Due diligence is a process of verification, investigation, or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information and to verify anything else that was brought up during an M&A deal or investment process.

What is due due diligence?

Due diligence is a process of verification, investigation, or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows.

What is a due diligence fee in real estate?

Under the standard form Offerto Purchase and Contract, the buyer may also give the seller a “due diligence fee” for the buyer’s right to conduct due diligence, including any inspections, loan applications, and appraisals, for a negotiated period of time (the “due diligence period”).

What happens after the due diligence period expires?

After the expiration of the due diligence period, the buyer’s right to terminate is severely limited. For more information about due diligence, refer to the Commission’s brochure, “Questions and Answers on Due Diligence for Residential Buyers,” available on the Commission’s website.

What is contingent due diligence in real estate?

What is Contingent Due Diligence? Contingent investigation represents one of the several protections to a buyer when undertaking a new investment or initiating a contract. Contingent due diligence means that a company or buyer has shown and confirmed interest in the seller.

What does due diligence in real estate mean?

It is essentially the “doing your homework” part of real estate. When RE agents bring up due diligence, they usually refer to either the buyer's research prior to making an offer or the contingency period before to the final closing.

What is the purpose of a due diligence period?

The due diligence period gives the homebuyer the opportunity to identify any potential issues or problems with the home that could compromise the purchase. It also gives the buyer the chance to back out of the transaction if certain contingencies aren't met.

Is due diligence the same as earnest money?

The Due Diligence Fee is Not Earnest Money. Due diligence money is non-refundable, whereas earnest money is refundable if the buyer decides not to buy the home within the due diligence period. Earnest money is usually a much larger amount than the due diligence fee.

What is due diligence money in NC?

In short, due diligence and earnest money are fees that are paid upfront by you when you enter into a contract to buy a home from a seller. These funds let them know that you are serious about your commitment to buying their home.

What does due diligence include?

Due diligence is defined as an investigation of a potential investment (such as a stock) or product to confirm all facts. These facts can include such items as reviewing all financial records, past company performance, plus anything else deemed material.

What comes after due diligence?

After due diligence is completed, the buyer and seller will likely work together in training & consultation for at least a couple of months. The buyer's goal should be to ask them as few questions as possible that satisfy their comfortability with the acquisition.

What is purpose of due diligence money in real estate?

The due diligence money is a good faith payment made by the buyer to show the seller that he or she is interested and serious in purchasing the home and to compensate the seller for taking the property off the market should the buyer decide not to go through with the home purchase.

How much does due diligence cost?

Not including the costs for both the buyer's and seller's team, attorneys costs for due diligence might range from $5-50,000, quality of earnings reviews can range from $30-300,000, a market study will range from $150-350,000, and consulting firms will have costs on top of these.

What is due diligence when buying a home?

“Due Diligence” is the buyer's opportunity to engage in a process of further investigation of the property and the transaction as described in the Offer to Purchase form within a period of time agreed to by the seller and buyer.

How long is the due diligence period in NC?

fourteen to thirty daysIn North Carolina, due diligence periods typically last anywhere from fourteen to thirty days. During the due diligence period, the buyer gets time to negotiate repairs, home owner association agreements, and review home inspection reports without the pressure of other buyers.

Can you negotiate after due diligence?

There are typically two major dates in home buying: the inspection period (sometimes called a due diligence period or something similar) and the closing date. Both of these can be used in negotiations. A seller might be interested in closing as soon as possible or perhaps needs extra time to find a new place to live.

Can you negotiate during due diligence?

The buyer and seller can negotiate the due diligence date. It is often less than 30 days. However, it will all depend on if any issues a home inspector finds with the home. When a home needs repairs, a buyer may be able to negotiate with the seller during the period of due diligence.

What are the 3 principles of due diligence?

The Framework is based on three pillars: 1) the State duty to protect human rights, 2) the corporate responsibility to respect human rights and 3) access to remedy where human rights are violated. In relation to the second pillar, the Guiding Principles recommend human rights due diligence as a central approach.

What is due diligence and why is it important?

Due diligence is essentially an investigation to target any risk from a legal perspective. This process occurs before acquiring a business or company. The purpose is to have knowledge of the risks prior to purchase. For example, when purchasing a real property, it is important to know who the legal owner is.

Why is it important to conduct due diligence?

Due diligence gives you access to important and confidential information about a business, often within a time period specified in a letter of intent. With this information you can assess the business's financial position and identify risks and ongoing potential.

What is the purpose of a due diligence in a business acquisition?

In the M&A process, due diligence allows the buyer to confirm pertinent information about the seller, such as contracts, finances, and customers. By gathering this information, the buyer is better equipped to make an informed decision and close the deal with a sense of certainty.

What is due diligence in financial statements?

What is Due Diligence? Due diligence is a process of verification, investigation, or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information. Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows.

Why do we do due diligence?

There are several reasons why due diligence is conducted: To confirm and verify information that was brought up during the deal or investment process. To identify potential defects in the deal or investment opportunity and thus avoid a bad business transaction. To obtain information that would be useful in valuing ...

