Payment and Settlement Systems: A Primer

- Introduction. A payment denotes the performance or discharge of an obligation to pay, which may or may not involve money transfer.

- Netting and Settlement in Payment Transactions. ...

- Institutions and Organisations in payment system. ...

- Securities Settlement System. ...

- Wholesale Settlement System. ...

- Retail Payment System. ...

- Conclusion. ...

- Our other related write-ups

What is a good settlement amount?

What is a good settlement amount? Very roughly, if you think that you have a 50% chance of winning at trial, and that a jury is likely to award you something in the vicinity of $100,000, you might want to try to settle the case for about $50,000.

How to cash out structured settlement payments?

- Withdraw any payment or amount of money earlier than the pre-set date

- Change the amount of the periodic payments (how much to get in a payment)

- Change the future payment structure (when to get the payments)

How to sell structured settlement payments?

Your Quick Guide to Selling Structured Settlement Payments

- Decide How Much You Want to Sell. When selling structured settlement payments, you have the option of selling the entire annuity or part of it.

- Ask for Quotes. Next, you’ll need to consult with a company to get a quote. ...

- Sign the Contract. ...

- Get a Judge’s Approval. ...

- Get Cash Now by Selling Structured Settlements. ...

What is average settlement period?

The Average Settlement Period for Trade payables depicts with an average of 250 days an even higher period for goods to be paid by the business to suppliers. Considerable reasons for this result might be a special trade payment agreement with some suppliers.

What is payment and settlement system of RBI?

