An early payment discount – also known as a prompt payment discount or early settlement discount – is a discount that buyers can receive in exchange for paying invoices early. It’s typically calculated as a percentage of the value of the goods and services purchased.

What is an early payment discount?

- PrimeRevenue An early payment discount is one form of trade finance in which a buyer pays less than the full invoice amount due by paying the supplier earlier than the invoice maturity date. An early payment discount is also commonly referred to as a cash discount or prompt payment discount. There are two approaches to early payment discounting.

What is a settlement discount?

A settlement discount is where a business offers another business a discount when an invoice is paid early.

What is the settlement discount if John pays within 10 days?

You offer settlement discount of 3% if John pays within 10 days. From the past experience with John you expect him to pay within a week because John has always paid you within a week. Therefore, at the time of sale, you adjust the transaction price for variability because you assume that you will have to provide settlement discount.

When should a seller recognize the revenue net of settlement discount?

If past evidence or other information indicate that yes, a customer will pay promptly, then the seller should recognize the revenue net of settlement discount at the time of sale. As an example, let’s say you make a sale of 1 000 to customer John on credit for 30 days.

What does settlement discount mean?

What Is a Settlement Discount? A settlement discount can often get referred to as cash discounts or prompt payment discounts. They're offered to customers when they purchase something from you to help complete the business transaction. Settlement discounts are often used in business-to-customer (B2C) transactions.

Should I accept an early payment discount?

An early payment discount or cash discount is offered as a means to get your customers to pay their bills a bit earlier. If you don't have a lot of late-paying customers, offering a cash discount may not be necessary, but if you do, offering a cash discount may be a good solution.

Why would you offer your customer an early settlement discount?

Early settlement discounts provide an incentive for customers to pay up promptly, ensuring you get the money you're owed within terms.

How is early payment discount calculated?

Your customers will typically define the discount they want in exchange for early payment, expressed as an annual percentage rate (APR). For example, if their desired APR is 12% and you want to be paid 30 days early, you would grant a 1% discount (12% APR / 360 days = 0.03% x 30 days = 1% discount).

How do you calculate settlement discount?

Total amount payable by the customer: The total amount payable by the customer is therefore the invoice total (discounted total) discount minus the credit note (discounted total) i.e.

What are the disadvantages of cash discount?

More cash on site means a greater security risk. Cash can be costlier to your business. People spend more when they pay with a credit card. You could anger or lose card-carrying customers.

What is a reasonable discount for cash payment?

2%A cash discount is usually around 1 or 2% of the invoice total, although some businesses may offer up to a 5% discount.

Is early payment discount income?

An early payment discount – also known as a prompt payment discount or early settlement discount – is a discount that buyers can receive in exchange for paying invoices early. It's typically calculated as a percentage of the value of the goods and services purchased.

Why would a supplier offer a sales discount to a customer?

Why Might a Seller Give a Cash Discount? A seller might offer a buyer a cash discount to 1) use the cash earlier, if the seller is experiencing a cash flow shortfall; 2) avoid the cost and effort of billing the customer; or 3) reinvest the cash into the business to help it grow faster.

Is there VAT on early settlement discount?

So when receiving a settlement discount is it VAT output then? Yes, because settlement discount received is an income we then record VAT output (a liability account - meaning we owe VAT).

When should you take a cash discount?

Why Might a Seller Give a Cash Discount? A seller might offer a buyer a cash discount to 1) use the cash earlier, if the seller is experiencing a cash flow shortfall; 2) avoid the cost and effort of billing the customer; or 3) reinvest the cash into the business to help it grow faster.

How do you incentivize customers to pay early?

Reward the customers who pay on time One of the most effective ways to get customers to pay on time is to offer them incentives. You may choose to give them gift certificates as rewards or small product discounts if you receive their payments a before the invoice due date.

