

What is clearing and settlement process in banking?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

How clearing and settlement process is working?

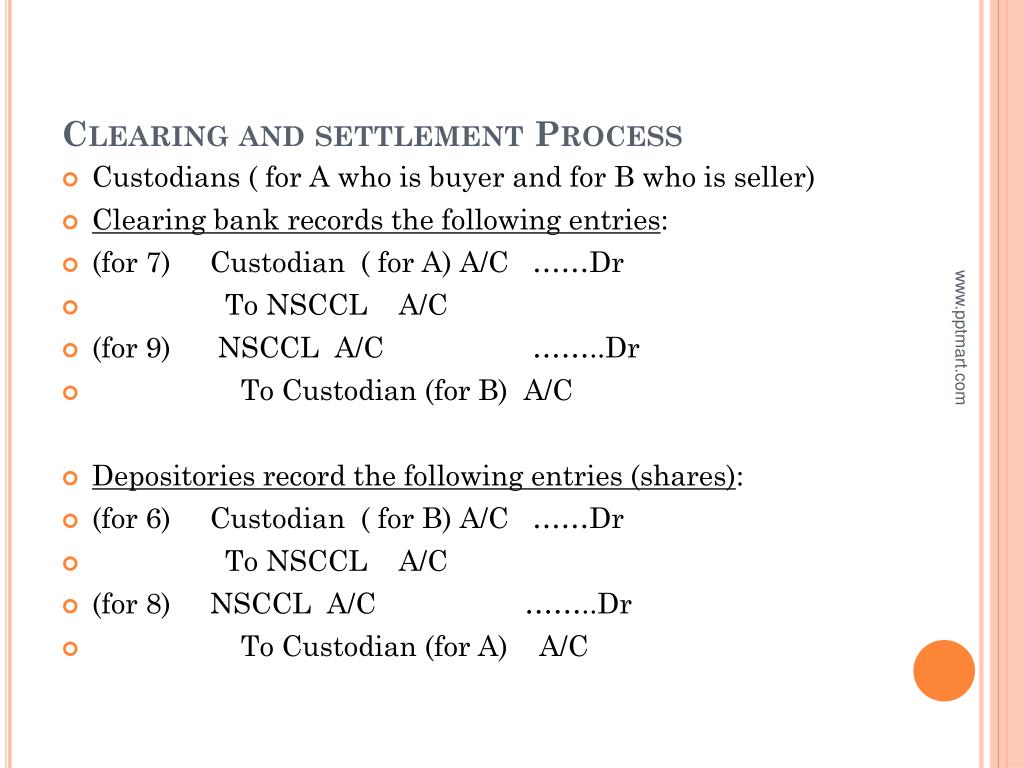

The clearing corporation receives funds and securities from the clearing banks and depositories for purchase and sale transactions respectively. So, if a clearing member is settling a purchase transaction, then the corporation receives the money in its clearing account via the clearing bank.

What is a clearing process?

Clearing is the process of reconciling an options, futures, or securities transaction or the direct transfer of funds from one financial institution to another.

What is the role of clearing and settlement system?

Clearing and Settlement Mechanisms (CSMs) are the processes underlying all payment transactions exchanged between two payment service providers (PSPs). are involved. payment schemes have to choose a CSM in order to comply with the reachability requirements of the schemes.

What is the settlement process?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

Why does it take 2 days to settle a trade?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What does settlement mean in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What are the various types of clearing?

For example, In India, the cheques are cleared in the clearing houses managed by RBI or the reserve bank of India....The types of clearing are as follows:Outward House Clearing. ... Inward House Clearing. ... Return House Clearing.

What does settlement mean in finance?

Settlement is the "final step in the transfer of ownership involving the physical exchange of securities or payment". After settlement, the obligations of all the parties have been discharged and the transaction is considered complete.

What is the purpose of settlement system?

Settlement systems – securities infrastructures – refer to multilateral arrangements and systems that are used for the clearing, settlement and recording of payments, securities, derivatives or other financial transactions. Securities settlement systems are used for post-trade processing.

What are the characteristics of clearing and settlement system?

Clearing and settlement In its widest sense, clearing ensures that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement. A key requirement for successful payment completion is sufficient liquidity on two levels: the payer and the payer's bank.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What does payment clearing mean?

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another.

What is the difference between settlement and clearing?

Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient's or sender's bank account and their bank's reserves.

What is the purpose of a clearing account?

A clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. It's created to just record the income or the expenses before they will move to the retained earnings in the balance sheet.

What is clearing in UK universities?

What is Clearing? Clearing is the system employed by UCAS and UK universities at the end of the academic year to fill course places that haven't been taken. Every year thousands of places are allocated this way, and it's certainly not a case of getting rid of the courses that nobody wants.

What is clearing corporation?

Clearing Corporation. This is an entity associated with a stock exchange that handles the confirmation, settlement, and delivery of shares. It acts as a buyer for the seller and a seller for the buyer. In simpler terms, it facilitates purchase on one end of the transaction and sale on the other.

What is settlement in stock market?

Settlement – where the shares are moved from the seller’s account to the buyer’s account and the money is moved from the buyer to the seller. This is done on T+2 Day.

How long does it take for equity to settle?

Perhaps in T+1 or T+2 day itself. At present, all equity trades are settled on a T+2 basis where investors receives the shares two days after purchase.

Which banks do clearing?

Almost all the banks are do clearing including HDFC Bank, ICICI Bank, SBI, and Axis Bank.

Who is the regulator of T+1 settlement?

SEBI, the market regulator, has recently introduced T+1 settlement cycle. Though it is yet to be implemented, this speeds the process to a whole new level.

Why do regulators have a trading cycle?

To ensure smooth operations and minimal risk, regulators have designed a trading cycle, as well as, a clearing and settlement process. As an investor, you don’t need to get into the technical details of these processes. However, it is important that you understand the working.

What is clearing and settlement?

Clearing and settlement are two important processes that are carried out when executing transactions in financial markets where a range of financial securities can be bought and sold. Clearing and settlement allow clearing corporations to realize any rights obligations, which are created in the process of securities trading, and to make arrangements so that the funds and securities can be transferred accurately in a timely, efficient manner. The article clearly explains how each of these functions falls into the process of securities trading, explains the relationship between the two processes, and highlights the similarities and differences between clearing and settlement.

Why is clearing and settlement important?

It is important that a strong clearing and settlement system is set in place to maintain the smooth securities trading operations within financial markets. Clearing is the second part of the process which will come after the execution of the trade and before the settlement of the transaction. Clearing is where buyers and sellers are matched ...

How does a clearing house work?

Since a large number of trades and transactions occur in financial markets in one day, the clearing house uses an automated system to set off the buy and sell orders so that only a few transactions will actually have to be settled. Once the buyers and sellers are matched and netted accurately, the clearing house will inform the parties to the transaction and make arrangements to transfer the funds to the seller and the securities to the buyer.

What is clearing transaction?

Clearing is where buyers and sellers are matched and confirmed, and transactions are netted down (set of buy with sell transactions) so that only a few transactions will actually have to be completed.

How long does it take to settle a securities transaction?

Settlement will be completed when the clearing corporation transfers ownership of the securities to the buyer and once the funds are transferred to the seller. Stocks and bonds are settled after 3 days from the date of execution; government securities, options and mutual funds settle one day after the execution date and certificates of deposit are usually settled on the same day as the execution.

What is the last stage of the clearing house process?

Settlement is the last stage of the process where the clearing house will transfer the ownership of the securities bought to the buyer and transfer funds in payment to the seller. The main advantage of the clearing and settlement system is the security of the transactions.

How long does it take for a clearing corporation to settle a bond?

Stocks and bonds are settled after 3 days from the date of execution; government securities, options and mutual funds settle one day after the execution date and certificates ...

What is clearing and settlement?

Clearing and settlement process in the financial derivatives markets are: The clearing and settlement process integrates three activities – clearing, settlement and risk management. The clearing process involves arriving at open positions and obligations of clearing members, which are arrived at by aggregating the open positions ...

What is the final settlement price?

The final settlement price is the closing value of the index/underlying security on the expiry day. In case of index/stock options, the buyer/seller of an option is obligated to pay/receive the premium towards the options purchased/sold by him.

What is daily MTM settlement?

Daily MTM settlement of profits/ losses based on the closing price of the futures contract is done on T+1 day . The final settlement is effected for expiring futures contracts and the process is similar to the daily MTM settlement.