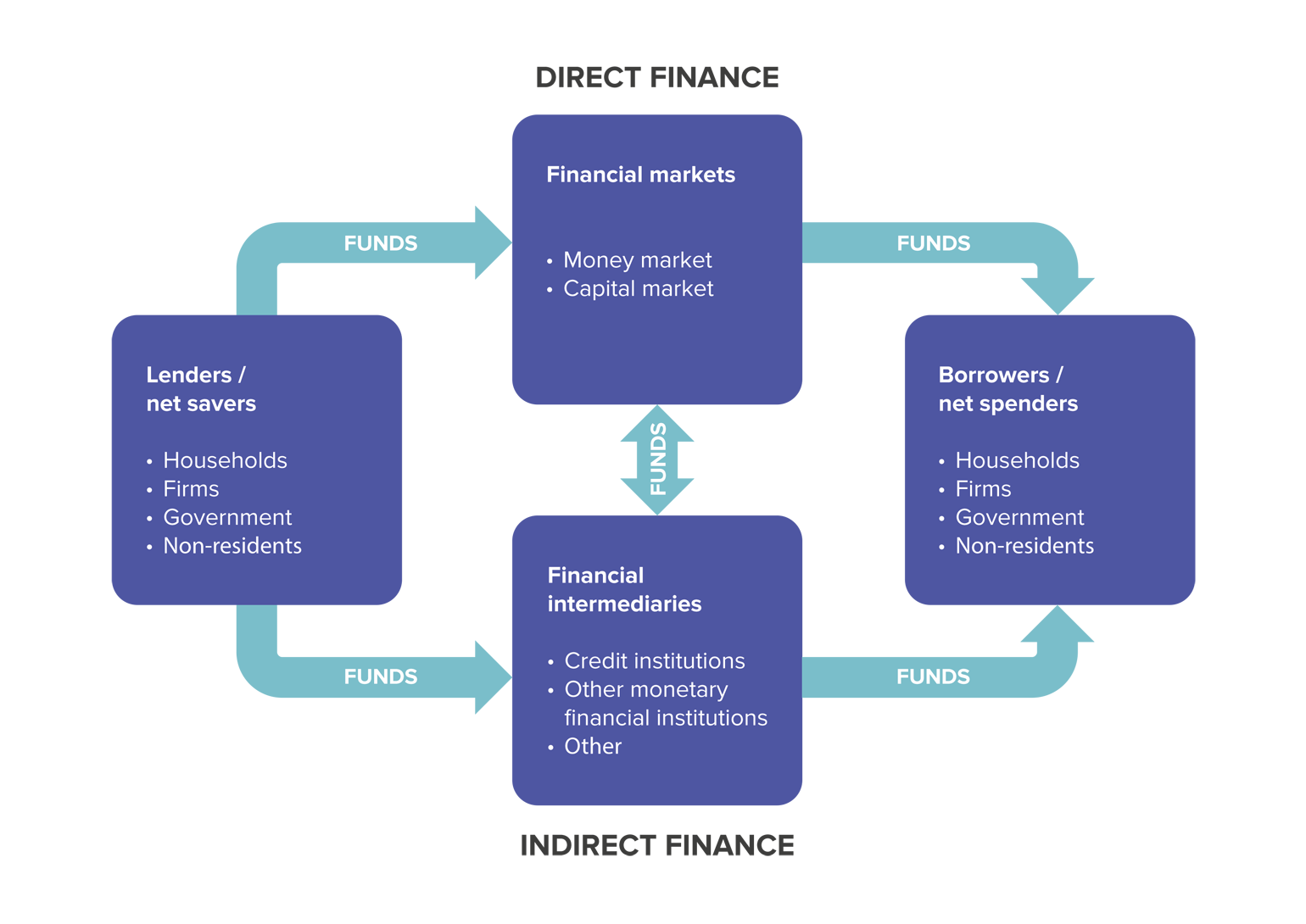

Payment and settlement systems play an important role in improving overall economic efficiency. They consist of all the diverse arrangements that we use to systematically transfer money-currency, paper instruments such as cheques, and various electronic channels.

What is payment and settlement system Upsc?

Payment and Settlement Systems Act, 2007 India is one of the few countries that has a specific payment systems law to ';.. provide for the regulation and supervision of payment systems in India and to designate RBI as the authority for the purpose and for matters connected therewith or incidental thereto.

What is the meaning of payment system?

The 'payments system' refers to arrangements which allow consumers, businesses and other organisations to transfer funds usually held in an account at a financial institution to one another.

What are different payment and settlement systems in India?

In the case of India, the RBI has played a pivotal role in facilitating e-payments by making it compulsory for banks to route high-value transactions through real-time gross settlement (RTGS) and also by introducing NEFT (National Electronic Funds Transfer) and NECS (National Electronic Clearing Services) which has ...

What do you mean by settlement system?

Settlement systems – securities infrastructures – refer to multilateral arrangements and systems that are used for the clearing, settlement and recording of payments, securities, derivatives or other financial transactions. Securities settlement systems are used for post-trade processing.

What is the role of payment system?

A payment system provides the channels through which funds are transferred among banks and other institutions to discharge payment obligations arising from economic and financial transactions across the entire economy. An efficient, secure and reliable payment system reduces the cost of exchanging goods and services.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What are the 4 types of payments?

Types of paymentsCash (bills and change): Cash is one of the most common ways to pay for purchases. ... Personal Cheque (US check): These are ordered through the buyer's account. ... Debit Card: Paying with a debit card takes the money directly out of the buyer's account. ... Credit Card: Credit cards look like debit cards.

What are the 3 methods of payment?

Payment OptionsCash.Checks.Debit cards.Credit cards.Mobile payments.Electronic bank transfers.

What are different payment systems?

Modern payment systems use cash-substitutes as compared to traditional payment systems. This includes debit cards, credit cards, electronic funds transfers, direct credits, direct debits, internet banking and e-commerce payment systems.

How many payment systems are there in India?

With the aim of touching lives of every Indian, NPCI has rolled out a variety of innovative retail payment products viz., IMPS, RuPay card scheme, UPI, NACH, Aadhaar-enabled Payments System (AePS), Aadhaar Payments Bridge System (APBS), NETC, *99# (USSD based) and BBPS.

What is the full form of UPI?

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

Why payment and settlement system is under RBI's regulation?

By overseeing payment and settlement systems, central banks help to maintain systemic stability and reduce systemic risk, and to maintain public confidence in payment and settlement systems.

What is settlement in payment gateway?

