What is the difference between clearing and settlement?

Clearing: The buyer and the seller receive documentation to establish their obligations. The clearing process occurs before settlement begins. Settlement: The settlement process involves the delivery of securities from the seller to the buyer and the delivery of funds from the buyer to the seller.

What is the settlement process in finance?

Settlement Process Overview In the financial industry, settlement is generally the term applied to the exchange of payment to the seller and the transfer of securities to the buyer of a trade. It’s the final step in the lifecycle of a securities transaction.

What is the meaning of “securities settlement”?

– Final transfer of securities (“delivery”) in exchange for final transfer of funds (“payment”) in order to settle the obligations. To learn more about the securities settlement and clearing processes attend a course in London: International Securities Settlement & Custodial Services

What is clearing and when does it occur?

Clearing occurs after trades have been confirmed. Clearing is the process involving the computation of the obligations of the counterparties to make deliveries or to make payments on the settlement date.

What is the clearing and settlement process?

The clearing and settlement process is divided into three: Trade Execution – where the buy or sell order is executed by you. This happens on T Day. Clearing – where the responsible entity identifies the number of shares that the seller owes and the amount of money that the buyer owes for every trade.

What do you mean by clearing of securities?

Clearing is the process of reconciling an options, futures, or securities transaction or the direct transfer of funds from one financial institution to another.

What's the difference between settlement and clearing?

Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient's or sender's bank account and their bank's reserves.

What is settlement of securities transactions?

In the context of securities, settlement involves their delivery to the beneficiary, usually against (in simultaneous exchange for) payment of money, to fulfill contractual obligations, such as those arising under securities trades. Nowadays, settlement typically takes place in a central securities depository.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

Who are involved in clearing process?

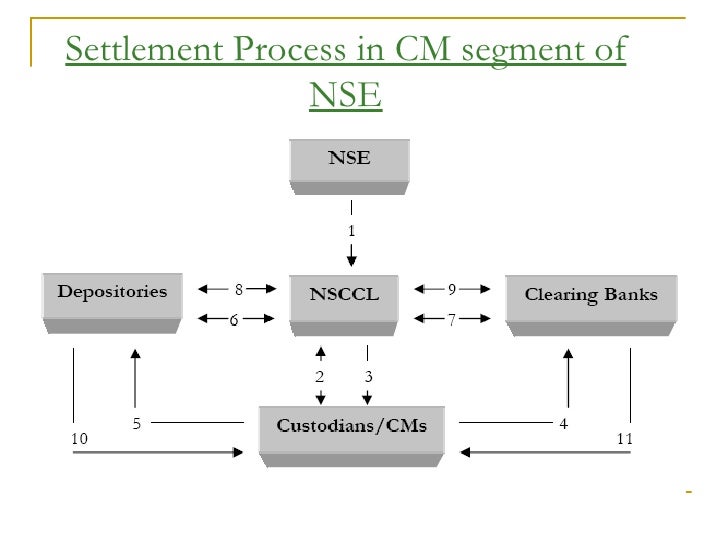

Several entities, like clearing corporation, clearing members, custodians, clearing banks, depositories, are involved in the process of clearing.

Why is clearing and settlement important?

Clearing and settlement Clearing is necessary because the speed of trade is much faster than the cycle time for completing the transaction. In its widest sense, clearing ensures that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement.

What are the various types of clearing?

For example, In India, the cheques are cleared in the clearing houses managed by RBI or the reserve bank of India....The types of clearing are as follows:Outward House Clearing. ... Inward House Clearing. ... Return House Clearing.

How does a clearing system work?

When a buyer purchases securities, options, or futures, the clearing process validates the transaction. A clearing house ensures that there are sufficient funds to complete the purchase, and the transfer is recorded before the security or funds are delivered to the buyer's account.

What is the difference between DTC and FED settlement?

For settlement in DTC and NSCC, the cash settlement is performed at the end of the processing day, on a net basis. For settlement in Fedwire Securities, the cash settlement is performed transaction by transaction during the day.

What are the types of settlement?

The four main types of settlements are urban, rural, compact, and dispersed. Urban settlements are densely populated and are mostly non-agricultural. They are known as cities or metropolises and are the most populated type of settlement. These settlements take up the most land, resources, and services.

What is clearing in investment banking?

Clearing is a process by which financial transactions are settled. That is the accurate and timely transfer of funds to a seller and a buyer's securities.

What is meant by clearing in banking?