What is SEBI portfolio based margining?

The SEBI has stipulated a portfolio-based margining system, which takes an integrated view of overall risk in a portfolio of all futures and options contracts for each client.

What Is Clearing?

Clearing is the procedure by which financial trades settle; that is, the correct and timely transfer of funds to the seller and securities to the buyer. Often with clearing, a specialized organization acts as the intermediary and assumes the role of tacit buyer and seller to reconcile orders between transacting parties. Clearing is necessary for the matching of all buy and sell orders in the market. It provides smoother and more efficient markets as parties can make transfers to the clearing corporation rather than to each individual party with whom they transact.

How does clearing protect the parties involved in a transaction?

The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What is clearinghouse fee?

Clearinghouses charge a fee for their services, known as a clearing fee . When an investor pays a commission to the broker, this clearing fee is often already included in that commission amount. This fee supports the centralizing and reconciling of transactions and facilitates the proper delivery of purchased investments.

What is an ACH clearing house?

An automated clearing house (ACH) is an electronic system used for the transfer of funds between entities, often referred to as an electronic funds transfer (EFT). The ACH performs the role of intermediary, processing the sending/receiving of validated funds between institutions.

Why is clearing necessary?

Clearing is necessary to match all buy and sell orders to ensure smoother and more efficient markets. When trades don't clear, the resulting out trades can cause real monetary losses. The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What happens when a clearinghouse encounters an out trade?

When a clearinghouse encounters an out trade, it gives the counterparties a chance to reconcile the discrepancy independently. If the parties can resolve the matter, they resubmit the trade to the clearinghouse for appropriate settlement. But, if they cannot agree on the terms of the trade, then the matter is sent to the appropriate exchange committee for arbitration .

What happens when an investor sells a stock?

When an investor sells a stock they own, they want to know that the money will be delivered to them. The clearing firms makes sure this happens. Similarly, when someone buys a stock, they need to be able to afford it. The clearing firm makes sure that the appropriate amount of funds is set aside for trade settlement when someone buys stocks.

What is IPS in settlement?

Using all this data, IPS calculates the total amount owed by each issuer and each acquirer. This function of Clearing process is crucial for the final stage of the Settlement process, as reconciliation files are generated on this basis. If the transaction was not received at the Clearing stage, it is not added to batch with all following consequences.

How long does authorization block on credit card?

The result of authorization is funds blocking on the customer’s card for up to 7 days for debit cards and 28 days for credit cards. This gives time to make sure that the customer’s card is valid and that the customer is not a fraud. This operation is free of charge and can be cancelled at any time for free. It is impossible to create a chargeback for this operation, since there was neither the Clearing fact, nor the Settlement fact, and the funds did not actually move. However, this operation can receive a fraud mark.

What is DMS transaction?

DMS transactions usually require a physical or virtual signature to be verified. This category includes credit card transactions (except for cases when credit cards are used to dispense cash at ATMs) and debit card transactions with signature authentication. When the acquirer`s card processing system receives an authorization message, it creates an authorization record through Electronic Draft Capture (EDC). The EDC record is then stored in the batch until Merchant initiates batch processing (at least once a day).

What Is Clearing?

- When an individual or business initiates a wire transfer, clearing begins the fund delivery process. First, the sender’s bank submits payment instructions to an interbank clearing network. These include each currency’s interbank settlement network along with systems dedicated to clearing. The Clearing House Interbank Payments Systems, known as CHIPS, is privately operated by The …

What Is Settlement?

- Banks can begin the settlement phase either immediately after clearing has taken place or later on. Most payment systems, CHIPS included, send a final settlement wire at the end of the business day to initiate this process. Unlike clearing, only a settlement network can facilitate settlement. If a clearing system like CHIPS has been handling the transaction, CHIPS will send t…

What Are The Differences Between Settlement and Clearing?

- One primary way in which clearing and settlement differ is that clearing determines the commitments of the funds and settlement is how banks do a final true-up with each other. Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the reci...

Moving Forward

- For accurate monitoring of payment rails, banks understand the nuances of terms like clearing and settlement to ensure precise accounts. For businesses working with banks, what’s most useful about noting the difference between these terms is that using the proper terminology can help clear up communication when talking about payments. If you're interested in consolidating …