What is “Settlement” in the Payment Processing World? Simply put, payment gateway settlement is when the bank transfers funds immediately with no waiting. It is the process where the money is transferred or routed from the customer's bank to the merchant's bank.

Which is not considered as a part of payment and settlement system?

Section 2(1) (i) of the PSS Act 2007 defines a payment system to mean a system that enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them, but does not include a stock exchange (Section 34 of the PSS Act 2007 states that its provisions will ...

Is NBFC part of payment and settlement system?

NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself; iii. deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks. 4.

What is the Payment and Settlement Systems Act?

Payment and Settlement Systems Act, 2007. A sound and appropriate legal framework is a necessary requirement for efficient payment systems. The legal environment should include (i) laws and regulations of broad applicability that address issues such as insolvency and contractual relations between parties;

What is the need for payments and settlements?

The need for payments and settlements is as old as the need for goods and services. The earliest known Payment and Settlement System (PSS) was the barter system facilitating exchange through goods and / or services. With the concept of money, people progressed to settling their economic transactions using currency notes and coins.

What is the PSS Act?

PSS Act and the Payment and Settlement Systems Regulations, 2008 framed thereunder, provide necessary statutory backing to the RBI to exercise oversight over the payment and settlement systems in the country.

How does an efficient payment system affect the economy?

An efficient payment system promotes market efficiency and reduces the cost of exchanging goods and services. By the same token, its failure can result in loss of confidence in the financial system and in the very use of money.

Who can operate payment systems in India?

RBI has since authorised various Payment System Operators (PSOs) such as CCIL (financial market infrastructure - central counterparty), NPCI (retail payments organisation), card payment networks, cross-border inbound money transfers entities, ATM networks, PPI issuers, Instant Money Transfer operators, TReDS platform providers and Bharat Bill Payment Operating Units (BBPOUs) to operate payment systems in the country. PSS Act and the Payment and Settlement Systems Regulations, 2008 framed thereunder, provide necessary statutory backing to the RBI to exercise oversight over the payment and settlement systems in the country.

Which country has a specific payment system law?

India is one of the few countries that has a specific payment systems law to ';..provide for the regulation and supervision of payment systems in India and to designate RBI as the authority for the purpose and for matters connected therewith or incidental thereto.'; RBI's scope for regulation extends to the whole gamut of payment systems ...

What is the shift in payment preference?

This striking shift in payment preference has been due to the creation of robust electronic payment systems such as RTGS, NEFT and ECS that has facilitated seamless real time or near real time fund transfers. In addition, this decade has witnessed introduction of innovative payment systems that provide instant credit to the beneficiary, with the launch of fast payment systems such as IMPS and UPI that are available to consumers round the clock for undertaking fund transfers, and introduction of mobile based payment systems such as Bharat Bill Payment System (BBPS), PPIs to facilitate payment of bills and purchase of goods and services and National Electronic Toll Collection (NETC) to facilitate electronic toll payments. The convenience of these payment systems ensured rapid acceptance as they provided consumers an alternative to the use of cash and paper for making payments. The facilitation of non-bank FinTech firms in the payment ecosystem as PPI issuers, BBPOUs and third-party application providers in the UPI platform have furthered the adoption of digital payments in the country.

What is SIA in banking?

The Italian Interbank Company for Automation (SIA), established in 1977 by CIPA (Convenzione Interbancaria per i Problemi dell’Automazione), has the objective of providing operational support for the Italian banking system’s automation projects. It manages the national interbank network (RNI) and is responsible for the development and operation of an integrated system of services and procedures which constitute the technological platform supporting the payment system and the financial market. Recently, a project to integrate the RNI in SWIFT was launched given the convergence of network systems towards internet protocols. At the beginning of 2000 the Bank of Italy completed the disposal of its stake in the SIA, which in 1999 had merged with CED-Borsa (a software company which manages stock exchange trading systems), thereby integrating the management of IT systems in market and settlement systems.

What is CLS Bank?

