To calculate your PF please check in your salary slip (if you have one) what the monthly deduction is (usually 12% of the basic pay), and also check if your employer is contributing 12% to your PF account (as is mandatory), or if the employer's contribution, too, is deducted from your salary (as some companies do).

Full Answer

Can I claim full settlement from my PF account?

If you've left your job or have retired, you can claim full settlement from your PF account. However, there are certain rules and regulations to it. Know the T&Cs of EPF withdrawal, how to submit claim form and more. Hi, You are already have a Credit Report with us. Log in to your Dashboard by clicking here ! Congratulations!

How to withdraw funds from EPF account for final settlement?

He has to fill Form 19 to withdraw funds from the EPF account for final settlement. The form can be filled only after two months of leaving the job or on retirement. The form can be filled both online (at EPF Member Portal) as well as offline.

What is the PF amount/PF contribution of an employee?

Each employee’s whether in the public or private sector and earns a basic salary of Rs.15,000/- has to register themselves with EPF. An employee will then be required to part with 12% of the basic wages together with a Deafness allowance as PF amount / PF contribution.

What is PF claim form 19?

In this article, you will learn about PF Claim Form 19. There are various forms available under the Employee Provident Fund Organisation (EPFO) Scheme. Automatic transfer of EPF fund. Saving TDS of any interest that is generated from the Employee Provident Fund.

What is an EPF?

How to fill out EPF form 19?

What is composite claim form?

How long can you claim EPS?

Can an employee withdraw funds from EPF?

See 2 more

About this website

How is PF settlement amount calculated?

An employee can also check the status of a PF claim via SMS. An employee needs to link their mobile number with the UAN portal. An SMS needs to be sent from that mobile number. SMS needs to be sent to 7738299899.

What is a PF settlement?

PF Settlement Form allows members to withdraw their PF balance after quitting their job, superannuation, termination or at the time of retirement. Under no circumstances, can any establishment or organisation can stop members from withdrawing from their EPF balance.

How long does PF settlement take?

Normally it takes 20 days to settle a claim or release the PF amount, if the same is submitted to concerned EPFO Office in complete.

How can I apply for full PF settlement?

Form 19 is filled for claiming final PF settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal and Form 10D for withdrawing your monthly pension. However, only the Composite Claim Form is required to be filled in the case when you are withdrawing your EPF funds offline.

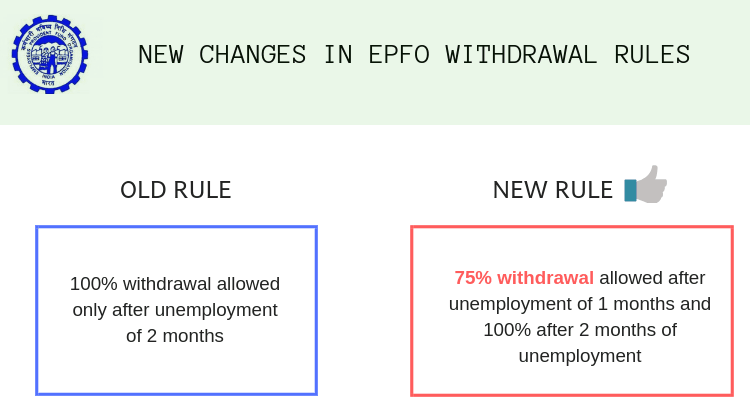

Can I withdraw 100% PF amount?

In some situations, you can withdraw the PF amount entirely or partially from your Provident fund before maturity. Unemployment case: If you are an account holder of the Provident fund, then you can withdraw around 75% of the total amount accumulated if you've been unemployed for a long time.

Can we withdraw full PF amount?

Employees can withdraw the entire sum accumulated in their EPF once they retire. However, this article explains how one can make premature withdrawals from the EPF account after meeting certain conditions. The EPFO gives an interest rate of 8.1% to subscribers of the Employee Provident Fund (EPF) for 2021-22.

How many times I can withdraw PF?

The minimum PF balance of the member should be more than ₹ 20,000 either individually or including that of the spouse in case he/she is also a member of the EPFO. However, a member can withdraw the PF balance only once in a lifetime to pay for the property.

When I can withdraw my PF after resignation?

There is usually a two-month waiting period following resignation before you can withdraw your PF funds. If you do not accept the next job in India, you can instantly withdraw the remaining sum from your EPF account.

Can we withdraw PF before leaving job?

Yes, one can claim their EPF amount without having to go through the EPFO Portal. To do so offline, one will be required to get a Composite Claim Form, fill it in completely and submit the same.

Is Final PF settlement taxable?

EPFO Taxability: A member with the Employees' Provident Fund Organsiation (EPFO) is liable to pay TDS (Tax Deducted at Source) on withdrawal of his Employees' Provident Fund (EPF) if his term of service is less than five years and the accumulated amount in the his EPF account exceeds Rs 50000.

Is Final PF settlement taxable?

EPFO Taxability: A member with the Employees' Provident Fund Organsiation (EPFO) is liable to pay TDS (Tax Deducted at Source) on withdrawal of his Employees' Provident Fund (EPF) if his term of service is less than five years and the accumulated amount in the his EPF account exceeds Rs 50000.

Does PF final settlement includes pension amount?

Under Employee Provident Fund Act 1952, you can withdraw the full PF amount if you retire from your service after having attained the age of 58 years and you can also claim the EPS amount (Employees' Pension Scheme amount) at the same time.

What is claim form 19 for PF settlement?

EMPLOYEES' PROVIDENT FUND SCHEME 1952 FORM 19 FOR CLAIMING FINAL SETTLEMENT FROM PROVIDENT FUND INSTRUCTIONS WHO CAN APPLY: 1. Members of the fund after leaving service under conditions mentioned against 3 below. In case of the death of the member, the family members/nominee/legal heir should apply through Form 20.

Can we withdraw PF after resignation?

You cannot withdraw your EPF account balance immediately after resigning from your job. If you choose to take your money from your PF account before the five-year period is through, you will be required to pay tax on the amount.

How Long Will it Take to Transfer the PF Balance to My Account After Submitting Form 19?

Once you have successfully submitted form 19, the PF amount should be transferred within 20 days of the submission date.

What if The Amount is Not Credited Within The Specified Time Period?

In case the amount is not credited to the account within the specified period, you should report your concern to the Regional Provident Fund Commis...

Do I Need My Employer’s Approval to Withdraw The PF Amount?

No, the employer’s approval is not required if the member’s UAN is active and the KYC process is complete.

Can EPF Amount be Claimed Through Cheque?

Yes, members can claim their EPF amount through a cheque. They will need to mention the PF amount, attach a ₹1 revenue stamp and sign the applicati...

Q: How can I make my PF deduction from salary calculation easy?

Ans: If we talk about the calculator process of PF deduction on salary , you can use the EPF calculator. It will help you make the calculations pe...

Q: How much is the PF on basic salary?

Ans: Out of the 12% contribution, 3.67% goes to the employee EPF account, and 8.33% goes to the EPS account.

Q: Can I take out my PF salary funds if I’m employed but not in a position?

Ans: After one period of inactivity, you can take 75%t of your EPF deposit. You can withdraw 25% when you're unemployed for two continuous months.

Q: Am I required to connect to my PAN and aadhaar with the EPF portal?

Ans: Yes, if you intend to access the EPF portal to access online services, it is necessary to connect the UAN directly to both your PAN and Aadhaar.

Q: What is the process for employees to receive the UAN number?

Ans: If you're employed by an organisation that employs more than 20 people and are qualified to receive EPF benefits, you receive this number. EPF...

PF Form 19 - A Complete Guide for Final PF Settlement Online - SY Blog

What is Form 19 in PF. EPF stands for Employees’ Provident Fund. It is a retirement scheme launched by the government of India. In this scheme, every employee working in the public or the private sector offers a percentage of their salary every month.

EPF Form 19 in Fillable PDF - Karvitt

Download EPF Form 19 - Form for Claiming the Employees’ Provident Funds dues in Fillable PDF which you can fill before print on your PC / Laptop

PF Form 19 - Benefits & Limitations | How to Fill Form 19 for PF ...

Who Should Fill PF Form 19? EPF Form 19 will have to be filled up by an employee holding a provident fund account. The form is used only for withdrawing EPF amount at the time of retirement or when an employee quits.. Also, if an employee exits a job, he/she will have to be unemployed for at least two months to utilise this form for withdrawal.

What is an EPF?

Employees’ Provident Fund (EPF) is a retirement scheme where an employee and his employer contribute a part of the salary during the service period and the member withdraws the lump-sum amount on retirement. An employee can also request for the final settlement of the EPF account once he leaves the job. He has to fill Form 19 to withdraw funds from the EPF account for final settlement.

How to fill out EPF form 19?

How to Fill EPF Form 19 Online. Once you leave a job, you can either settle your PF account or transfer it to the new EPF account in the new organisation. In case you want to make a final settlement, you can fill Form 19 both online as well as offline.

What is composite claim form?

Composite Claim Form is a combination of Form 19, Form 10C and Form 31. Form 19 is filled for PF final settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal. However, only the Composite Claim Form has to be filled for withdrawing funds offline.

How long can you claim EPS?

If you have cumulative service tenure of fewer than 10 years then the funds remain as it is to your PF account. You can claim for the EPS amount at any time using form 10C. The claim can be made both offline or online through the UAN Member e-Sewa Portal.

Can an employee withdraw funds from EPF?

