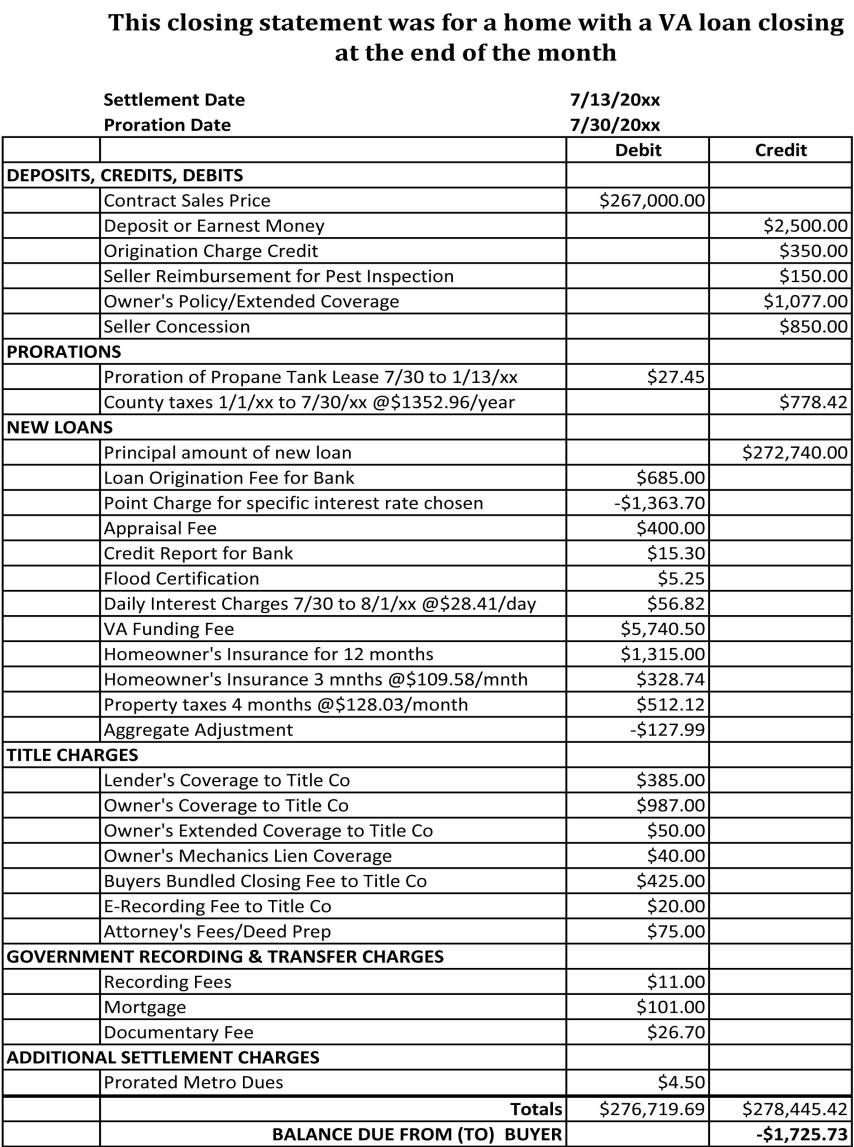

How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

What does a HUD statement look like?

What does a HUD-1 look like? The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller. The breakdown of the pages is as follows: Page One

What in my settlement statement is deductible?

The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What is a confidential settlement statement?

Confidential Settlement Statement Example. johnawest.com. The purpose of including confidentiality clauses in settlement agreements is to keep both parties away from sharing the details with the World. This Confidential Settlement Statement Example is a well-drafted confidentiality agreement that can settles most potential litigation nightmares.

What is the purpose of the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is a settlement statement the same as a HUD?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What is the HUD settlement cost booklet?

Settlement Cost Booklet is an informational booklet that helps the borrowers become familiar with the home-buying and mortgage process so that they make informed decisions and avoid common pitfalls. The booklet helps borrowers get a basic understanding of the mortgage process, disclosures, and fees.

Is closing disclosure same as HUD statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What a closing statement looks like?

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

What is the difference between a closing disclosure and a HUD?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What replaced the HUD-1 Settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What is a HUD in real estate?

HUD Homes (REO) A HUD home is a 1- to 4-unit residential property acquired by HUD as a result of a foreclosure action on an FHA-insured mortgage. HUD becomes the property owner and offers it for sale to recover the loss on the foreclosure claim.

What is a HUD-1 Settlement Statement?

