Final Settlement Price. – means the Settlement Price quoted by the Exchange on which the Future trades at the close of trading on the last day on which such Future trades determined by subtracting from 100 the Canadian Bankers ' Acceptance Reference Rate for such day, rounded to the nearest 1/1000th of a percent- age point.

What is settlement price in trading?

A settlement price, typically used in the derivatives markets, is the price used for determining profit or loss for the day, as well as margin requirements. The settlement price is the average price at which a contract trades, calculated at both the open and close of each trading day,...

What is the final settlement price of the Nikkei 225 Futures?

The final settlement price of the Nikkei 225 futures and options on futures is based on the Special Opening Quotation of the Nikkei Stock Average, used to settle the Nikkei Stock Average futures at the Osaka Securities Exchange. The final settlement price on all cash settlements will be to the 1/100th of an index point.

Where can I find the settlement and last trade price?

Both the settlement and last trade price are then published on the contract specifications page. Also on the contract specifications page is the daily settlement procedure, which provides an explanation for how to calculate the settlement price. CME Settlement Vs.

What is a'settlement price'?

What is a 'Settlement Price'. A settlement price, typically used in the derivatives markets, is the price used for determining profit or loss for the day, as well as margin requirements.

What Is the Settlement Price?

When is the settlement price determined?

What happens if you own a call option with a strike price of $100?

How are settlement prices calculated?

What is the difference between closing and opening price?

Is the settlement price the same as the opening price?

See 3 more

About this website

How is final settlement price calculated?

The final settlement price for a single stock futures or equity option contract shall be determined by the arithmetic mean of the prices of the underlying security on the securities market during the last 60 minutes of trading before market close on the final settlement day.

What does settlement price mean?

Settlement prices are essentially the fair market value of a commodity or financial derivative as determined by buyers and sellers in a market at a particular point in time known as the settlement period.

What is the difference between closing price and settlement price?

Closing price of any scrip on any day is the weighted average price of last 30 minutes of trading for that day. But daily settlement is only for future contracts and daily settlement price is based on closing price of futures contract.

What is settlement price in trade?

Daily settlement price for futures contracts is the closing price of such contracts on the trading day.

How do you calculate cash settlement?

Instead, under the cash settlement, the contract is settled in cash. In this case, if the price of Gold increases to Rs 50,000 per 10gms, you only have to pay the difference between the strike price (Rs 40,000) and the spot price (Rs 50,000) for 500gms of Gold.

How do you calculate bond settlement price?

The settlement amount is calculated by adding back the accrued interest on the clean price and then multiplying by the face value.

Why closing price is important?

The Closing Price helps the investor understand the market sentiment of the stocks over time. It is the most accurate matrix to determine the valuation of stock until the market resumes trading the next day.

Why close price is different from last price?

The last traded price (LTP) usually differs from the closing price of the day. This because the closing price of the day on NSE is the weighted average price of the last 30 mins of trading. The last traded price of the day is the actual last traded price.

What is the difference between close and settlement?

A loan settlement will typically involve negotiating with your creditors to settle for less than the total amount you owe. Closure: Closure is the process of formally dissolving your bankruptcy case. Closure is when you stop making payments and your creditors take legal action to collect the debt.

How nifty close is calculated?

The NIFTY closing prices are calculated by taking the last half an hour weighted average closing prices of the constituents of the index.

What is tick size in trading?

Tick size is the minimum price increment change of a trading instrument. Tick sizes were once quoted in fractions (e.g., 1/16th of $1), but today are predominantly based on decimals and expressed in cents. For most stocks, the tick size is $0.01, but fractions of a cent may also occur.

How is futures settlement price calculated?

Daily Settlement Price The closing price for Commodities futures contract shall be calculated on the basis of the last half an hour weighted average price of such contract or such other price as may be decided by the relevant authority from time to time.

What is stock closing price?

"Closing price" generally refers to the last price at which a stock trades during a regular trading session. For many U.S. markets, regular trading sessions run from 9:30 a.m. to 4:00 p.m. Eastern Time.

How is futures settlement price determined?

Typically, the settlement price is set by determining the weighted average price over a certain period of trading, typically shortly before the close of the market.

What is US settlement fee?

U.S. Settlement Agency etc. Trading Activity Fee (Charged for sell orders only) USD 0.00013 / Share.

What does daily settlement mean?

Daily settlement means that all futures transactions are to be cleared on a daily basis in the futures market. The daily settlement is based on the difference between the settlement price and the futures price at which you buy or sell.

Settlement Price Definition & Example | InvestingAnswers

What is a Settlement Price? Settlement price refers to the market price of a derivatives contract at the close of a trading day.. How Does a Settlement Price Work? Also called the closing price, the settlement price is the price at which a derivatives contract settles once a given trading day has ended. It is also the market price at which a given contract begins trading at the opening of the ...

Settlement price financial definition of settlement price

The nominal settlement price, under the termination agreement, reflects the acknowledgement by 64Bit Ltd of its mismanagement of the joint venture operations, including a wrongful allocation of the partnership's resources, mainly during the start-up phase.

Quick Facts on Settlements at CME Group

CC1056/00/1014 Futures, options and swaps trading is not suitable for all investors, and involves the risk of loss. Futures and swaps are leveraged investments, and because only a percentage of a contract’s value is required to trade, it

Understanding Equity Index Daily & Final Settlement - CME Group

Equity Index Daily & Final Settlement. When trading Equity Index futures, there are two types of settlement: daily and final. Daily settlement refers to the contract’s settlement price on a daily basis while final settlement represents the final value of the contract at expiration

Examples of Final Settlement Price in a sentence

The decision of the Exchange and the Clearing House with respect to the determination of the Final Settlement Price by this alternate means shall be binding on all parties holding an open position in the Contract at termination of trading.

