Credit card settlement is basically a mutual agreement between the credit card holder and the bank/credit card issuer that helps the credit card holder when it becomes too difficult for him/her to keep up with the credit card dues. This might be because of multiple reasons, from actual financial emergencies to reckless expenses on credit cards.

Which is the best credit card offer in India?

Top 10 Credit Cards in India – Features & Benefits

- FinBooster: YES Bank - BankBazaar Co-branded Credit Card. ...

- IndusInd Bank Platinum Aura Edge Visa Credit Card. ...

- YES Prosperity Edge Credit Card. ...

- RBL Bank Shoprite Credit Card. ...

- Standard Chartered Platinum Rewards Credit Card. ...

- Indian Oil Citi Credit Card. ...

- HDFC Freedom Credit Card. ...

- Axis Bank Neo Credit Card. ...

- Yatra SBI Credit Card. ...

How to get a credit card fast in India?

Top 10 things to check before getting a credit card in India

- Find the usage purposes of the credit card. ...

- Choose the right type of credit card. ...

- Know your credit limit. ...

- Find out the grace period. ...

- Annual percentage rate (APR) APR is nothing but the interest rate applied to the remaining unpaid amount or balance after the grace period is completed.It varies with the banks and ...

Should I accept a credit card settlement?

You should, however, avoid debt settlement companies. To get the ball rolling, you (or your attorney) should contact the creditor and make an offer to settle the debt. A credit card company might accept a settlement if you're very delinquent on your payments.

How to pay your rent with credit card in India?

How to pay rent online on a platform like Paytm?

- Visit the Rent Payment page on Paytm

- Select your city and society

- Enter all the necessary details

- Tap on ‘Proceed’ to check your rent

- Select ‘Credit card’ as the mode of payment and pay

How to settle credit card debt?

You can negotiate a settlement with a bank over the outstanding credit card dues by convincing the lender to cut down on the interest portion of the bill. However, the settlement agreement you sign with the lender mandates you to pay off the entire principal amount due. After you pay the due on which you and your lender agreed upon, it’s time to get the settlement letter from the bank stating the agreed amount being paid by you.

How much paise to settle with collection company?

Negotiate with the collection company try to settle with forty paise in one rupee or less.

How to convince someone to settle for less than what you owe?

Also, list who you else you owe money to. This way you can present a legitimate reason why they should accept your offer to settle for less than what you owe. You need to be sincere in explaining your situation to them and that your debt to them is creating undo hardship and stress. They need to believe that getting the full amount owed is unlikely; that a settlement is the best way to prevent a complete loss.

Where can I complain about RBI?

If you not received any reply from hdfc then you may complaint RBI RBI Banking Ombudsman . RBI setup 15 Banking Ombudsman offices through out India. You can complaint at your region officer where there is full details of such officer who responsible to take your complaint.

What happens if you settle for $300 and file 1099?

So if you owed $1000 and settled for $300, then the forgiven amount is $700. Conversely, this is treated as income to you. Now $600 of the $700 is not reported in regards to your taxes. However, you will be obligated to declare the difference ($100) when filing your yearly tax return. Publication 4681 (2015), Canceled Debts, Foreclosures, Repossessions, and Abandonments

Do settlement companies report remaining balance in credit report?

Sometimes even after settlement collection company report remaining balance in credit report that's when your written proof will work when you gonna dispute that in credit bureaus.

Can you agree to a payment plan if your income is not steady?

You can tell them that your monthly income is not steady and therefore can't agree to a payment plan. Tell them that you can pay "x" amount in one lump sum. Start lower than what you can actually afford. This will allow some room for negotiation.

How does a credit card settlement affect your credit score?

During a settling of debt the creditor which is the bank updates it in the credit report of the person , and then the report shows the status as either “Paid settled“ or “settled". Any payment status different to “Paid as agreed” or “fully paid” can have damaging effect on the person's credit. Though the Status of “Paid Settled” is way better than the status showing “Unpaid" But now as the person is not fully paying back so the case of credit card settlement can have a negative impact on the credit score. There are many factors which tend to affect the credit so the exact effect can vary in reference to the other information of your credit report.

How many points does a 780 credit score lose?

On the other hand, it is supposed that a person has a credit score of 780 and has no other late payments then he/she will tend to lose 140 -160 points. So this shows how credit score get affects by the settlement.

What is the information on a credit report?

The information and status of a person's account is listed on credit report, and it includes the information that if the payments made by the person were on time, late or is the account closed and so.

Does credit scoring provide the base?

Credit Scoring companies do not provide the base or derivation of how to calculate the credit score, it might contain such type of calculation and metrics which may affect the credit score to a great extent. To understand this let us take a hypothetical situation with two different candidates with different scores.

What is clearing and settlement?