We can define the HUD-1 statement, also known as the HUD-1 form, as a settlement form that itemizes and reconciles all the charges that the buyer and seller pay in purchasing real estate. These charges include a loan origination fee and discount points.

Meet some of our Real Estate Lawyers

Mr. LaRocco's focus is business law, corporate structuring, and contracts. He has a depth of experience working with entrepreneurs and startups, including some small public companies.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.

Is HUD 1 settlement exempt?

Some home equity products are now exempt from using the HUD-1 settlement form, such as open-ended lines of credit. Your lender will let you know whether a HUD-1 settlement statement is involved, or if you’ll receive a Truth-in-Lending disclosure instead.

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is HUD 1?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America. The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, ...

Where is my closing credit?

Usually this credit will be given on the first page of the respa, buyers side, indicating that the amount being credited is being added to the amount the Buyer has to use, therefore, a check will not be given to the Buyer at the time of the closing.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

What is a RESPA?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

What is a HUD-1 statement?

When you refinance or purchase a home, one of the first things that your lender is going to provide you with is a HUD-1 Settlement Statement. This particular statement contains all the fees and costs that incurred with the financing of your home. In order to ensure that it is 100% accurate, it is important for both the seller and buyer to fully comprehend this document and to review it as it contains a handful of details that are important for both parties. The Real Estate Settlement Procedures Act (RESPA) requires that the HUD-1 statement is utilized in every federally regulated mortgage loan.

Who is responsible for reviewing HUD-1?

Buyers and sellers are the ones who are responsible for reviewing their HUD-1 Settlement Statement form in order to ensure that it is accurate. Before the end of closing, every error found must be corrected. Until every question that relates to the HUD-1 Settlement Statement has been satisfactorily answered, no seller or buyer is obligated to complete a closing. Alongside his or her loan officer, the HUD-1 needs to be especially reviewed by the buyer before the closing of a home purchase or mortgage loan. Comparing the mortgage loan documents to the HUD-1 Settlement Statement will prevent the buyer from obligation to loan terms that are incorrect.

How many sections are there in HUD-1?

The HUD-1 Settlement Statement form contains twelve main sections, and a lot more subsections. You will notice that some sections on the form are specifically referred to the borrower’s costs and fees. Other sections on the form refer to the seller that’s in the transaction. One day prior to the closing, every party to the transaction is required to attain a copy of the HUD-1 Settlement Statement form. However, in a lot of cases, the form’s entries are still changing a couple of hours before the closing is conducted. A title agent, lender, or real estate professional can answer any question you may have that regard to the HUD-1 Settlement Statement form.

What is section L on HUD?

This section on the HUD-1 Settlement Statements details information on loan fees, costs that were paid to real estate professionals, items paid in advance such as homeowners insurance and interests, and several required escrow items. You will notice that additional subsections detail items such as home warranties, survey, home inspections, deed fees, and title fees. Section L subsections are 1400-Total Settlement Charges, 1300-Additional Settlement Charges, 1200-Government Recording and Transfer Charges, 1100-Title Charges, 1000-Reserves Deposited with Lender, 900-Items Required by Lender to be Paid in Advance, 700-Total Sales/Broker’s Commission on Price, and 800-Items Payable in Connection with Loan. Before signing any closing document, make sure to carefully review each of these items in this section. In order to make sure that you understood all the charges stated in this section, prior to closing, ask any questions. If you stop and think about it, it is better to prevent than lament.

What is section J in a mortgage?

This section contains details on the buyer’s amounts paid, amount due, and amount of cash that the borrower gets or pays at closing. The subsections in section J are 300-Cash at Settlement To/From Borrower, 200-Amounts Paid or in Behalf of Borrower, and 100-Gross Amount Due from Borrower. In order to determine what exactly the borrower will need to take or pay home from closing, it is important that this section is carefully reviewed.

What is the HUD?

HUD refers to the Department of Housing and Urban Development, which is the arm of the federal government that makes legislation relating to home ownership and property development.

Who prepares HUD forms?

The HUD is prepared by the settlement or closing agent at closing time. You have the right to inspect this form one day prior to settlement. Compare the HUD to the GFE to make sure you weren’t overcharged for a loan, title, escrow fees, or document recording.

What is HUD-1 form?

In a sentence, the HUD-1 form is a document that itemizes every financial transaction that is happening between all parties involved in the transfer of property. That’s the short of it.

What information is on a closing statement?

There is a lot of data on the closing statement. Information re the buyer seller, lender, property details, and settlement agent is listed. The majority of the document is a lot of figures. It’s not practical to list them all here, but here are a few examples.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.