More Definitions of Final Settlement Price

Final Settlement Price in respect of a contract means Due Date Rate ( DDR) determined by the Clearing Corporation for settling that contract in accordance with the method specified in the Contract Specification or such other method as may be notified by the Relevant Authority.

What is full and final settlement?

Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

Major activities included in the full and final settlement

The full and final settlement consists of clearances from various departments like IT, finance, HR, and admin. Also, it is important to understand which components to include while calculating the final dues payable to the employee. Let’s look at each of the activities in detail:

When does the full and final settlement take place?

It is essential to note that an employee, whether resigning or being terminated, has the right to get all the dues settled within a reasonable timeframe. It is a common practice to finalise the process within 30-45 days from the employee’s last working day.

Full and final settlement payslip format

The FnF settlement letter is issued with reference to the resignation letter submitted by the employee. There is no set format for the FnF letter and sometimes companies just generate a payslip in place of the letter. The following details should form part of the payslip.

A few pointers for employers to keep in mind

While computing the value of FnF settlement amount, the employers should keep the following points in mind:

Calculate employee full and final settlement with RazorpayX Payroll

Now that you know about the full and final settlement process, isn’t it a lot to do manually?

Opening Index Values

On typical days, CME Group begins disseminating index values immediately at 8:30 a.m. Central Time (CT). Because the index value is based on the last price for each stock, the opening index value will reflect the previous day's closing price for any stock that has yet to open.

Special Opening Quotation

Special Opening Quotations of the indexes generally will be based on the opening values of the component stocks, regardless of when those stocks open on expiration day. However, if a stock does not open on that day, its last sale price will be used in the Special Opening Quotation.

Example of Opening Index Calculations

A sample calculation of the S&P 500 Index and Special Opening Quotation is shown below. When either:

NASDAQ-100 Index and NASDAQ Composite Index Expiration Procedure

NASDAQ-100 Index futures and options on futures, E-mini NASDAQ-100 futures and options and E-mini NASDAQ Composite futures expire on a quarterly cycle.

Nikkei 225 Expiration Procedure

Nikkei 225 futures and options on futures expire on a quarterly cycle, the second Friday of the contract month. The final settlement price of the Nikkei 225 futures and options on futures is based on the Special Opening Quotation of the Nikkei Stock Average, used to settle the Nikkei Stock Average futures at the Osaka Securities Exchange.

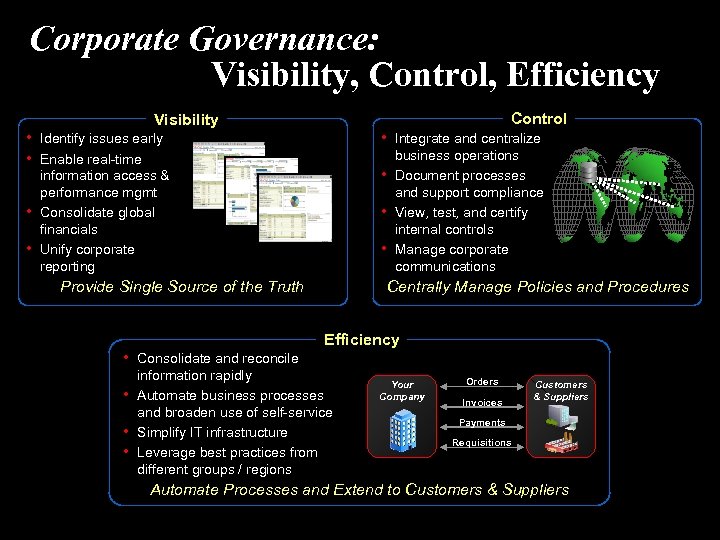

Equity Index Daily & Final Settlement

When trading Equity Index futures, there are two types of settlement: daily and final.

Daily Settlement

For most Equity Index futures, daily settlement price for the front month is calculated using a volume weighted average price (VWAP) based on the last 30 seconds of the trading day.

Final Settlement

When it comes to final settlement for U.S.-based Equity Index contracts, the value is determined using a Special Opening Quotation, known as the SOQ.

Summary

For more information on the daily and final settlement process for each product, refer to the individual contract specifications on cmegroup.com.

What is the closing price of equities?

The price of equities when the exchange opens is referred to as the opening price. The price of equities when the exchange closes is referred to as the closing price, which is the last trade price or the last price the market traded at when it closed.

What is closing price?

The closing price is used to calculate the settlement price.

What Is the Settlement Price?

The settlement price, typically used in the mutual fund and derivatives markets, is the price used for determining a position's daily profit or loss as well as the related margin requirements for the position.

When is the settlement price determined?

The settlement price will be determined on the settlement date of a particular contract.

What happens if you own a call option with a strike price of $100?

If you own a call option with a strike price of $100 and the settlement price of the underlying asset at its expiration is $120, then the owner of the call is able to purchase shares for $100, which could then be sold for a $20 profit since it is ITM. If, however, the settlement price was $90, then the options would expire worthless since they are OTM.

How are settlement prices calculated?

Settlement prices are typically based on price averages within a specific time period. These prices may be calculated based on activity across an entire trading day—using the opening and closing prices as part of the calculation—or on activity that takes place during a specific window of time within a trading day.

What is the difference between closing and opening price?

The opening price reflects the price for a particular security at the beginning of the trading day within a particular exchange while the closing price refers to the price of a particular security at the end of that same trading day. In cases where securities are traded on multiple markets, a closing price may differ from the next day’s opening price due to off-hours activity occurring while the first market is closed.

Is the settlement price the same as the opening price?

While the opening and closing prices are generally handled the same way from one exchange to the next, there is no standard on how settlement prices must be determined in different exchanges, causing variances across the global markets.