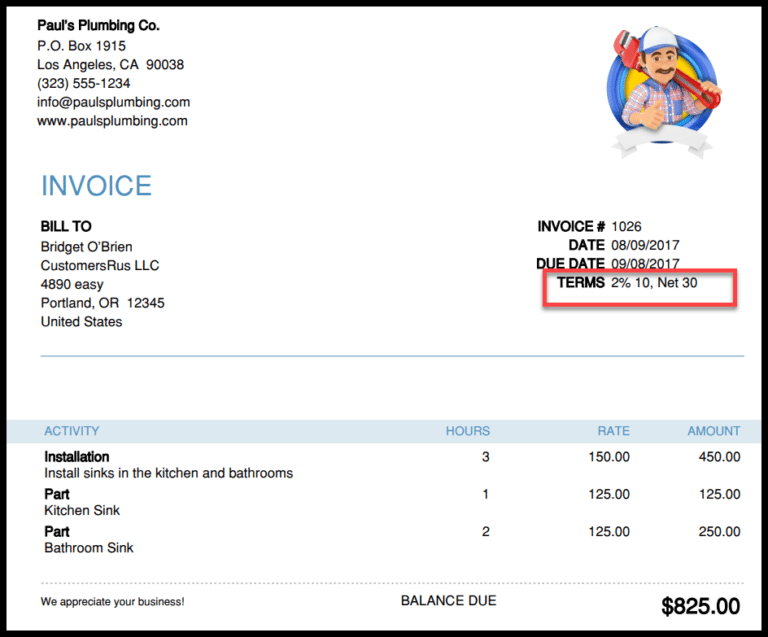

What is a typical prompt payment discount?

A common early payment discount is expressed as '2/10 net 30 days'. This means that the invoice needs to be paid within 30 days – but the buyer will receive a 2% discount on their purchase if they pay the invoice within 10 days.

How should prompt payment discount be dealt with when valuing inventory at Lcnrv?

How should prompt payment discount be dealt with when valuing inventories at the lower of cost and net realisable value (NRV), according to IAS2 Inventories ? Prompt payment discount (期日前の支払いの割引) should be ignored, because only trade discounts are taken into account, per IAS2 para11.

What does early settlement mean?

Early settlement will mean receivables will get smaller and so the cost less

Why is cash received early?

If cash is received earlier, it will improve the supplier’s liquidity position, because it reduces the length of its cash operating cycle. This will be particularly important if a seller is suffering from cashflow problems. If the cash from customers is received early, the cost of financing receivables is reduced.

What happens to receivables when cash is received early?

If the cash from customers is received early, the cost of financing receivables is reduced.

When customers are deciding which payments to make to suppliers and which ones to delay, they are likely to pay?

When customers are deciding which payments to make to suppliers and which ones to delay, they are likely to pay those suppliers offering a discount for early payment first.

Does increasing credit terms increase sales?

Occasionally you may be told that a new policy of INCREASING the credit term will also increase sales (as a larger credit term will attract more customers)

Is a discount an incentive?

It is possible that offering a discount may provide an incentive to new customers, because the cost of the goods from a supplier offering a discount may now be less than those of a supplier not offering a discount, provided that the potentially new customer pays within the specified time limit.

What is an early payment discount?

What is Early Payment Discount? An early payment discount is one form of trade finance in which a buyer pays less than the full invoice amount due by paying the supplier earlier than the invoice maturity date. An early payment discount is also commonly referred to as a cash discount or prompt payment discount.

Why are early payment discounts important?

It also reduces the risk of nonpayment or late payment. For some non-investment-grade suppliers, an early payment discount is an attractive alternative to traditional financing methods like commercial-based lending. Suppliers also feel that they will be rewarded with more business if they participate in customers’ early payment discount programs.

What are Early Payment Discounts?

An early payment discount is a form of trade finance and a means for companies to obtain a discount on vendor invoices when paying early. A business pays less than the full amount due while the supplier receives payment earlier than standard payment terms. It benefits both accounts receivable and accounts payable and helps add to your bottom line.

How are Early Payment Discounts Calculated?

As a vendor, you define how many days early a discount can be applied and the amount. For example, an invoice with the terms 2/10 – net 30 means a net 30-day invoice with a 2% discount if paid in 10 days (instead of 30).

