Does the rebate appear on the hud-1/settlement statement?

Does the rebate appear on the HUD-1 Settlement Statement? Yes, we work with the closing attorney and your lender from the beginning of the transaction to make sure that your rebate is accounted for properly.

How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

What is an Alta/Closing Disclosure/HUD-1 statement?

ALTA Settlement Statements are used in conjunction with the HUD-1 settlement statement. Under the new CFPB regulations, most real estate transactions require the use of the new Closing Disclosure Form. However, the HUD-1 settlement statement is still used in certain cases such as: Home equity revolving lines of credit.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What is the purpose of the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Is a HUD-1 the same as a closing statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Where can I find my HUD-1?

HUD-1 Forms | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

What is the HUD-1 now called?

Closing DisclosureThe Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction.

What is the difference between a settlement statement and a closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

When did the CD replace the HUD?

Oct. 3, 2015The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

How do you read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What does HUD mean in real estate?

U.S. Department of Housing and Urban DevelopmentHUD Homes | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is HUD 1?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America. The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, ...

When will be my first mortgage payment?

An example is if the closing is September 15, the first mortgage payment will not be until November 1. The November 1st payment will represent the principal and interest for October. The interest from Sept 15-Sept 30 will be prepaid on the closing date.

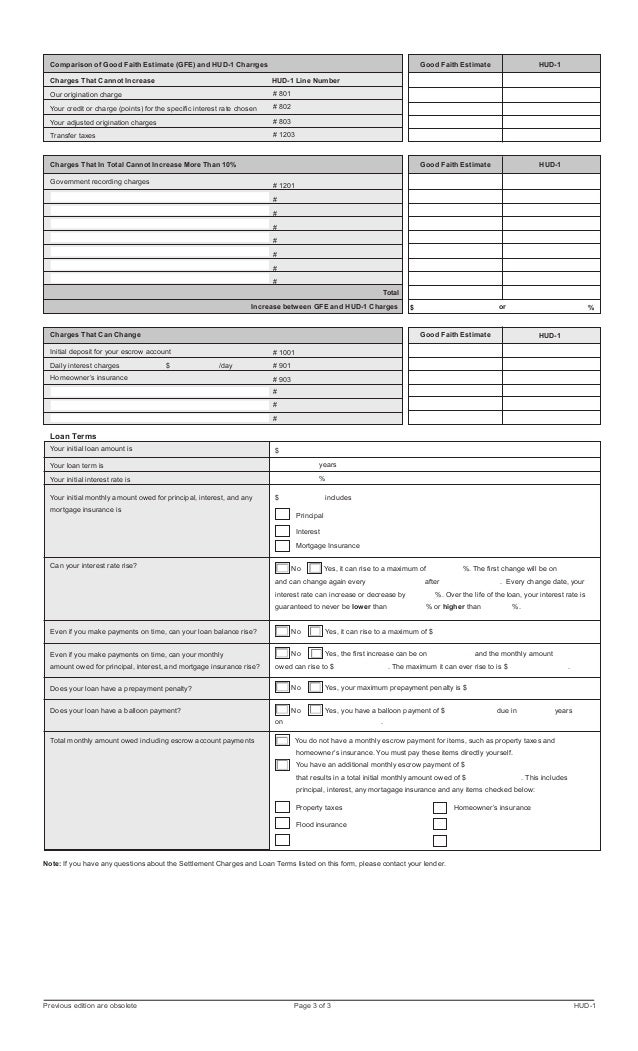

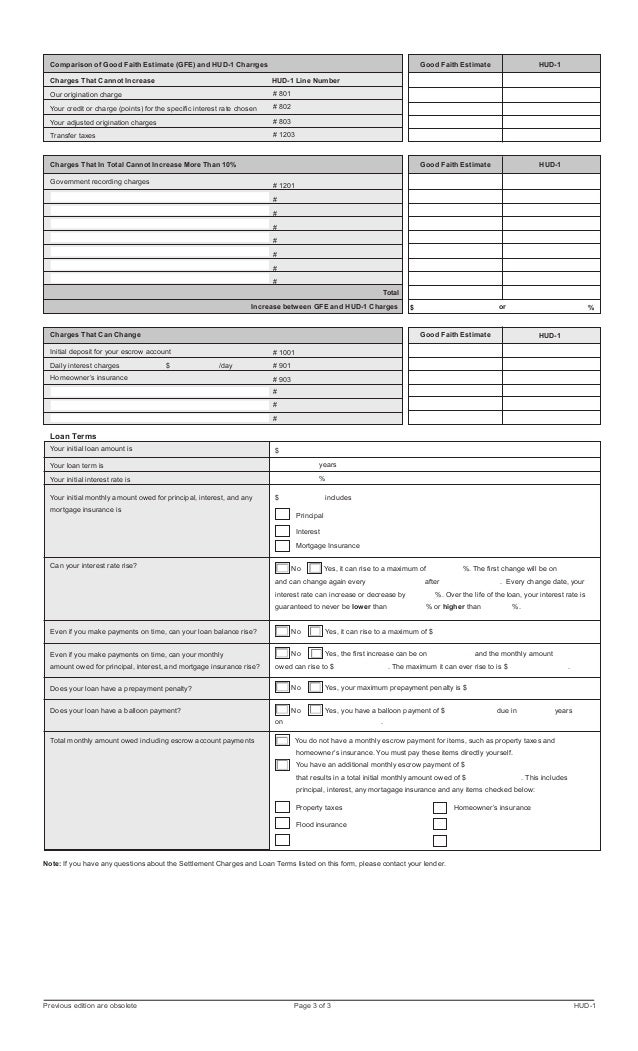

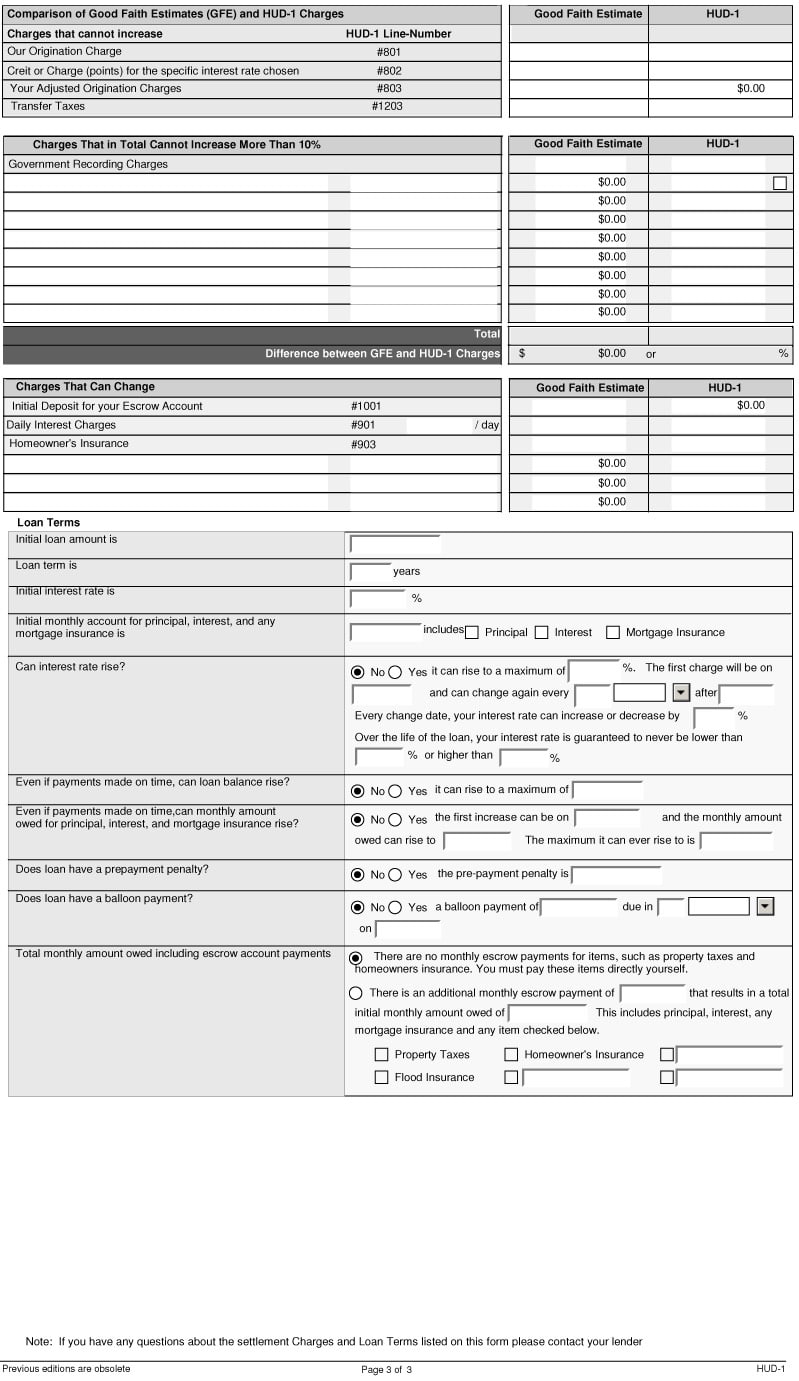

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

What is a RESPA?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

What is HUD-1 form?

In a sentence, the HUD-1 form is a document that itemizes every financial transaction that is happening between all parties involved in the transfer of property. That’s the short of it.

Who prepares HUD forms?

The HUD is prepared by the settlement or closing agent at closing time. You have the right to inspect this form one day prior to settlement. Compare the HUD to the GFE to make sure you weren’t overcharged for a loan, title, escrow fees, or document recording.

What is the HUD?