What are the costs of due diligence?

The costs of undergoing a due diligence process depend on the scope and duration of the effort, which depends heavily on the complexity of the target company. Costs associated with due diligence are an easily justifiable expense compared to the risks associated with failing to conduct due diligence. Parties involved in the deal determine who bears the expense of due diligence. Both buyer and seller typically pay for their own team of investment bankers, accountants, attorneys, and other consulting personnel.

Why is due diligence important?

Due diligence helps investors and companies understand the nature of a deal, the risks involved, and whether the deal fits with their portfolio. Essentially, undergoing due diligence is like doing “homework” on a potential deal and is essential to informed investment decisions.

Does due diligence benefit sellers?

However, due diligence may also benefit the seller, as going through the rigorous financial examination may, in fact, reveal that the fair market value of the seller’s company is more than what was initially thought to be the case. Therefore, it is not uncommon for sellers to prepare due diligence reports.

What is due diligence?

Due diligence is a thorough examination of information and strict adherence to the applicable rules and regulations. It ensures asset protection as well as the avoidance of malpractices and conflicts.

What is due diligence in investment?

Due diligence refers to both collection and verification of relevant information before making an investment agreement.

Why Investors Conduct Due Diligence?

The due diligence process provides investors with information on both advantages and disadvantages surrounding the investment option. When an investor or analyst performs analysis on a stock, there are several factors to consider. It is not confined to the entities financial performance; instead, market dynamics is very crucial. Also, a single piece of information about the company can influence the share price. Hence, the process must include a background study of the company, products/services, market, customer base, stock market performance/history, etc.

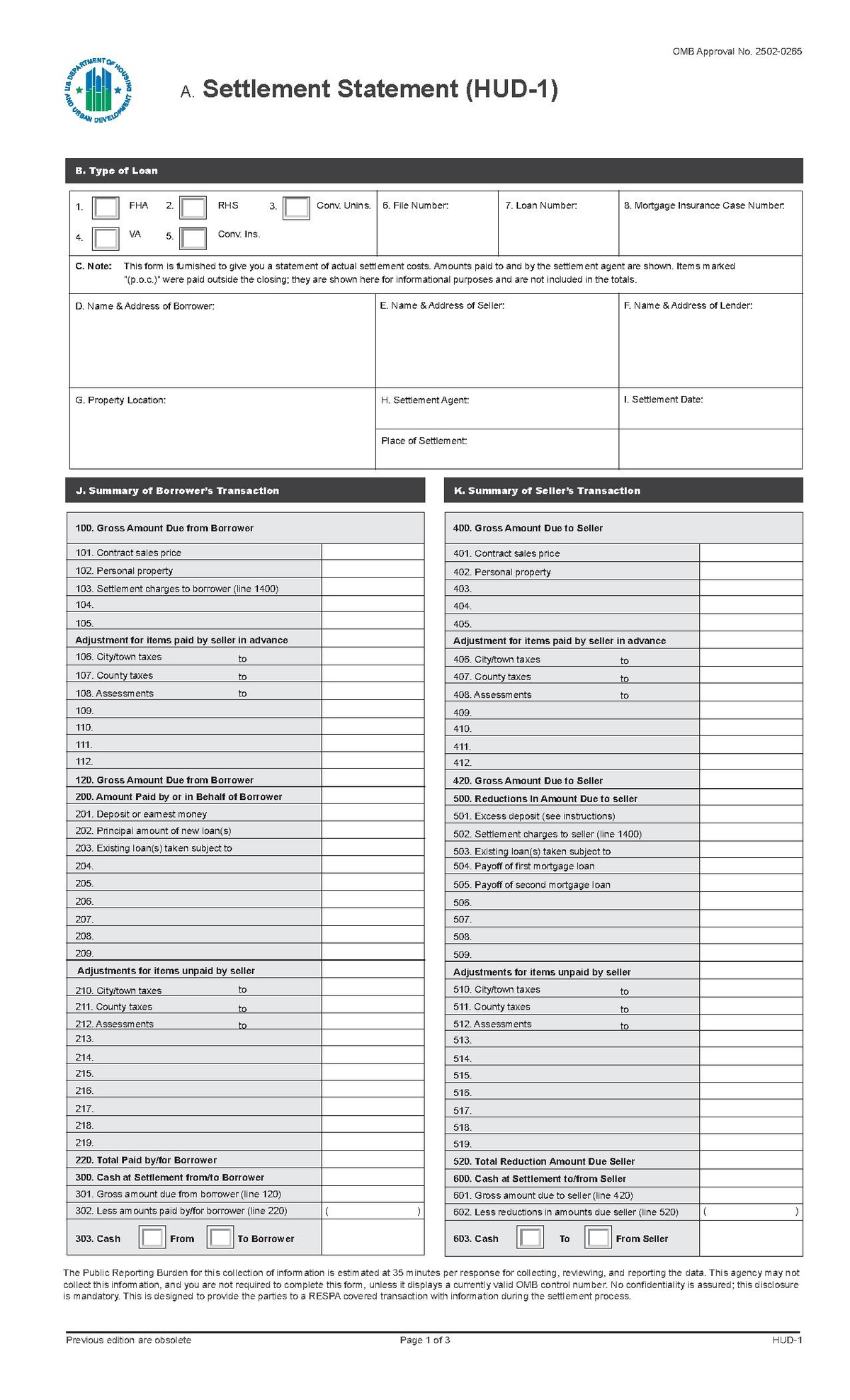

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

Examples of Due Diligence Statement in a sentence

You are agreeing to follow the Counseling program’s Recording Policy to handle protected health information in a legal and ethical manner when you sign the Due Diligence Statement at the beginning of each semester of practicum and internship.