Final Thoughts

Adding discount terms to a pay cycle benefits both the vendor and the customer. It’s a win-win situation for all parties involved. Not only does it assist with cash flow problems, but a company can also avoid late payments and strengthen business relationships.

What is an early payment discount?

An early payment discount is a reduction in the amount on a supplier's invoice if the customer pays the supplier promptly. The early payment discount is also known as a cash discount. (The seller may refer to the early payment discount as a sales discount. The buyer may refer to the early payment discount as a purchases discount .)

How long does it take to pay an invoice with 1/10 net 30?

Let's assume that a company sells goods on credit and offers an early payment discount expressed as 1/10, net 30. This means that a customer is allowed to deduct 1% of the invoice amount, if payment is made within 10 days (instead of paying the full amount in 30 days). In other words, the customer saves 1% for paying 20 days early. Therefore, an invoice of $1,000 with terms of 1/10, net 30 means that the $1,000 obligation will be settled in full for $990 if it is paid within 10 days.

Does an early payment discount appear on an invoice?

The buyer may refer to the early payment discount as a purchases discount .) Not all companies offer early payment discounts. If the discount is allowed it will appear on the sales invoice.

What is settlement discount?

A settlement discount is where a business offers another business a discount when an invoice is paid early. This is usually a percentage discount if an invoice is paid within a specified number of days, for example, a 5% discount for invoices paid within 15 days. Settlement discounts can be recorded for both sales and purchase transactions - ...

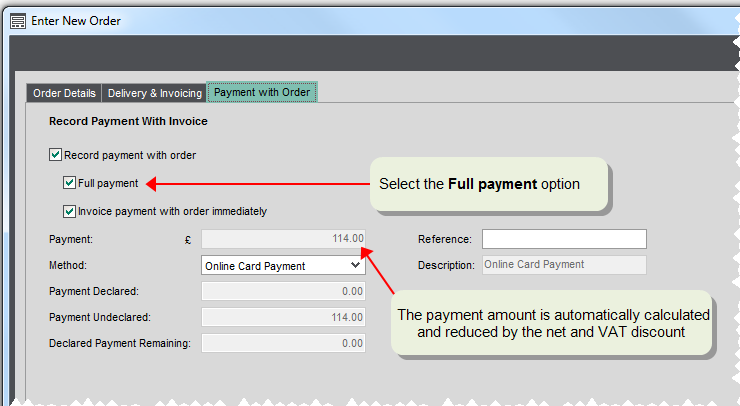

When an invoice is paid immediately, is the settlement discount automatically taken?

When an invoice is paid immediately, the settlement discount is automatically taken. The VAT is discounted on the invoice and no subsequent VAT adjustment is necessary.

How to make sure that the correct discounts are always entered?

To help make sure that the correct discounts are always entered, you can store the discount settings on your customer and supplier accounts. Each time an order or invoice is entered, the discount details are automatically entered on the transaction.

When an invoice contains settlement discount is paid within the discount period, is the VAT charged?

When an invoice that contains settlement discount is paid within the discount period, the VAT is only charged on the discounted invoice amount. VAT must be calculated and shown on the invoice at the full rate. If the customer pays within the settlement discount period, the VAT is discounted and a VAT adjustment must be processed. Businesses must:

When can you record a discount?

When the payment is received from a customer , you can record the discount amount. This is then posted to the Discounts Allowed nominal account. When the payment is paid to a supplier, you can record the discount amount. This then posted to the Discounts taken nominal account.

Do you need to issue a credit note if you pay an invoice early?

If the invoice is paid within the discount period, there is no need to issue an additional credit note.

Can you enter discounts for each supplier account?

Enter discounts for each supplier account if they are different to the default.

What Is a Settlement Discount?

A settlement discount can often get referred to as cash discounts or prompt payment discounts. They’re offered to customers when they purchase something from you to help complete the business transaction. Settlement discounts are often used in business-to-customer (B2C) transactions.

How to Calculate a Settlement Discount

The first thing to keep in mind when calculating a settlement discount is the original invoice terms. You would issue an invoice for the amount in full and then issue a credit note for the discount. Make sure that you clearly display the terms and the discount percentage on the invoice.

