What does DTC stand for?

Depository Trust Company (DTC) The DTC or Depository Trust Company is one of the world's largest securities depositories. Learn how the DTC lowers risks and costs for investors.

What is held at DTC?

DTC holds the deposited securities in “fungible bulk,” meaning that there are no specifically identifiable shares directly owned by DTC participants. Rather, each participant owns a pro rata interest in the aggregate number of shares of a particular issuer held at DTC.

What is the definition of DTC?

The disability tax credit (DTC) is a non-refundable tax credit that helps persons with disabilities or their supporting persons reduce the amount of income tax they may have to pay. An individual may claim the disability amount once they are eligible for the DTC.

How does DTC work?

How does BMW DTC work? The DTC feature brought by BMW works by making stabilization measures when the wheels start losing traction. Such a feature starts working by curbing the engine output. As it does so, it also stops the slip on the wheels. This function is also possible to turn on and off, depending on the driver’s preference.

See more

What does DTC settlement mean?

The Depository Trust and Clearing CorporationThe Depository Trust and Clearing Corporation (DTCC) is a financial services company that provides clearing and settlement services for the financial markets. The DTCC settles most securities transactions in the U.S. Settlement is integral to securities transactions.

What does DTC mean in banking?

Depository Trust CompanyThe Depository Trust Company (DTC), DTCC's central securities depository subsidiary, provides depository and book-entry services and operates a securities settlement system.

How does a DTC transfer work?

What Is a Depository Transfer Check? A depository transfer check (DTC) is used by a designated collection bank to deposit the daily receipts of a corporation from multiple locations. Depository transfer checks are a way to ensure better cash management for companies, which collect cash at multiple locations.

How does DTCC settlement work?

Settlement at DTC occurs business day at approximately 4:15 p.m. eastern standard time. This is when the cash is moved through the Federal Reserve Bank of New York on behalf of all of the transactions that were processed and completed that day.

How long does DTC transfer take?

Under the "ACATS for Banks" program initiated by DTCC in February 1999, banks may voluntarily participate in ACATS. If a bank participates in the program, then a transfer from the participating bank to a brokerage firm or vice a versa should occur in the standard ACATS time frame of six business days.

What is DCT payment?

Though the direct cash transfers (DCT) plan proposed in India does not explicitly recognise financial inclusion as its objective, the basic building blocks for this link to be a success are already there, ie, strong policy push for financial inclusion, payments infrastructure, etc.

How do you become eligible for DTC?

Eligibility requirements include that the securities must be; issued in a transaction registered with the U.S. Securities and Exchange Commission (“SEC”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”); or issued in a transaction exempt from registration pursuant to a '33 Act exemption, that ...

What is the difference between DTC and FED settlement?

For settlement in DTC and NSCC, the cash settlement is performed at the end of the processing day, on a net basis. For settlement in Fedwire Securities, the cash settlement is performed transaction by transaction during the day.

How does DTC make money?

The DTC holds trillions of dollars worth of securities in custody, including corporate stocks and bonds, municipal bonds, and money market instruments. It settles funds at the end of each trading day using the National Settlement Service.

What is settlement process?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

What is DTC eligible?

DTC Eligibility means that a public company's securities are able to be deposited through DTC. DTC is the largest securities depository in the world and holds over thirty-five trillion dollars worth of securities on deposit. DTC accepts deposits of securities from its participants only, who are usually clearing firms.

What is direct transfer of cleared cash?

Cleared funds are money that has been fully transferred from one account to another, for example after depositing a check. Cleared fund are available for immediate withdrawal or use. Payments and money transfers take time to clear, especially if the originator uses a different bank than the receiver of the funds.

What does DT mean on a money order?

A "DT" decline code means that you have already charged the same credit card, for the same amount, with the same invoice number within the last 10 minutes. It's essentially a duplicate transaction.

What is DTC settlement?

DTC’s Settlement Service for equity, corporate debt and municipal debt securities transactions consolidates and facilitates end-of-day net funds settlement of a participant’s net debits and credits.

What is a DTC?

The Depository Trust Company (DTC), the central securities depository subsidiary of DTCC, provides settlement services for virtually all broker-to-broker equity and listed corporate and municipal debt securities transactions in the U.S., as well as institutional trades, money market instruments and other financial obligations. Settlement, a consolidated end-of-day process and the final step of a securities trade, completes the transfer between trading parties of securities ownership and cash.

