What is Cost Settlement? 3 Medicaid is a joint federal and stateprogram that funds allowable medical services for eligible individuals. For every dollar a public school dist rict spends to provide direct medical services to Medicaid eligible individuals, the federal government is responsible for a portion of the costs.

Full Answer

How much does Medicaid pay for a personal injury settlement?

As an illustration, consider that Medicaid paid $200,000 for an injured individual's medical expenses. The individual then arrived at a settlement and received $300,000, of which $100,000 was allocated for medical expenses, $100,000 for lost wages, and $100,000 for pain and suffering.

Can states recover Medicaid expenses from settlements?

In the 2006 decision of Arkansas Department of Health and Human Services, et al. v. Ahlborn, the United States Supreme Court ruled that states could only recover the portion of the Medicaid expenses that the settlement attributed to medical costs.

What are out-of-pocket costs for Medicaid enrollees?

States have the option to charge premiums and to establish out of pocket spending (cost sharing) requirements for Medicaid enrollees. Out of pocket costs may include copayments, coinsurance, deductibles, and other similar charges.

What is a Medicaid spend down state?

These states are sometimes referred to as “spend down” states and allow Medicaid applicants to spend their “excess” income on medical expenses until they reach the medically needy income limit. Once they have done so, they are income eligible for the remainder of the spend down period.

What is healthcare cost settlement?

Cost settlement methodology generates reimbursement for services based on both claim payments for services rendered (interim payments), and a settlement of the costs associated with the provision of services.

What is a cost report settlement?

COST REPORT SETTLEMENTS means, collectively, all amounts owing to Borrower from the applicable Governmental Authority in connection with Medicare and Medicaid cost reports, for any period of determination.

What is the purpose of a cost report?

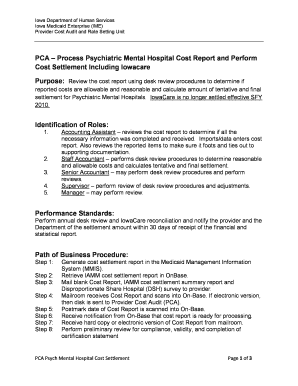

PURPOSE: To ensure that the filed cost report has been reviewed for accurate presentation of the facility's operations, compliance with applicable regulations, and adequate documentation to support the costs claimed.

What is the purpose of Medicare cost report?

Medicare cost reports are used to report expenses for different types of Medicare reimbursable facilities, such as Skilled Nursing Homes (SNFs), Home Health Agencies (HHAs), Home Offices, Hospices, Rural Health Clinics (RHCs), Federally Qualified Health Centers (FQHCs), Comprehensive Outpatient Rehabilitation ...

How often are Medicare cost reports filed?

Each yearEach year, Medicare Part A providers must submit an acceptable Medicare Cost Report (MCR) package to their Medicare Administrative Contractor (MAC) for the purposes of determining their Medicare reimbursable cost.

Why is Medicare cost reporting important to reimbursement?

Currently, only about 10% of all Medicare certified providers continue to receive payment under a cost based methodology. For these providers, the Medicare cost report is essential because it settles a provider's current interim rate and sets its future interim rate.

What are the benefits of cost reporting?

Why Cost Reports are Crucial for Construction & DesignKnow where money was made and how much. This will help price future projects more accurately. ... Investigate losses. ... Hold your staff accountable. ... Have contingencies in place for the unexpected. ... Provide information on which types of projects are profitable.

What type of data is included in a final cost report?

The contents of a cost report will often include: The costs incurred on the project up to the date of the report. A forecast of the likely costs over the rest of the project, which might be updated using metrics like CPI or TCPI. The risk allowances or contingencies based on possible unforeseen circumstances.

How do you prepare a cost report?

0:2710:05How to Prepare a Production Cost Report - YouTubeYouTubeStart of suggested clipEnd of suggested clipCost report now how many units did we start in to production. That's our units started fiftyMoreCost report now how many units did we start in to production. That's our units started fifty thousand six hundred then we add those together and that gives us our total units of 65/100.

Who signs Medicare cost report?

signed by its administrator or chief financial officer certifying the accuracy of the electronic file or the manually prepared cost report.” PROCEDURE: 1.

Are Medicare cost reports audited?

Cost Report Process The audit and settlement process determines whether providers are paid in accordance with CMS regulations and instructions. These days, CMS uses Medicaid Administrative Contractors (MACs) to provide audit services. MACs annually receive upwards of 50,000 Medicare cost reports.

What is a cost report in accounting?

A production cost report identifies the total cost (direct materials, labor, and overhead), of producing a product.

What is a cost report in accounting?

A production cost report identifies the total cost (direct materials, labor, and overhead), of producing a product.

What is the purpose of a production report?

The purpose of this form is to keep track of a production's progress and expenses and to help determine what salary is owed to the cast and crew.

What is a project cost report?

Project Cost Reporting is a feature on the Project Page that allows for more robust and flexible reporting that incorporates all elements of the cost of a project. See Configure and Export a Project Cost Report in Portfolio Financials.

What is a cost to complete report?

Cost to Complete is a forensic analysis of the current, in-progress job status of an ongoing construction project, combined with a detailed evaluation of the remaining work and budget to complete it.

What is cost sharing in Medicaid?

Cost Sharing. States have the option to charge premiums and to establish out of pocket spending (cost sharing) requirements for Medicaid enrollees. Out of pocket costs may include copayments, coinsurance, deductibles, and other similar charges.

How does Medicaid work?

Medicaid rules give states the ability to use out of pocket charges to promote the most cost-effective use of prescription drugs. To encourage the use of lower-cost drugs, states may establish different copayments for generic versus brand-name drugs or for drugs included on a preferred drug list. For people with incomes above 150% FPL, copayments for non-preferred drugs may be as high as 20 percent of the cost of the drug. For people with income at or below 150% FPL, copayments are limited to nominal amounts. States must specify which drugs are considered either "preferred" or "non-preferred." States also have the option to establish different copayments for mail order drugs and for drugs sold in a pharmacy. See more information in Prescription Drugs.

Can you charge out of pocket for coinsurance?

Certain vulnerable groups, such as children and pregnant women, are exempt from most out of pocket costs and copayments and coinsurance cannot be charged for certain services.

Can you get higher copayments for emergency services?

States have the option to impose higher copayments when people visit a hospital emergency department for non-emergency services . This copayment is limited to non-emergency services, as emergency services are exempted from all out of pocket charges. For people with incomes above 150% FPL, such copayments may be established up to the state's cost for the service, but certain conditions must be met.

What is the component of a medical malpractice settlement?

When an individual is awarded a settlement in a medical malpractice or personal injury suit, it is typically for more than just the medical expenses. A component of the award is often attributable to pain and suffering, loss of wages or an ongoing disability.

When did the Social Security Act change?

Despite the Ahlborn decision, Congress amended the Social Security Act in 2013, thereby giving the states the right to recover their entire medical expenses from Medicaid beneficiaries' awards and settlements.

Can a state recover compensation for medical malpractice?

If the injured individual is ultimately rewarded funds through a personal injury or medical malpractice claim, the state can recover a portion of such funds in order to reimburse itself for the care it provided.

Will Medicaid be able to recover medical expenses?

Going forward, a State's Medicaid program will only be able to recover the medical expenses specifically delineated in the settlement agreement , even if such amount is less than what was actually paid. This will enable the injured person who initiates a lawsuit to keep a greater portion of his settlement.

Why is cost settlement important?

Cost settlement ensures districts receive the right amount of reimbursement because district costs can vary across the state.

What is Medicaid in education?

3. Medicaid is a joint federal and stateprogram that funds allowable medical services for eligible individuals. For every dollar a public school dist rict spends to provide direct medical services to Medicaid eligible individuals, the federal government is responsible for a portion of the costs.

What is annual cost report?

The Annual Cost Report is an opportunityfor LEAs to report their true costs for providing SEMI services in order to reconcile with the interim revenue received.

How much is allowable because of CMS approved list of materials and supplies but must be depreciated?

Allowablebecause it is on the CMS approved list of materials and supplies but must be depreciated if over $5,000

What is indirect cost rate?

The Indirect Cost Rate is used to include additional costs of doing business that cannot be easily ident ified within a particular grant, contract, or program, but are nece ssary for the general operation of the organization.

Can you record costs for the first, third, and fourth quarters?

Costs can only be recorded for the first, third and fourth quarters despite Mike working in Q2. Costs can only be recorded for time worked as a Psychologist, which includes Q1 and Q2.

Can nursing services be claimed in Q1?

Nursing Services YES, these costs would be claimed in Q1 when they were paid NO, the payment is for services rendered outside of the fiscal year and cannot be claimed in the FY18 annual report OT Services YES, because the services were paid for in Q3 of FY18 YES, because the services were rendered during FY18 PT Services NO, these costs would be claimed in Q1 of FY19 because that is when they were paid YES, even though these services were paid in a different fiscal year, the services were performed during FY18