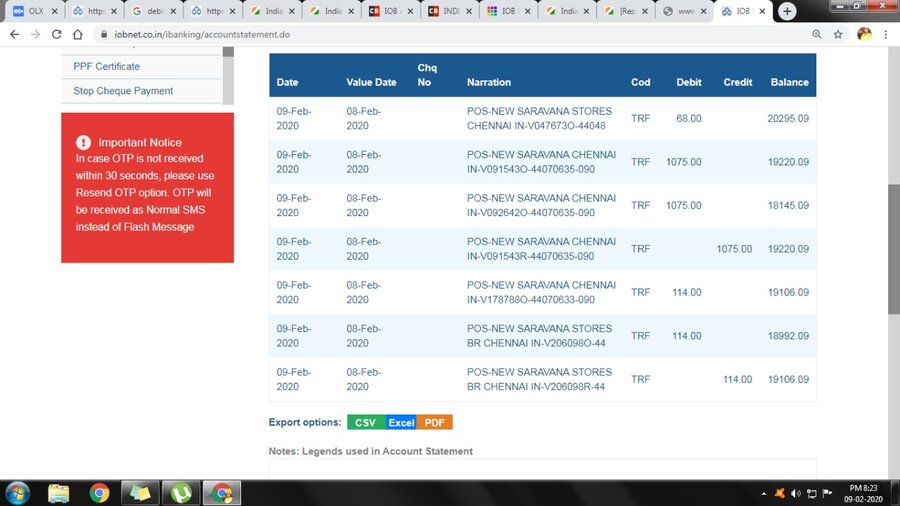

So to start with, clearing and settlement in financial service industry refers to all activities from the time a commitment is made for a transaction until it is settled. So the transactions which has been successfully authorized by Issuing Bank has to be settled before sales can be deposited into the merchant’s bank account. When it comes to Credit card settlement, this is usually being done in three stages:

What is clearing a card?

Clearing: Through this process Issuing Bank exchanges transaction information with the Acquiring Bank. After successful reconciliation with the merchant, Acquiring Bank generates outgoing settlement file for various Card schemes/networks (MasterCard ,Visa etc.).These Card networks then further break these files into clearing files and is sent to different Issuing banks.

What is credit card 101?

Credit card 101: Clearing and settlement While the first article covered the basics of authorization process ,this article delves into the second leg of credit card transaction lifecycle :Clearing and settlement which essentially involves reconciliation and transfer of funds among Issuer, Acquirer and merchant. #payments #creditcardtransactionprocessing

What happens when acquiring bank receives a merchant batch?

Once the Acquiring Bank receives the merchant batch, it performs the reconciliation with their own transaction log for this merchant. If the information is validated, then the Acquiring Bank sends a confirmation message to the merchant.

What is a transaction submitted?

Generally transactions are submitted electronically and all POS /virtual payment handling systems are modified to naturally do that at pre-characterized stretches. Generally toward the finish of the business day, the vendor terminal makes a batch of the multitude of transactions finished during the day and sends the equivalent to the acquirer.

What is the second leg of the credit card life cycle?

I ended the previous article by mentioning that obtaining an authorization is just the first step and in this article I would be explaining the second leg of the Credit card transaction life cycle, that is Clearing and Settlement. Technically, the authorization leg is also called BASE 1 and clearing/settlement leg is called BASE 2 .If you haven't read the article on authorization process, I would recommend you to go through that first. Here is the link for the same.

Does an issuance bank charge an exchange fee?

Issuing Bank also levies an Interchange fees on the Acquirer and adjust the same while transferring the fund to Acquirer. We have to remember that when it comes to credit card, it's an unsecured line of credit and eventually any bad debt or fraud transaction is going to fall on Issuer's book and Interchange fees helps the Bank in covering those risks.

What is a credit card settlement process?

Advertisements from credit card debt settlement companies suggest that you can use the credit card settlement process to get out of debt for just pennies on each dollar owed. But like all things that sound too good to be true, there are many potential downsides to credit card settlement that you should be aware of before entering a credit card settlement process.

How much can a credit card company settle?

Sometimes the credit card settlement process is effective, and consumers can settle their debt for anywhere between 25% and 80% of the original amount they owed. But other times, credit card companies may refuse to settle and may take consumers to court instead.

How to settle credit card debt without damaging credit?

When consumers want to know how to settle with credit card companies without damaging their credit rating, we typically recommend a debt management program . Debt management involves setting a budget you can live with while you continue to pay down your debt over time. For a small fee, we’ll take responsibility for paying all your bills on time – you just have to make one payment to an account with ACCC each month and we’ll take care of the rest. We’ll also work to seek reductions in interest rates, finance charges, and late fees to help you pay down your debt more quickly.

What happens if you stop paying your credit card bills?

You stop paying your monthly credit card bills. The money that you would have paid your creditors goes into a savings account, usually managed by a debt settlement agency. After several months, when your credit card account is significantly overdue, your settlement agency approaches your credit card company and proposes to settle your debt ...

Does the credit card settlement process affect your credit rating?

Because you must stop paying your bills in order to make debt settlement more attractive to your creditors, your credit rating will inevitably be severely damaged. In fact, it may take as long as seven years before you can apply for loans, credit cards, mortgages, and credit.