CLS Bank International (“CLS Bank”) is a multi-currency cash settlement system. Through its CLS Settlement platform, CLS Bank settles payment instructions related to trades in foreign exchange (“FX”) spot contracts, FX forwards, FX options, FX swaps, non-deliverable forwards, credit derivatives and 17 major currencies. CLS Bank’s parent company, CLS Group Holdings AG, is a Swiss company that owns CLS U.K. Intermediate Holdings, Ltd., which in turn owns CLS Bank and CLS Services Ltd., a company organized under the laws of England that provides technical and operational support to CLS Bank. As an Edge Act corporation, CLS Bank is regulated and supervised in the US by the Federal Reserve. In the United Kingdom, HM Treasury has specified CLS Bank as a recognized payment system, and it is subject to regulation by the BoE. CLS is a “user-owned” financial market utility used to mitigate settlement.

Is Swift a payment system?

SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFT’s customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.

Is CLS Bank regulated?

As an Edge Act corporation, CLS Bank is regulated and supervised in the US by the Federal Reserve. In the United Kingdom, HM Treasury has specified CLS Bank as a recognized payment system, and it is subject to regulation by the BoE. CLS is a “user-owned” financial market utility used to mitigate settlement.

Applicability

A payment company must comply with stipulated RBI requirements to ensure that the technology deployed to operate the payment system is safe, secure, and efficient, and as per the approved process flow.

Objective

To ensure every system provider shall operate the payment system in accordance with the provisions of the PSS Act and the rules and regulations which deal with the operation of payment system.

Approach

Phase 1: Audit Planning Planning and preparation of the audit scope and objectives.

What is a payment system?

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, instruments, people, rules, procedures, standards, and technologies that make its exchange possible. A common type of payment system is called an operational network that links bank accounts ...

Why is a national payment system important?

An efficient national payment system reduces the cost of exchanging goods, services, and assets. It is indispensable to the functioning of the interbank, money, and capital markets. A weak payment system may severely drag on the stability and developmental capacity of a national economy.

What are the challenges of global payments?

The challenges for global payments are not simply those resulting from volume increases. A number of economic, political, and technical factors are changing the types of cross-border transactions conducted. Such factors include: 1 Corporations are making more cross-border purchases of services (as opposed to goods), as well as more purchases of complex fabricated parts rather than simple, raw materials. 2 Enterprises are purchasing from more countries, in more regions. 3 Increased outsourcing is leading to new in-country and new cross-border intracompany transactions. 4 More enterprises are participating in complex, automated supply chains, which in some cases drive automatic ordering and fulfillment. Online purchasing continues to grow, both by large enterprises as part of an automated procurement systems and by smaller enterprises purchasing directly. 5 There is continued growth in the use of cross-border labor. 6 Individuals are increasingly taking their investments abroad.

What is ACH settlement?

An ACH is considered a net settlement system, which means settlement may be delayed . This poses what is known as settlement risk . Real-time gross settlement systems (RTGS) are funds transfer systems where the transfer of money or securities takes place from one bank to another on a "real-time" and on "gross" basis.

What is electronic payment?

Traditional payment systems include negotiable instruments such as drafts (e.g., cheques) and documentary credits such as letters of credit. With the advent of computers and electronic communications, many alternative electronic payment systems have emerged. The term electronic payment refers to a payment made from one bank account to another using electronic methods and forgoing the direct intervention of bank employees. Narrowly defined electronic payment refers to e-commerce —a payment for buying and selling goods or services offered through the Internet, or broadly to any type of electronic funds transfer .

How does globalization affect payments?

For the payments industry, the result is higher volumes of payments— in terms of both currency value and number of transactions. This is also leading to a consequent shift downwards in the average value of these payments.

Is cross-border payment rewarding?

But for these providers, cross-border payments are both lucrative (especially given foreign exchange conversion revenue) and rewarding, in terms of the overall financial relationship created with the end customer.

What is a settlement payment?

A settlement is a payment or payments that will conclude the financial obligation in full, thus finishing the agreed term and amount in total.

What does "real time settlement" mean?

Settlement in "real-time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.