What does NSCC stand for?

National Securities Clearing Corporation (NSCC) is a subsidiary of Depository Trust & Clearing Corporation (DTCC) that provides centralized clearing, risk management, information, and settlement services to the financial industry.

What is the National Securities Clearing Corporation (NSCC)?

This reduces their financial exposure and capital requirements. The National Securities Clearing Corporation was established in 1976 and is a registered clearing corporation, regulated by the U.S. Securities and Exchange Commission (SEC).

What is the difference between the DTCC and NSCC?

The Depository Trust and Clearing Corporation (DTCC), the parent company of the NSCC, acts as a contra-party for the exchange of securities and a central depository of securities. The National Securities Clearing Corporation (NSCC) provides clearing, settlement, and other post-trade financial services to the U.S. securities exchange market.

What is the net settlement corporation (NSCC)?

Today, this corporation serves as a seller for every buyer, and buyer for every seller for trades that settle in U.S. markets. The NSCC helps reduce the value of payments exchanged by an average of 98% daily. Also, it’s important to note that NSCC generally clears and settles trades on a T+2 basis.

What does NSCC stand for?

National Securities Clearing CorporationNational Securities Clearing Corporation (NSCC)

What is NSCC for mutual funds?

NSCC's Role as the Mutual Fund Clearing House NSCC provides centralized clearance, settlement and information services for a substantial majority of U.S. inter-broker trades in equity securities, corporate and municipal bonds, exchange-traded funds and unit investment trust shares.

How does DTCC settlement work?

Settlement at DTC occurs business day at approximately 4:15 p.m. eastern standard time. This is when the cash is moved through the Federal Reserve Bank of New York on behalf of all of the transactions that were processed and completed that day.

What is NSCC number?

[email protected]. 615-353-3655.

Why is NSCC Important?

The organization provides settlement services to the financial industry, along with risk management, information, and centralized clearing. The NSCC offers multilateral netting allowing brokers to offset buy and sell positions into a single payment obligation.

Is NSCC private?

The college delivers over 130 programs in five academic schools: Access, Education and Language; Business and Creative Industries; Health & Human Services; Technology and Environment; and Trades and Transportation....Nova Scotia Community College.TypePublic Community CollegeEstablished19969 more rows

What is the difference between DTC and FED settlement?

For settlement in DTC and NSCC, the cash settlement is performed at the end of the processing day, on a net basis. For settlement in Fedwire Securities, the cash settlement is performed transaction by transaction during the day.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What is the difference between DTC and DTCC?

The Depository Trust and Clearing Company (DTCC) owns the DTC and manages risk in the financial system. Formerly an independent entity, the DTC was consolidated with several other securities-clearing companies in 1999 and became a subsidiary of the DTCC.

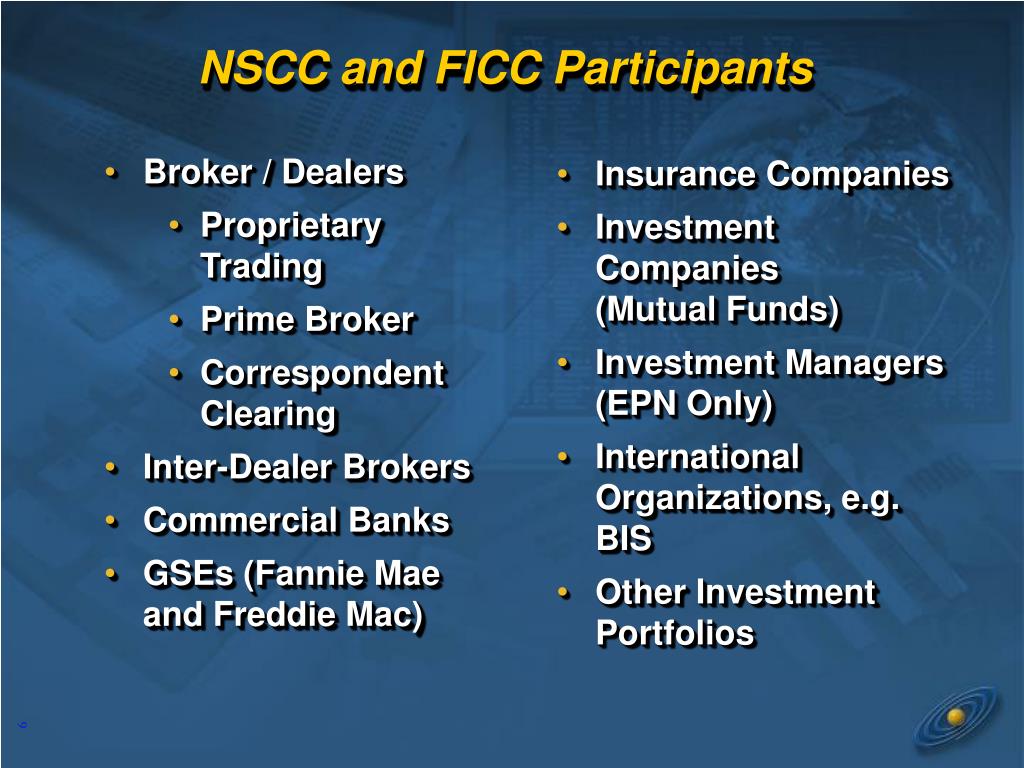

How many members are in the NSCC?