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another.

Who acts as a clearing house of securities?

A clearing house is an intermediary between buyers and sellers of financial instruments. It is an agency or separate corporation of a futures exchange responsible for settling trading accounts, clearing trades, collecting and maintaining margin monies, regulating delivery, and reporting trading data.

What is the difference between clearing and execution?

When discussing trades, clearing means placing the actual trade with the exchange. This can only be done by a clearing broker who works for the exchange, not an executing broker, who works for a brokerage. Execution is when the trade is finalized by being "cleared" through the exchange.

What does clearing and custody mean?

A clearing firm is a firm that handles orders to buy and sell securities, in addition to maintaining custody of those securities. USA Financial Securities has formed a strategic relationship with Pershing, LLC to execute, clear and custody the assets of clients.

What is clearing of securities?

Clearing is the process involving the computation of the obligations of the counterparties to make deliveries or to make payments on the settlement date. The settlement instructions are then communicated to central securities depositories and to custodians that many investors use for the safekeeping of their securities.

What is settlement registration?

Settlements Registration. Many settlement systems have associated “registri es” in which the ownership of securities is listed in the records of the issuer. Registrars typically assist issuers in communicating with securities owners about corporate actions, dividends, etc.

Why are netting arrangements becoming more common in securities markets with high volumes of trades?

Netting arrangements are becoming more common in securities markets with high volumes of trades because properly designed netting significantly reduces the gross exposures in such markets.

How does clearance work?

Clearance usually occurs in one of two ways: Many systems calculate the obligations for every trade individually . This means that clearance occurs on a gross or trade-for-trade basis. In other systems, the obligations are subject to netting. In some markets, a central counterparty interposes itself between the two counterparties to ...

What is final transfer of security?

Final transfer of a security by the seller to the buyer constitutes delivery, and final transfer of funds from the buyer to the seller constitutes payment. When delivery and payment have occurred, the settlement process is complete.

Is clearing and settlement of securities complex?

So even while the principles involved in the clearing and settling of securities may be simple and fairly easily understood, their inner working are far more complex. Local and international permutations can be highly complex in terms of process, practice and principle.

How does clearing protect the parties involved in a transaction?

The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What Is Clearing?

Clearing is the procedure by which financial trades settle; that is, the correct and timely transfer of funds to the seller and securities to the buyer. Often with clearing, a specialized organization acts as the intermediary and assumes the role of tacit buyer and seller to reconcile orders between transacting parties. Clearing is necessary for the matching of all buy and sell orders in the market. It provides smoother and more efficient markets as parties can make transfers to the clearing corporation rather than to each individual party with whom they transact.

What is clearinghouse fee?

Clearinghouses charge a fee for their services, known as a clearing fee . When an investor pays a commission to the broker, this clearing fee is often already included in that commission amount. This fee supports the centralizing and reconciling of transactions and facilitates the proper delivery of purchased investments.

What is an ACH clearing house?

An automated clearing house (ACH) is an electronic system used for the transfer of funds between entities, often referred to as an electronic funds transfer (EFT). The ACH performs the role of intermediary, processing the sending/receiving of validated funds between institutions.

How much margin is needed to hold an index futures contract overnight?

As a hypothetical example, assume that one trader buys an index futures contract. The initial margin required to hold this trade overnight is $6,160. This amount is held as a "good faith" assurance that the trader can afford the trade. This money is held by the clearing firm, within the trader's account, and can't be used for other trades. This helps offset any losses the trader may experience while in a trade.

Why is clearing necessary?

Clearing is necessary to match all buy and sell orders to ensure smoother and more efficient markets. When trades don't clear, the resulting out trades can cause real monetary losses. The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What happens when a clearinghouse encounters an out trade?

When a clearinghouse encounters an out trade, it gives the counterparties a chance to reconcile the discrepancy independently. If the parties can resolve the matter, they resubmit the trade to the clearinghouse for appropriate settlement. But, if they cannot agree on the terms of the trade, then the matter is sent to the appropriate exchange committee for arbitration .

What is clearing and settlement?

Clearing and settlement are two important processes that are carried out when executing transactions in financial markets where a range of financial securities can be bought and sold. Clearing and settlement allow clearing corporations to realize any rights obligations, which are created in the process of securities trading, and to make arrangements so that the funds and securities can be transferred accurately in a timely, efficient manner. The article clearly explains how each of these functions falls into the process of securities trading, explains the relationship between the two processes, and highlights the similarities and differences between clearing and settlement.