Related to Due Diligence Statement

Due Diligence Review means the performance by Buyer of any or all of the reviews permitted under Section 44 hereof with respect to any or all of the Loans or Seller or related parties, as desired by Buyer from time to time.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is gross amount due?

The gross amount due from the buyer and to the seller.This includes the contract sales price, value of any personal property and the total amount of the settlement charges and fees extracted from the final total on page 2 (line 1400).

Where is my closing credit?

Usually this credit will be given on the first page of the respa, buyers side, indicating that the amount being credited is being added to the amount the Buyer has to use, therefore, a check will not be given to the Buyer at the time of the closing.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

Can a bank be a settlement agent?

The settlement agent can take the form of a title agency, mortgage broker, even the bank could act as a settlement agent however it is recommended hiring an experienced real estate law firm experienced in real estate closings to take care of the closing.

Are there problems with the HUD-1 Settlement Statement?

Despite best efforts by the Housing and Urban Development department and the RESPA, mistakes can and do happen when preparing the settlement statements. It is extremely important to understand each and every entry on the HUD form. As previously mentioned it is highly recommended hiring an experienced real estate attorney to take care of the closing as in addition to resolving any legal disputes, they are likely to make use of specialist r eal estate closing software which will reduce the chances of human error when preparing the settlement statement by means of validating input, ensuring figures are within allowed ranges and automatically calculating figures used throughout the HUD form.

What is due diligence in real estate?

In the typical residential real estate sales transaction, a buyer offers to purchase property from a seller. After negotiating the price and terms, the buyer and seller sign an offer to purchase and contract, and the buyer gives the seller (or the seller’s broker) an earnest money deposit to show good faith in the transaction. Under the standard form Offerto Purchase and Contract, the buyer may also give the seller a “due diligence fee” for the buyer’s right to conduct due diligence, including any inspections, loan applications, and appraisals, for a negotiated period of time (the “due diligence period”). Prior to the expiration of the due diligence period, the buyer may terminate the contract for any reason. After the expiration of the due diligence period, the buyer’s right to terminate is severely limited. For more information about due diligence, refer to the Commission’s brochure, “Questions and Answers on Due Diligence for Residential Buyers,” available on the Commission’s website.

What is a closing statement?

A: A closing or settlement statement is a document that summarizes all funds received by you and the seller at closing, and all funds paid by you and the seller for various expenses of the transaction (real estate broker commissions, loan payoffs, fees for inspections, property taxes, etc.). For all closings involving federally insured loans, the Real Estate Settlement Procedures Act (RESPA) requires that this information be disclosed on a Seller Disclosure or a Buyer Disclosure form for each party.

What is a quitclaim deed?

The best one — the general warranty deed — contains the seller’s warranty that good title is being conveyed to you. A quitclaim (or non-warranty) deed contains no warranties at all; therefore, you accept title from the seller “as is.” A special warranty deed contains limited warranties from the seller. If you are given anything other than a full or general warranty deed, immediately consult with your attorney.

What is prorated at closing?

A: Certain items (real estate taxes, some utility bills, occasionally special assessments, etc.) are prorated at closing. “Prorating” occurs when you and the seller are each responsible for a portion of an expense. For example, property taxes are assessed as of January 1 but not normally payable until the end of the year. The seller is responsible for his share of the property taxes from January 1 through the closing date. You will be responsible for the remainder of the year. Review the contract carefully to be sure you know what items, if any, will be prorated at closing.

How long do you have to receive a closing disclosure?

A: If you are using a lender to assist with the purchase of the home, by law, you must receive your Closing Disclosure three (3) business days prior to closing. The Closing Disclosure will come from your lender. Contact your lender (or loan officer) at least a week before closing to find out how you will receive your Closing Disclosure. Ask whether your Closing Disclosure will be sent to you via email, postal mail, or if you will have to download it from a website.

How to transfer funds to closing attorney?

A: Before transferring any funds via wire transfer, contact the closing attorney’s office by telephone using a publicly verified phone number and speak directly to the closing attorney or a member of his/her staff to obtain the correct wire transfer information. Do not rely upon emails, text messages, or telephone calls from persons claiming to be the closing attorney or a member of his/her staff. Such persons may be attempting to give you fraudulent wiring instructions in an effort to steal your money.

What happens if a property is destroyed before closing?

If the property is damaged or destroyed by fire or other casualty prior to closing, the risk of loss is on the seller. The buyer has the option to terminate the contract and recover any earnest money deposit. Continued