NSCC has roughly 4,000 participants, and is regulated by the U.S. Securities and Exchange Commission (SEC).

What is a balance order?

The trade settlement instruction generated for a Non-CNS security is called a Balance Order. A Deliver Balance Order is issued to a firm that is a net seller of securities. Conversely, a Receive Balance Order is issued to a firm that is a net buyer of securities. Click here to see an example of a Balance Order.

Who owns DTCC?

The DTCC follows this model. It is owned by its users and re-allocates equity every three years as user share shifts. In the past 12 months (to September 2020) it earned $1.9 billion in revenues, of which it absorbed $1.5 billion in operating costs and returned $158 million as rebates to its users.

How do you become a member of the NSCC?

Membership is available to any qualified and approved:Broker/Dealer.Clearing agency.Investment company or other regulated pooled investment entity.Insurance Company or insurance agency.Bank or Trust.

What does Ficc stand for?

FIXED INCOME, CURRENCY AND COMMODITIESFIXED INCOME, CURRENCY AND COMMODITIES (FICC) —

Who owns DTCC?

Depository Trust & Clearing CorporationTypePrivateOwnerBanks, brokersNumber of employees4,300SubsidiariesNSCC DTC FICC DTCC Deriv/SERV LLC DTCC Solutions LLC EuroCCP Ltd. DTCC Loan/SERV LLC Warehouse Trust Company LLC DTCC Derivatives Repository Ltd.Websitewww.dtcc.com12 more rows

How do you become a DTCC participant?

Membership Requirements In order to utilize DTCC's Insurance Services, participants are required to be members of National Securities Clearing Corporation (NSCC). For more information about NSCC Membership, and specifically membership requirements to use DTCC's Insurance Services, please contact ([email protected]).

What is NSCC settlement?

The process is centralized with the Depository Trust Company’s money settlement so that common participants can be provided with consolidated reports and a single access point for settlement information. The NSCC summarizes and nets the money debit and credit transaction data recorded throughout the day, and for each participant, generates an aggregate money credit or debit.

What is the purpose of NSCC?

The NSCC needs to maintain credible risk management controls and fulfill the statutory requirements according to the Exchange Act. The requirements are established as “Covered Clearing Agency” rules to improve the legal structure for the oversight ...

What is the balance accounting system for the NSCC?

The National Securities Clearing Corporation provides a Balance Accounting System for the securities that are not eligible for CNS processing. The system produces instructions for receipt and delivery of netted and allotted positions to the NSCC members. The balance order portion settled through the NSCC is called the “clearance cash adjustment,” which provides a modification to mark-to-market price to process the allotted and netted balance orders.

What is the National Securities Clearing Corporation?

Securities and Exchange Commission (SEC) Securities and Exchange Commission (SEC) The US Securities and Exchange Commission, or SEC, is an independent agency of the US federal government that is responsible for implementing federal ...

What is a DTCC?

The Depository Trust and Clearing Corporation (DTCC), the parent company of the NSCC, acts as a contra-party for the exchange of securities and a central depository of securities.

What is a continuous settlement system?

As it is a continuous settlement system, the new positions issued and the positions that remain open after their original settlement date are netted so that the failed positions are closed. For settlement purposes, the NSCC assumes the responsibility for its members for receiving and paying for the securities.

What is clearing house?

Clearing House A clearing house acts as a mediator between any two entities or parties that are engaged in a financial transaction. Its main role is to ensure that the transaction goes smoothly, with the buyer receiving the tradable goods he intends to acquire and the seller receiving the right amount paid

What is settlement process?

In the financial industry, settlement is generally the term applied to the exchange of payment to the seller and the transfer of securities to the buyer of a trade. It’s the final step in the lifecycle of a securities transaction.

What time does DTC settlement occur?

Settlement at DTC occurs business day at approximately 4:15 p.m. eastern standard time. This is when the cash is moved through the Federal Reserve Bank of New York on behalf of all of the transactions that were processed and completed that day.

What is DTC new issue?

