Full Answer

Does the rebate appear on the hud-1/settlement statement?

Does the rebate appear on the HUD-1 Settlement Statement? Yes, we work with the closing attorney and your lender from the beginning of the transaction to make sure that your rebate is accounted for properly.

How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

What is an Alta/Closing Disclosure/HUD-1 statement?

ALTA Settlement Statements are used in conjunction with the HUD-1 settlement statement. Under the new CFPB regulations, most real estate transactions require the use of the new Closing Disclosure Form. However, the HUD-1 settlement statement is still used in certain cases such as: Home equity revolving lines of credit.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What is the purpose of the HUD-1 Settlement Statement?

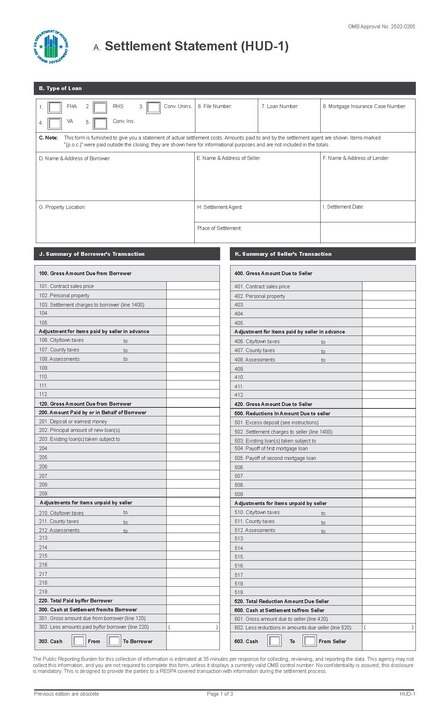

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is a HUD-1 the same as a closing statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What replaced the HUD settlement statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What is the HUD-1 now called?

The Current Closing Disclosure The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

When did the CD replace the HUD?

Oct. 3, 2015The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

Why is it called a HUD statement?

The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development.

What is the difference between a HUD-1 and hud1a?

Differences. As the HUD 1A form is used in refinancing transactions, its principle section is L, pertaining to the loan. The HUD 1 form is longer by about a page. The additional sections in HUD 1 relate to the sale transaction.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

Which document must the borrower receive at least three days before the signing appointment?

The Closing Disclosure is a form that lists all final terms of the loan you've selected, final closing costs, and the details of who pays and who receives money at closing. Your lender sends you a Closing Disclosure at least three business days before closing.

Who protects respa?

RESPA covers loans secured with a mortgage placed on one-to-four family residential properties. Originally enforced by the U.S. Department of Housing & Urban Development (HUD), RESPA enforcement responsibilities were assumed by the Consumer Financial Protection Bureau (CFPB) when it was created in 2011.

Which type of loan will use HUD-1 in place of closing disclosure?

A HUD-1 form is most commonly used for reverse mortgages and mortgage refinance transactions. Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD-1 form.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

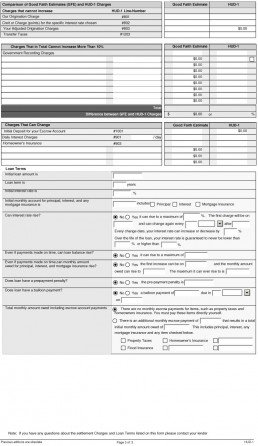

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is a HUD-1?

The HUD-1 (or a similar variant called the HUD-1A) is used primarily for reverse mortgages and mortgage refinance transactions. The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development . Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, ...

What is the HUD-1A used for?

Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, as appropriate, must be used for all mortgage transactions that are subject to the Real Estate Settlement Procedures Act.

When do you need to inspect a HUD-1?

The settlement agent must permit the borrower to inspect the HUD-1 or HUD-1A settlement statement, completed to set forth those items that are known to the settlement agent at the time of inspection, during the business day immediately preceding settlement. Items related only to the seller's transaction may be omitted from the HUD-1.

Is a HUD-1 exempt from the Truth in Lending Act?

The TRID rule mandates the use of a Closing Disclosure form instead. The use of the HUD-1 or HUD-1A is also exempted for open-end lines of credit (home -equity plans) covered by the Truth in Lending Act and Regulation Z. A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts ...

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is HUD 1?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America. The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, ...

When will be my first mortgage payment?

An example is if the closing is September 15, the first mortgage payment will not be until November 1. The November 1st payment will represent the principal and interest for October. The interest from Sept 15-Sept 30 will be prepaid on the closing date.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

What is a RESPA?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

What Is a HUD-1?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction. A HUD-1 form is most commonly used for reverse mortgages and mortgage refinance transactions.

When did HUD 1 replace HUD 1?

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1. In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

What is the closing disclosure form?

Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD-1 form. Either form must be reviewed by the borrower before the closing, in order to prevent errors or any unplanned for expenses.

What form does a settlement agent use for a refinance?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form. Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD-1 form.

How many days before closing do you have to provide a mortgage disclosure?

Borrowers must be provided with the disclosure three days before closing. This five-page form includes finalized figures for all closing fees and costs to the borrower, as well as the loan terms, the projected monthly mortgage payments, and closing costs. Mortgage lending discrimination is illegal.

How long does it take to file a HUD loan?

One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development (HUD). The three days are meant to allow the borrower to ask the lender questions and clear up any discrepancies or misunderstandings regarding costs before closing.

What is the reverse side of HUD-1?

Oddly, the HUD-1 is meant to be reviewed verso, or reverse side, first. The reverse side has two columns: The left-hand column itemizes the borrower's charges and the right-hand column itemize s the seller's charges.

What is HUD-1 form?

In a sentence, the HUD-1 form is a document that itemizes every financial transaction that is happening between all parties involved in the transfer of property. That’s the short of it.

Who prepares HUD forms?

The HUD is prepared by the settlement or closing agent at closing time. You have the right to inspect this form one day prior to settlement. Compare the HUD to the GFE to make sure you weren’t overcharged for a loan, title, escrow fees, or document recording.

What is the HUD?

HUD refers to the Department of Housing and Urban Development, which is the arm of the federal government that makes legislation relating to home ownership and property development.

What information is on a closing statement?

There is a lot of data on the closing statement. Information re the buyer seller, lender, property details, and settlement agent is listed. The majority of the document is a lot of figures. It’s not practical to list them all here, but here are a few examples.

What is HUD-1 statement?

The settlement agent shall use the HUD-1 settlement statement in every settlement involving a federally related mortgage loan in which there is a borrower and a seller. For transactions in which there is a borrower and no seller, such as refinancing loans or subordinate lien loans, the HUD-1 may be utilized by using the borrower's side of the HUD-1 statement. Alternatively, the form HUD-1A may be used for these transactions. The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted. The use of the HUD-1 or HUD-1A is exempted for open-end lines of credit (home-equity plans) covered by the Truth in Lending Act and Regulation Z.

Who completes HUD-1?

The settlement agent shall complete the HUD-1 or HUD-1A, in accordance with the instructions set forth in appendix A to this part. The loan originator must transmit to the settlement agent all information necessary to complete the HUD-1 or HUD-1A. (1) In general. The settlement agent shall state the actual charges paid by ...

Who must state the actual charges paid by the borrower and seller on the HUD-1?

The settlement agent shall state the actual charges paid by the borrower and seller on the HUD-1, or by the borrower on the HUD-1A. The settlement agent must separately itemize each third party charge paid by the borrower and seller.

Can HUD-1 be modified?

The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted.