What is an Alta statement and why do I need one?

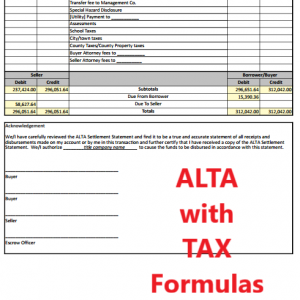

What is an ALTA Statement? The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is an Alta Closing Disclosure?

The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer. ALTA statements were put into use to provide thorough breakdowns for agents and brokers to receive at the end of the transaction. Are ALTA Settlement Statements the Same as Net Sheets?

Where can I get a sample Alta settlement statement?

An ALTA settlement statement is provided during the closing of a transaction and contains solid numbers rather than estimates. Where Can I Download a Sample ALTA Settlement Statement? You can download a sample ALTA statement by clicking the text link below.

What does POC borrower mean on a settlement statement?

When POC is listed on the Settlement Statement, the letters are often followed by the words Borrower, Seller, Broker, or Lender. This refers to who paid the fee. For example, if the borrower paid for the appraisal before the closing, the fee would be marked as "POC Borrower" on the Settlement Statement.

How many versions of ALTA Settlement Statement are there?

How to contact ALTA?

About this website

What does the entry POC on the closing document mean?

What does POC mean on a closing statement? paid outside of closing.

What is a POC item?

A proof of concept (POC) is a demonstration of a product, service or solution in a sales context. A POC should demonstrate that the product or concept will fulfill customer requirements while also providing a compelling business case for adoption.

Where may Items listed as POC paid outside closing appear on the HUD 1?

Charges that are paid outside of closing by any party must be included on the HUD, but they must be marked “P.O.C” and should not be included in the totals. P.O.C. items should be disclosed outside of the columns.

How do you read an Alta statement?

The ALTA statement is an itemized list of all the cost components that the seller and the buyer are supposed to pay during the home closing process to multiple parties. The statement segregates these cost components into 8-9 sections. Each cost component could either be debited or credited to the concerned party.

Why is POC needed?

The proof of concept is so valuable because it's a pilot project to evaluate the feasibility of your plan before work begins, similar to a prototype or lean manufacturing “minimum viable product”. A POC verifies that concepts and theories applied to a project will result in a successful final product.

Which of the following statements best describes a proof of concept POC )?

A proof of concept (POC) is an exercise in which work is focused on determining whether an idea can be turned into a reality. A proof of concept is meant to determine the feasibility of the idea or to verify that the idea will function as envisioned. It is sometimes also known as proof of principle.

Is a closing disclosure the same as a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Which of the following fees Cannot increase at settlement?

Charges That Cannot Increase: The origination charge, credit charge, adjusted origination charges, and transfer taxes have a zero tolerance.

What happens if the amounts charged are outside the tolerance limitations?

Tolerance Cures If the amounts paid by the borrower at closing exceed the amount disclosed on the loan estimate beyond the applicable tolerance threshold, the lender must refund the excess to the borrower no later than 60 calendar days after the consummation.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What is a final closing statement?

DEFINITION. A closing statement is a written record of the terms of a loan or other financial transaction, disclosing the final terms of an agreement.

What does Alta stand for?

American Land Title AssociationAmerican Land Title Association (ALTA)

What does POC brand stand for?

VeloNews does not have any independent data on the helmet, though POC — it stands for piece of cake — is known for merging of safety and modern aesthetics. Its mountain bike and ski products are bright and burly, and the company's helmet does appear a bit bigger than its soon-to-be competitors.

What is a POC in technology?

A proof of concept (POC) is how startups demonstrate to a corporation that their technology is financially viable. The startup essentially creates a prototype in a sandbox-environment to prove their technology is capable of handling real-world applications.

What does a proof of concept look like?

A POC typically involves a small-scale visualization exercise to verify the potential real-life application of an idea. It's not yet about delivering that concept, but showing its feasibility.

What is POC in real estate?

Paid outside closing (POC) is the fees or payments rendered outside of normal title insurance and underwriting fees due at the time of closing a loan.