HUD refers to the Department of Housing and Urban Development, which is the arm of the federal government that makes legislation relating to home ownership and property development.

What information is on a closing statement?

There is a lot of data on the closing statement. Information re the buyer seller, lender, property details, and settlement agent is listed. The majority of the document is a lot of figures. It’s not practical to list them all here, but here are a few examples.

What is a HUD-1 statement?

When you refinance or purchase a home, one of the first things that your lender is going to provide you with is a HUD-1 Settlement Statement. This particular statement contains all the fees and costs that incurred with the financing of your home. In order to ensure that it is 100% accurate, it is important for both the seller and buyer to fully comprehend this document and to review it as it contains a handful of details that are important for both parties. The Real Estate Settlement Procedures Act (RESPA) requires that the HUD-1 statement is utilized in every federally regulated mortgage loan.

Who is responsible for reviewing HUD-1?

Buyers and sellers are the ones who are responsible for reviewing their HUD-1 Settlement Statement form in order to ensure that it is accurate. Before the end of closing, every error found must be corrected. Until every question that relates to the HUD-1 Settlement Statement has been satisfactorily answered, no seller or buyer is obligated to complete a closing. Alongside his or her loan officer, the HUD-1 needs to be especially reviewed by the buyer before the closing of a home purchase or mortgage loan. Comparing the mortgage loan documents to the HUD-1 Settlement Statement will prevent the buyer from obligation to loan terms that are incorrect.

How many sections are there in HUD-1?

The HUD-1 Settlement Statement form contains twelve main sections, and a lot more subsections. You will notice that some sections on the form are specifically referred to the borrower’s costs and fees. Other sections on the form refer to the seller that’s in the transaction. One day prior to the closing, every party to the transaction is required to attain a copy of the HUD-1 Settlement Statement form. However, in a lot of cases, the form’s entries are still changing a couple of hours before the closing is conducted. A title agent, lender, or real estate professional can answer any question you may have that regard to the HUD-1 Settlement Statement form.

What is section L on HUD?

This section on the HUD-1 Settlement Statements details information on loan fees, costs that were paid to real estate professionals, items paid in advance such as homeowners insurance and interests, and several required escrow items. You will notice that additional subsections detail items such as home warranties, survey, home inspections, deed fees, and title fees. Section L subsections are 1400-Total Settlement Charges, 1300-Additional Settlement Charges, 1200-Government Recording and Transfer Charges, 1100-Title Charges, 1000-Reserves Deposited with Lender, 900-Items Required by Lender to be Paid in Advance, 700-Total Sales/Broker’s Commission on Price, and 800-Items Payable in Connection with Loan. Before signing any closing document, make sure to carefully review each of these items in this section. In order to make sure that you understood all the charges stated in this section, prior to closing, ask any questions. If you stop and think about it, it is better to prevent than lament.

What is section J in a mortgage?

This section contains details on the buyer’s amounts paid, amount due, and amount of cash that the borrower gets or pays at closing. The subsections in section J are 300-Cash at Settlement To/From Borrower, 200-Amounts Paid or in Behalf of Borrower, and 100-Gross Amount Due from Borrower. In order to determine what exactly the borrower will need to take or pay home from closing, it is important that this section is carefully reviewed.

What Is A HUD-1 Statement?

- The HUD-1 form is a three-page mortgage document required in certain cases. This document contains an itemized list of every fee charged for the loan. This form is also commonly referred to as a settlement statementbecause it’s one of the final pieces of paperwork that comes before the transaction officially closes, or “settles.”

Mortgages That Require A HUD-1 Statement

- The HUD-1 form used to be furnished in most real estate transactions, but today, it doesn’t play a role in typical home purchases. If you receive a HUD-1 form nowadays, you’re likely dealing with one of these specific types of mortgages: 1. Reverse mortgage: If you’re an older homeowner tapping your equity via a reverse mortgage, you’ll receive the HUD-1 statement. 2. Refinance: If y…

HUD Settlement Statement vs. Closing Disclosure

- The more common settlement statementin real estate is a closing disclosure, which is now issued to most borrowers. Both the HUD-1 and closing disclosure have the same aim: to educate borrowers about all the costs of their mortgage. The differences between the two include: 1. How long it is– The closing disclosure is designed to be easier to read for borrowers. It’s a bit longer …

Understanding The HUD-1 Form

- The three pages of the HUD-1 form include a summary of all the costs associated with the mortgage (page 1), an itemized list of each expense (page 2) and a comparison between your initial loan estimate and the final settlement (page 3). Here’s a rundown of everything you’ll see: 1. Commission feesdue to real estate agents 2. Loan charges, including origination fee, prepaid poi…

Bottom Line

- If you receive the HUD-1 statement, read this document closely. Ideally, have a real estate attorney help you double-check it to make sure you aren’t overpaying for anything and that there are no mistakes that could cost you extra money. Remember: You could be paying back this amount for decades to come, so the day you receive the HUD-1 plays a very important role in your financial f…