Key Takeaways

Offering discounts to your customers can have a ton of different benefits. Not only can you increase sales, but you can increase customer loyalty. And, with a settlement discount, it can also help in other areas.

How to calculate early payment discount?

The early payment discount is calculated by taking the discount percentage ― such as 1% ― and multiplying it by the invoice amount. For example, a 1% discount on a $1,000 invoice equals $10. If the invoice is paid within the discount terms ― such as 10 days ― the customer would pay $990 ― $1,000 less $10.

Why do vendors get early payment discounts?

As a vendor, you will get paid sooner and can reduce the risk of nonpayment, which could result in hiring a collection agency. From the customer’s perspective, you will be able to build a good credit history with your vendor suppliers, which could result in an increase in your credit limit.

How long does it take to get a 1% discount on an invoice?

This means the customer receives a 1% invoice discount if the payment is submitted within 10 days. If the customer does not pay within 10 days, then the invoice is due in 30 days with no discount. This type of prompt payment discount can be used to incentivize those customers who never seem to pay their invoices on time.

How much is an invoice settled for in 10 days?

In other words, if you pay in 10 days or less, the invoice can be settled for $980 instead of $1,000. If you pay after 10 days, you must pay the full $1,000. The screenshot below shows how payment terms are generally shown on an invoice: Sample invoice created in QuickBooks with early payment discount terms. ×.

Why should early payment be in writing?

The terms of an early payment discount should be in writing to prevent any problems. Having the terms in writing prevents timing-related issues. Usually, the customer and the vendor have different views as to when the clock starts ticking for receiving payment. The customer will start the clock when their accounts payable department receives the invoice while the vendor will start counting on the date of the invoice. Clearing up this issue ahead of time will avoid problems later on.

How to offer a discount to a vendor?

The discount a vendor offers will vary based on a number of factors: 1 What is standard in the industry: Find out what kind of payment terms other businesses in your industry are offering. You want to make sure that the payment terms you offer are not too far off from the industry standard. 2 What early payment discounts are offered by the competition: Check out what kind of payment terms your competitors are offering. To stay competitive, you should offer similar payment terms. 3 What your client’s payment history is: If a customer consistently pays on time, there is no need to offer early payment discount terms. However, you could decide to reward customers that pay on time with a customer appreciation discount periodically.

What are the benefits of paying bills early?

The benefits of early payment discounts for customers are: Save money: The discounts add up over time to save you a significant amount of money, particularly if several of your suppliers offer the discounts. Build business credit: By paying your bills early, you can increase your business credit score.

Why are settlement discounts allowed?

Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

Why do companies offer settlement discounts?

Therefore, the main purpose of offering settlement discount is to encourage customers to settle debts early.

What is the difference between Trade Discount and Settlement Discount?

Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

Why do companies give discounts?

Companies grant discounts for customers in order to provide incentives for them to purchase more products. This is a widely utilized sales technique in all types of organizations and, trade discount and settlement discount are two main types of discounts granted.

What is a trade discount?

A trade discount is a discount given by the seller to the buyer at the time of making a sale. This discount is a reduction in the list prices of the quantity sold. The main objective of trade discount is to encourage customers to purchase company’s products in more quantities.

What is Company X discount?

E.g. Company X is a clothing retailer, and it grants a 15% discount for customers who buy clothing items within a selected date range in festive season.

What is settlement discount?

To make it absolutely clear for everyone: Settlement discount is a discount for prompt payment of invoice by the customer. Let’s say you sell something for 1 000 on 30-day credit and you offer 3% off if a customer pays within 10 days. Those 3% – or 30 in this case – is a settlement discount.

How long does it take to get 10% settlement discount?

Let’s say that an entity that sells goods on credit for 100 and offers 10% settlement discount if the customer pays within 10 days. Otherwise, the full amount is to be paid after 30 days.

Does a seller have to pay promptly?

Seller assumes that customer WILL pay promptly. If past evidence or other information indicate that yes, a customer will pay promptly, then the seller should recognize the revenue net of settlement discount at the time of sale. As an example, let’s say you make a sale of 1 000 to customer John on credit for 30 days.