What is the end of day net funds settlement?

End-of-day net funds settlement is conducted through settling banks that act on behalf of participants, so that funding occurs via a single transmission, called the National Settlement Service (NSS), to the Federal Reserve.

What is DTCC learning?

DTCC Learning offers comprehensive, fast-track training for DTCC customers of financial services organizations who are looking to expand their expertise and abilities in using the post-trade processing products and services provided by DTCC’s subsidiaries.

What is a broker in a DTC?

A broker is an intermediary who. is listed in the ownership records of the Depository Trust Company. The transfer agents maintain the records of the issuers on which Cede & Co., the nominee of the DTC, is recorded as the registered owner. The legal title lies with the DTC, whereas the investor holds the shares indirectly.

What is a DTCC?

Depository Trust and Clearing Corporation (DTCC) The Depository Trust and Clearing Corporation (DTCC) is a US-based corporation that acts as a centralized clearing and settlement company for different. .

What is a broker in a depository trust?

A broker is an intermediary who#N#is listed in the ownership records of the Depository Trust Company. The transfer agents maintain the records of the issuers on which Cede & Co., the nominee of the DTC, is recorded as the registered owner.

What is clearing house?

Clearing House A clearing house acts as a mediator between any two entities or parties that are engaged in a financial transaction. Its main role is to ensure that the transaction goes smoothly, with the buyer receiving the tradable goods he intends to acquire and the seller receiving the right amount paid

What is the difference between street name and DTC?

The legal title lies with the DTC, whereas the investor holds the shares indirectly. The street name method of holding any security is the least expensive, and the risk associated is also lower.

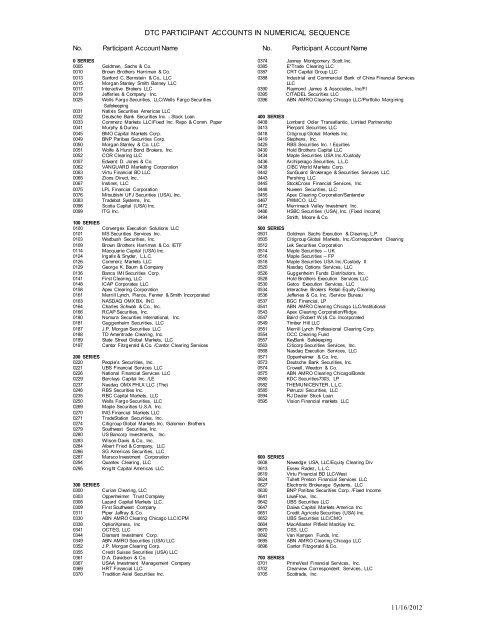

Who are the participants in the DTC?

The majority of the large banks and broker-dealers in the U.S. are participants in the DTC. Hence, they occur as sole registered owners for securities deposited and held by them at the DTC. The brokers and dealers, participants of the DTC, own a pro-rata interest in the shares held by issuers at the DTC.

Is direct registration more expensive than holding a security in a street name?

The direct registration method of holding any security is more expensive than holding a security in a street name; however, the risk associated is still lower. 3. Physical Certificate. An investor can hold a security in physical form as a certificate; however, it is a more expensive and high-risk option.

What is a DTC?

The Depository Trust Company (DTC) offers a wide array of services for processing corporate action events for the approximately 1.3 million active securities eligible at the depository. These services include announcing details of upcoming events and providing participants with information about their entitlements, accepting and acting on their instructions, and collecting, allocating, and reporting payments across various corporate action event types, including distributions, redemptions, and reorganizations.

What is DTC in banking?

Through its suite of Securities Processing services The Depository Trust Company (DTC) provides its participant firms a range of safekeeping and processing services for various types of securities. Securities Processing services deliver efficient and cost-effective solutions for deposits, withdrawals, electronic direct registration and custody.

What is DTC issuer services?

DTC's Issuer Services provide an array of central communication and information resources for depository-eligible securities that facilitate outreach by issuers to shareholders. Through its efficient, cost-effective and risk-mitigating offerings, Issuer Services help achieve timely and accurate communication among interested parties with respect to securities held and serviced at DTC.

What is underwriting in DTC?

Underwriting is the entry point for depository and book-entry transfer services at The Depository Trust Company (DTC). Services offered through the Underwriting group offer efficiencies in the capital markets and reduce risk to participants by automating and facilitating the distribution and settlement of new and secondary issues.

What is agent services?

Agent Services is the entry point for transfer agents at DTC. In order to establish a relationship with DTC, agents must first become DTC-eligible. The links below provide information and documentation that agents must complete in order to become DTC-eligible agents, FAST agents, and eligible for DTC's Direct Registration System (DRS). The Issuer Services link provides access to an array of central communication and information resources for depository-eligible securities that facilitate outreach by issuers to shareholders.

What is settlement in securities?

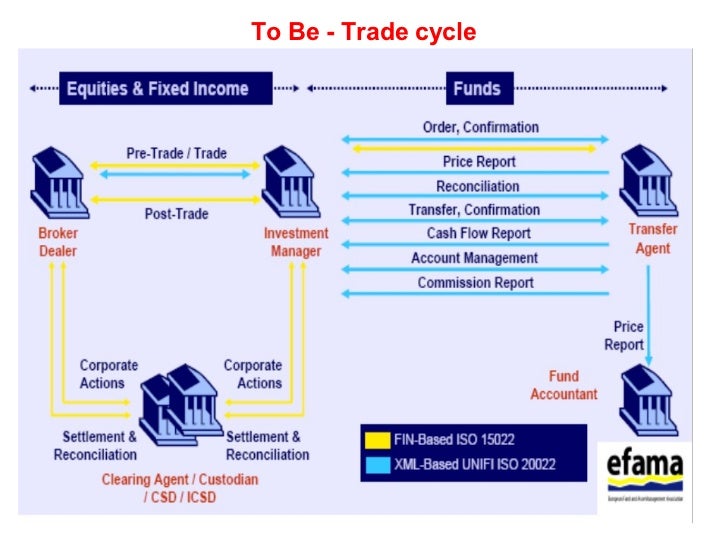

Settlement, a consolidated end-of-day process and the final step of a securities trade, completes the transfer between trading parties of securities ownership and cash. DTC, the central securities depository subsidiary of DTCC, provides settlement services for virtually all broker-to-broker equity and listed corporate and municipal debt securities transactions in the U.S., as well as institutional trades, money market instruments and other financial obligations.

What is global tax?

Global Tax Services offers a variety of services for both domestic and international clients including services to provide tax relief on non-U.S. securities, withholding tax services on U.S.-sourced income paid to non-U.S. institutions and a tax reporting data service. The offerings are as follows:

Products and Services Menu

Click on the boxes below to learn about the transaction types and activities that make up the settlement process.

Inventory Management System

The Inventory Management System provides you with the ability to manage when and in what order deliveries from your inventory should be attempted. IMS is a service offered to you as a deliverer. Inventory is the number of shares you have available to meet your deliveries.

Record Formats Messages

Clients may submit their transactions to DTC via ISO 15022 Messaging and Batch Files. Batch files utilize a CCF (Computer to Computer File Transmission, a proprietary format) and MQ Series. For more information contact [email protected] .

Settlement Web

The Settlement Web is DTC's primary Settlement user interface. Clients have the ability to view their settlement activity as well as to submit transactions to DTC for end of day money settlement.

SMARTTrack Services

SMART/Track provides a centralized communications hub for the transmission of various message types between clients.

What time does DTC settlement occur?

Settlement at DTC occurs business day at approximately 4:15 p.m. eastern standard time. This is when the cash is moved through the Federal Reserve Bank of New York on behalf of all of the transactions that were processed and completed that day.

What type of money market instrument is eligible for settlement at DTC?

There are 14 types of Money Market Instruments (MMIs) that are eligible to settle at DTC and they include Corporate Commercial Paper, Municipal Commercial Paper, Medium Term Notes, Institutional Certificates of Deposits and several others . Commercial Paper has the shortest maturity dates and is the most active from an issuance and maturing perspective since it allows corporate issuers to determine their cash flow needs on a daily basis if necessary. Key participants in the MMI space include:

What is DTC new issue?