The New Issue Eligibility program allows underwriters and other DTC Participants to submit eligibility requests for new and secondary security offerings. Once DTC makes an eligibility determination and accepts the securities for depository and book-entry services, the securities can be distributed quickly and efficiently. These securities are then available for the full range of DTC deposit and book-entry services. Lead managers, underwriters, placement agents and other market players that are DTC participants can use the service. In addition, firms that are not direct participants but maintain a clearing relationship with a DTC participant can use the service as a correspondent; however, the Participant through which the securities are introduced to DTC remains responsible for all activities within its account.

What is collateral loan service?

The Collateral Loan Service allows DTC clients and their customers to pledge securities as collateral for a loan or for other purposes to the Federal Reserve Bank (Fed), the Options Clearing Corp (OCC) and commercial banks with pledgee accounts at DTC. These transactions can be made free (i.e., the money component of the transaction is settled outside of the depository) or valued (i.e., the money component of the transaction is settled through DTC as a debit/credit to the pledgor's and pledgee's DTC money settlement accounts).

What type of money market instrument is eligible for settlement at DTC?

There are 14 types of Money Market Instruments (MMIs) that are eligible to settle at DTC and they include Corporate Commercial Paper, Municipal Commercial Paper, Medium Term Notes, Institutional Certificates of Deposits and several others . Commercial Paper has the shortest maturity dates and is the most active from an issuance and maturing perspective since it allows corporate issuers to determine their cash flow needs on a daily basis if necessary. Key participants in the MMI space include:

When do SPPs have to be received?

SPPs must be received by approximately 3:10 p.m. Eastern Standard Time to relieve any transactions that are pending because of net debit cap or insufficient collateral in their accounts. SPPs can be requested back by the client up until 3:00 p.m. as long as this transaction passes DTC’s risk controls.

How long does it take for DTC to process a security?

DTC, as the depository for all equity, municipal and corporate debt, including money market securities, in the U.S., receives instructions from a variety of organizations to process the movement of a security throughout a 23 hours per day, 5 days per week processing window. The key providers of these movements include NSCC, Omgeo, ...

What is NSCC in CNS?

The NSCC is the counterparty for members during each day in the CNS process, eliminating counterparty risk. If something happened to an NSCC member during a trading day, the NSCC would be responsible for fulfilling the member's obligations. There were more than 3,480 NSCC member entries in 2021, and many of them were for divisions ...

How many NSCC entries will there be in 2021?

There were more than 3,480 NSCC member entries in 2021, and many of them were for divisions of a single company. 1 The NSCC acts as a sort of "honest broker" between brokerages in the continuous net settlement process. The CNS process helps the NSCC to reduce the value of payments exchanged by an average of 98% daily.

What Is Continuous Net Settlement?

Continuous Net Settlement (CNS) is a settlement process used by the National Securities Clearing Corporation ( NSCC) for the clearing and settlement of securities transactions. CNS includes a centralized book-entry accounting system, which keeps the flows of securities and money balances orderly and efficient.

What is the CNS process?

During the CNS process, reports are generated that document the movements of money and securities. This system processes most broker-to-broker transactions in the United States that involve equities, corporate bonds, municipal bonds, American depositary receipts ( ADRs ), exchange-traded funds (ETFs), and unit investment trusts. NSCC is a subsidiary of the Depository Trust Clearing Corporation (DTCC).

What is NSCC settlement?

Money is settled with the NSCC at day's end. The method is centralised with the money settlement of the Depository Trust Company so that common participants can acquire consolidated reports and a single point of access to settlement data. The NSCC encapsulates and nets the money credit and debit transaction information captured during the day, producing an aggregate money debit or credit for every participant. DTC participants' transactions are likewise netted and recorded.

When was NSCC formed?

National Securities Clearing Corporation (NSCC) was formed in 1976 as a subsidiary of Depository Trust & Clearing Corporation (DTCC).

What is a DTCC clearing broker?

Clearing brokers affiliated with the DTCC are exchange members who aid in properly settling trades and completing transactions. Furthermore, the paperwork associated with the clearing and implementing a transaction is kept by these clearing brokers.

What is NSCC in banking?

National Securities Clearing Corporation (NSCC) was established in 1976 as a subsidiary of Depository Trust & Clearing Corporation (DTCC). The Corporation performs clearance, settlement, risk managing, central counterparty services and a guarantee of accomplishment for specified transactions in the financial industry.

What is NSCC balance accounting?

For securities that do not qualify for CNS processing, the NSCC offers a Balance Accounting System. The system sends NSCC members instructions for receipt and delivery of allotted and netted positions.

What is t+2 in NSCC?

Thus, t+2 is how NSCC usually settles and clears deals.

What is the SEC?

Moreover, the Securities and Exchange Commission (SEC) is a federal government agency that enforces federal securities laws and develops securities rules. It is also liable for stock and options exchanges, the securities industry, and the regulation of electronic securities markets and other national events. The SEC's mission is to safeguard investors and guarantee that markets are efficient, fair, and orderly. Apart from that, it attempts to create a market environment in which individuals can have faith.