Why is clearing and settlement important?

It is important that a strong clearing and settlement system is set in place to maintain the smooth securities trading operations within financial markets. Clearing is the second part of the process which will come after the execution of the trade and before the settlement of the transaction. Clearing is where buyers and sellers are matched ...

How does a clearing house work?

Since a large number of trades and transactions occur in financial markets in one day, the clearing house uses an automated system to set off the buy and sell orders so that only a few transactions will actually have to be settled. Once the buyers and sellers are matched and netted accurately, the clearing house will inform the parties to the transaction and make arrangements to transfer the funds to the seller and the securities to the buyer.

What is clearing transaction?

Clearing is where buyers and sellers are matched and confirmed, and transactions are netted down (set of buy with sell transactions) so that only a few transactions will actually have to be completed.

How long does it take to settle a securities transaction?

Settlement will be completed when the clearing corporation transfers ownership of the securities to the buyer and once the funds are transferred to the seller. Stocks and bonds are settled after 3 days from the date of execution; government securities, options and mutual funds settle one day after the execution date and certificates of deposit are usually settled on the same day as the execution.

What is the last stage of the clearing house process?

Settlement is the last stage of the process where the clearing house will transfer the ownership of the securities bought to the buyer and transfer funds in payment to the seller. The main advantage of the clearing and settlement system is the security of the transactions.

How long does it take for a clearing corporation to settle a bond?

Stocks and bonds are settled after 3 days from the date of execution; government securities, options and mutual funds settle one day after the execution date and certificates ...

What is the process of clearing and settlement?

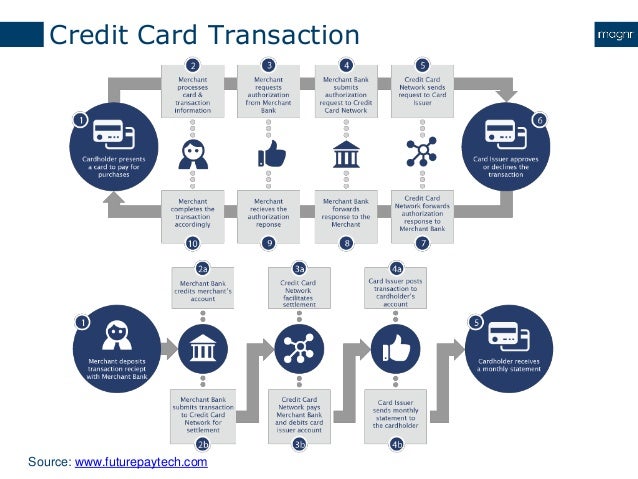

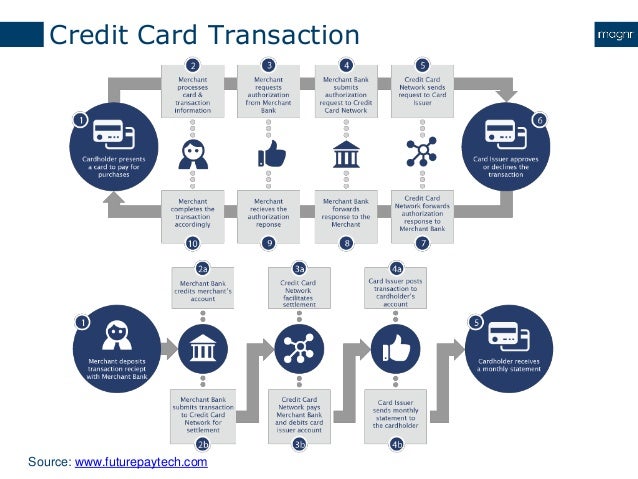

Execution, Clearing, and Settlement. Any transfer of financial instruments, such as stocks, in the primary or secondary markets involves 3 processes: Execution is the transaction whereby the seller agrees to sell and the buyer agrees to buy a security in a legally enforceable transaction. All processes leading to settlement is called clearing, ...

What is settlement in securities?

Settlement is the actual exchange of money, or some other value, for the securities. Clearing is the process of updating the accounts of the trading parties and arranging for the transfer of money and securities. There are 2 types of clearing: bilateral clearing and central clearing. In bilateral clearing, the parties to the transaction undergo ...

What is bilateral clearing?