The New Issue Eligibility program allows underwriters and other DTC Participants to submit eligibility requests for new and secondary security offerings. Once DTC makes an eligibility determination and accepts the securities for depository and book-entry services, the securities can be distributed quickly and efficiently. These securities are then available for the full range of DTC deposit and book-entry services. Lead managers, underwriters, placement agents and other market players that are DTC participants can use the service. In addition, firms that are not direct participants but maintain a clearing relationship with a DTC participant can use the service as a correspondent; however, the Participant through which the securities are introduced to DTC remains responsible for all activities within its account.

What is DTC transaction?

DTC acts upon instructions received directly from its clients and/or their service providers. The main transaction types processed by DTC on behalf of its clients include Deliver Orders (including stock loans and returns, bank-to-broker customer transfers, etc.), Payment Orders and Collateral Loans.

What is ATP in DTC?

The Account Transaction Processor (ATP) is one of the U.S. security industry’s most critical transaction processing systems and has been the core books and records of DTC for over 30 years. This mission-critical application maintains industry participant positions and risk management controls for the U.S. marketplace. The two main DTC risk management controls are the collateral monitor, which ensures that DTC participants maintain sufficient collateral in the form of cash or securities to cover their debit balances, and net debit caps, which ensure that DTC has sufficient liquidity to complete EOD settlement in the event that a DTC participant fails to pay its end-of-day obligation. ATP processes all settlement related security movements between counterparties, including NSCC’s Continuous Net Settlement Service. ATP annually handles over 350 million transactions valued at over $142 trillion and generates an activity audit trail for reconciliation and reporting.

How long does it take for DTC to process a security?

DTC, as the depository for all equity, municipal and corporate debt, including money market securities, in the U.S., receives instructions from a variety of organizations to process the movement of a security throughout a 23 hours per day, 5 days per week processing window. The key providers of these movements include NSCC, Omgeo, ...

What is a DTC?

It’s the final step in the lifecycle of a securities transaction. DTC is the central securities depository for equity securities, such as common stock, as well as municipal and corporate debt securities, including money market instruments.

What happens if a DTC borrows as a result of a failure of a settlement bank?

If DTC makes a borrowing as a result of the failure of a Settling Bank or Participant to complete timely settlement the Settling Bank or Participant will be charged interest on that borrowing as follows:

What is a settlement bank?

A Settling Bank is a bank Participant that settles for itself and may settle for other Participants for which it is the designated Settling Bank, including other bank Participants. A Settling Bank can be located in any Federal Reserve district, but it must have access to the Settlement User Interface and online access to the National Settlement Service (“NSS”) provided by the Federal Reserve Banks (individually and collectively, the “Fed” unless indicated otherwise) and Fedwire®.

What is the process called when you reach your net debit cap?

This procedure is called Settlement Progress Payments (SPP).

What is RAD in DTC?

RAD allows Participants to review and either approve or reject incoming transactions before they are processed. Unless otherwise noted in DTC’s Rules and Procedures, client-initiated settlement instructions, including valued DOs, POs, pledges and releases of pledged securities are subject to RAD controls. MMI transactions are subject to RAD regardless of whether they are free of payment or for value.

What time does ID Net drop?

ID Net Firm deliveries from the ID Netting Subscriber Receive Account #919 that are pending for position or because of risk management controls will drop at 11:30 a.m. eastern time on settlement date

What happens after a trade is affirmed?

After a trade has been affirmed and deemed eligible for ID Net, the ID Net process will continue to check the transaction’s eligibility up until 8 p. m. on the night of SD-1. If a trade becomes ineligible, for example, a Reorganization is announced, the trade will be removed from the ID Net process regardless of whether it is in an authorized or an exempt state. The trade will be staged for trade-for-trade settlement between the ID Net Firm and the ID Net Bank and will maintain its current state, i.e., authorized trades will remain authorized and exempted trades will remain exempted.

What is collateral loan?

The Collateral Loan Program allows you to Pledge securities held in your general free account as collateral for a loan or for other purposes (such as Letters of Credit) to a Pledgee participating in the program. You can also request the Pledgee to release Pledged securities. These Pledges and releases can be free (when money proceeds are handled outside DTC) or valued (when money proceeds are applied as debits and credits to the Pledgee's and Pledgor's money settlement accounts). A Pledgee may, but need not be, a Participant. Only a Pledgee which is a Participant may receive valued Pledges.