An employee can also request for the final settlement of the EPF account once he leaves the job. He has to fill Form 19 to withdraw funds from the EPF account for final settlement.

What is PF attested with?

The form should be attested with the member signature or thumb impression along with Employer’s Signature; Designation & Seat of the Employer. As mentioned above, the employee has an option to claim PF through Online mode. Let’s see how to do it.

What is EPF in India?

The EPF is one of the main savings platform for all employees working in government, public, or private sector. Get to know more on form 19.

How long do you have to be unemployed to withdraw EPF?

To withdraw EPF with Form 19, the employee needs to be unemployed for a period of at least 2 months.

How long does it take to get PF withdrawals?

After successful submission within 15-20 days, PF withdrawal amount will be deposited to your bank account linked with UAN.

How to fill out Form 19?

Here is the step by step procedure to fill Form 19 Online: Step 1: Visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/. Step 2: Login into the UAN portal – Enter UAN member, Password & Captcha Code. Step 3: Click on the tab “Online Services” and select Claim FORM 31, 19 &10C) from the drop-down menu.

How is EPF interest calculated?

EPF interest is calculated according to the contributions made by the employer and employee. Every year the EPF Organization officials are change the EPF Interest Rate. Each month, an employee has to part with 12% of their basic pay together with a Dearness allowance.

What is an EPF?

Employees Provident Fund (EPF) is a government run initiative that is under the Employee’s Provident Fund and Miscellaneous Provisions Act 1952. This scheme mainly covers establishments in which 20 or more people are employed.

Is EPF a good investment?

What makes EPF a good investment is the fact that you can access your full contribution upon retiring. For this reason, you will have to keep track of the entire contributions by calculating the PF contributions and interest. EPF Calculator (PF Calculation)

Is the entire contribution of an employer added to the EPF kitty?

The entire contribution of an employer is not added to the EPF kitty. This is because 8.33% of their contribution is sent to Employees Pension Scheme but is calculated on Rs.15,000/-. The remaining balance is then retained in the EPF scheme. What makes EPF a good investment is the fact that you can access your full contribution upon retiring. For this reason, you will have to keep track of the entire contributions by calculating the PF contributions and interest.

How long does it take to get EPF?

When an employee applies for EPF claim online then it takes 5-15 days to get the PF amount into the bank account. You can track your EPF Claim submitted online by clicking on Online Services -> Track Claim Status. You will see a window similar to shown in the image below.

Is EPS refundable?

You will get an amount equal to the total of column 1 and 2. The EPS contribution is not refundable. You can only receive it as monthly pension when you reach pensionable age. Your monthly pension amount is decided by the number of years you have contributed not the amount you contributed.

How long does it take for PF to be credited?

If your claim status is showing settled (or) if you have received a text message that your claim has been settled then within 1-3 banking working days your PF amount will be credited into your bank account.

How to reclaim PF?

You can submit a PF reauthorization form to your PF office (or) correct your bank details on the UAN member portal and ask your employer to approve them. After their approval, reclaim your PF amount.

What is PF reauthorization form?

PF reauthorization form is used to reapply for PF amount with correct bank details. On PF reauthorization form you need to write correct bank details and attach bank passbook copy or cancelled cheque. This form should be submitted to your regional PF office.

What happens if my PF isn't credited?

If your PF amount isn’t credited to your bank account even after 3 days then there may be a problem with your bank details like your bank account number or IFSC code. So you have to check whether you have updated the correct bank details in the UAN member portal or not.

How long does it take for PF to return to UAN?

If they are wrong the PF amount will return to your PF account within 7-10 days.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Is debt settlement good for you?

Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

What is an EPF?

Employees’ Provident Fund (EPF) is a retirement scheme where an employee and his employer contribute a part of the salary during the service period and the member withdraws the lump-sum amount on retirement. An employee can also request for the final settlement of the EPF account once he leaves the job. He has to fill Form 19 to withdraw funds from the EPF account for final settlement.

How to fill out EPF form 19?

How to Fill EPF Form 19 Online. Once you leave a job, you can either settle your PF account or transfer it to the new EPF account in the new organisation. In case you want to make a final settlement, you can fill Form 19 both online as well as offline.

What is composite claim form?

Composite Claim Form is a combination of Form 19, Form 10C and Form 31. Form 19 is filled for PF final settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal. However, only the Composite Claim Form has to be filled for withdrawing funds offline.

How long can you claim EPS?

If you have cumulative service tenure of fewer than 10 years then the funds remain as it is to your PF account. You can claim for the EPS amount at any time using form 10C. The claim can be made both offline or online through the UAN Member e-Sewa Portal.

Can an employee withdraw funds from EPF?

An employee can also request for the final settlement of the EPF account once he leaves the job. He has to fill Form 19 to withdraw funds from the EPF account for final settlement.