Settlement Statement - Residential Title

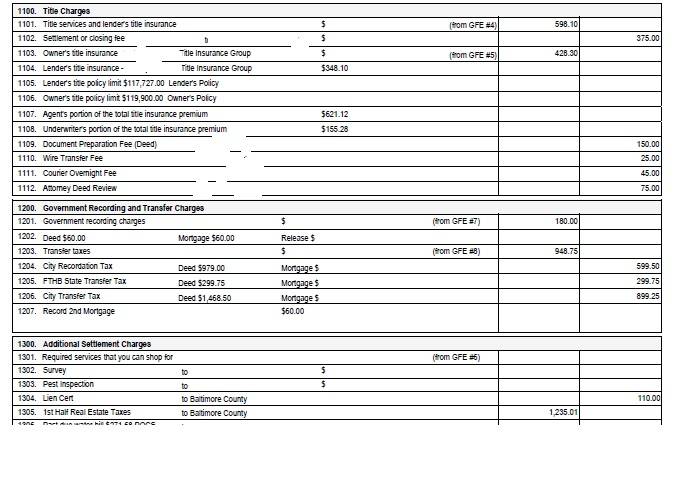

responsibilities of buyer and seller for paying the points should be stipulated in the sales contract. 803-804. Appraisal Fee and Credit Report- These are costs incurred by the buyer for appraising the property and conducting a credit check of the buyer.

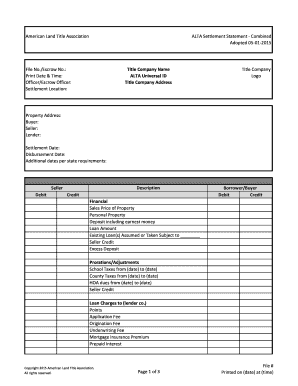

Es cro w No .: Title Company Name Title C o mp any ALTA Universal ID ...

File # Printed on (date) at (time) Copyright 2015 American Land Title Association. All rights reserved. Page 3of Interest on Payoff Loan ($ amount/day)

ALTA Universal ID Title Company Address

We/I have carefully reviewed the ALTA Settlement Statement and find it to be a true and accurate statement of all receipts and disbursements made on my account or by me in this transaction and further certify that I have received a copy of the

A. Settlement Statement (HUD-1)

A. Settlement Statement (HUD-1) Previous edition are obsolete Page 1 of 3 HUD-1 B. Type of Loan J. Summary of Borrower’s Transaction 100. Gross Amount Due from Borrower C. Note:

TRID Fee Placement and Tolerance Chart

TRID Fee Placement and Tolerance Chart As of 1/1/2016 By VS Loan Estimate ZERO Tolerance 10% Tolerance NO Tolerance Requirement Section A. Origination

Fillable Form Closing Disclosure | Edit, Sign & Download in PDF | PDFRun

Get a Closing Disclosure here. Edit Online Instantly! - The Closing Disclosure includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

Why is POC not included in settlement statement?

If a fee is marked as POC, it is not included in the bottom line on the settlement statement because someone has already paid it (in the case of a paid appraisal) or the borrower does not owe it (in the case of a yield spread premium).

Why are POC fees listed on the mortgage settlement statement?

POC fees are listed on the Settlement Statement because the Real Estate Settlement Procedures Act (RESPA) states that all fees associated with a federally regulated mortgage must be shown on the Settlement Statement, regardless of whether they have already been paid or not.

What is POC in mortgage?

Paid Outside of Closing. POC stands for Paid Outside of Closing, and refers to any fee that is not being disbursed at the closing. The two most common POC charges are the appraisal fee (if it has been paid by the borrower before the closing) and the yield spread premium (the rebate that the lender pays the mortgage broker).

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.

Who pays for personal property?

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

Who levies title and mortgage costs?

These costs are levied by the county for recording the new title and mortgage for the new owner.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is an ALTA Statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is closing disclosure?

The closing disclosure is provided to the buyer and pertains a list of fees and costs and how they work into the buyer’s total expense. It is important to note that only the lender can provide the Closing Disclosure to the buyer 3 days prior to closing? And only the buyer should be able to see it unless they allow the release of it by signing a release disclosure. You should also know that the lender is obligated under the TRID regulations, and the lender can be penalized for failing to disclose 3 days after they’re loan application is approved and again 3 days prior to closing.

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

What is a HUD-1?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer.

Is ALTA the same as net sale?

No, an ALTA settlement statement is not the same as the net sale sheet. A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make. The net sale sheet is not final, and multiple sheets may be provided as offers are made and transactions process. An ALTA settlement statement is provided during the closing of a transaction and contains solid numbers rather than estimates.

Can you have a buyer's statement and seller's statement in ALTA?

But please note that it is possible to have a combined ALTA Buyer’s or Seller’s statement.

How many versions of ALTA Settlement Statement are there?

There are four versions of the ALTA Settlement Statement available:

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

How many versions of ALTA Settlement Statement are there?

There are four versions of the ALTA Settlement Statement available:

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].