In bilateral clearing, the parties to the transaction undergo the steps legally necessary to settle the transaction. Central clearing uses a third-party — usually a clearinghouse — to clear trades. Clearinghouses are used by the members who own a stake in the clearinghouse. Members are often broker-dealers.

Why do clearinghouses require collateral?

Because it takes time to settle a trade and to protect the financial integrity of the clearinghouses, clearinghouses require collateral from member firms. Member firms must post collateral depending on. Because trading volume and risk changes every day, firms must adjust their collateral at the clearinghouse daily.

Why do firms have to adjust their collateral at the clearinghouse?

the firm’s financial condition. Because trading volume and risk changes every day, firms must adjust their collateral at the clearinghouse daily. Clearinghouses even provide tools to their member firms so that they can anticipate the daily changes of collateral requirements.

What is a clearinghouse in derivatives?

For options and futures and other types of cleared derivatives, the clearinghouse acts as a counterparty to both the buyer and the seller, so that transactions can be guaranteed, thereby virtually eliminating counterparty risk.

What happens when a clearinghouse becomes insolvent?

If a member firm becomes financially insolvent, only then will the clearinghouse make up for any shortcomings in the transaction. For transferable securities, the clearinghouse aggregates the trades from each of its members and nets out the transactions for the trading day.

What happens at clearing?

With clearing, the net securities and net amount is arrived at. So suppose you have purchased 1000 shares of company A and then sold 100 shares and then sold 100 shares again. While doing this, you had spend Rs 1000 in buying and you received Rs 100 for selling and Rs 100 again for selling. So overall at the clearing stage, net obligation is that you have purchased 800 shares and you spend Rs 800. This is what happens at clearing.

Where are trades settled?

After the trades are cleared (clearing might be done by a clearing house), they are settled in a depository (such as NSDL -National Securities Depository Limited or CDSL – Central Depository Services Limited in Indian markets)

Depository Trust Company

- The Depository Trust Company, or DTC, is one the largest securities depositories in the world. The DTC facilitates the clearing and settlement of securities transactions. It does this by maintaining a “book-entry” system. This is an electronic method of recordkeeping, as opposed to issuing physi…

Euroclear and Clearstream

- In Europe, the two largest clearing systems are Euroclearand Clearstream. Similar to the DTC in the United States, Euroclear and Clearstream provide settlement services for securities. Both services operate electronic book-entry transfer systems. This eliminates the need for physical certificates. A series of steps facilitate cross-market deals between DTC and Euroclear or Clears…

Trading Mechanics of Clearing and Settling Debt Securities

- There are two methods of transferring securities between brokers/dealers and the DTC—the Deposit/Withdrawal At Custodian (DWAC)process and the Direct Registry System (DRS). Both use the FAST system. The electronic format of securities transfers provides investors with efficiency and cost savings. Both systems enable the holding of securities “on the books” of a transfer age…

Confirmation of Trade Details

- The confirmation of trade occurs between direct market participants and indirect market participants (institutional investors and foreign investors or their agents). This first step in the clearing and settlement process is to make certain that the counterparties to the trade (the buyer and the seller) agree on the terms, that is, the security involved, the price, the amount to be exch…

Clearance

- Clearing occurs after trades have been confirmed. Clearing is the process involving the computation of the obligations of the counterparties to make deliveries or to make payments on the settlement date. The settlement instructions are then communicated to central securities depositories and to custodians that many investors use for the safekeeping...

Delivery Versus Payment

- This relates to the linkage of transfer instructions by a securities transfer system and a funds transfer system and often involves several stages during which the rights and obligations of the buyer and the seller are significantly different. Very often accounts may have been debited or credited, but the transfer remains provisional, and one or more parties may hold the right by law …

Settlements Registration

- Many settlement systems have associated “registries” in which the ownership of securities is listed in the records of the issuer. Registrars typically assist issuers in communicating with securities owners about corporate actions, dividends, etc.

Safekeeping Or Custody

- This is an ongoing part of thesecurities settlement process after the final settlement of a trade. While securities are normally held in a CSD, many of the ultimate holders of securities are not direct members of these depositories. Rather, investors establish “custody” relationshipswith depository members, who provide safekeeping and administrative services related to the holdin…

Securities Settlement and Custodial Services Program

- To learn more about the securities settlement and clearing processes attend a course in London: International Securities Settlement & Custodial Services. Eureka Financial offers over 100 public and in-house training courses in banking and finance, corporate finance and M&A, risk management, operations, investments, wealth management, soft skills and management. For m…